You're looking at a crisp 100-dollar bill. To a traveler in New York, that's maybe a decent dinner for two or a single ticket to a mid-tier Broadway show if you're lucky. But the moment you swap it for Gandhi-printed notes, the math changes.

When people search for 100 dollars in Indian rupees, they usually want a quick number. As of early 2026, you're looking at somewhere around 8,400 to 8,600 INR, depending on the day’s mood in the forex markets. But honestly? That number is a lie. Well, not a lie, but it’s definitely not the whole truth. If you go to a bank, you won't get that rate. If you use a credit card at a Delhi cafe, you won't get that rate.

Currency is messy. It's influenced by oil prices, Federal Reserve tantrums, and how many iPhones people in Bengaluru are buying this month.

The Reality of Converting 100 Dollars in Indian Rupees Today

Let's get real about the "interbank rate." That’s the fancy number you see on Google or XE. It’s the price banks charge each other. You? You’re a retail customer. When you try to turn 100 dollars in Indian rupees, you hit the spread.

The spread is the "tax" the middleman takes. If the official rate is 85.00, the exchange booth at the Indira Gandhi International Airport might offer you 81.00. That’s a massive haircut. You’ve just lost enough money to buy three plates of high-end butter chicken just by standing in line.

Smart money doesn't use airport booths. Ever.

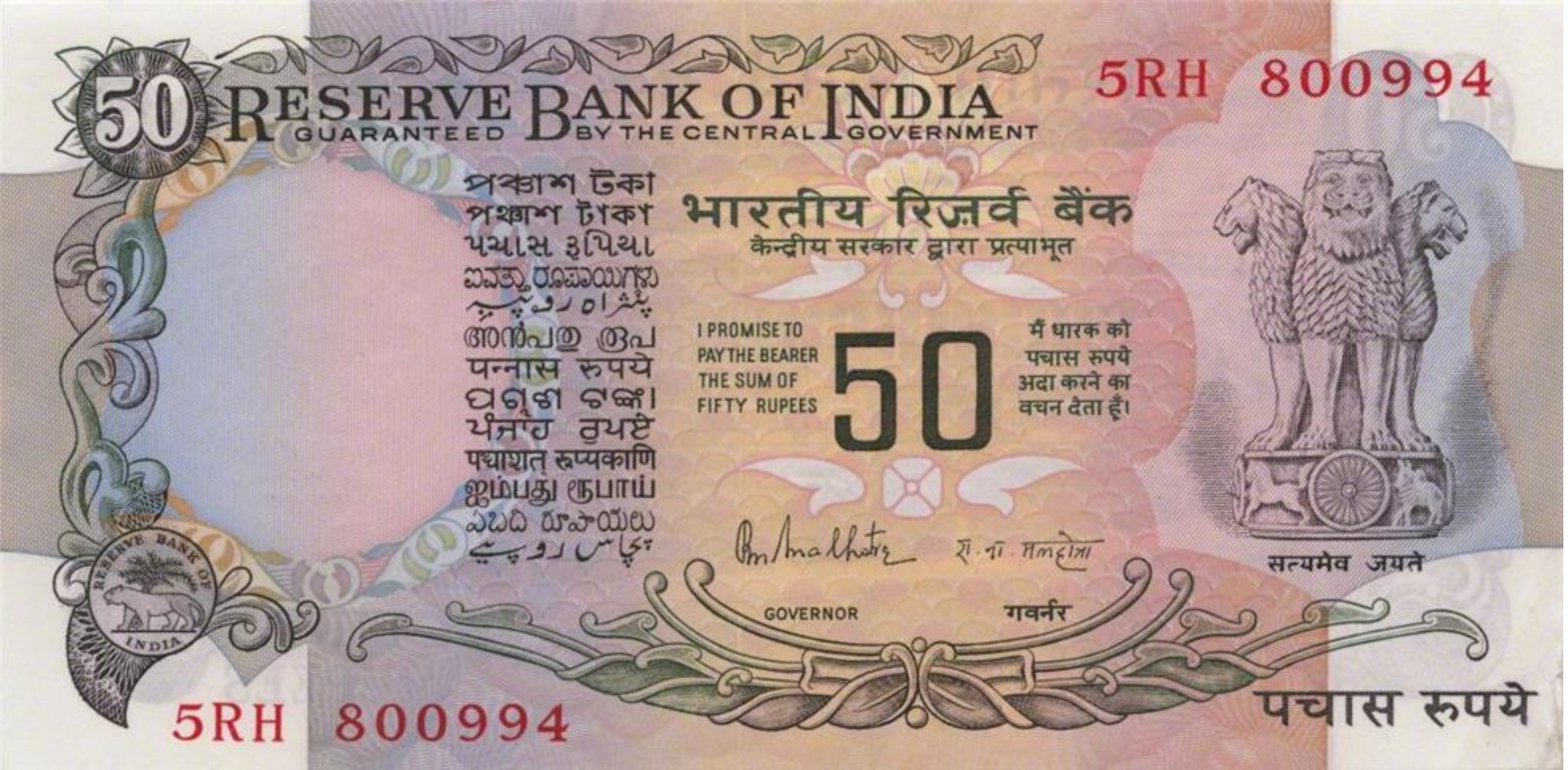

✨ Don't miss: Starting Pay for Target: What Most People Get Wrong

The Indian Rupee (INR) has been on a long, slow slide against the Greenback for decades. Back in the 80s, your hundred bucks would have fetched you maybe 1,200 rupees. In 2010, it was roughly 4,500. Today, it’s double that. This isn't just "inflation." It’s a complex dance between the Reserve Bank of India (RBI) and global investors. The RBI actually steps in quite often. They don't want the rupee to crash, but they also don't want it too strong because that hurts Indian exports. If the rupee is too expensive, no one buys Indian textiles or software services.

