Everyone is staring at the Federal Reserve like it’s a crystal ball. If you’re trying to buy a house, refinance a car loan, or just keep your small business from drowning in debt, the only question that matters is when will interest rates go down. Honestly, the answer changes every time a new jobs report drops or a CPI number leaks. It’s a moving target.

Jerome Powell, the Fed Chair, has been pretty blunt about it. He isn't moving until he’s "confident" that inflation is dead and buried at that magic $2%$ mark. Right now? We're in a tug-of-war. On one side, you have a labor market that stays surprisingly resilient. On the other, you have consumers who are starting to feel the pinch of $5%+$ federal funds rates. It’s a mess.

The Inflation Ghost That Won't Leave

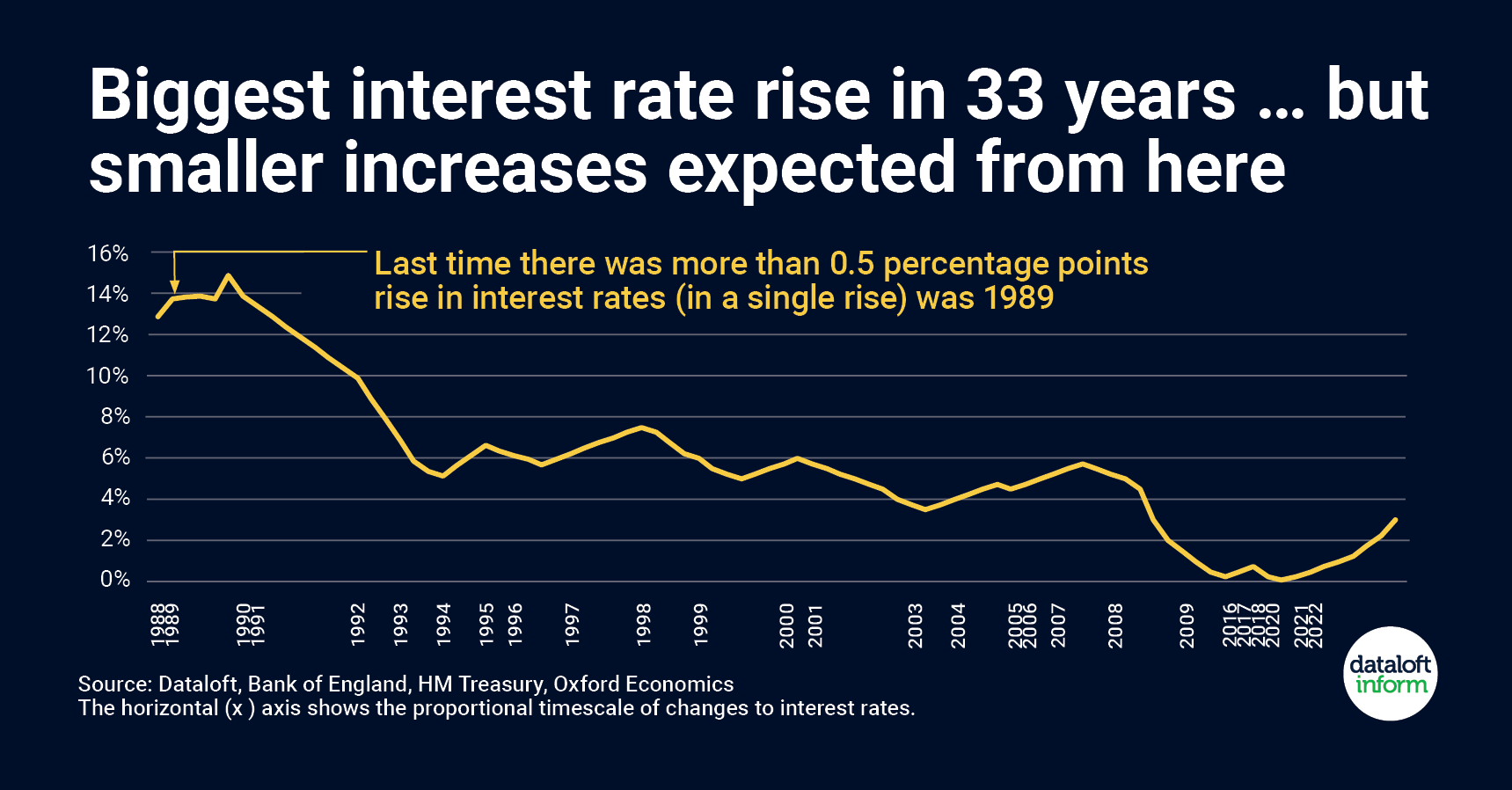

Inflation is the primary reason we're even asking when will interest rates go down. Think back to 2021. Everything was "transitory." Then, suddenly, it wasn't. The Fed had to slam on the brakes, hiking rates faster than we’ve seen in decades. Now, they’re terrified of letting go too soon. If they cut rates tomorrow and inflation spikes back up, they look like fools.

It’s called the "Burne’s Mistake." Back in the 1970s, Arthur Burns (then Fed Chair) cut rates too early, and inflation came roaring back like a horror movie villain. Powell is obsessed with not being that guy. He wants to see "cooling," but not a "collapse." It’s a razor-thin line.

