You've probably noticed it. The ticker for HCL Tech flashes on the screen, the numbers dance, and suddenly everyone has an opinion. But honestly, the stock price HCL Tech isn't just a number—it’s a reflection of a massive shift in how India’s third-largest IT giant is playing the long game.

Most retail investors look at the daily fluctuations and panic. Big mistake.

If you’re staring at the chart today, you’re seeing a company that just navigated a wild Q3 in January 2026. One day the stock is up 1.5% because of a massive $3 billion deal win, and the next, it's sliding because of a one-time ₹956 crore charge related to those new Indian labor codes. It’s a lot to process. But if you want to understand where your money is actually going, you have to look past the "noise" of the quarterly dips.

The Truth About the Q3 Rollercoaster

Let's talk about what just happened. HCL Technologies reported its December 2025 (Q3 FY26) results, and the headlines were... mixed, to put it lightly. Net profit took an 11% hit year-on-year, landing at ₹4,076 crore. Naturally, the knee-jerk reaction from the market was to sell, and the stock price HCL Tech dipped over 1% in a single session.

But wait. Revenue actually jumped 13% to ₹33,872 crore.

So, why the profit drop? It wasn't because they're losing clients. It was basically a math problem. The company had to account for a massive one-time expense due to the implementation of new labor codes. When you strip that away, the underlying business is actually "punching above its weight," as some analysts at JM Financial noted.

Breaking Down the Revenue Engine

- HCL Software: This is the secret sauce. While services are the bread and butter, the software division saw a staggering 28% sequential growth. It’s seasonal, sure, but it provides a high-margin cushion that peers like TCS or Infosys don't have in the same way.

- The AI Pivot: Advanced AI revenue hit $146 million this quarter. That’s up nearly 20% in just three months. C Vijayakumar, the CEO, hasn't been shy about saying AI is now a "measurable driver" rather than just a buzzword.

- New Bookings: They bagged $3.01 billion in new deals. To put that in perspective, that’s a 43% surge year-over-year.

Why the Stock Price HCL Tech Still Matters for Income Seekers

If you’re a dividend hunter, HCL Tech is kinda like that reliable friend who always shows up. Even with the profit dip, the board declared another ₹12 per share interim dividend.

Think about that for a second.

They have paid dividends for over 90 consecutive quarters. In a volatile market where "growth" stocks are bleeding, HCL Tech’s dividend yield—sitting comfortably between 3.5% and 4%—offers a floor for the stock price HCL Tech. When the price drops, the yield becomes even more attractive, which usually brings the "big fish" (institutional investors) back into the pool to buy the dip.

| Metric | Current Reality (Jan 2026) |

|---|---|

| 52-Week High | ₹1,939 |

| 52-Week Low | ₹1,302 |

| PE Ratio | ~26.5 |

| Dividend Yield | ~3.3% - 3.7% |

The AI "Hype" vs. Reality

Everyone talks about AI, but HCL is actually embedding it into their "AI Force" and "AI Foundry" platforms. They aren't just selling "consulting"; they are selling automated software engineering.

I was looking at their recent deal with a US-based manufacturer. They didn't just "fix their IT." They built an entire Enterprise AI governance framework. This matters because these aren't "one-and-done" contracts. They are deep, sticky relationships that keep the revenue flowing even when the global economy feels a bit shaky.

However, it’s not all sunshine. The IT sector is still facing "elongated decision cycles." Basically, clients are taking forever to sign on the dotted line because they’re worried about inflation and high interest rates in the US and Europe. HCL Tech isn't immune to this.

📖 Related: How Port to Port International Corporation Actually Moves Your Cargo Across the Map

What the Experts are Whispering

Brokerages are split, which is always more interesting than a consensus.

- The Bulls: Motilal Oswal is still screaming "Buy" with a target price of ₹2,200. They love the deal pipeline and the software margins.

- The Skeptics: Some firms, like ICICI Securities, have been more cautious, setting targets closer to ₹1,400 earlier in the cycle because of "growth visibility" concerns.

- The Middle Ground: Axis Securities and others have an "Equal Weight" or "Add" rating, eyeing a target of roughly ₹1,770.