Why the Rate Fluctuates Every Single Hour

Why does the value change while you're sleeping?

- Crude Oil: India imports about 80% of its oil. When Brent Crude gets expensive, India has to sell rupees to buy dollars to pay for that oil. More rupees on the market means the rupee's value drops. Simple supply and demand.

- FPI and FII flows: When Wall Street feels risky, they dump money into the National Stock Exchange (NSE) in Mumbai. To do that, they buy rupees. The rupee gets stronger. When they get scared, they pull out. Rupee weakens.

- The Fed: If the US Federal Reserve raises interest rates, dollars go back home to earn that sweet, safe interest. This leaves the rupee out in the cold.

What Can You Actually Buy with 100 Dollars in India?

This is where the concept of Purchasing Power Parity (PPP) kicks in. It's a nerdy term, but it basically means "how far does my money go?"

If you have 100 dollars in Indian rupees, you have roughly 8,500 INR. In Manhattan, 100 dollars is a rounding error. In Jaipur or Pune? It’s a lifestyle.

To give you some perspective, 8,500 rupees can cover a week of mid-range hotel stays in a smaller city. It can buy you roughly 40 to 50 hearty meals at a local "dhaba" or even 5-6 dinners at a high-end, white-tablecloth restaurant in South Mumbai. If you're into tech, that's almost the price of a decent budget smartphone or a pair of high-quality noise-canceling headphones from a local brand like boAt.

🔗 Read more: Why the Old Spice Deodorant Advert Still Wins Over a Decade Later

Compare that to the US. What does 100 dollars buy? A tank of gas and some groceries?

This gap is why "geo-arbitrage" is becoming so popular. Digital nomads earn in dollars and spend in rupees. They are literally playing the 100 dollars in Indian rupees game every single day to live like royalty while working from a beach in Goa.

The Hidden Fees Most People Forget

If you send 100 dollars from a US bank to an Indian bank, you might expect 8,500 rupees to show up.

Wrong.

First, there’s the wire transfer fee. That could be 15 to 30 dollars. Right there, 30% of your money is gone. Then there’s the "hidden markup" on the exchange rate. Most traditional banks hide an extra 2-3% in the rate without telling you. By the time the money hits a bank account in HDFC or ICICI, you might only see 6,800 rupees.

💡 You might also like: Palantir Alex Karp Stock Sale: Why the CEO is Actually Selling Now

It’s daylight robbery.

Better Ways to Exchange Money

- Neobanks: Platforms like Wise (formerly TransferWise) or Revolut use the real mid-market rate. They charge a transparent fee. You'll likely get the closest possible value to the actual 100 dollars in Indian rupees quote you see on Google.

- Remittance Apps: Remitly or Western Union (online) often have "new customer" deals where they give you a boosted rate for your first transfer.

- Travel Cards: If you’re physically in India, avoid local "Money Changers" in tourist traps. Use a Charles Schwab or Fidelity debit card that refunds ATM fees and gives you the live Visa/Mastercard rate.

The Future of the Rupee-Dollar Pair

Economists at Goldman Sachs and local firms like Kotak Mahindra are constantly debating where this is going. Some think the rupee is undervalued. Others point to India's trade deficit and say 90 rupees to the dollar is inevitable.

India is trying to internationalize the rupee. They want to settle trade in INR instead of USD with countries like Russia or the UAE. If that actually works long-term, the demand for dollars might drop slightly, stabilizing the rate. But for now, the dollar is king.

Actionable Steps for Handling Your Currency Conversion

If you need to move or spend 100 dollars in Indian rupees, don't just wing it.

- Check the Mid-Market Rate: Use a neutral source like Reuters or Bloomberg to see what the "true" price is before you commit to a transaction.

- Time Your Transfer: If the Indian stock market is rallying, the rupee usually strengthens. If oil prices are spiking, wait a few days if you can; the rupee might dip further, giving you more bang for your buck.

- Avoid the "Zero Commission" Trap: Whenever a kiosk says "Zero Commission," it just means they've baked a terrible exchange rate into the price. You're still paying; they're just not calling it a fee.

- Use UPI if possible: If you have a way to access UPI (India's instant payment system) as a traveler—which is getting easier with "UPI One World"—take it. It’s the most efficient way to spend money in India without carrying wads of cash that you exchanged at a bad rate.

- Small Amounts, Big Losses: Converting exactly 100 dollars is often the least efficient way to move money because fixed fees eat a larger percentage. If you can, wait until you have 500 or 1,000 dollars to convert to dilute the impact of wire fees.

The exchange rate is a moving target. It’s a reflection of global politics, local manufacturing, and the price of a barrel of oil in the Middle East. Understanding that 8,500 rupees isn't just a number, but a fluctuating piece of a global puzzle, helps you keep more of your money where it belongs—in your pocket.