It was supposed to be a quick "reset." Back in early 2025, when the administration declared a national emergency over trade deficits and launched the first wave of 10% across-the-board hikes, the logic was simple: make it too expensive to buy from China, and the jobs will come rushing back to Ohio and Pennsylvania.

Fast forward to right now, January 2026. If you’ve tried to buy a new laptop or even a decent set of kitchen cabinets lately, you’ve seen the price tags. They’re high. Honestly, they're higher than most experts predicted. While the massive "reciprocal" tariffs that threatened to hit 125% were mostly paused after the November 2025 "Trump-Xi Truce," the tariff on Chinese imports hasn't actually gone away. It's just settled into a weird, expensive new normal.

The "Truce" That Didn't Lower Prices

Most people think the deal signed in November 2025 fixed everything. It didn't. What it actually did was stop the bleeding.

China agreed to buy a massive amount of soybeans—roughly 25 million metric tons a year through 2028—and the U.S. agreed to shave 10 percentage points off the "fentanyl-related" tariffs. But here's the kicker: the core Section 301 duties and the baseline 10% emergency tariffs are still very much alive.

According to data from the Tax Policy Center, the average tariff rate on all imports is hovering around 17% as we start 2026. For stuff coming specifically from China? It’s much higher. We are looking at an average burden of about $2,100 per household this year just in passed-through tariff costs.

✨ Don't miss: Pacific Plus International Inc: Why This Food Importer is a Secret Weapon for Restaurants

Why your stuff is still expensive

- Inventory Lag: Retailers aren't just going to drop prices because a "truce" was signed. They are still selling through stock they imported when rates were peaking at 40% or higher last summer.

- The "De Minimis" Death: This is the big one. In 2025, the U.S. basically killed the $800 duty-free limit for e-commerce. Those cheap packages from Temu or Shein? They’re getting hit with duties now that they never faced before.

- Supply Chain Ghosting: Companies didn't move back to the U.S. They moved to Vietnam and Mexico. But guess what? Those factories in Vietnam still use Chinese parts. So, the "made in Vietnam" sticker often hides a product that was still hit by tariffs on the component level.

What Most People Get Wrong About the 2026 Trade Landscape

There is a common myth that tariffs only hurt the "big guys" or "the CCP." In reality, the most aggressive price hikes have hit the things you can't easily avoid buying.

Take a look at the Budget Lab at Yale's latest report. They found that leather goods—shoes, handbags, work boots—saw short-run price spikes of nearly 24%. Even after "substitution" (finding other places to buy from), those prices are staying about 8% higher than they were in 2024.

Electronics are in the same boat. If you're looking for a new monitor or a power tool, you’re paying a "trade war tax" of roughly 16% to 18% at the register.

The Supreme Court Wildcard

We have to talk about the legal drama. Right now, the U.S. Supreme Court is weighing in on the International Emergency Economic Powers Act (IEEPA). The administration used this to bypass Congress and slap those emergency tariffs on China, Canada, and Mexico last year.

🔗 Read more: AOL CEO Tim Armstrong: What Most People Get Wrong About the Comeback King

If the court rules that the President overstepped, we could see a massive wave of refunds. Importers are already salivating at the thought of getting billions back from the Treasury. But for you? Don't expect a check in the mail. Most retailers will likely pocket those refunds to cover the losses they took in 2025 rather than lowering your prices.

Is Manufacturing Actually Coming Home?

The short answer: Sorta, but not the way you think.

