You’ve been there. You’re standing at the checkout, iPhone in hand, ready for that satisfying "ping" and a checkmark. But then you see it: a clunky, old-school credit card reader that looks like it belongs in 2005. No contactless symbol. No Apple Pay logo. Just a cashier staring at you while you frantically dig through your pockets for a physical wallet you haven't touched in weeks.

It’s 2026. You’d think every store on the planet would accept digital wallets by now, right?

Well, it’s complicated. While over 90% of retailers in the U.S. and nearly 100% in many European cities have jumped on the bandwagon, there are still some massive "dead zones" that catch people off guard. Knowing where can I pay with Apple Pay isn't just about convenience anymore; it’s about not getting stranded at a gas pump or a grocery store with no way to pay.

The Big Names: Where It Just Works

Honestly, if you’re at a major chain in 2026, you’re usually safe. Most big-box retailers spent the last few years upgrading their point-of-sale (POS) systems because contactless is faster for them, too.

In the world of grocery stores, you’re almost always golden at places like Trader Joe’s, Whole Foods, ALDI, and Wegmans. Regional giants like Meijer, Publix, and Safeway have also been fully integrated for a while. Even Costco, which used to be notoriously picky about payment methods, now accepts Apple Pay at most of its warehouse locations (as long as you have a Visa card linked, of course).

If you’re shopping for tech or home goods, you can walk into Best Buy, Apple Stores (obviously), or Sephora and tap-to-pay without a second thought. Target was a bit of a late bloomer years ago, but now it’s fully on board across all checkout lanes, including self-checkout.

Here’s a quick mental checklist of the "Always Yes" crew:

👉 See also: The Facebook User Privacy Settlement Official Site: What’s Actually Happening with Your Payout

- Pharmacy: CVS, Walgreens, Rite Aid.

- Fast Food: McDonald’s, Starbucks, Chick-fil-A, Taco Bell, Dunkin’.

- Apparel: Nike, Adidas, American Eagle, Macy’s, Kohl’s.

- Books/Hobby: Barnes & Noble, Staples.

The "Holdouts": Why Some Stores Still Say No

This is the part that trips people up. You’d assume a massive company like Walmart would be the first to adopt new tech. Nope.

As of early 2026, Walmart is still the biggest Apple Pay holdout in the U.S. They want you to use "Walmart Pay," which is tucked inside their own app. It’s annoying. You have to open the app, find the QR code scanner, and link your card there. It’s not a hardware issue; their terminals can technically handle NFC (Near Field Communication), but they’ve basically "locked" it to keep you in their ecosystem and save on those pesky transaction fees.

Then there’s the Home Depot and Lowe’s situation. For years, these two were the bane of every Apple Pay user's existence. While some locations have finally started rolling out NFC-enabled readers over the last year, it’s still weirdly hit-or-miss. Don’t bet your morning project on it unless you’ve checked your specific store first.

Hobby Lobby and Sam’s Club (owned by Walmart) are other common spots where your iPhone will likely stay in your pocket. Sam’s Club, like its parent company, pushes its "Scan & Go" feature instead.

Gas Stations and the Pump Struggle

Gas stations used to be the Wild West for Apple Pay. You’d see the logo on the door, but the actual pump reader would be broken or non-existent.

Things have smoothed out. Major brands like Shell, ExxonMobil, Chevron, and BP have mostly finished their nationwide hardware upgrades. Most of these even have their own apps where you can select your pump and pay with Apple Pay before you even step out of the car. It’s a lifesaver in the winter.

✨ Don't miss: Smart TV TCL 55: What Most People Get Wrong

7-Eleven and Wawa are also super reliable for tap-to-pay at the pump and the register. Just look for the sideways "Wi-Fi" looking symbol or the Apple Pay logo on the screen.

Transit: The Secret Superpower of Apple Pay

If you’re traveling, Apple Pay is actually better than a physical card. Many major cities now use "Express Transit" mode.

In places like New York City (OMNY), London (TfL), Tokyo (Suica/Pasmo), and Chicago (Ventra), you don't even have to wake your phone or use Face ID. You just tap your iPhone or Apple Watch against the turnstile, and it lets you through. It’s incredibly fast.

In 2025 and 2026, this expanded to dozens of smaller transit systems. Even if a city doesn't have a dedicated transit card in the Apple Wallet, they often just let you "tap and go" with your standard credit card via Apple Pay.

How to Check Before You Get to the Register

There is a "hack" for this that surprisingly few people use. If you’re unsure if a store takes it, open Apple Maps.

Search for the business. Tap on it to open the details. Scroll down to the section that lists things like "Good for Kids" or "Takeout." If they accept Apple Pay, you’ll see the logo right there. It’s not 100% perfect—sometimes data is a few months behind—but it’s the most reliable way to check without calling the store like it's 1995.

🔗 Read more: Savannah Weather Radar: What Most People Get Wrong

Using It Online and in Apps

We often focus on the physical world, but where can I pay with Apple Pay online? It’s basically everywhere now.

