Trust is a fragile thing. In the world of elite business schools, it's the only currency that actually trades at par. But lately, the Ivy League is looking a little bankrupt. If you’ve been following the news, you know the Harvard Data Science scandal didn’t just break; it shattered. It centers on Francesca Gino, a high-profile Harvard Business School professor whose work on—ironically—honesty and unethical behavior has been called into question.

It started with a few spreadsheet cells. It ended with a $25 million lawsuit and a reputation in tatters.

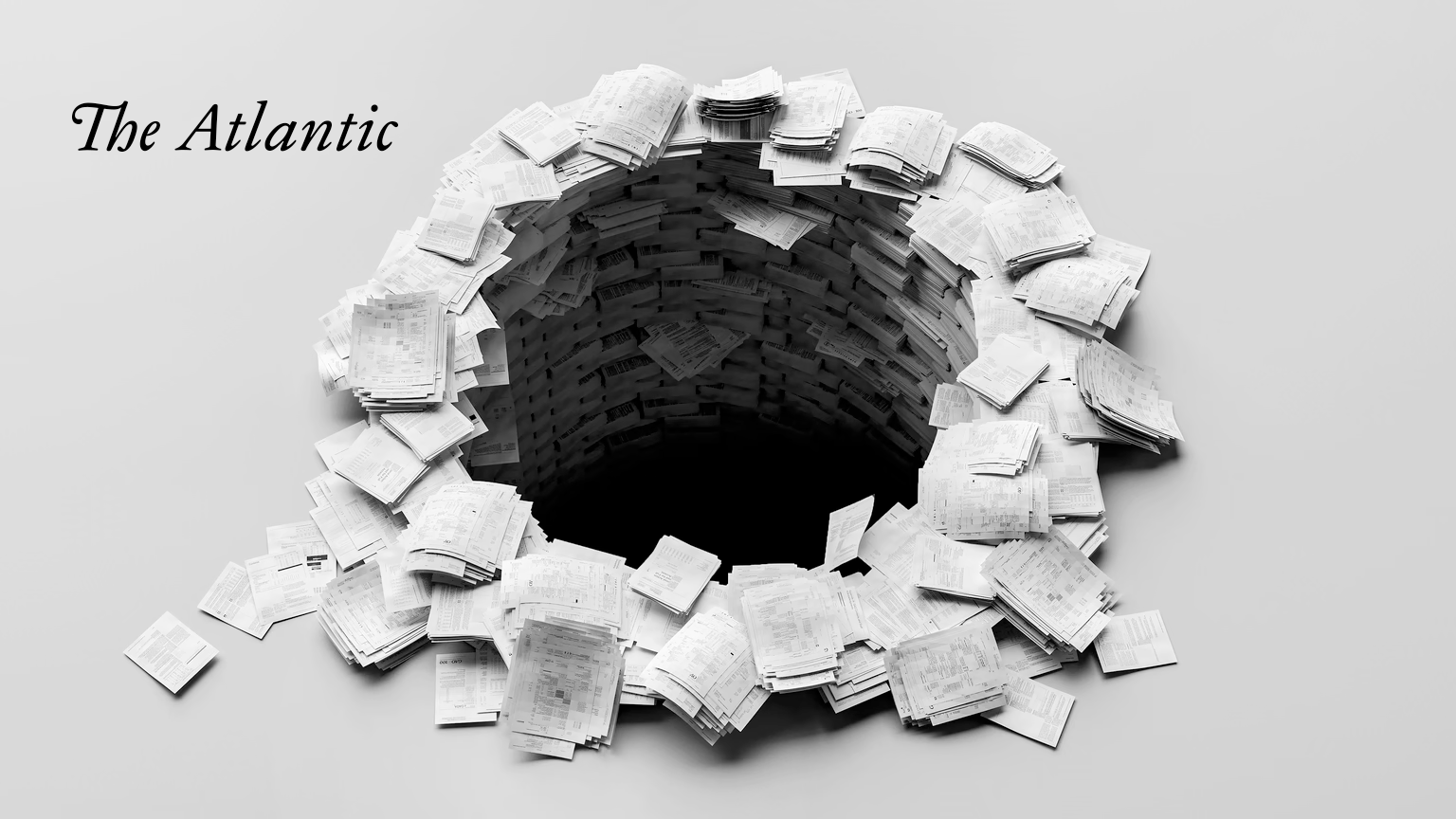

Data doesn't lie, but people do. Or at least, they "adjust" things. When the blog Data Colada published their multi-part series detailing alleged data manipulation in Gino’s papers, the academic world didn't just gasp. It went into a full-scale meltdown. We aren't talking about a single typo here. We are talking about systematic patterns that suggest data was moved around to make results look way more significant than they actually were. It’s the kind of stuff that makes you wonder if the "nudge" theory we've all been sold is actually just a shove in the wrong direction.

The Harvard Data Science Scandal: What Really Happened at HBS

Let’s get into the weeds because that’s where the bodies are buried. The heart of the Harvard Data Science scandal involves a series of papers, one of which famously claimed that signing an honesty pledge at the top of a form makes people more truthful than signing at the bottom. It was a beautiful finding. Policy makers loved it. Insurance companies tried to implement it.

Then came the "Data Replicada" team—Uri Simonsohn, Leif Nelson, and Joseph Simmons. These guys are the Sherlock Holmes of spreadsheets. They looked at the raw data and found something weird. In one dataset, the rows had been sorted in a way that defied logic, and certain numbers seemed to have been manually changed to support the hypothesis.

Harvard took it seriously. Very seriously.

