Gold is acting weird lately. Honestly, if you’ve been watching the stock market price of gold over the last few months, you’ve probably noticed the old rules don't seem to apply anymore. Usually, when the dollar gets strong, gold takes a hit. When interest rates go up, people ditch the "yellow metal" because it doesn't pay a dividend.

But right now? It's sitting near $4,600 an ounce.

That's a massive jump from where we were just a year ago. It’s almost like the market is pricing in a totally different reality. We're seeing banks like Goldman Sachs and JPMorgan Chase scramble to update their targets, with some analysts now whispering about $5,000 or even $6,000 gold before the year is out.

Why? Because the "safe haven" trade isn't just about fear anymore. It’s about a fundamental shift in who owns the stuff and why they're holding on so tight.

The Secret Drivers Behind the Scenes

Most retail investors look at the gold price and think "inflation." Sure, that’s part of it. But the real heavy lifting is being done by central banks.

They’re buying gold at a pace we haven't seen in decades. Specifically, emerging market central banks—think China, India, and Turkey—are trying to diversify away from the U.S. dollar. It’s a "de-dollarization" play that has moved from a fringe theory to a billion-dollar reality.

When a central bank buys 50 tons of gold, they aren't planning to sell it next week if the price drops 2%. They’re locking it in a vault for ten years. This "sticky" demand creates a floor that prevents the price from crashing, even when the U.S. economy looks decent.

💡 You might also like: Canada Tariffs on US Goods Before Trump: What Most People Get Wrong

The Weird Correlation Break

Historically, gold and "real yields" (interest rates minus inflation) move in opposite directions. It makes sense: if you can get a 5% return on a "safe" government bond, why hold a heavy bar of metal?

But in 2025 and moving into 2026, that relationship broke.

Yields stayed relatively high, yet gold kept hitting new records. This tells us that the "fear of loss" or the desire for an alternative to paper currency is currently stronger than the "desire for yield."

How the Stock Market Actually Sets the Price

When we talk about the stock market price of gold, we aren't just talking about people trading physical coins. The price you see on your phone is determined by two main things: the London Over-the-Counter (OTC) market and the COMEX in New York.

- The London Fix: Twice a day, big banks participate in an auction to set a benchmark price. It’s very formal, very "old school," and provides a baseline for the whole world.

- Futures Markets (COMEX): This is where the action happens. Traders bet on what the price will be three months from now. Most of these people never actually want to touch a gold bar; they just want the profit from the price movement.

- ETFs: Exchange-Traded Funds like GLD allow regular people to buy gold through their brokerage accounts. When millions of people buy ETF shares, the fund has to go out and buy physical gold to back those shares. This adds a huge layer of demand that didn't exist twenty years ago.

Gold is a dollar-denominated asset. Basically, if the dollar loses 10% of its value, gold should technically go up by 10% just to stay equal. It's like a seesaw. Lately, both the dollar and gold have been strong at the same time—a rare "crisis" signal that suggests investors are nervous about everything except hard assets.

The Mining Problem Nobody Talks About

You can't just "print" more gold.

📖 Related: Bank of America Orland Park IL: What Most People Get Wrong About Local Banking

Mining companies like Newmont and Barrick Gold are actually struggling to find new, high-grade deposits. Bank of America’s analysts have pointed out that the 13 major North American miners are expected to see a 2% decline in production this year.

It takes about 10 to 15 years to bring a new gold mine from discovery to production. We are currently living through the "underinvestment" of the 2010s. When demand goes up and supply is stuck in the mud, the price only has one way to go.

It’s also getting more expensive to get the stuff out of the ground. "All-in sustaining costs" are pushing $1,600 an ounce. If the price ever fell back to $2,000, many mines would barely be breaking even after you factor in energy, labor, and environmental regulations.

Is Gold Actually a Good Investment Right Now?

It depends on who you ask.

The "permabulls" think we’re heading for a sovereign debt crisis where gold is the only thing left standing. The skeptics say it’s a "pet rock" that doesn't produce anything.

