If you haven't looked at the money in Freetown lately, you're in for a shock. It's not just that the bills look different; the entire math of the country has shifted. Gone are the days of carrying backpacks full of cash just to pay for a nice dinner. Honestly, it was getting ridiculous. People were walking around with literal bricks of 5,000 and 10,000 "old" leone notes, feeling like millionaires but barely being able to afford a tank of gas.

The official currency for Sierra Leone is the Leone, but which one? That's where it gets tricky for travelers and even some locals. Since July 2022, the country has been operating under a redenominated system. Basically, the Bank of Sierra Leone chopped off three zeros. If you had 1,000 old leones (SLL), it suddenly became 1 new leone (SLE). It sounds simple on paper, but in the markets of Kroo Town or the busy streets of Bo, the transition has been a wild ride of confusion, inflation, and a lot of mental arithmetic.

The Big Reset: SLE vs. SLL

The "New Leone" wasn't just a design choice. It was a desperate move to save the economy from drowning in its own paper. Imagine trying to run a business where a simple invoice requires you to type twelve zeros. Systems were crashing. Accounting software couldn't handle the digits.

💡 You might also like: How to fill the cheque book without making a mess of your bank account

The Bank of Sierra Leone, led by Governor Kelfala Kallon at the time of the launch, pushed the SLE as a way to "restore confidence." They even introduced a 20 leone note, which features the portrait of Constance Cummings-John, a pioneer for women's rights and the first female mayor of Freetown. It’s a beautiful note, yellow and vibrant, but for many, it just felt like less money.

Psychology is a funny thing in economics. When you tell someone their 1,000,000 leones is now 1,000 leones, they feel poorer. This "money illusion" can actually drive prices up because sellers might round up costs more aggressively. By early 2026, we’ve seen that while the zeros are gone, the underlying pressure on the currency for Sierra Leone hasn't vanished. Inflation is still a beast that the central bank is trying to tame with aggressive interest rate hikes.

What’s in Your Wallet?

If you're visiting today, you’ll see the following banknotes in circulation:

