The ticker never stops. If you walk past that famous clock in Manhattan, you see the digits blurring. It's fast. By the time you finish this sentence, the government has borrowed another couple hundred thousand dollars. We are looking at a U.S. national debt 2025 reality that has finally moved past the "abstract problem" phase and into something that actually dictates how your bank account behaves.

For years, economists treated the debt like a boogeyman in a closet—scary, sure, but it never actually jumped out. Then 2024 happened. Now, in 2025, the math has changed because the "free money" era is officially dead and buried.

The Trillion-Dollar Interest Trap

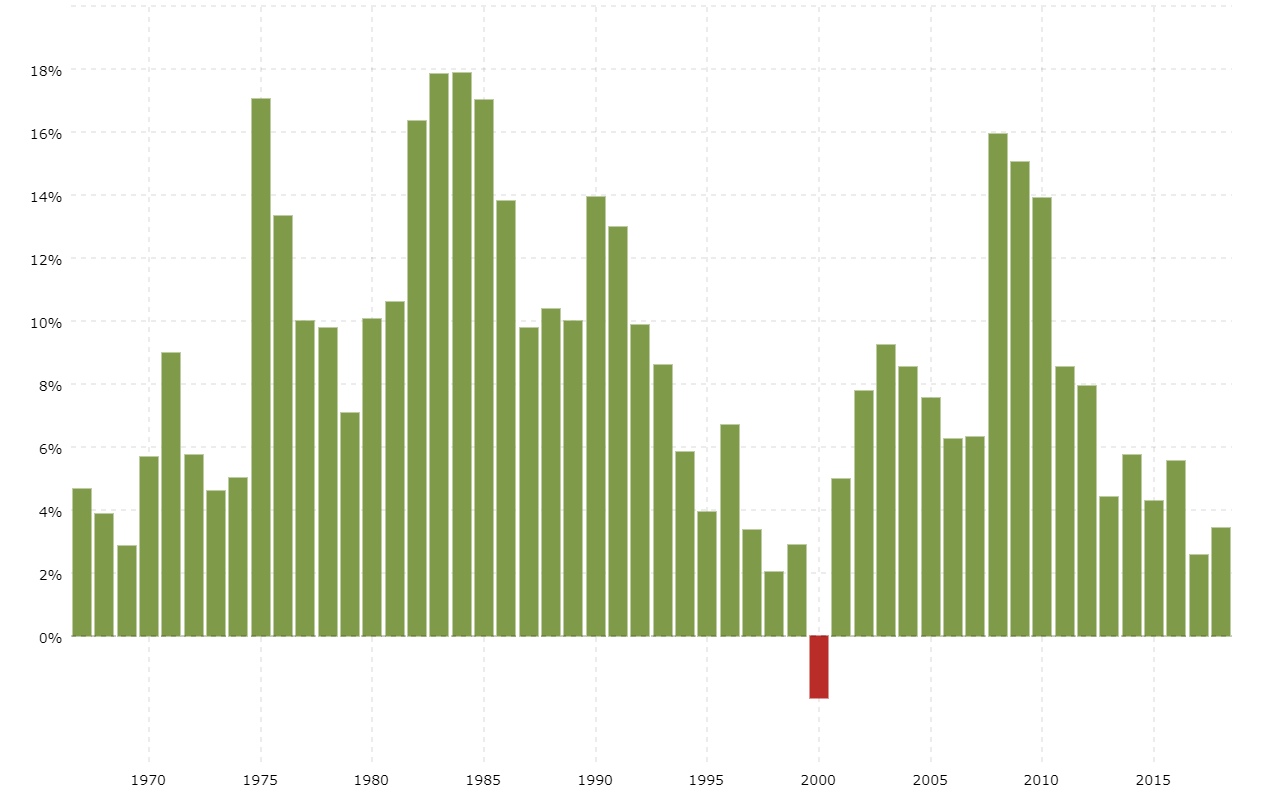

Honestly, the total number—north of $36 trillion—is so big it’s basically meaningless to the human brain. We can't conceptualize it. But here is the part that matters: interest. For the first time, the United States is spending more on interest payments than it does on its entire defense budget. Let that sink in for a second. We’re paying more to "rent" money we already spent than we are to fund the most powerful military on earth.

It’s a snowball effect. When interest rates jumped to fight inflation, the cost of servicing that massive pile of debt skyrocketed. In 2025, we are seeing the Treasury Department issue more short-term debt to cover the interest on the old debt. It’s the sovereign version of paying off one credit card with another, except the credit limit is backed by the "full faith and credit" of the American taxpayer.

What’s Actually Driving the U.S. National Debt 2025 Surge?

People love to argue about this. Some blame foreign aid. Others blame social programs. The reality is a lot more boring and much harder to fix. It's the "Big Three": Social Security, Medicare, and interest. Everything else—the stuff politicians usually shout about on TV—is basically rounding error in comparison.

