If you’ve spent any time tracking the stock market lately, you know the name Super Micro Computer (SMCI). It’s basically been the ultimate litmus test for investor sanity over the last few years. One day it’s the darling of the AI revolution, and the next, it’s a cautionary tale about accounting controls and delisting fears. Honestly, looking at the Super Micro Computer stock price history is like looking at a heart rate monitor during a marathon.

The story isn't just about numbers on a screen; it’s about a company that found itself at the absolute center of the greatest hardware land grab in history.

🔗 Read more: XRP ETF Approval Date: What Most People Get Wrong

The Vertical Ascent (2023 - Early 2024)

For a long time, Supermicro was just a reliable, somewhat niche player in the server world. They were known for "building block" architecture—basically, they could customize servers faster than the big guys like Dell or HPE. Then, Generative AI happened.

When ChatGPT took over the world, every data center on the planet suddenly needed NVIDIA’s H100 GPUs. Supermicro had a massive advantage: their deep, decades-long relationship with Charles Liang and Jensen Huang meant they got those chips first.

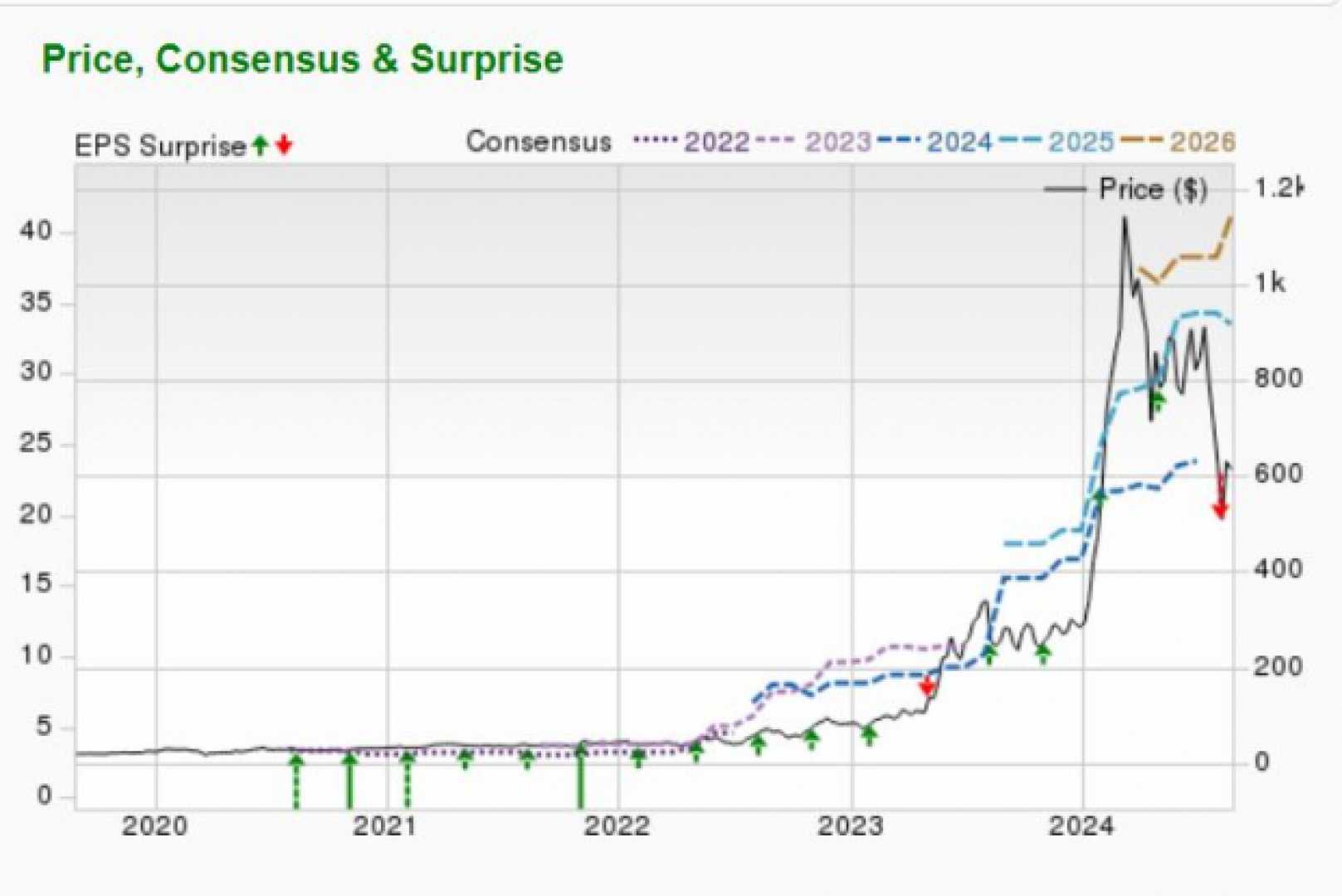

- The Boom: In early 2023, the stock was trading at what now looks like pocket change.

