Money makes the world go 'round, but Jerome Powell decides how fast that world actually spins. Technically, the title is "Chair of the Board of Governors of the Federal Reserve System," but most people just say Chair of the Federal Reserve or "Fed Chair." It’s arguably the most powerful economic position on the planet. When this person speaks, markets tremble, mortgage rates shift, and billionaires lean in to catch every syllable.

Jerome Powell currently holds the seat. He wasn't always the "bad guy" raising rates to fight inflation. Honestly, back in 2020, he was the hero printing money to save the global economy from a total meltdown. Now? He’s the guy trying to "soft land" a massive economic plane without crashing it into a recession. It is a stressful gig. You've got politicians on both sides screaming at you, and if you mess up by even a quarter of a percentage point, millions of people could lose their jobs.

The Role of the Chair of the Federal Reserve

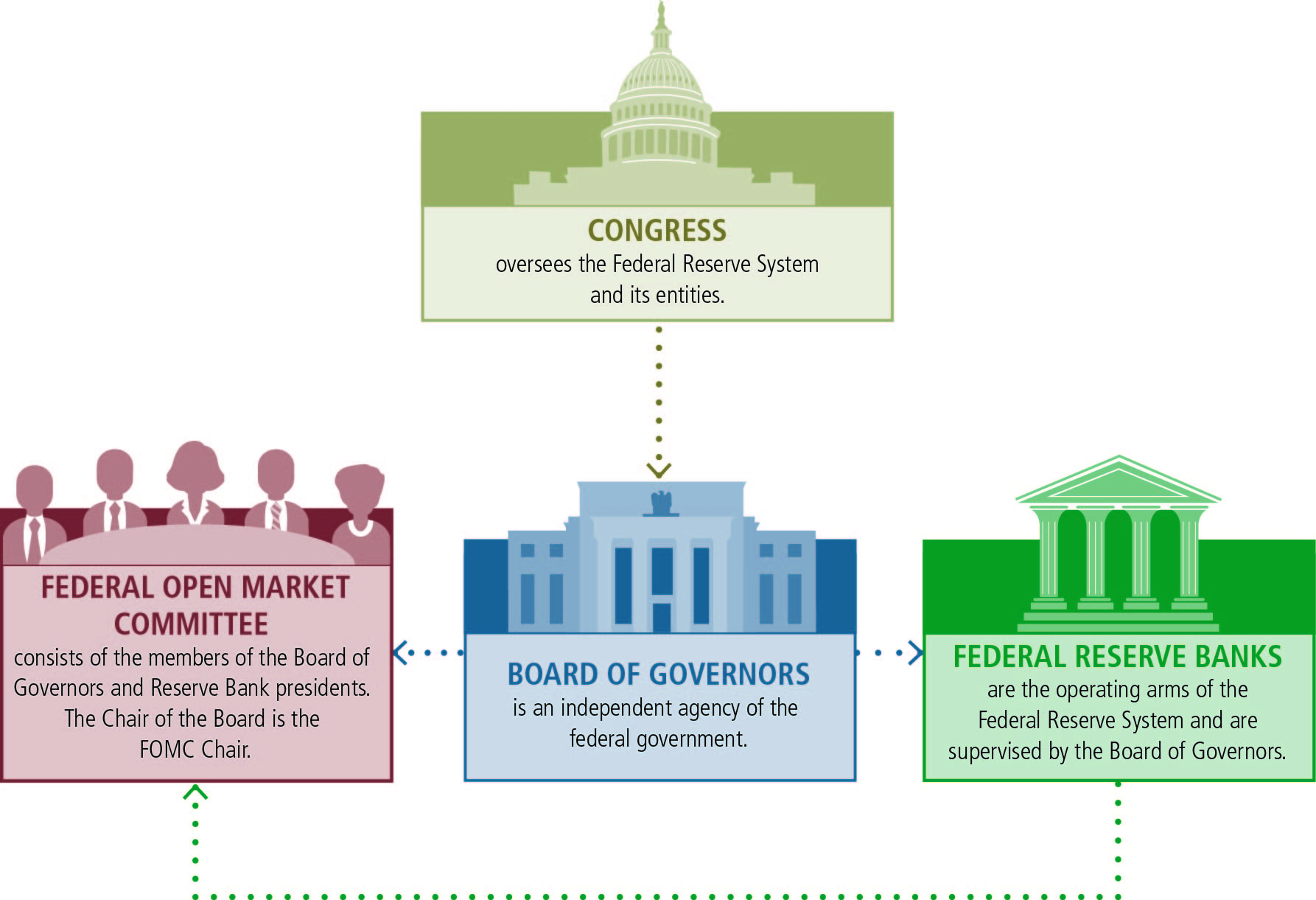

What does this person actually do all day? It isn’t just sitting in a big marble building in D.C. counting gold bars. The Chair of the Federal Reserve is the face of the U.S. central bank. They lead the Federal Open Market Committee (FOMC), which is the group that decides whether your credit card interest rate goes up or down.

The "Dual Mandate" is their North Star. Congress told the Fed they have two jobs: keep prices stable (low inflation) and make sure as many people have jobs as possible (maximum employment). The problem? These two things often hate each other. If you want more jobs, you lower rates, but then prices go up. If you want lower prices, you raise rates, but then companies stop hiring. It’s a constant, high-stakes seesaw.

Powell doesn't work alone, though. He's one of seven governors. But make no mistake—his voice carries the most weight. He’s the one who has to go to Capitol Hill and get grilled by Senators who often don't understand how macroeconomics works. He has to stay "apolitical," which is basically impossible in the current climate, but he tries his best to stick to the data.

