Ever feel like the stock market is just a giant, confusing blob of numbers? You’re not alone. When people talk about "the market," they usually mean the Dow or the S&P 500, but that’s barely scratching the surface of total equity market value.

Think of it this way.

If you bought every single share of every public company in the world, what would that bill look like? That’s what we’re talking about here. It’s the sum total of all the "stuff" owned by shareholders globally. As of early 2024, the global figure was hovering somewhere north of $110 trillion, according to data from the S&P Global BMI and the World Federation of Exchanges. It’s a massive, shifting number that tells us more about the health of the world than any GDP report ever could.

📖 Related: Map of Suez Canal Explained: What Most People Get Wrong

What is Total Equity Market Value, Honestly?

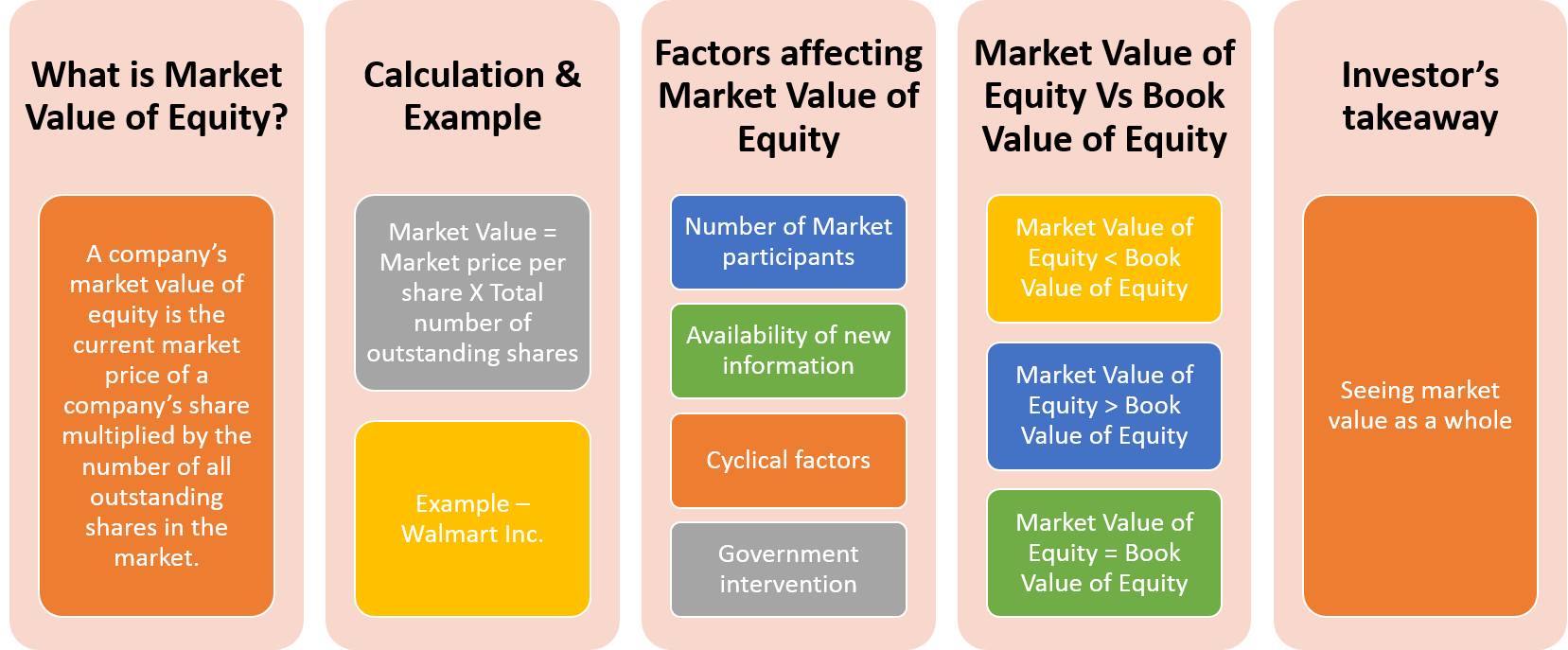

Basically, it's the aggregate market capitalization. You take the share price of every company and multiply it by the number of shares out there. Then you add them all up. Simple, right? Kinda.

The tricky part is that it’s never static. While you’re reading this sentence, the total equity market value of the New York Stock Exchange (NYSE) has probably shifted by a few billion dollars. It’s a living breathing organism. Most people focus on the U.S. market because, frankly, it’s the biggest kid on the playground. The U.S. equity market usually represents about 40% to 50% of the entire world’s stock value.

The Big Players and the Small Fry

We often obsess over the "Magnificent Seven"—Apple, Microsoft, Nvidia, and the rest of that crew. And for good reason. These handful of companies hold a disproportionate amount of the total equity market value. In late 2023 and early 2024, Nvidia’s explosive growth single-handedly dragged the global total higher.

But here is the thing.

The "Total Market" includes the tiny dry-cleaning chain in the Midwest that went public forty years ago and the massive state-backed enterprises in emerging markets like Brazil or India. When you look at an index like the Wilshire 5000, you’re getting a much better look at the actual U.S. total equity market value than you are with the Dow Jones Industrial Average, which only tracks 30 companies.

Why Should You Actually Care?

It isn't just a number for nerds in suits. It’s the "Buffett Indicator."

Warren Buffett famously noted that the ratio of total market cap to Gross Domestic Product (GDP) is "probably the best single measure of where valuations stand at any given moment." If the total equity market value is way higher than the GDP, it usually means stocks are getting expensive. Investors call this "being overextended." When the ratio was sitting at record highs before the 2000 tech bubble burst, people should have been looking at the exits.

