You're standing in your kitchen in New York or maybe sitting in a coffee shop in Austin, and you need to get five thousand dollars to a bank account in London. It should be easy. It's 2026. We have self-driving cars and AI that can write poetry, but sending money across the Atlantic still feels like navigating a minefield of hidden fees and "intermediary bank" nonsense. Honestly, the biggest mistake people make is trusting their local bank by default.

Banks are comfortable. You have the app. You know the login. But when you initiate a US to UK money transfer through a traditional big-brand bank, you're basically paying a "convenience tax" that can cost you hundreds of pounds on the other end. It isn't just the wire fee, which is usually around $25 to $50. It’s the exchange rate markup. Banks often bake a 3% to 5% spread into the mid-market rate. If you're sending $10,000, you might be "losing" $500 without even realizing it. That’s a weekend trip to Edinburgh gone before the money even hits the Thames.

The Exchange Rate Myth and the Mid-Market Reality

Most people check Google for the exchange rate. They see $1 equals £0.78 and think, "Great, that’s what I’ll get." Then they open their bank app and see £0.75. What happened? That gap is the spread.

The "mid-market rate" is the real-time midpoint between the buy and sell prices of global currencies. It’s what banks use to trade with each other. It’s the "fair" price. Retail banks almost never give this to you. Instead, they give you a "retail rate." If you want to handle a US to UK money transfer like a pro, you have to look for providers that either offer the mid-market rate for a transparent fee or keep their spread under 0.5%.

Companies like Wise (formerly TransferWise) or Revolut have built their entire business models on this transparency. They use local bank accounts in both countries. When you send money, you aren't actually sending it across the ocean. You pay USD into their US account, and they pay out GBP from their UK account. It’s a clever workaround that bypasses the SWIFT network’s heavy lifting and high costs.

Why SWIFT is slow and expensive

SWIFT stands for the Society for Worldwide Interbank Financial Telecommunication. It’s a messaging system, not a fund transfer system. Think of it like a series of connecting flights. Your money leaves your bank, hits a "correspondent bank," maybe hits another one, and finally lands in Barclays or HSBC. Every stop along the way might take a little "nibble" out of your total. These are intermediary fees. You can send $1,000 and only £740 arrives, even if the math said it should be more.

Choosing the Right Tool for Your Specific Amount

Size matters here. A lot.

If you are sending $500 to a friend for a stag do in London, just use whatever is easiest. The $10 difference isn't worth three hours of research. But if you are buying a flat in Manchester or moving your entire life savings because you got a job in the City, the math changes.

For large transfers—we’re talking $50,000 and up—specialist currency brokers like Atlantic Money or Currencies Direct often beat the "techy" apps. Why? Because they offer personalized service and "forward contracts." A forward contract lets you lock in an exchange rate today for a transfer you’ll make in the future. If the Pound is weak today but you don't need to pay your UK solicitor for three weeks, locking that rate in protects you from a sudden spike in the GBP value.

Small transfers vs. Big moves

- Under $1,000: Use Revolut or Wise. It’s instant, the UX is great, and the fees are pennies.

- $1,000 to $20,000: Wise is usually the king here. Their transparency is hard to beat.

- Over $50,000: Look into a dedicated FX broker. You can actually talk to a human who might shave an extra 0.2% off the rate. On $100k, that's $200. It adds up.

Taxes and the IRS: The Part Everyone Forgets

Sending a US to UK money transfer isn't just about the rate; it’s about the paperwork. Uncle Sam wants to know what you're doing.

If you're a US citizen or resident alien and you have more than $10,000 in foreign bank accounts at any point during the calendar year, you have to file an FBAR (Report of Foreign Bank and Financial Accounts). This is FinCEN Form 114. If you forget, the penalties are genuinely terrifying. We’re talking $10,000 per non-willful violation.

📖 Related: Belmont University Nashville TN Tuition: What Most People Get Wrong

Also, consider the gift tax. If you’re sending money to a relative in the UK, you can send up to $18,000 (as of 2024/2025 limits) per person, per year, without having to file a gift tax return. If you go over that, you don't necessarily owe tax—most people won't ever hit the lifetime exemption—but you must report it.

On the UK side, HMRC generally doesn't tax "capital" being brought into the country. If it's your own money that you already paid US tax on, you're usually fine. But if that money generates interest in a UK account, that interest is taxable income. If you're a "non-dom" or dealing with complex residency status, please talk to a tax pro. The UK tax system is a thicket of rules that changed significantly in 2025.

Speed: When Does the Money Actually Arrive?

"Instant" is a relative term.

If you use a fintech app, and both you and the recipient have accounts with that app, it can be seconds. If you're doing a standard ACH pull from your US bank to a provider, it takes 1-3 business days for the provider to even get your dollars. Then another day to convert and send via the UK's "Faster Payments" network.

Total time? Usually 2 to 5 business days.

