Crypto moves fast. Actually, it moves at a speed that makes traditional finance look like it’s stuck in molasses. If you haven't checked the charts in the last forty-eight hours, you're basically looking at ancient history. Right now, as we navigate through January 2026, the top crypto coins by market cap are telling a story that isn't just about price—it's about who actually survived the "purge" of 2025 and who is actually being used by real humans.

Most people think market cap is just "price times supply." Technically, yeah, that’s the math. But in reality? It’s a scoreboard of trust. It’s the market’s way of saying, "We believe this specific digital ledger won't vanish into a cloud of server smoke tomorrow."

The Heavyweights: Bitcoin and the Trillion-Dollar Club

Bitcoin is currently sitting at roughly $1.92 trillion in market cap. It’s the undisputed king, trading around $96,000 to $97,000. It’s funny because, back in 2023, people were arguing if it would ever see $50k again. Now, we’re looking at a world where Bitcoin is breathing down the necks of tech giants like Alphabet and Amazon.

📖 Related: How Many Bytes Make a Bit: The Answer Most People Get Backward

The launch of spot ETFs a couple of years ago changed the DNA of Bitcoin. It’s no longer just "magic internet money" for cypherpunks; it’s a line item on corporate balance sheets. JPMorgan analysts recently noted that institutional inflows are expected to hit new records this year, largely because the "fear" of Bitcoin has been replaced by the "fiduciary duty" to own it.

Then you have Ethereum.

Honestly, Ethereum is in a weird spot. Its market cap is hovering around $400 billion, with ETH priced near $3,300. While Bitcoin is the "digital gold," Ethereum is the "digital oil." It powers everything from decentralized finance (DeFi) to those tokenized Treasury bills that big banks are suddenly obsessed with.

Standard Chartered’s Geoff Kendrick recently suggested that 2026 might actually be the year Ethereum finally outpaces Bitcoin’s growth. Why? Because the network is finally getting its act together with Layer-2 scaling. If you've used Base or Arbitrum lately, you know it’s finally cheap enough for a regular person to use without selling a kidney to pay for gas fees.

The Infrastructure Wars: Solana vs. BNB

This is where things get spicy. For the longest time, BNB held the number three non-stablecoin spot with an iron grip. Today, BNB has a market cap of about $128 billion. It’s the backbone of the Binance ecosystem, and despite all the regulatory drama the exchange faced, the chain just keeps pumping out updates like the recent Fermi upgrade.

But Solana is the one everyone is whispering about at bars.

Solana’s market cap is currently around $81 billion. That’s a massive recovery from the post-FTX days when people thought it was dead. It’s fast. Like, really fast. While Ethereum is trying to scale through a patchwork of different networks, Solana is doing it all on one layer. It’s become the "casino" of the crypto world—if you’re trading meme coins or looking at high-speed retail apps, you’re probably on Solana.

The gap between BNB and SOL is shrinking. It’s a classic battle of the "Old Guard" (BNB) versus the "New Speed" (SOL).