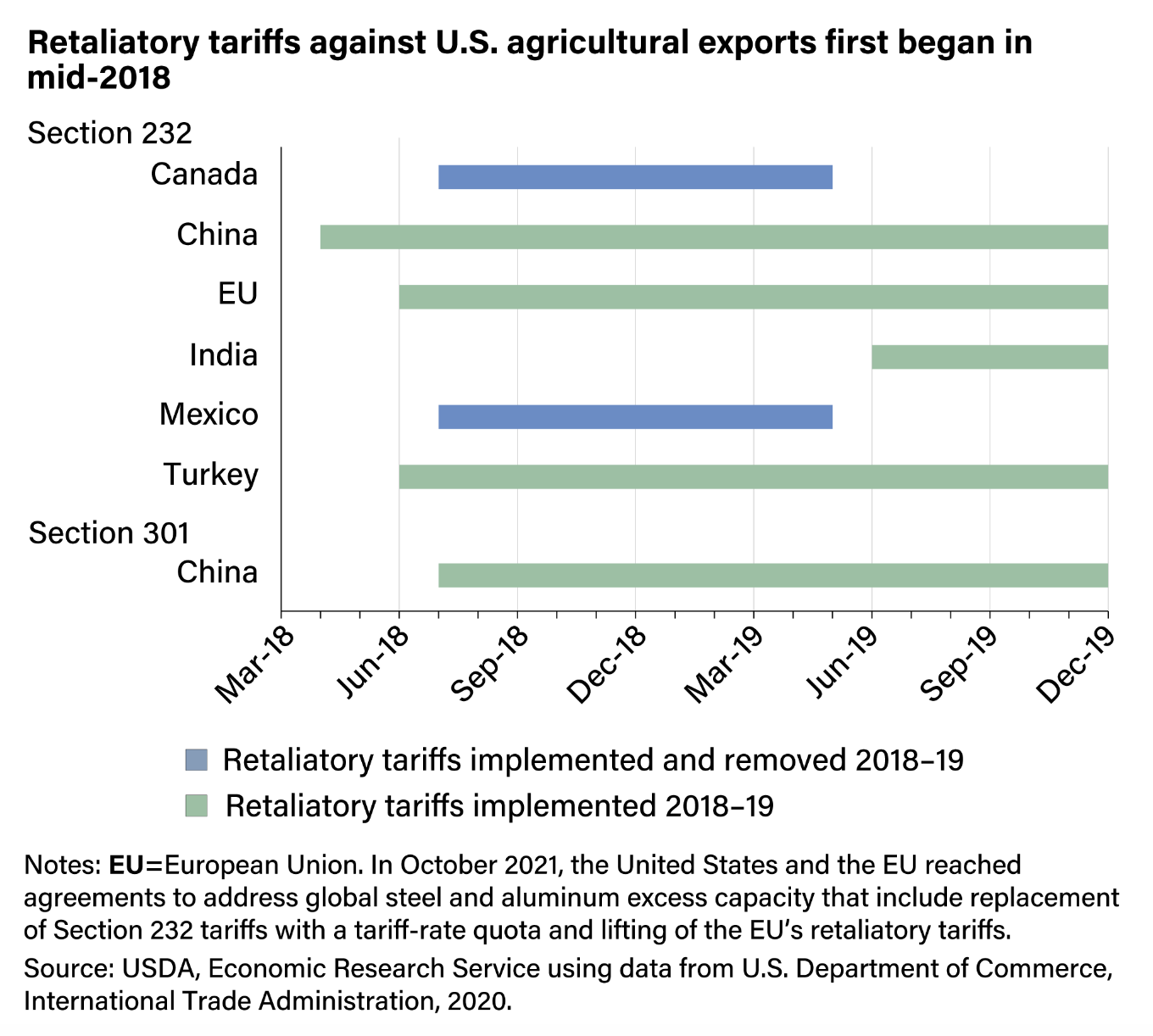

U.S. manufacturing output did expand by about 3.2% over the last year. That’s the good news. The bad news is that this growth has been "crowded out" by other sectors. Agriculture is struggling because China’s retaliatory tariffs (even the suspended ones) created a year of total chaos for soy and corn exports. Construction is also taking a hit because the cost of steel and specialized Chinese machinery has made building new warehouses incredibly pricey.

In a weird twist, China reported a record $1.189 trillion trade surplus for 2025. Even with our tariffs, the rest of the world is buying more from them than ever. They’ve basically pivoted to selling to Southeast Asia and Latin America, which then sells back to us. It’s a giant, expensive game of "middleman."

💡 You might also like: Wall Street Lays an Egg: The Truth About the Most Famous Headline in History

The 2026 Forecast: What You Should Do

If you’re waiting for the tariff on Chinese imports to vanish so you can buy that big-ticket item, you might be waiting a long time. The current "truce" is set to expire in November 2026. Trade analysts like Chad Bown have noted that these cycles of "escalation followed by temporary peace" are likely the new permanent strategy.

Actionable Steps for Consumers and Small Businesses

- Lock in Tech Purchases Now: The USTR is currently reviewing exclusions for 178 product categories, including solar equipment and medical tech. These expire in November. If your business needs this gear, buy it before the next "cliff" in Q4 2026.

- Verify Your "Origin" Stories: If you're a small business importing from "third countries" like Thailand or Malaysia, check your paperwork. Customs and Border Protection (CBP) is getting way more aggressive about "transshipment"—investigating whether that product is actually 90% Chinese and just packed in a different box.

- Budget for the $2k Hit: As mentioned, the Tax Policy Center estimates an extra $2,100 in household costs this year. It’s not a visible tax on your paycheck, but it’s there in the grocery aisle and the electronics store.

The reality of 2026 is that the trade war isn't over; it's just changed its clothes. We've traded "free trade" for "managed trade," and the management fee is being charged directly to your credit card.

Keep an eye on the Section 232 negotiations regarding critical minerals. President Trump just issued a new proclamation on January 14, 2026, targeting processed minerals. If those negotiations fail, your next electric vehicle or smartphone battery could be the next thing to get a 25% price bump. Stay alert, because in this trade environment, the only constant is the price tag going up.