So, you just opened that yellow envelope from the King County Assessor. It’s a ritual. Every year, homeowners across Seattle, Bellevue, and the surrounding suburbs hold their breath, hoping the property tax rate King County WA hasn’t spiked enough to ruin their summer vacation plans.

Honestly, it’s confusing. You see your home value "drop" on Zillow, but then your tax bill goes up. How does that even work? Most people think property taxes are like sales tax—a flat percentage of what your stuff is worth.

That's not it at all.

Washington uses a "budget-based" system. This basically means the government decides how much money it needs first. Then, they look at everyone's property and divvy up the bill. It’s more like a group of friends splitting a pizza tab than a standard tax. If the pizza gets bigger, or if your friends decide to add extra toppings (voter-approved levies), your slice of the bill gets more expensive.

Why the Property Tax Rate King County WA is Moving in 2026

For the 2026 tax year, things are getting spicy. Voter-approved measures are the primary engine driving changes right now. Specifically, King County Proposition 1 (the Parks and Open Space levy) was approved by voters in August 2025. This adds about $0.2329 per $1,000 of assessed value starting in 2026.

If you own a home worth $800,000, that’s roughly an extra $186 a year just for parks.

Then there’s Sound Transit. In late 2025, the Sound Transit board greenlit a 1% property tax increase for 2026. They need the cash for light rail expansion. While 1% sounds tiny, it adds up when you combine it with school levies and emergency medical services.

👉 See also: E-commerce Meaning: It Is Way More Than Just Buying Stuff on Amazon

Most homeowners in King County are looking at an aggregate rate that hovers around 0.90% to 1.1% of their home's assessed value. But here is the kicker: that "rate" is just an average. Depending on where you live—say, Renton versus Medina—your total levy rate can vary wildly.

Breaking Down the Bill

Your 2026 bill isn't just one tax. It’s a stack of them.

- State School Levy: Usually the biggest chunk, roughly 40-50% of your bill.

- King County General Fund: Pays for the sheriff, jails, and county courts.

- City Taxes: Seattle, Bellevue, and Redmond have their own needs.

- Special Districts: Ports, libraries, and those famous Sound Transit "ST3" levies.

The Assessment Game: Why Your Bill Rises When Values Fall

Here is a weird reality. If every house in King County dropped 10% in value tomorrow, your taxes wouldn't necessarily go down.

Wait, what?

Because the county needs a fixed dollar amount to run the lights, if everyone’s value drops equally, the property tax rate King County WA simply adjusts upward to collect the same total revenue. You only get a break if your home’s value drops faster than your neighbor's.

It's a relative game.

✨ Don't miss: Shangri-La Asia Interim Report 2024 PDF: What Most People Get Wrong

King County Assessor John Wilson has often pointed out that the 1% cap on "regular" levy increases is a bit of a myth. While the county's base budget growth is capped, voter-approved "excess" levies have no such ceiling. That’s why your bill feels like it’s on a permanent escalator.

Seniors and the $84,000 Threshold

If you are 61 or older, there is some genuine relief available, but you have to go get it. The state recently overhauled the income limits.

For the 2026 tax year, if your household income is $84,000 or less, you might qualify for a significant exemption. This doesn't just lower the rate; it "freezes" the assessed value of your home.

Imagine your home is worth $700,000 now. If you qualify, the county taxes you as if it’s always worth $700,000, even if the market goes crazy and it hits $1.2 million in five years.

You can apply online through the King County Assessor’s portal. It’s a bit of a paperwork nightmare—you’ll need tax returns, Social Security statements, and proof of age—but it can save you thousands. Literally. Some seniors see their bills cut by 50% or more.

