You're standing at the DMV or maybe closing on a house, and suddenly someone asks for a physical payment. It feels like 1995. You dig through a junk drawer, find that dusty checkbook, and realize you've forgotten the basics. Specifically, you’re staring at those little boxes and wondering how to write a check number so the bank doesn't reject it.

It’s a weirdly stressful moment.

Most of our financial lives happen in the "tap to pay" world. But paper checks still move trillions of dollars every year. According to the Federal Reserve's 2023 Payments Study, while check usage is declining, the average value of a check has actually increased to over $2,600. That’s not pocket change. When you're writing a check for that amount, you can't afford a sloppy mistake that triggers a fraud alert or a "Stop Payment" fee from your bank.

Let's get into the weeds of how this actually works.

The Anatomy of the Check Number

Look at the top right corner. That’s usually where the check number lives. It’s also repeated at the very bottom of the document, tucked into that string of weird, magnetic-ink characters known as the MICR line (Magnetic Ink Character Recognition).

Why is it in two places? Basically, it's for redundancy. The top number is for your eyes—and the eyes of the person you’re paying—while the bottom number is for the high-speed sorting machines at the Federal Reserve and private clearinghouses.

💡 You might also like: Why New in United States Trends Are Shifting Everything You Know About the Economy

If you're using a personal check, the number is typically 3 or 4 digits. Business checks often go much longer.

The check number serves one primary purpose: tracking. It’s the "ID card" for that specific piece of paper. Without it, you couldn’t tell the bank to stop payment on a specific check if it got lost in the mail. You’d be stuck cancelling your entire account. That’s a nightmare nobody wants.

Why the Sequence Actually Matters

You might think you can just write any old number in that box if you're using a generic form. You can't.

Banks look for patterns. If you suddenly jump from check #105 to check #9000, it might flag a fraud department's algorithm. New accounts usually start at #101. Why 101? It’s a psychological trick. It makes the account holder look like they’ve been around the block a few times. Writing check #001 screams "I just opened this account five minutes ago," which can make some merchants nervous about whether the funds are actually there.

Step-by-Step: Don't Mess This Up

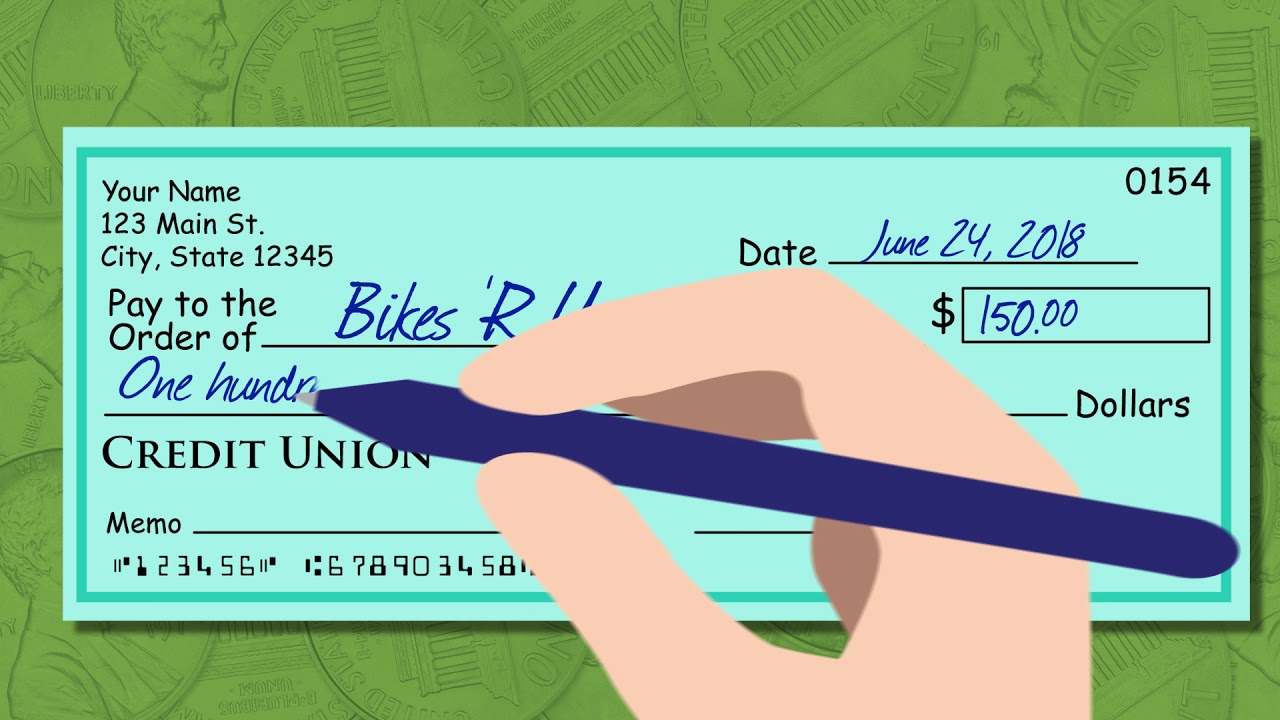

When you sit down to write a check number and fill out the rest of the fields, precision is your best friend.

First, the date. Use the current date unless you’ve cleared a "post-dated" check with the recipient. Even then, be careful—banks aren't actually legally required to honor a future date and might cash it anyway, potentially bouncing your other payments.