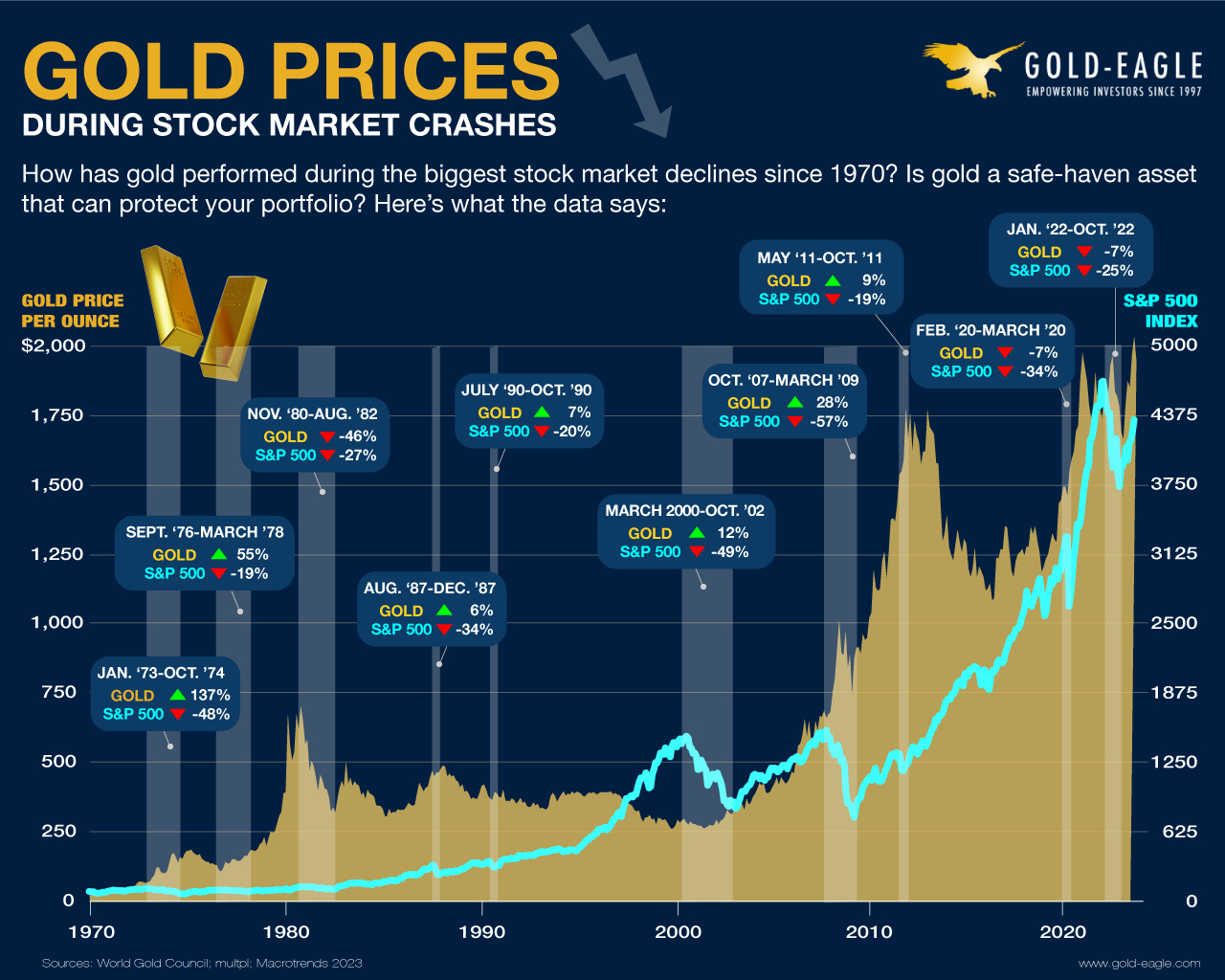

The truth is usually in the middle. Most financial advisors recommend a 5% to 10% allocation. It’s not there to make you a millionaire overnight; it’s there to make sure you aren't broke if the rest of your portfolio (stocks and bonds) decides to dive 30% at the same time.

👉 See also: Are There Tariffs on China: What Most People Get Wrong Right Now

Watch Out for These Risks

- Central Bank Selling: If a country like the Philippines or Uzbekistan decides to dump their reserves to support their local currency, it can cause a temporary price crash.

- The "AI Productivity" Boom: If AI actually makes the economy 5% more efficient and kills inflation, the need for gold as a hedge disappears.

- Peace: Much of the current premium is "war insurance" regarding tensions in the Middle East and Eastern Europe. If those conflicts settle, gold could easily drop $300 in a week.

Actionable Steps for Your Portfolio

If you're looking to get exposure to the stock market price of gold, don't just blindly buy.

First, decide if you want physical metal or "paper" gold. Physical (coins/bars) is great for "end of the world" scenarios but has high markups and storage issues. ETFs are better for trading but you don't actually own the metal.

Second, watch the $4,300 support level. Technical analysts say as long as gold stays above that mark, the "bull run" is still on. If it breaks below that, it might be time to take some profits.

Third, look at the gold-to-silver ratio. Right now, silver is incredibly cheap compared to gold. Historically, when gold runs this hard, silver eventually catches up with a massive, violent move to the upside.

Finally, check your mining stocks. Many miners are actually lagging behind the price of the metal itself. If gold stays at $4,600, these companies are going to report record-breaking profits in their next quarterly earnings. That might be where the real "value" is hiding.

Keep an eye on the Federal Reserve’s next meeting. If they signal more rate cuts even with inflation above 2%, that’s the green light for the next leg up. Don't get caught chasing the peak, but don't ignore the structural shifts that are making "gold 2.0" a very different beast than the gold of our parents' generation.