We have an aging population. That isn't a political statement; it's a demographic fact. As the Baby Boomer generation continues to retire, the draw on Social Security and Medicare increases. According to the Congressional Budget Office (CBO), these mandatory spending programs are baked into the cake. Unless someone has the political courage to touch the "third rail" of politics, the U.S. national debt 2025 figures will keep climbing regardless of who sits in the Oval Office.

Then there is the revenue side. Or the lack of it. Tax receipts haven't kept pace with the spending ramp-up that started during the 2020 lockdowns and never really scaled back to "normal" levels. We’re running "wartime" deficits during a period of (relative) peace and economic growth. That’s the part that keeps institutional investors up at night.

The "Crowding Out" Effect on Your Wallet

You might wonder why you should care if the government owes trillions. You still have to pay your rent, right? Well, there is this thing called "crowding out." When the government borrows this much money, it competes with everyone else for capital.

If the Treasury is sucking up all the available cash in the market to fund its deficits, there’s less left over for small business loans or mortgages. This keeps interest rates "stickier" for longer. You see it in 7% mortgage rates even when inflation cools down. The U.S. national debt 2025 situation acts like a floor that prevents your borrowing costs from dropping back to those 2019 levels we all miss.

Is a "Debt Crisis" Actually Coming?

Experts like Ray Dalio have been warning about a "Great Deleveraging" for a while. It sounds apocalyptic. Is it? Probably not tomorrow. The U.S. Dollar is still the world's reserve currency, which gives Washington a "get out of jail free" card that no other country possesses. We borrow in our own currency. We can, technically, print the money to pay it back.

But there’s a catch. Printing money to pay debt is the fastest way to destroy the purchasing power of the dollar. It's a hidden tax. You might have $5,000 in the bank, but if the government devalues the currency to manage the U.S. national debt 2025, that $5,000 buys a lot less at the grocery store. We’ve already felt the appetizer of this over the last three years. The main course is what people are worried about now.

The Role of Foreign Buyers

For decades, China and Japan were the biggest fans of U.S. debt. They bought Treasuries by the truckload. Lately? Not so much. China has been trimming its holdings, and Japan has its own currency issues to deal with. This means the U.S. has to offer higher interest rates to attract other buyers. This creates a feedback loop: higher rates attract buyers but make the debt more expensive to maintain, which leads to more borrowing. It's a cycle that’s hard to break without a massive fiscal shock.

Misconceptions That Need to Die

Many people think we "owe" all this money to China. That’s actually wrong. The largest holder of U.S. debt is... the United States. Between the Federal Reserve, Social Security trust funds, and American pension funds, we owe most of this money to ourselves. While that sounds better than owing it to a foreign adversary, it’s still a massive liability. If the government defaults, your pension fund or 401(k) is the one taking the hit.

Another myth is that we can just "cut waste, fraud, and abuse" to balance the budget. Look, there is plenty of waste. But even if you fired every single federal employee and closed every national park, you still wouldn't balance the budget. The gap is too wide. The math simply doesn't work without addressing the structural spending mentioned earlier.

Navigating the Fiscal Reality

So, what do you actually do with this information? Watching the debt clock doesn't put money in your pocket. In fact, it mostly just causes anxiety. But understanding the trajectory of the U.S. national debt 2025 helps you make better financial decisions.

✨ Don't miss: How Did The S\&P 500 Close Today: The Real Story Behind Thursday's Snapback

Expect volatility. The bond market is getting twitchy. Whenever there is a "debt ceiling" debate in Congress, expect the stock market to take a dip. These aren't just political theater anymore; they are moments where the market questions the fundamental stability of the financial system.

Actionable Insights for 2025

Stop waiting for 3% mortgages. They aren't coming back anytime soon because the government's borrowing needs are keeping upward pressure on yields. If you are looking to buy a home or refinance, work with the reality of "higher for longer."

Diversify your assets. If the government is forced to inflate its way out of debt, hard assets—things like real estate, gold, or even certain stocks with pricing power—tend to hold their value better than straight cash sitting in a low-interest savings account.

Keep an eye on tax policy. With the 2017 tax cuts set to expire or be renegotiated soon, the massive debt load puts pressure on the government to find revenue anywhere it can. Don't be surprised if "loopholes" you currently use start disappearing.

The U.S. national debt 2025 isn't a cliff we are falling off tomorrow. It's a heavy backpack the economy is wearing while trying to climb a mountain. We can keep climbing, but we're going slower, and it's getting harder to breathe. Staying informed and flexible is the only way to make sure you don't get caught when the weight finally shifts.

Focus on your own "personal debt-to-GDP" ratio. In an era of national fiscal instability, keeping your own balance sheet clean is the best hedge you have. Minimize high-interest consumer debt and keep a liquid emergency fund that can handle the price swings we’re likely to see as the Treasury navigates this minefield.