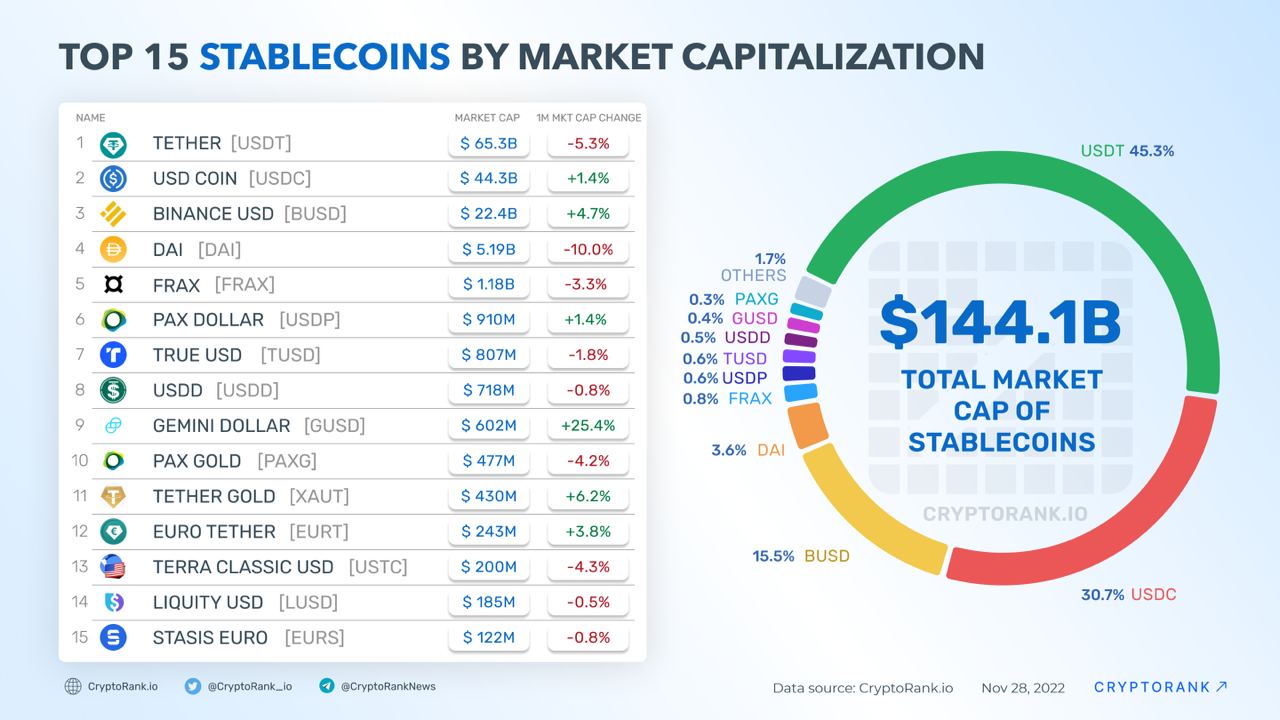

The Boring (But Crucial) Middle: Stablecoins

You can’t talk about market cap without talking about the "digital dollars." Tether (USDT) is massive. It has a market cap of over $186 billion. That is a staggering amount of liquidity. If Tether were a bank, it would be one of the biggest in the United States.

Then there’s USDC, sitting at about $75 billion.

The dynamic here is simple: Tether is the king of global offshore trading and remittances. USDC is the "clean" version that US-based institutions prefer because Circle (the company behind it) is trying to play by the rules.

If you see these market caps growing, it usually means people are "sitting on the sidelines" with cash, waiting for a dip to buy. When stablecoin market caps drop? That usually means people are swapping their digital dollars for Bitcoin or Alts. It's the pulse of the market.

What about the "Zombies"?

You’ve got coins like XRP and Cardano (ADA).

XRP has had a wild ride, currently holding a market cap of $126 billion, largely fueled by its legal victories and its use in cross-border payments. It’s basically the "banker's coin."

Cardano, on the other hand, is at $14 billion. It has a die-hard community, but in terms of market cap, it’s been sliding down the rankings as newer, faster chains take the spotlight. It’s a reminder that a high market cap in 2021 doesn’t guarantee a spot in the top 10 in 2026.

Why Market Cap Can Be a Total Lie

Here is the part most influencers won't tell you: market cap can be manipulated.

If I create a coin with 1 trillion tokens and sell one to my friend for $1, the "market cap" is technically $1 trillion. Obviously, that's fake.

In the real crypto market, you have to look at FDV (Fully Diluted Valuation).

This is what the market cap would be if all tokens were released. Some of these shiny new "top 50" coins have billions of tokens locked away, waiting to be dumped on retail investors in three years. If the market cap is $1 billion but the FDV is $20 billion, you’re looking at a massive future supply shock.

- Bitcoin FDV: Almost identical to market cap. (Transparent)

- Newer L1/L2s: Often have FDVs 5x-10x higher than their current market cap. (Risky)

The 2026 Shift: Utility over Hype

We are moving away from the era where a dog picture on a coin can hit a $40 billion market cap overnight. Okay, Dogecoin is still there (sitting at **$24 billion**), but it’s the exception, not the rule.

The coins moving up the ranks now are those integrated into the "real" world. We’re talking about tokenized real-world assets (RWAs). When BlackRock’s BUIDL fund crossed $1 billion in 2025, it signaled a shift. The market caps of the future will be driven by how much "real" money is flowing through the pipes, not just how many people are gambling on a "100x" moonshot.

Regulatory Reality

The US "Clarity Act" is the big shadow looming over everything right now. The Senate is looking at it as we speak. If it passes, it provides a green light for pension funds and insurance companies to start allocating to these top assets. That could double the total crypto market cap (currently around $3.4 trillion) almost overnight.

Actionable Steps for Navigating Top Cryptos

If you’re looking at the top crypto coins by market cap as a way to build a portfolio, stop looking at the dollar price. Look at the Market Cap Dominance.

- Monitor Bitcoin Dominance (BTC.D): If Bitcoin's share of the total market is rising, it usually means the market is scared and fleeing to safety. If it's falling, "Altcoin Season" might be starting.

- Check the FDV-to-Market Cap Ratio: Never buy a top coin without knowing when the next big "unlock" of tokens is happening. If a massive amount of supply is hitting the market next month, the market cap might stay the same while your token price tanks.

- Watch the Stablecoin Inflow: Follow data on platforms like Glassnode or CoinMarketCap to see if USDT is being minted. New USDT usually means new buying power is entering the system.

- Diversify by "Sector": Don't just buy the top five coins. They might all be doing the same thing. Pick the leader of Digital Gold (BTC), the leader of Smart Contracts (ETH), and the leader of high-speed retail (SOL).

The "Top 10" list is a revolving door. Today’s giant is tomorrow’s cautionary tale. Stay skeptical, watch the liquidity, and remember that in crypto, the only thing more volatile than the price is the narrative.

Next Steps for Your Research:

- Check the current FDV of your holdings against their circulating market cap to see potential inflation.

- Verify the Total Value Locked (TVL) on chains like Solana and Ethereum to see if the market cap is backed by actual usage or just speculation.

- Monitor the US Federal Reserve's interest rate decisions for 2026, as high-market-cap assets remain sensitive to global liquidity shifts.