In 2021, we saw this ratio hit nearly 200% in the U.S. That’s wild. Historically, the average is much lower, closer to 100%.

- It helps you spot bubbles before they pop.

- It tells you if the "real economy" (stuff we make and sell) is keeping up with the "paper economy" (stock prices).

- It shows which countries are actually gaining influence.

China’s total equity market value has seen massive swings over the last decade. It’s a rollercoaster. Watching their total value compared to the U.S. gives you a front-row seat to the geopolitical tug-of-war that defines our era.

✨ Don't miss: World map of Panama Canal: Why This Tiny Shortcut Controls Your Life

The Massive Gap Between Price and Reality

Here’s a secret. The market isn't the economy.

You’ve probably seen headlines where the stock market is hitting "All-Time Highs" while your local grocery store is raising prices and people are getting laid off. That’s because total equity market value is forward-looking. It represents what investors think will happen in the next six to eighteen months. It doesn't care about what happened yesterday.

If the Federal Reserve signals they might cut interest rates, the total market value might jump by $2 trillion in a single afternoon. Did the companies actually get $2 trillion better at making products in those three hours? Nope. But the value of their future cash flows just became more attractive to investors.

Public vs. Private: The Missing Trillions

One thing that drives me crazy is when people ignore private equity. The total equity market value we see on CNBC only tracks public companies. There is a massive universe of private companies—think SpaceX or Stripe—that aren't included in these tallies.

If we added the estimated value of every private firm, the "Total Equity" of the world would be significantly higher. Some analysts at firms like Bain & Company suggest that private equity dry powder and asset values are growing at a pace that rivals public markets. This matters because if more companies stay private longer, the public "total market" might actually become a less accurate reflection of the true economy.

How to Track This Without Going Insane

You don't need a Bloomberg Terminal. Honestly, you can just look at broad-market ETFs.

The Vanguard Total Stock Market ETF (VTI) is a great proxy for the U.S. total equity market value. It tracks the CRSP US Total Market Index. If VTI is up, the total value of corporate America is up. For the global view, look at the Vanguard Total World Stock ETF (VT).

Watch Out for the "Concentration Risk"

Lately, the total equity market value has been heavily skewed. We are living in a "top-heavy" era.

When a few tech giants make up 25% of the total value, the "total" becomes a bit of a lie. If Apple has a bad day, the total equity market value of the U.S. drops, even if 3,000 smaller companies all had a great day. This is why seasoned investors look at "Equal Weighted" versions of the market to see if the growth is actually healthy or just driven by a few AI-hyped stocks.

Global Shifts: The Rise of the Rest

For decades, the U.S. was the only game in town. But the total equity market value of emerging markets has been creeping up. India, specifically, has seen its market cap explode. In early 2024, India's stock market briefly overtook Hong Kong's to become the fourth largest in the world.

That is a tectonic shift.

It tells us that capital is flowing into New Delhi and Mumbai. It tells us that investors trust those legal systems and growth prospects more than they used to. If you only look at the S&P 500, you miss this entire story. You miss the fact that the "Global Total" is becoming more diverse, even if the U.S. still holds the crown for now.

Common Misconceptions That Get People Burned

- "High Market Value = Good Economy." Not always. A high total market value can sometimes just mean there's too much cheap money floating around (inflation of assets).

- "The Market Can't Fall if Value is High." Actually, the higher it goes relative to GDP, the harder it usually falls.

- "Stock Splits Increase Value." No. If a company does a 2-for-1 split, they just have more shares at half the price. The total equity market value stays exactly the same. It’s like cutting a pizza into 12 slices instead of 6. You still have the same amount of pizza.

Practical Steps for the Average Investor

So, what do you actually do with this information? Don't just stare at the trillion-dollar numbers and feel small. Use them to calibrate your expectations.

Check the Buffett Indicator. Look at the current ratio of U.S. Market Cap to GDP (you can find this on sites like GuruFocus). If it's near historical highs, maybe don't dump your entire life savings into a single tech stock today. Maybe lean into some cash or bonds.

Diversify beyond the "Total." If the total equity market value is being driven by just five companies, consider looking at "Small-Cap" or "International" funds. These often represent the parts of the total value that are currently "on sale."

Ignore the daily noise. The total value will fluctuate based on a tweet or a random jobs report. Look at the three-to-five-year trend. That is where the real story lives.

Understand the 'Float.' Some companies have a huge market cap, but only a tiny bit of their stock is actually available to trade (this is called the free float). This can make the total equity market value feel higher than it actually is because a few trades can move the price of everything.

Investing is basically just participating in the growth of this total value over time. Since the dawn of the modern stock market, the total equity market value has generally trended upward, despite wars, pandemics, and depressions. It’s a bet on human ingenuity.

✨ Don't miss: Where Are Trump Bibles Made: What Most People Get Wrong

Keep an eye on the big picture, but don't let the massive numbers intimidate you. At the end of the day, it's just a reflection of what we, as a global society, think our collective hard work is worth.

Actionable Next Steps

- Compare Indices: Open a charting tool and compare the S&P 500 (SPY) against a Total Market Index (VTI). If VTI is lagging, the "broad market" isn't as strong as the headlines suggest.

- Verify Valuation: Search for the "Current Wilshire 5000 to GDP ratio." If it is above 150%, recognize that we are in a high-valuation environment.

- Audit Your Portfolio: Check how much of your personal "total value" is tied up in the top 10 largest global companies. You might be less diversified than you think.