A History of Power and Personality

The Fed hasn't always been this way. If you look back at Paul Volcker in the late 70s and early 80s, the man was a giant—literally and figuratively. He smoked cigars in meetings and hiked interest rates to 20% to kill inflation. People hated him. Farmers drove tractors to the Fed building to protest. But he didn't budge. That’s the kind of backbone the Chair of the Federal Reserve needs.

📖 Related: Olin Corporation Stock Price: What Most People Get Wrong

Then you had Alan Greenspan. They called him the "Maestro." He held the job for almost 20 years. People used to watch the size of his briefcase to guess if he was going to change rates. If it was thick, he was bringing a lot of data to make a big move. If it was thin, maybe things would stay the same. It was a weird time. He championed "FedSpeak," which was basically a way of talking for an hour without actually saying anything concrete.

Ben Bernanke followed him and had to deal with the 2008 Great Financial Crisis. He was a scholar of the Great Depression, which turned out to be pretty lucky for us. He started "Quantitative Easing," which is a fancy way of saying the Fed started buying up tons of debt to keep money flowing. Then came Janet Yellen, the first woman to hold the post, who is now the Treasury Secretary. She was known for being incredibly detail-oriented and focused on the labor market.

Now we have Powell. He’s a lawyer by training, not an academic economist, which makes him a bit of an outlier. Some people think that gives him a more "real world" perspective. Others think it makes him too reliant on his staff. Regardless, he’s the one at the podium.

Why the Market Obsesses Over Every Word

Every few weeks, the Fed releases a statement. Then, 30 minutes later, the Chair of the Federal Reserve holds a press conference. Traders watch these like teenagers watching a leaked trailer for a Marvel movie. They aren't just looking at the words; they’re looking at the body language.

"Hawkish" vs. "Dovish." These are the two flavors of Fed policy. A hawk wants high rates to keep inflation dead. A dove wants low rates to keep the economy soaring. Lately, Powell has been a bit of a hawk, though he's trying to transition back to being a dove as inflation cools down.

👉 See also: Funny Team Work Images: Why Your Office Slack Channel Is Obsessed With Them

Here is the thing about being the Chair of the Federal Reserve: you can't be too honest. If Powell stood up and said, "Yeah, I think the economy is about to tank," it would cause the economy to tank instantly. He has to use coded language. He says things like "data-dependent" or "restrictive territory." Basically, he’s saying, "We’re watching the numbers, and if things get weird, we’re going to pivot."

The Criticism: Are They Too Slow?

One of the biggest knocks against the Fed is that they are "behind the curve." In 2021, Powell famously called inflation "transitory." He thought the price hikes were just a temporary glitch from the pandemic. He was wrong. It wasn't transitory, and the Fed had to scramble to raise rates faster than they had in decades.

Critics like Elizabeth Warren have slammed Powell for being too aggressive with rate hikes, fearing he’ll cause a recession that hurts the working class. On the other side, some conservative economists argue he waited way too long to act and let the inflation fire get out of control. It’s a thankless job. You’re either the person who killed the party or the person who let the house burn down.

What This Means for Your Wallet

The Chair of the Federal Reserve doesn't just affect Wall Street; they affect your bank account. When Powell raises the "Federal Funds Rate," a few things happen:

- Savings Accounts: You finally start earning a little bit of interest on your cash.

- Mortgages: Buying a house becomes way more expensive. A 3% mortgage vs. a 7% mortgage is the difference between a nice house and no house for many people.

- Credit Cards: Your monthly minimum payment probably goes up because most cards have variable rates tied to the Fed’s moves.

- Car Loans: That new SUV just got a lot more expensive to finance.

The Fed is basically trying to make it "more expensive" to exist so that people spend less, which forces companies to stop raising prices. It’s a blunt instrument for a very delicate problem.

✨ Don't miss: Mississippi Taxpayer Access Point: How to Use TAP Without the Headache

Moving Forward: The Next Era of the Fed

As we look toward the future, the Chair of the Federal Reserve faces new challenges. We have massive government debt, a changing global landscape where the dollar might not be the only king, and the rise of AI which could mess with employment numbers in ways we don't understand yet.

The job is changing. It’s no longer just about interest rates. It’s about financial stability, climate-related financial risks (a hot-button issue), and the potential for a "Digital Dollar."

Actionable Steps for Navigating Fed Decisions

Since you can't control what Jerome Powell does, you have to control how you react to him.

- Watch the "Dot Plot": Every quarter, the Fed releases a chart showing where each member thinks rates will be in the future. It’s the best roadmap we have. Don't just read the headlines; look at the dots.

- Lock in Fixed Rates: If the Fed is talking about being "higher for longer," it’s a bad time for variable-rate debt. If you can refinance into a fixed rate when they signal a pause, do it.

- Keep Cash in High-Yield Accounts: When the Chair of the Federal Reserve keeps rates high, your "boring" savings account might actually beat the stock market for a while. Shop around for banks that pass those rate hikes on to you.

- Don't Fight the Fed: This is an old market saying. If the Fed is trying to cool the economy, don't bet on a massive bull market rally. They have more money than you do. They will win.

The person sitting in that chair is human. They make mistakes. They look at the same jobs reports and CPI data that we do, they just have to make much bigger decisions based on them. Understanding the motivations of the Chair of the Federal Reserve won't make you a millionaire overnight, but it will keep you from being blindsided when the economic winds shift.

Keep an eye on the FOMC meeting calendar. The next few years will be a masterclass in whether a central bank can actually control a modern, chaotic economy without breaking it.