Everything changed the moment the markets opened this morning. If you’ve been refreshing your browser every five minutes to check the tipo de cambio dolar peso mexicano tiempo real, you already know the feeling. That little knot in your stomach when the numbers jump three cents in the blink of an eye. It isn’t just numbers on a screen. It's your next vacation. It's the price of the laptop you’ve been eyeing. For many business owners in Mexico, it’s the difference between a profitable month and a complete disaster.

The peso is a weird beast. People call it the "proxy" for emerging markets. Basically, because the Mexican peso is so liquid and trades 24 hours a day, global investors use it as a punching bag whenever they’re scared about something else entirely—like a bank failure in Europe or a tech slump in China. You’re sitting there in Mexico City or Monterrey just trying to buy some equipment, and suddenly you’re paying for a crisis happening ten thousand miles away.

Honestly, the "super peso" era we saw recently felt like a fever dream. We got used to seeing 16.50 or 17.00 per dollar, and everyone thought the party would never end. But the market has a funny way of humbling people. Between domestic political shifts and the Federal Reserve’s constant flip-flopping on interest rates, the volatility has come back with a vengeance.

Understanding the volatility in the tipo de cambio dolar peso mexicano tiempo real

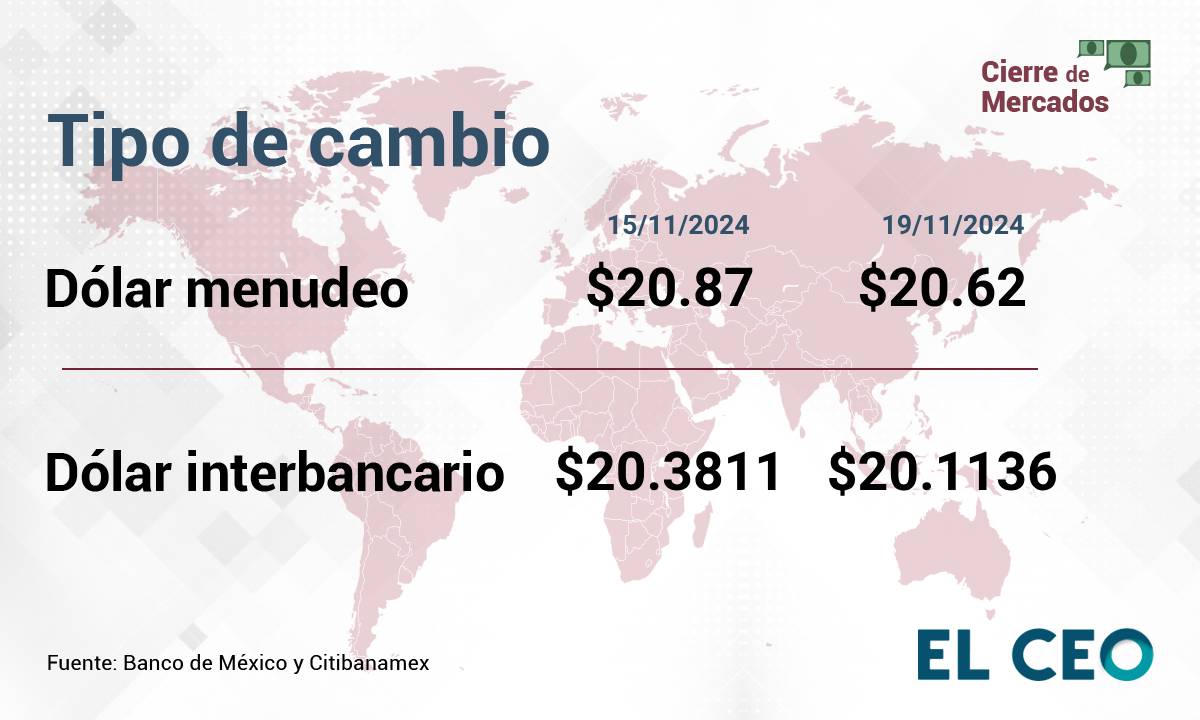

Why does it move so fast? It’s not just one thing. It’s a messy soup of high-frequency trading algorithms and massive institutional moves. When you look at the tipo de cambio dolar peso mexicano tiempo real on a site like Bloomberg or Reuters, you’re seeing the interbank rate. That’s the big-boy rate. The rate you get at a casa de cambio in the airport or at a BBVA branch is always going to be "worse" for you because they need to take their cut.

Right now, the Bank of Mexico (Banxico) is in a tight spot. They’ve kept interest rates high to fight inflation, which makes the peso attractive to investors who want to park their money and earn a decent return. It's called the "carry trade." But if the US Federal Reserve starts cutting rates faster than expected, or if Mexico's own economy starts to cool down too much, that money flies out of the country faster than a tourist leaving Cancun after a hurricane.