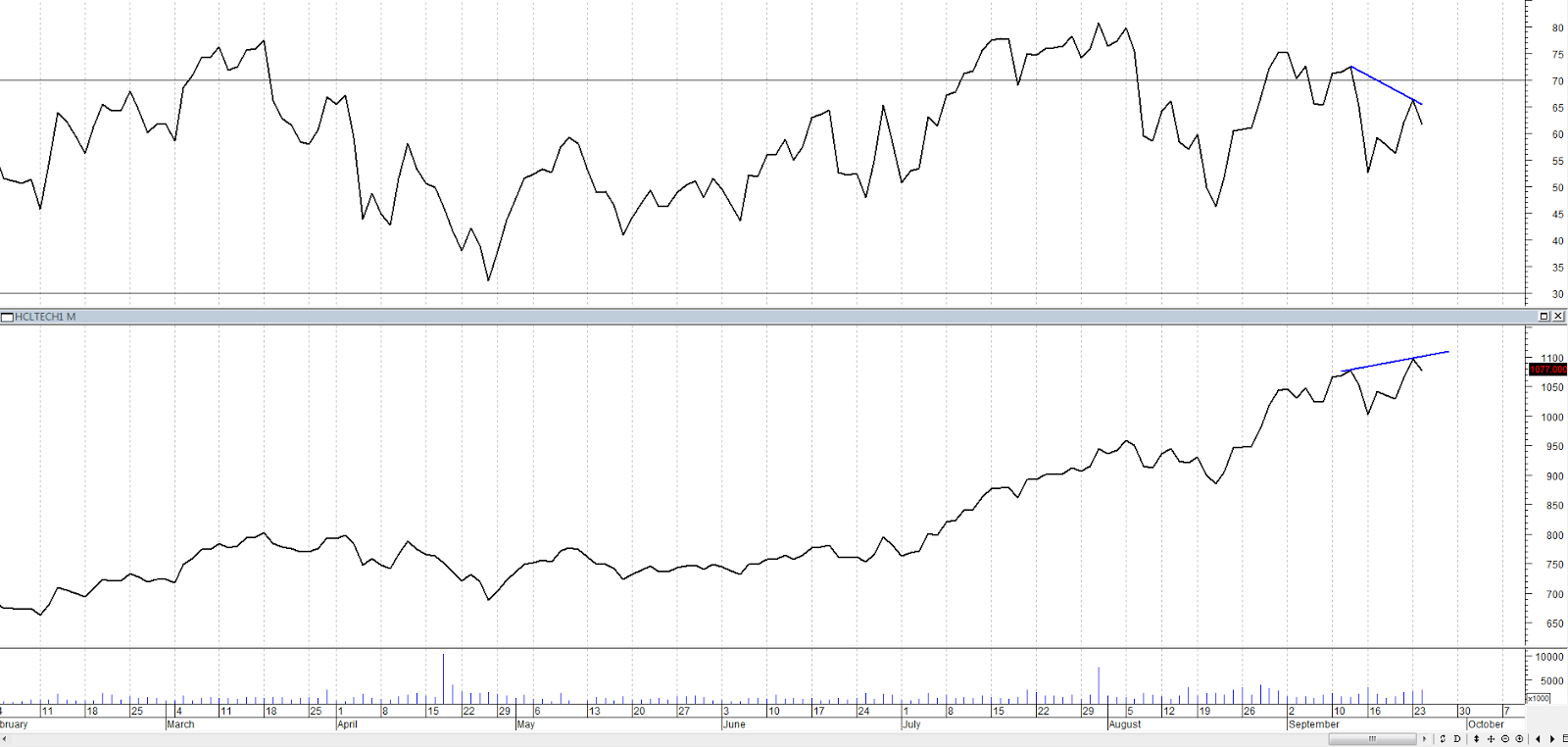

The stock price HCL Tech is currently hovering around the ₹1,650–₹1,670 range. It’s sitting above its 50-day and 200-day moving averages, which technically means it's in a bullish trend, but it’s facing stiff resistance at the ₹1,700 mark.

Actionable Insights for Your Portfolio

So, what do you actually do with this info?

Don't buy HCL Tech if you're looking to double your money in three weeks. This isn't a "to the moon" crypto play. Buy it if you want exposure to the AI transition through a company that actually generates massive free cash flow.

📖 Related: Adams Express Stock Price: Why This 170-Year-Old Secret Still Matters

Keep an eye on the January 16, 2026 record date. If you want that ₹12 dividend, you need to be in before the ex-date.

Also, watch the "attrition" numbers. HCL’s attrition dropped to 12.4% recently. In the IT world, that’s a huge win. It means they aren't bleeding talent to competitors, which saves them a fortune in recruitment and training costs.

Your Next Steps

- Check your entry point: If the stock price HCL Tech pulls back toward the ₹1,610 support level, that’s historically been a zone where buyers step in.

- Verify the Dividend: Ensure your brokerage account is set up to receive the payout on January 27, 2026.

- Watch the US Macro Data: Since a huge chunk of HCL's revenue comes from the US, any news on Fed rate cuts will likely send the stock higher.

- Rebalance: If HCL Tech has become more than 10% of your portfolio, consider if you’re too heavy in IT given the current "cautious" global demand environment.

The bottom line is simple. HCL Tech is transitioning from a "service provider" to a "tech-product hybrid." That transition is messy, expensive, and sometimes hits the bottom line, but it’s the only way to survive in the age of AI.