Next is the "Pay to the Order of" line. Be specific. If you’re paying a utility bill, write "City Water Department," not just "Water."

Then comes the numeric amount box. Write it clearly. If you’re paying $1,250.50, ensure the decimal point is obvious. People often forget that this box is actually secondary to the written line below it.

The Rule of Words

This is where people get tripped up. The long line in the middle of the check is for the written amount. Legally, under the Uniform Commercial Code (UCC), if the number in the box and the words on the line disagree, the words win.

If you write "$100" in the box but "One Thousand Dollars" on the line, the bank is technically supposed to process it as a thousand bucks.

To write a check number and amount correctly, use the "and 00/100" format for cents. Draw a line through any remaining empty space so no one can "accidentally" add a few extra zeros to your payment. It’s an old-school security measure that still works.

The MICR Line Mystery

Take a look at those funky numbers at the bottom. They look like a robot wrote them because, well, they did.

🔗 Read more: TD Bank New York Routing Number: How to Find Yours Without Getting a Headache

The first set of numbers is your 9-digit Routing Transit Number (RTN). This identifies your specific bank. The second set is your account number. The third set? That’s your check number again.

When the bank’s machine reads this line, it uses magnetism. This is why you should never staple through the bottom of a check. If you put a staple through the MICR line, the machine might misread the account or check number, leading to a manual processing delay. That can hold up your payment for days.

Common Myths and Mistakes

People think they can use any color ink. They’re wrong.

Stick to blue or black. Red ink often disappears under the scanners used by banks, making the check look blank or illegible. Glitter pens? Forget it. You want high contrast.

Another big mistake is the "memo" line. People think it’s legally binding. It really isn't. Writing "Payment in Full" on a check for less than you owe doesn't magically wipe out your debt in most states, despite what some "life hack" influencers might tell you. The memo line is mostly for your own record-keeping and to help the recipient's accounting department figure out which account to credit.

The Voided Check

Sometimes you aren't trying to pay someone; you're just trying to set up direct deposit. You'll be asked to provide a "voided check."

To do this, you simply write "VOID" in large letters across the front. Make sure you don't cover the routing or account numbers at the bottom, as the payroll department needs those. By writing VOID, you’re ensuring that if the check falls into the wrong hands, it can’t be filled out and cashed.

Is the Paper Check Dying?

Honestly, it’s taking a long time to go away.

In many real estate transactions, a personal check won't cut it anyway—you'll need a cashier's check or a wire transfer. However, for small businesses, contractors, and landlords, checks remain a staple because they don't carry the 3% processing fees that credit cards do.

If you're a freelancer, you've probably received a check recently. It's still the "language of business" for many legacy industries. Understanding how to write a check number and track your sequence is vital for your own bookkeeping. If you don't keep a check register, you're flying blind. You won't know that $500 is "gone" until it actually clears, which could be weeks later.

Security Protocols You Should Follow

Check washing is a real thing.

Criminals use chemicals to erase the ink on a check and rewrite the amount and the recipient. To prevent this, use a gel pen. Gel ink (like the Uniball 207) contains pigments that permeate the fibers of the paper, making it nearly impossible to "wash" without destroying the check itself.

Also, never leave the "Pay to the Order of" line blank. That’s essentially a "blank check," and anyone who finds it can write in their own name and any amount they want.

What to do if you mess up

If you're in the middle of writing and you realize you wrote "2024" instead of "2026," don't try to scribble over it. Most banks will reject a check with heavy alterations because it looks like tampering.

Just write "VOID" across it, tear it out, and start over with the next check in the sequence. It’s better to waste a 20-cent piece of paper than to deal with a flagged transaction.

✨ Don't miss: 10 Pounds Is How Many Dollars: Why Your Exchange Rate Isn't What Google Says

Managing Your Checkbook Ledger

Every time you write a check number, you should immediately record it in your ledger.

- The Check Number: This helps you reconcile your bank statement at the end of the month.

- The Date: Knowing when you handed over the check helps you track how long it's taking to clear.

- The Payee: Who did you give it to?

- The Amount: Subtract this from your balance immediately.

Don't wait for your mobile banking app to show the transaction. Checks are "floating" money. If you forget you wrote one, you might spend that money elsewhere and end up with a nasty overdraft fee.

Actionable Next Steps for Better Banking

Writing a check is a manual process in a digital world, which makes it prone to human error. To keep your finances tight, follow these steps:

- Audit your checkbook: Ensure your current check sequence matches what your bank has on file. If there’s a massive gap, you might have lost a book of checks.

- Switch to Gel Pens: Buy a dedicated black gel pen for your checkbook to prevent check washing fraud.

- Use a Check Register: Whether it's the paper one that came with the checks or a simple spreadsheet, log every single check the moment you rip it out.

- Monitor "Pending" Transactions: Check your online banking every few days to see which checks have cleared. If a check hasn't cleared after 30 days, contact the person you gave it to. It might be lost.

- Secure Your Checks: Store your checkbook in a locked drawer or a home safe. A stolen checkbook is a direct line to your bank account.

Knowing how to write a check number is just the start. It's about maintaining the discipline of a system that, while old, still carries significant legal and financial weight. If you treat that piece of paper with the same respect you treat your digital login credentials, you'll be fine.