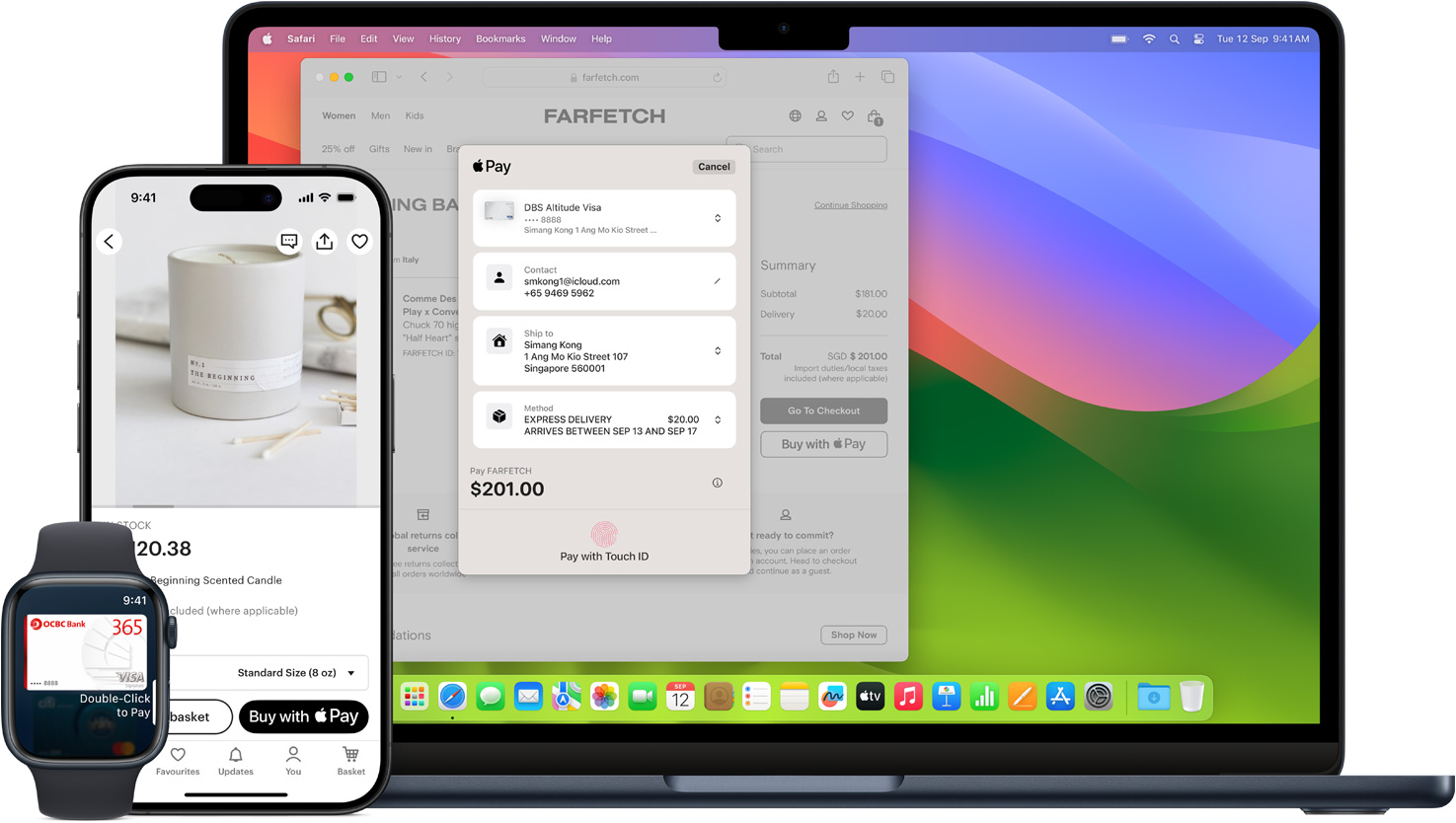

Apps like Uber, DoorDash, Airbnb, and Etsy have integrated it so deeply that it’s usually the default option. If you’re browsing in Safari on your iPhone or Mac, keep an eye out for the "Buy with Apple Pay" button. It saves you from typing in your shipping address and 16-digit card number for the billionth time. It’s safer, too, because the merchant never actually sees your real card number.

International Travel: A Different World

If you’re headed to Europe, Australia, or parts of Asia (like Singapore or South Korea), you’ll actually find Apple Pay is more common than in the U.S.

In London or Sydney, it’s rarer to find a place that doesn't take it. Even small street food vendors and "hole-in-the-wall" coffee shops have portable Square-style readers that love Apple Pay. Just watch out for some parts of Germany or Japan where cash is still king in smaller villages, but in the cities, you’re basically set.

Common Myths and Mistakes

One big misconception is that you need an internet connection to use Apple Pay at a store. You don't. The "handshake" happens between your phone's NFC chip and the terminal. Your phone doesn't need Wi-Fi or cellular data to authorize a physical transaction.

Another one? "It’s not as secure." Actually, it’s way more secure than swiping or even using a chip. Apple Pay uses "tokenization." When you pay, it sends a random string of numbers (a token) to the merchant, not your actual card info. If the store gets hacked later, the hackers don't get your credit card number.

Actionable Steps for the "Wallet-Less" Life

If you’re ready to stop carrying a bulky wallet, here is how you should play it:

- Audit your "Must-Haves": Identify if your regular grocery store or gas station is a holdout (looking at you, Walmart). If they are, you still need a backup.

- Set up Express Transit: Go into your Wallet settings and pick a default card for transit. It makes commuting 10x smoother.

- Use the Maps Filter: Before heading to a new restaurant or boutique, check the Apple Maps "Useful to Know" section.

- Keep a "Ghost" Card: If you really want to go minimal, keep one physical card (and your ID) tucked into a MagSafe wallet on the back of your phone. That covers you for the 5-10% of places that still live in the past.

The world is moving toward a phone-only economy, and while the "where can I pay with Apple Pay" question still has a few "no" answers, those gaps are closing every single day. Just keep that backup card handy for the Walmart runs.