You’re standing at a checkout counter or sitting at a desk, pen in hand, looking at a blank piece of paper that represents actual, cold hard cash. It's a bit nerve-wracking. Honestly, even with Venmo and Zelle everywhere, knowing how to fill the cheque book correctly is still a foundational adult skill that people weirdly assume you just know by instinct. You don’t. One tiny slip—a decimal in the wrong place or a signature that looks a bit too shaky—and the bank’s fraud detection software treats your payment like a radioactive isotope.

It’s about security. It’s about not letting some random person turn your $100 birthday gift into a $1,000 nightmare just by adding a zero.

Writing a cheque is basically a formal instruction to your bank. You are telling them, "Hey, take this specific amount of my money and give it to this specific person." If that instruction is blurry, the bank won't execute it. Banks like Chase or Wells Fargo process millions of these, and their automated scanners are incredibly picky. If you mess up, the cheque bounces. Then you get hit with a "Returned Item Fee," which is usually around $35. That's a lot of money for a typo.

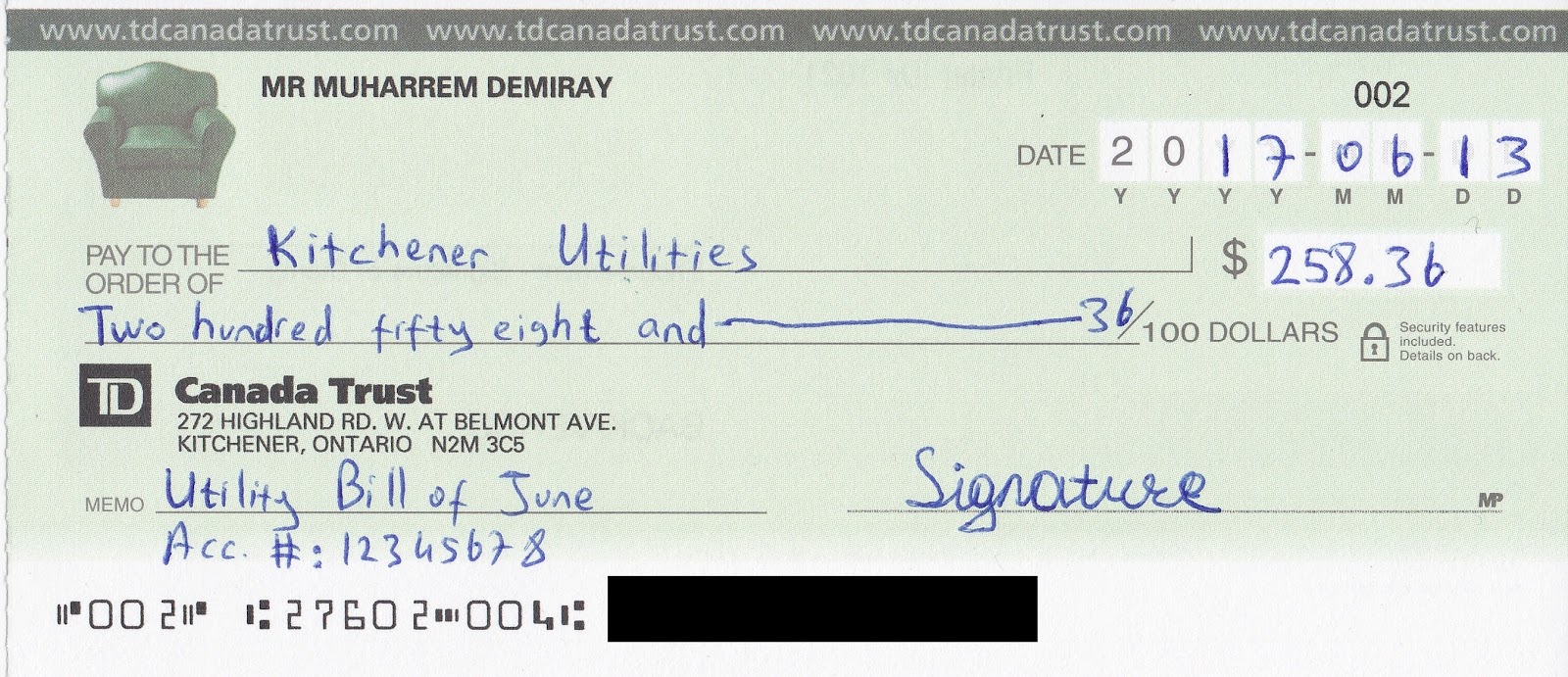

The anatomy of a perfect cheque

Let’s get into the weeds of the physical slip of paper. At the top right, you’ll see the date line. Don’t get fancy here. Just write the current date. Some people try "post-dating" cheques—writing a future date so the person can't cash it until then. Big mistake. Most banks don’t even look at the date when they process a deposit via an ATM or mobile app. If you give someone a post-dated cheque, they can often cash it immediately, and your bank will likely honor it, potentially overdrawing your account.

Then there’s the "Pay to the Order of" line. This is where you put the name of the person or the business. Be precise. If you're paying a utility company, use their full legal name, not a nickname. If you leave this blank, that cheque is essentially "payable to bearer." That means if you drop it on the sidewalk, anyone who picks it up can write their own name in and take your money. It’s like losing a $100 bill, but worse, because it’s linked to your entire balance.

Getting the numbers right (The hard part)

You have two places to write the amount. There is the small box on the right side for the numerical digits, and then there’s the long line in the middle where you write the amount out in words.