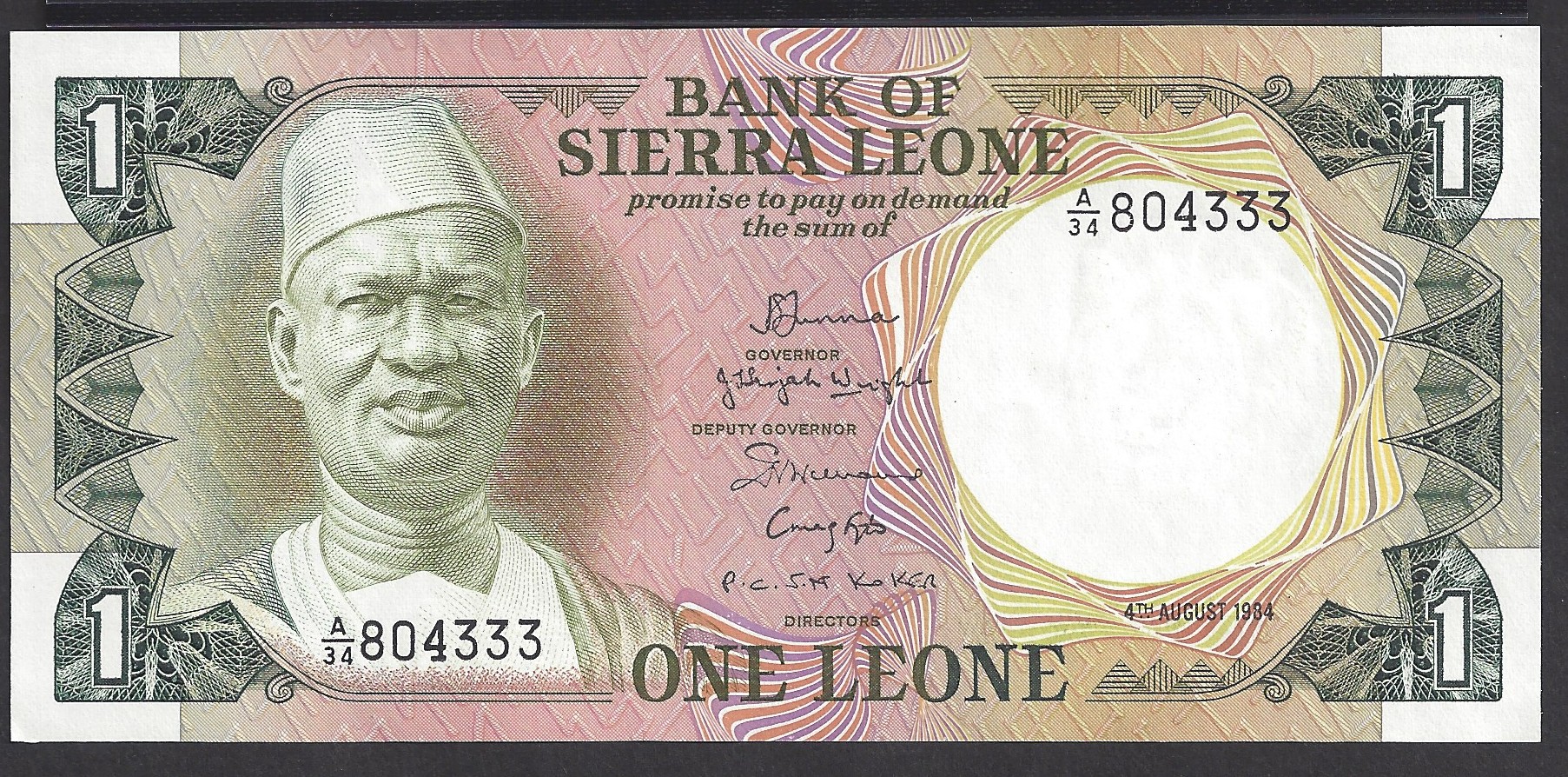

The tiny 1 Leone note is red and features Bai Bureh, the great military strategist. It's the equivalent of the old 1,000. Then there's the 2 Leone (brownish, featuring Isaac Wallace-Johnson) and the 5 Leone (purple, featuring Sengbe Pieh of the Amistad fame). The 10 Leone is a cool blue-green and depicts a dove flying over the map, while the 20 Leone remains the big player in the stack.

Coins are back, too. Sorta. They come in 1, 5, 10, 25, and 50 cents. But let’s be real—you won’t see them much. Much like the old 100 leone coins that people used to make jewelry out of because the metal was worth more than the face value, these new cents struggle to find a purpose in a world where a bottle of water costs several leones.

Why the Exchange Rate Still Hurts

You’ve probably seen the headlines. The leone has been one of the weakest currencies globally for years. As of mid-January 2026, the exchange rate hovers around 23 SLE to 1 USD. If you’re thinking in "old" terms, that’s 23,000 leones to the dollar.

💡 You might also like: Why Your Sixty Second Commercial 1 Strategy is Probably Failing (and How to Fix It)

Why is it so volatile? Sierra Leone depends heavily on exports like diamonds, iron ore, and cocoa. When global prices for these commodities dip, the leone feels the punch. Plus, the country imports almost everything—fuel, rice, electronics. When the leone drops, the price of a bag of rice in a Freetown shop goes up the very next morning. It’s a direct hit to the stomach for the average family.

There’s also the "parallel market" to consider. While official banks give you one rate, the "black market" or informal money changers often offer a slightly better deal. It’s technically discouraged, but it’s a reality of life in most of West Africa. If you’re a tourist, stick to the banks or reputable hotels to avoid getting scammed or accidentally breaking local laws.

Practical Survival Tips for Using Currency in Sierra Leone

Handling money here requires a bit of strategy. Don't just show up with a credit card and hope for the best.

- Cash is King: Outside of high-end hotels like the Radisson Blu or the Atlantic Lumley, Sierra Leone is a cash-driven society. Even where cards are accepted, the "system is down" is a phrase you’ll hear often.

- ATM Limits: ATMs in Freetown usually dispense New Leones, but they have daily limits. Often, you can only pull out about 2,000 to 4,000 SLE at a time (roughly $85 to $170 USD). If you need more, you’ll be making multiple trips.

- Dollar Preference: If you are bringing foreign currency, bring crisp, new $100 bills. Older "small head" bills or anything torn or marked will likely be rejected by banks and changers.

- Digital Wallets: Keep an eye on Orange Money and Afrimoney. Mobile money is exploding in Sierra Leone. It’s often easier to pay for a taxi or a meal by transferring funds via your phone than digging for change.

The Future of the Leone

Is the leone going to stabilize? The World Bank recently noted some resilience in the economy, projecting growth around 4.3% for 2026. The government is trying to move away from being just a "dig it and ship it" economy (mining) to something more sustainable like agriculture and tourism.

But there's a shadow over all this: debt. The cost of servicing external debt is high, which drains the foreign reserves the central bank needs to support the leone. If they can’t keep enough dollars in the vault, the currency for Sierra Leone will likely continue its slow slide against the greenback.

One thing is for sure: the people of Sierra Leone are incredibly resourceful. They’ve survived a civil war, Ebola, and hyperinflation. They treat the currency with a sort of weary respect. They know that today’s price isn’t tomorrow’s price, and they plan accordingly.

📖 Related: Dow Close Today: Why the Market is Hovering Near 50,000

If you are planning to do business or travel here, your best move is to stay liquid and stay informed. Check the rates daily. Don’t hold onto too much local currency if you’re planning to leave the country, as it’s nearly impossible to exchange the leone once you’re outside of West Africa.

Actionable Steps for Managing Your Money

- Check the Daily Rate: Use the Bank of Sierra Leone’s official website or a trusted app like XE to see the mid-market rate before you head to a currency exchange.

- Split Your Stash: Keep some money in a mobile wallet (Orange/Afrimoney) for small daily purchases and keep physical cash for larger transactions.

- Validate Your Notes: When receiving change, look for the holographic threads on the 10 and 20 SLE notes. Counterfeiting isn't rampant, but it’s always better to be the person who checks.

- Register for Mobile Money: If you're staying for more than a week, get a local SIM card and set up a mobile money account. It’s the single most convenient way to handle the currency for Sierra Leone without carrying a bulky wallet.