If you need it there now, you have to use a domestic Wire Transfer (Fedwire) to send the money to your provider. This usually costs $25 at your US bank but gets the money to the exchange provider in hours rather than days.

Avoiding the Scams

It sounds obvious, but people get caught every day.

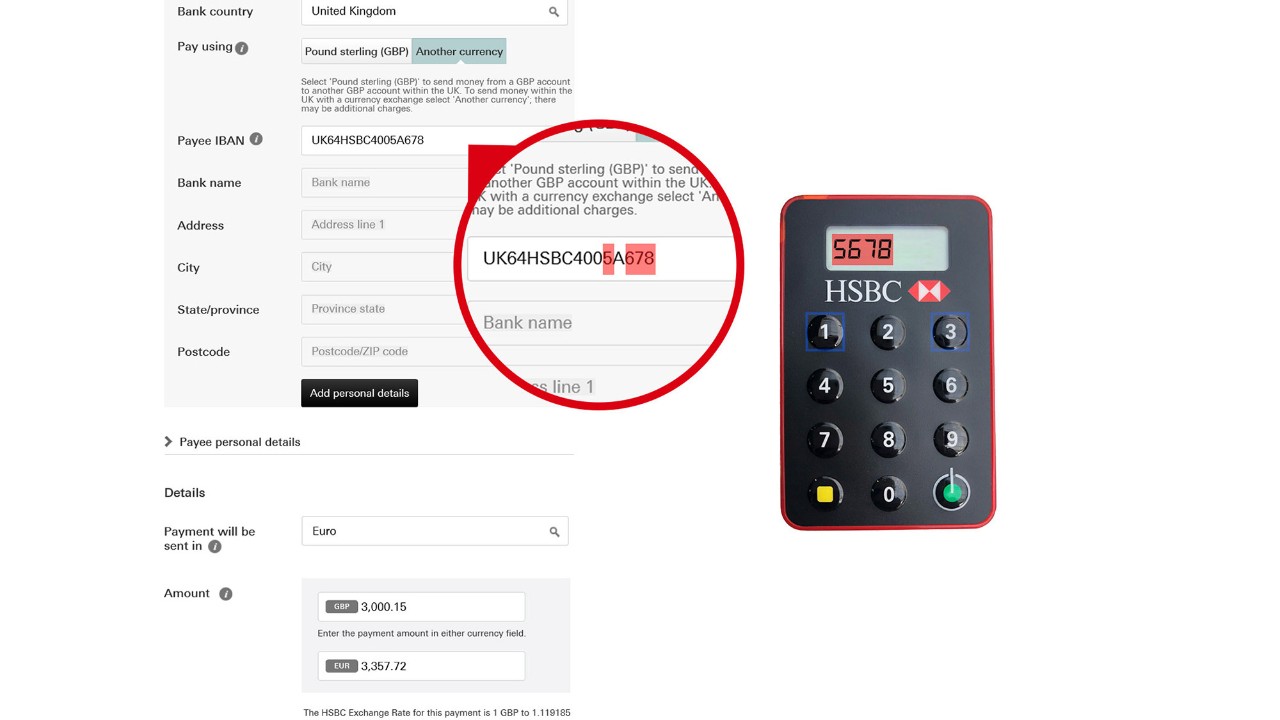

If you're buying a property in the UK, verify the bank details over the phone with your solicitor. "Man-in-the-middle" attacks are huge right now. Scammers intercept emails, change the IBAN/Account Number on an invoice, and your $200,000 down payment vanishes into a ghost account in seconds. Once it's gone via wire, it is nearly impossible to claw back.

🔗 Read more: The Disadvantages of Sole Proprietorships: What Your CPA Might Not Tell You

Always send a test amount. If you're sending a large sum, send £10 first. Confirm the recipient got it. Then send the rest. It’s an extra step, it might cost an extra fee, but it’s the only way to sleep soundly.

Practical Next Steps for Your Transfer

Don't just click "send" on the first app you see. Start by checking the current mid-market rate on a neutral site like Reuters or Bloomberg. This is your baseline.

If you are sending more than $5,000, open accounts with at least two providers—say, Wise and a broker like XE or Atlantic Money. Compare the "all-in" cost. Look at the final amount of GBP that will actually hit the UK bank account after all fees are subtracted. That is the only number that matters.

Check your US bank's daily transfer limits. Many banks cap ACH transfers at $5,000 or $10,000 per day. If you need to send $50,000, you'll need to either plan it out over a week or visit a branch to authorize a larger wire.

Finally, ensure your UK recipient has their IBAN (International Bank Account Number) and BIC/SWIFT code ready. UK accounts use a Sort Code (6 digits) and an Account Number (8 digits), but for international moves, the IBAN is the gold standard for avoiding errors. Clear those hurdles, and your money will make it across the pond without getting caught in the gears of the old-school banking system.