Here is the golden rule: If the two amounts don't match, the word version wins. If you write "$100.00" in the box but write "One Thousand Dollars" on the line, the bank is legally allowed to pull $1,000 from your account. It’s called the "Uniform Commercial Code" (UCC) in the United States, specifically Section 3-114. It dictates that words control figures. So, pay attention.

🔗 Read more: US Stock Futures Now: Why the Market is Ignoring the Noise

When writing the words, start at the very far left of the line. Don't leave a gap. If you leave a space before writing "Fifty," someone could easily write "One Hundred and" in front of it. After you finish writing the amount, draw a thick line through the remaining empty space all the way to the word "Dollars." This is a classic security move. It prevents anyone from adding extra words to increase the value.

For cents, use a fraction. If you’re writing a cheque for $150.25, you’d write: One Hundred Fifty and 25/100.

Why your signature is the ultimate gatekeeper

The bottom right line is for your signature. This is the only thing that makes the cheque legal. Without it, the paper is worthless. Your signature should match the one the bank has on file from when you opened the account. If you’ve changed your name or your handwriting has evolved significantly over twenty years, you might actually want to go into a branch and update your signature card.

Don't sign the cheque until you've filled out every other part.

Think about it. If you sign a blank cheque and lose it, you’ve basically handed a blank canvas to a thief. Also, use a blue or black pen. Never use a pencil. Gel pens that "bleed" are also a bad idea because the ink can smudge, making the MICR line (those weird numbers at the bottom) unreadable for the bank's scanners.

The Memo Line: Your personal filing cabinet

The "Memo" or "For" line at the bottom left is technically optional. The bank doesn't care what you write there. You could write "For being a great friend" or "Rent for October." However, for your own record-keeping, it's a lifesaver. If you're paying a bill, always put your account number in the memo. That way, if the company loses the paper trail, they can still figure out whose account to credit once they see the cheque.

💡 You might also like: TCPA Shadow Creek Ranch: What Homeowners and Marketers Keep Missing

Common mistakes and how to avoid the "Void"

Everyone messes up eventually. If you make a mistake, don't try to erase it. Ink erasers exist, but banks look for those signs as a mark of fraud. If you scribble out a number and write over it, the bank will likely reject it to protect you.

The best move? Write "VOID" in large, bold letters across the front of the cheque.

Then, tear it up. Don't just throw it in the trash whole. Thieves can sometimes find ways to use the routing and account numbers at the bottom even if the cheque is voided. This brings us to the most important part of how to fill the cheque book: the register.

Every cheque book comes with a little ledger. Use it. Immediately.

Write down the cheque number, the date, who it went to, and the amount. It’s so easy to forget a $40 cheque you wrote at a craft fair, and then three weeks later, it hits your account right when you're trying to pay your mortgage. That’s how people end up in "ChexSystems," which is basically the "blackball" list for banking. If you have too many bounced cheques, you might find it impossible to open a bank account anywhere for five years.

The security secrets of the MICR line

Look at the very bottom of your cheque. See those blocky, strange-looking numbers? That's the MICR (Magnetic Ink Character Recognition) line.

📖 Related: Starting Pay for Target: What Most People Get Wrong

- The first set of numbers is your Routing Number. This identifies your specific bank.

- The second set is your Account Number. This is you.

- The third set is the Cheque Number, which should match the number in the top right corner.

These are printed in a special magnetic ink. When you deposit a cheque, the machine "reads" the magnetism of the ink to quickly sort where the money is coming from. This is why you should never staple a cheque or crinkle it right over those numbers. If the magnetic strip is damaged, a human has to manually process it, which can delay your payment or cause it to be rejected.

Dealing with "Cash" cheques

You can write a cheque to "Cash." This basically means anyone who holds the paper can trade it for money. It’s extremely risky. Usually, people do this when they are at their own bank and want to withdraw money but forgot their debit card. If you're going to do this, wait until you are standing at the teller's window before you write "Cash" and sign it.

Honestly, it’s almost always better to just write the cheque to yourself. If your name is John Doe, write "John Doe" on the "Pay to" line. It provides a tiny extra layer of security compared to just writing "Cash."

Practical steps for a clean transaction

If you're still feeling a little shaky about the process, keep these practical points in mind for your next transaction. Consistency is your friend here.

- Use a permanent pen. Avoid those "erasable" pens that were popular a few years ago. High-tech fraudsters use chemicals to "wash" cheques, and cheap ink makes their job way too easy.

- Keep your cheque book locked away. It sounds old-school, but a stolen cheque book is a direct map to your identity.

- Check your balance first. This sounds obvious, but "floating" a cheque (writing it on Monday knowing you don't have the money until Friday's payday) is technically fraud and a massive gamble with your credit score.

- Balance your register monthly. Compare your little paper ledger to your mobile banking app. If there’s a cheque you wrote months ago that hasn't been cashed, you need to know that money is "spoken for" and not available to spend.

- Watch for "stale" cheques. Most cheques are valid for six months. After 180 days, a bank isn't legally required to honor them. If you’re the one receiving a cheque, deposit it immediately.

Writing a cheque is one of those tasks that feels like it belongs in 1995, but it's still a major part of how the world moves large sums of money, especially for rent, contractors, or government payments. By taking thirty seconds to be precise—writing clearly, filling the gaps, and recording the entry—you protect your hard-earned money from simple errors and sophisticated fraud.

Next time you open that little cardboard folder, remember that the "word line" is king and the "memo line" is for your future sanity. Once the cheque is signed and delivered, check your online banking a few days later to ensure the amount deducted matches exactly what you wrote down. Consistency in monitoring is the final step in the process.