Don't Miss the Deadlines

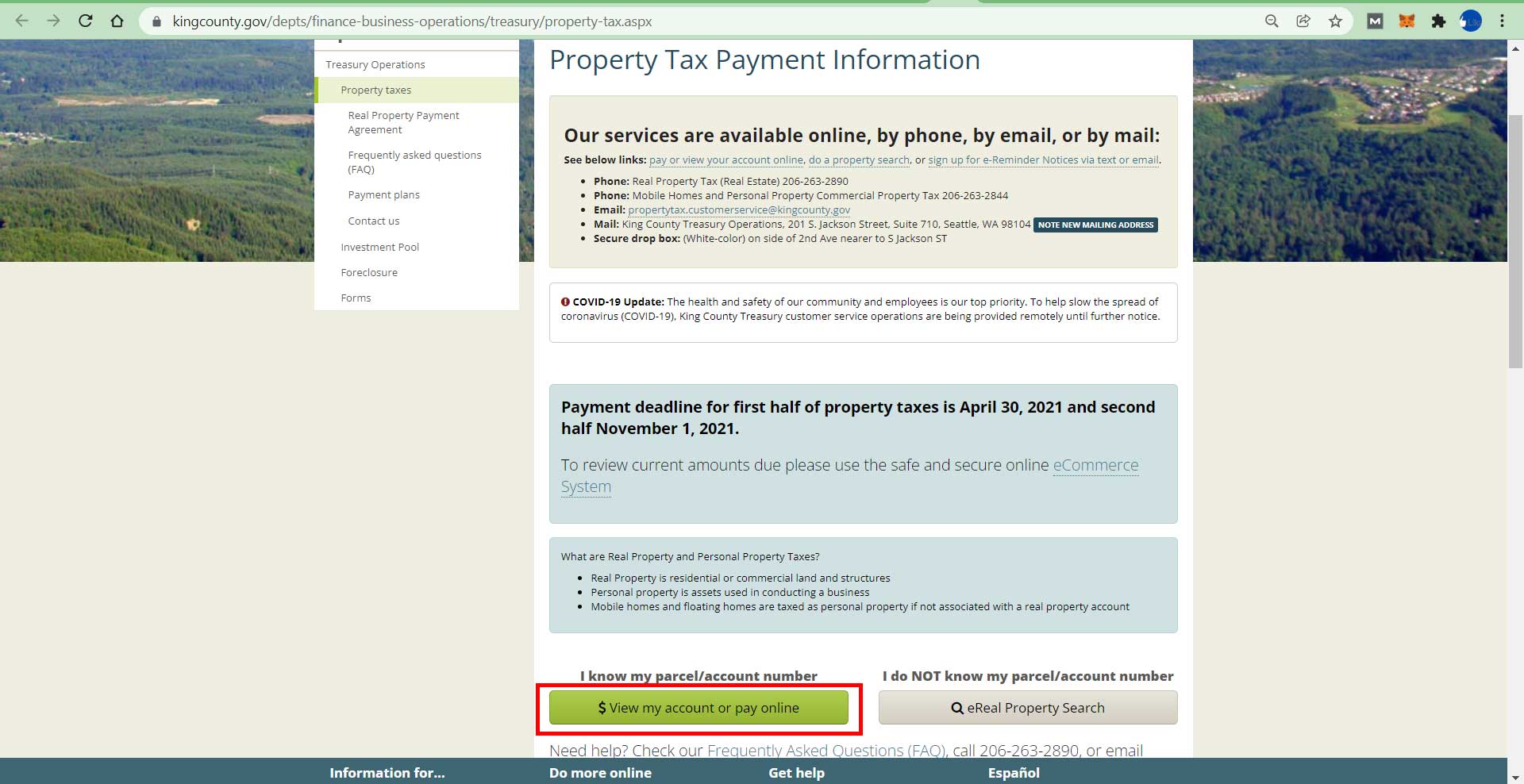

- April 30: First half of your property taxes are due.

- October 31: Second half is due.

- June 1: This is when the 3% penalty hits if you forgot that first payment.

The "New Construction" Trap

Are you planning to build a DADU (Detached Accessory Dwelling Unit) or a massive backyard deck?

🔗 Read more: Private Credit News Today: Why the Golden Age is Getting a Reality Check

Be careful.

New construction is one of the few things that lets the county bypass the 1% revenue cap. When you add value to your property, the assessor "adds" that new value to the tax rolls immediately. If you spend $300,000 on a mother-in-law suite, expect your tax bill to jump by roughly **$3,000 per year** starting the following cycle.

Actionable Steps for King County Homeowners

Stop guessing about your bill and start managing it.

First, verify your assessed value. The county mails "Official Property Value Notices" every year between June and October. Don't toss it. Compare it to recent sales on your street. If the county thinks your house is worth $900,000 but three identical houses next door just sold for $800,000, you have a case for an appeal.

Second, file an appeal if the math is wrong. You generally have 60 days from the date the notice was mailed to petition the Board of Equalization. You don't need a lawyer, but you do need evidence. Photos of that cracked foundation or the neighbor's unpermitted junkyard help.

Third, check for exemptions. Beyond the senior exemption, there are programs for disabled veterans and even "home improvement" exemptions that can delay tax increases on certain renovations for three years.

Property taxes in the PNW are a heavy lift. The property tax rate King County WA isn't going to get cheaper as the region grows, but understanding the levies—like the new 2026 Parks Levy—helps you at least know where the money is going.

Keep an eye on the November 2026 ballot. There are already whispers of new transit and school bonds that could shift the needle again. Stay informed, check your assessment early, and make sure you aren't paying more than your fair share of that regional pizza tab.