✨ Don't miss: Range Resources Stock Price: Why Everyone Is Watching Natural Gas Right Now

They conducted an internal investigation that lasted over a year and produced a report spanning nearly 1,300 pages. Their conclusion? They believed Gino was responsible for the discrepancies. They placed her on administrative leave and began the process of stripping her of her tenure. That’s the academic equivalent of the death penalty. You don’t see it happen to stars. And Gino was a star. She was a best-selling author, a sought-after consultant, and a powerhouse in behavioral science.

Why this isn't just about one professor

It’s easy to point at one person and say "bad apple." But the Harvard Data Science scandal points to a systemic rot. The "publish or perish" culture isn't just a cliché. It’s a monster. To get tenure at a place like HBS, you need "flashy" results. You need findings that get cited in The New York Times and Harvard Business Review. Boring results—even if they are true—don't get you a corner office or a book deal.

The incentives are totally skewed. If a researcher spends three years on a study and the result is "nothing much happened," they’ve essentially wasted three years of their career in the eyes of many search committees. So, there is this massive, underlying pressure to find something. Anything. Even if you have to squint at the data until it looks like what you want.

Gino didn't take this lying down. She sued Harvard, the dean, and the Data Colada bloggers for $25 million, alleging defamation and a "gender-biased" investigation. Her argument? That the errors could have been made by research assistants or were simply not her fault. It’s a messy, high-stakes legal battle that has split the academic community. Some see her as a victim of a witch hunt; others see her as a symbol of everything wrong with modern social science.

The Fallout and the "Crisis of Replication"

Honestly, this whole thing is part of a much bigger headache called the Replication Crisis. For the last decade, psychologists and behavioral economists have been sweating. Why? Because when other scientists try to redo famous experiments, they often can't get the same results.

The Harvard Data Science scandal is just the loudest explosion in a long line of pops. Dan Ariely, another titan in the field and a frequent co-author with Gino, also faced scrutiny over a different paper involving the same honesty-pledge data. When two of the biggest names in "honesty research" are flagged for data irregularities, the irony is so thick you could cut it with a knife.

- The "Nudge" is Budging: Many of the small psychological tricks companies use to influence consumer behavior are now being re-examined.

- Open Science is the New Standard: Researchers are now being pushed to share their raw data and "pre-register" their studies (basically saying what they expect to find before they do the work) to prevent moving the goalposts later.

- The Cost of Retractions: Every time a major paper is retracted, it’s not just a blow to the author. It’s a blow to every practitioner who used that research to build a business strategy or a government policy.

It makes you think about all those "evidence-based" management books on your shelf. How much of that "evidence" is actually just noise that someone massaged into a signal?

The Legal War and HBS Reputation

Harvard is in a tight spot. By moving to revoke tenure, they are signaling that they value integrity over prestige. But by being sued, they are exposing their internal processes to the light of day. The lawsuit filed by Gino claims Harvard ignored evidence that could have exonerated her. It also claims they treated her more harshly than male professors accused of similar issues.

Whether those claims hold water is up to the courts. But the damage to the HBS brand is real. When people think of Harvard Business School, they think of the "gold standard." If the gold standard is found to be gold-plated lead, the whole system of prestige starts to wobble.

The Harvard Data Science scandal has forced a lot of soul-searching in Cambridge. It’s not just about the data. It’s about the culture of celebrity academia. When a professor becomes a "brand," they become "too big to fail." Until, of course, they aren't.

What Businesses Should Learn From This Mess

If you're sitting in a corporate office thinking this is just "academic drama," think again. This has massive implications for how you use data in your business.

First, stop worshipping at the altar of "statistically significant." In the Harvard Data Science scandal, the focus was on getting a p-value below 0.05—the magic number for publication. In business, we do this too. We look for a 2% lift in a marketing campaign and call it a victory without asking if that lift is actually real or just a fluke of how we sliced the segment.

Second, check your incentives. If you tell your data scientists that they only get bonuses if they find "insights" that lead to growth, guess what? They will find them. They might not be lying, but they will definitely be looking through a biased lens. You need people who are rewarded for being right, not just for being exciting.

✨ Don't miss: Secretary of commerce salary: What Most People Get Wrong

Third, transparency is your best friend. The only reason the Harvard Data Science scandal came to light is because the data was eventually made available for scrutiny. If your company’s "proprietary algorithms" are a black box that no one can audit, you are sitting on a ticking time bomb.

How to Protect Your Own Data Integrity

You don't need a PhD to avoid a scandal. You just need a healthy dose of skepticism and some better processes.

- Red Teaming: Encourage your team to try and debunk their own findings. If someone comes to you with a "huge discovery," ask them to try and prove themselves wrong first.

- Raw Data Audits: Don't just look at the PowerPoint slides. Occasionally, have a third party look at the raw Excel or SQL outputs. Look for weird patterns, identical numbers, or "too perfect" distributions.

- Reward the "Null" Result: Make it okay for a project to fail. If a pilot program doesn't work, celebrate the fact that you didn't waste millions of dollars scaling a lie.

- Diversify your Sources: Never rely on a single study or a single researcher. If an idea—like the honesty pledge—seems too good to be true, wait for someone else to replicate it before you bet the farm on it.

The Harvard Data Science scandal is a reminder that even the smartest people in the room are susceptible to the same pressures as everyone else. We all want to be right. We all want to be successful. But in the long run, the truth is the only thing that actually scales.

The lawsuit is still winding its way through the system. Retractions are still being filed. The conversation about how we do science—and how we use it in business—is just getting started. Don't be the last person to realize that the "breakthrough" you're following might just be a spreadsheet error in disguise.

Keep your data clean and your skepticism high. It’s the only way to stay out of the headlines for the wrong reasons.