You’ve probably noticed that eggs don't cost $$8$ anymore, but your insurance premiums and rent are still climbing. That’s "sticky" inflation. Service-sector inflation is much harder to kill than the price of milk. Until the cost of getting your car fixed or going to a movie stabilizes, the Fed is going to keep their finger on the pause button.

The Jobs Market Paradox

Usually, high interest rates kill jobs. That’s the "Phillips Curve" logic economists love to cite. But this cycle is weird. We’ve had high rates for a while, and yet, unemployment hasn’t skyrocketed.

As long as everyone has a job and is spending money, the Fed feels they have "room" to keep rates high. They don't want people to lose their jobs, obviously, but a slightly weaker job market gives them the green light to pivot. If the unemployment rate starts creeping toward $4.5%$ or $5%$, the conversation about when will interest rates go down shifts from "maybe next year" to "we need to cut right now."

- Non-farm payrolls: This is the big daddy of data. If this number comes in lower than expected, the market bets on rate cuts.

- Wage growth: If people are getting $5%$ raises, they spend more. Spending more keeps inflation high. It's a cycle.

- The "Quit Rate": Fewer people are quitting their jobs voluntarily lately. That means the "Great Resignation" is over and the labor market is finally chilling out.

What the Big Banks Are Saying

If you ask Goldman Sachs, they might give you one date. Ask JPMorgan, you’ll get another. Most Wall Street analysts have pushed back their expectations multiple times. Earlier this year, everyone was screaming for a March cut. March came and went. Then June.

The consensus is moving toward a "higher for longer" reality. We might see one or two small cuts toward the end of the year, but the days of $0%$ interest rates are gone. Dead. Buried. We’re likely settling into a "new normal" where a $3%$ or $4%$ mortgage is a pipe dream and $6%$ is actually considered a decent deal.

The bond market is the real indicator to watch. When the yield on the 10-year Treasury starts sliding, it’s a sign that the "smart money" thinks a recession—or at least a major slowdown—is coming. That’s usually when the Fed is forced to act.

How This Actually Hits Your Wallet

Wait.

That’s what most people are doing. But waiting has a cost. If you’re sitting on the sidelines of the housing market waiting for a $3%$ rate, you might be waiting a decade. Meanwhile, home prices keep drifting upward because there’s no inventory.

When rates do eventually drop, even by half a percentage point, a flood of buyers will hit the market. That creates a bidding war. You might save $$200$ a month on your mortgage payment but end up paying $$50,000$ more for the house itself. It’s a classic "pick your poison" scenario.

Credit cards are the real killer here. Most cards are tied to the Prime Rate. When the Fed moves, your card interest moves almost instantly. If you’re carrying a balance, you’re basically paying a "Fed tax" every month. Even a small cut won't bring those $24%$ APRs back down to $12%$.

Geopolitical Wildcards

We can't talk about when will interest rates go down without looking at the rest of the world. Oil prices are a massive variable. If conflict in the Middle East escalates and oil hits $$120$ a barrel, inflation goes back up. The Fed would be trapped. They couldn't cut rates even if the economy was slowing because energy costs would be driving prices through the roof.

💡 You might also like: Wells Fargo Bank Stock Symbol: What Most People Get Wrong About WFC

Then there's the deficit. The U.S. government is borrowing money at a staggering rate. To fund that debt, the Treasury has to offer attractive yields on bonds. If the government is competing for capital, it puts upward pressure on interest rates across the board, regardless of what the Fed wants.

The Verdict on the Timeline

So, when is it happening?

Probably not as soon as you want, but sooner than the doomers think. Most indicators suggest the Fed will look for a window in the latter half of the year to start a "normalization" process. They won't call it a rescue; they’ll call it an adjustment.

Expect small, incremental moves. Quarter-point drops. They want to "land the plane" softly. If they drop rates by a full percent in one meeting, it’s a sign of panic—and you don't want the Fed to be in a panic.

Actionable Steps to Take Right Now

- De-leverage your high-interest debt immediately. Don't wait for a rate cut to fix your credit card balance. The Fed’s moves are too slow to save you from $29%$ interest.

- Lock in high-yield savings. If you have cash, the current environment is actually great for you. 4-5% on a liquid savings account is the best risk-free return we’ve seen in a generation. Lock in a CD (Certificate of Deposit) now if you think rates are about to peak.

- Date the rate, marry the house. If you find a home you love and can afford the payment now, buy it. You can refinance later when rates eventually drop. You can't "refinance" the purchase price of the home downward once the market heats up again.

- Watch the PCE, not just the CPI. The Fed actually prefers the Personal Consumption Expenditures (PCE) index over the Consumer Price Index (CPI). If the PCE starts dipping consistently, that's your strongest signal that a rate cut is imminent.

- Audit your business loans. If you have a variable-rate business line of credit, talk to your banker about a "fixed-rate flip" or a cap. Don't assume the downward trend will be a straight line.

The reality is that "when" is less important than "how much." We are likely entering a multi-year period of mid-range rates. The era of free money is over, and the sooner you adjust your personal budget to a $5%$ or $6%$ world, the better off you'll be when the Fed finally decides to budge.