- The Peak: By March 2024, the euphoria reached a fever pitch. On a split-adjusted basis, the stock hit an all-time high of roughly $122.90.

- The "Nvidia Junior" Label: Investors started treating SMCI as a leveraged play on Nvidia. If Nvidia went up 2%, Supermicro went up 10%. It was a wild, profitable ride for anyone who got in early.

The Summer of Discontent: Hindenburg and the 10-K Delay

The party didn't just end; the lights were kicked out and the music stopped. In August 2024, Hindenburg Research dropped a short-seller report that sent shockwaves through the market. They alleged "glaring accounting red flags," including undisclosed related-party transactions and issues with revenue recognition.

Kinda sounds familiar, right? Supermicro actually had a similar run-in with the SEC back in 2020. This time, the timing was brutal. Shortly after the report, the company announced it would delay its annual 10-K filing.

The stock didn't just drop—it cratered. It lost about 26% of its value in a single morning on August 28, 2024. But the real pain came later. In October 2024, their auditor, Ernst & Young (EY), resigned in an unusually blunt fashion. They basically said they no longer wanted to be associated with the company’s financial statements.

💡 You might also like: Altria Group Inc Explained: What Most Investors Get Wrong in 2026

By late October 2024, a stock that had been over $100 just months prior was languishing near **$18**.

The 2024 Stock Split: A 10-for-1 Reset

Right in the middle of this chaos, Supermicro followed through on a plan to make its shares more "accessible." On October 1, 2024, they executed a 10-for-1 stock split.

Before the split, the stock was trading around $416. After the split, it opened around $41. Usually, a stock split is a celebratory moment—a sign that a company has grown so much that the price is too high for regular folks. For SMCI, it happened right as the ship was taking on water, which made for a very confusing time for retail investors.

The Long Road to Compliance (2025 - 2026)

Most people thought Supermicro was headed for delisting. They were in a race against the clock to file their delayed reports and keep their spot on the Nasdaq.

They eventually hired BDO as their new auditor and managed to submit their filings by the February 25, 2025 deadline. The market breathed a collective sigh of relief. The stock began to stabilize, but it wasn't a "to the moon" recovery. BDO issued an "adverse opinion" on their internal controls, which basically told investors: "The numbers are likely right, but the way they track them is still a mess."

🔗 Read more: Crowd Event Security Fence: Why Your Layout Is Probably Failing

As we sit in early 2026, the Super Micro Computer stock price history shows a company that has moved from "hype" to "execution."

- January 2026 Stability: The stock has been hovering in the $28 to $33 range.

- The "Governance Discount": It’s trading at a much lower multiple than it used to. Investors are still wary of the ongoing DOJ and SEC probes.

- Market Share Battles: While they are still a top-tier partner for NVIDIA’s new Blackwell Ultra and upcoming Vera Rubin chips, Dell and HPE have caught up.

Actionable Insights for Investors

Looking back at this roller coaster, there are a few things you’ve got to keep in mind if you're looking at SMCI today.

- Watch the Margins, Not Just Revenue: Supermicro’s revenue has been explosive, hitting over $22 billion in FY2025. But their gross margins dipped into the single digits as they fought for market share. If they can’t get back toward that 14% target, the stock will struggle to break out of its current range.

- The Regulatory "Sword of Damocles": Those DOJ investigations don't just disappear. Any news regarding fines or structural changes to management will cause immediate, double-digit volatility.

- Liquidity is Your Friend (and Enemy): Since the split, the stock is much easier to trade, but that also means more retail "noise." Don't get caught in the social media hype cycles.

- The Liquid Cooling Edge: One real reason to stay bullish is their lead in Direct Liquid Cooling (DLC). AI chips are getting so hot that traditional fans can't keep up. Supermicro has a genuine head start here that their competitors are still trying to replicate at scale.

If you’re tracking the Super Micro Computer stock price history to find a "bottom," remember that the AI infrastructure trade has matured. The days of 1,000% gains in twelve months are likely over. Now, it’s a game of professionalizing the back office and proving that they can be a "boring" blue-chip company that just happens to build the world's most powerful computers.

Next Steps for Your Portfolio

- Verify Compliance: Check the latest SEC filings to ensure no new 10-Q or 10-K delays have emerged.

- Monitor NVIDIA Product Cycles: Since SMCI is tied to the hip of NVIDIA, their price movements often precede SMCI's. Watch the rollout of the Vera Rubin platforms in 2026.

- Assess Peer Valuations: Compare SMCI's forward P/E (currently around 12-14x) against Dell and HPE to see if the "governance discount" has finally been priced in.