✨ Don't miss: Pacific Plus International Inc: Why This Food Importer is a Secret Weapon for Restaurants

I was talking to a friend who runs a small import business in Querétaro. He told me he stopped looking at the daily fluctuations because it was giving him migraines. He started using "forwards" or exchange rate hedges. It’s basically like buying insurance against the dollar getting too expensive. It costs a bit upfront, but at least he can sleep at night knowing his costs are locked in. Most people don’t do that. Most people just stare at Google Finance and hope for the best.

The role of remittances and "Nearshoring"

You can’t talk about the peso without talking about the billions of dollars sent home by Mexicans working in the US. It’s a massive pillar of the economy. When the dollar is strong, those families get more pesos. When the peso strengthens—like it did last year—those families actually struggle because their dollars don’t buy as many tortillas or pay as much rent as they used to. It's a cruel irony.

Then there's the buzzword of the decade: nearshoring. Companies like Tesla or various Chinese manufacturers moving production to northern Mexico creates a constant demand for pesos. They need to pay for construction, electricity, and salaries in the local currency. That creates a "floor" for the peso. It's why many analysts, despite the current craziness, don't think we're heading back to the "bad old days" of 25 pesos to the dollar anytime soon.

Where to get the most accurate data

Don't trust just any random app. Seriously. Some of them lag by fifteen minutes, which is an eternity in forex trading. If you’re making a big move, you need the real deal.

🔗 Read more: AOL CEO Tim Armstrong: What Most People Get Wrong About the Comeback King

- The Bank of Mexico (Banxico): They publish the "FIX" rate every business day. This is the official benchmark used for settling obligations in foreign currency.

- Investing.com or TradingView: These are great for seeing the candles move in real time. You can see the "bids" and "asks" which tell you how much people are actually willing to pay right this second.

- Google Finance: It’s fine for a quick check while you’re standing in line for coffee, but don’t base a million-peso business decision on it. It’s a bit simplified.

Remember that the market never really sleeps. Even when the Mexican stock exchange (BMV) is closed, the peso is being traded in Tokyo, London, and New York. That’s why you might wake up Monday morning and see that the tipo de cambio dolar peso mexicano tiempo real has "gapped" or jumped significantly from where it was on Friday afternoon.

Common mistakes when watching the rate

People get emotional. It’s human nature. When the dollar starts climbing, people panic-buy because they think it’s going to 30. Usually, that’s exactly when it hits a ceiling and drops back down.

Also, stop ignoring the spread. If the "mid-market" rate is 19.50, but your bank is selling to you at 20.10, you’re losing 3% right off the top. If you’re moving large amounts, you have to negotiate. Don't just take the first rate the teller gives you. Tell them you’re looking at the real-time interbank rate and see if they can shave off a few cents. You’d be surprised how often it works if you have a decent relationship with the bank.

Political noise is another big one. Every time there’s a headline about judicial reforms or trade disputes, the peso twitches. Sometimes it’s a genuine structural change, but often it’s just traders overreacting to a tweet or a snippet of a press conference. If you can learn to filter out the noise and look at the broader economic trends—like the trade balance and the inflation differential between the US and Mexico—you’ll be way ahead of the curve.

💡 You might also like: Wall Street Lays an Egg: The Truth About the Most Famous Headline in History

Strategies for the average person

If you have a trip coming up, stop trying to "time" the market perfectly. You won't. You aren't a Goldman Sachs trader with a 10-screen setup and a direct line to the Fed. Instead, buy your dollars in chunks. Buy a bit this week, a bit next month. It’s called dollar-cost averaging. It smooths out the peaks and valleys so you don't end up buying everything at the absolute worst moment.

For those holding savings in dollars, the temptation is to sell as soon as the peso weakens. But ask yourself: what is the long-term trend? If the US economy is outperforming Mexico's, the dollar generally wins over time. However, Mexico’s high interest rates are a powerful magnet for capital. It’s a balancing act.

Ultimately, the tipo de cambio dolar peso mexicano tiempo real is a reflection of the world's confidence in Mexico's future versus the safety of the US dollar. Right now, the world is a bit nervous. And when the world gets nervous, it buys dollars. That's just the reality we're living in.

Actionable steps for managing your money

Instead of just watching the ticker, take these specific steps to protect your finances from exchange rate volatility:

- Audit your expenses: Identify which of your recurring costs are dollar-denominated (like software subscriptions, imported goods, or international travel plans).

- Use a Multi-Currency Account: Consider using platforms like Wise or Revolut (if available) to hold balances in both pesos and dollars. This allows you to convert when the rate is favorable rather than when you're forced to.

- Set Price Alerts: Use an app like XE or Investing.com to set a "push notification" for when the peso hits a specific target. This stops you from checking your phone 50 times a day.

- Consult a Professional: If you are a business owner with more than 20% of your expenses in dollars, talk to a treasury specialist at your bank about "Hedge" instruments like Coberturas Cambiarias. It's not as complicated as it sounds.

- Diversify your Income: If possible, look for freelance work or investment opportunities that pay in USD. It’s the ultimate natural hedge against a weakening peso.