You've probably sent out dozens of them this month alone. But honestly, most people treat a statement template for billing like a digital receipt they can just "set and forget." That is a massive mistake. Your billing statement isn't just a piece of paper or a PDF attachment; it’s the final handshake in a business deal, and if that handshake is weak or confusing, you aren't getting paid on time.

I've seen small business owners pull their hair out over "missing" payments that were actually sitting in their customers' inboxes all along. The culprit? A cluttered, ugly, or technically incorrect statement that looked like spam or, worse, a math riddle. If your client has to squint to find the "Pay Now" button or can’t figure out why they’re being charged for a line item from three months ago, they’re going to close that tab. They’ll "deal with it later." And later usually means 30 days past due.

The Psychology Behind a Better Statement Template for Billing

Money is emotional. Even in B2B. When a client opens a billing statement, their brain is looking for reasons to delay the pain of parting with cash. A messy statement provides those reasons. If you want to speed up your cash flow, your statement template for billing needs to prioritize clarity over literally everything else.

Think about the last time you got a hospital bill. It’s usually a nightmare of codes, insurance adjustments, and terrifyingly vague totals. You probably didn't pay it the second you opened it. You waited because it felt "wrong" or "unclear." Your clients feel the same way about your invoices if you aren't careful. A professional statement should bridge the gap between "What is this?" and "Paid."

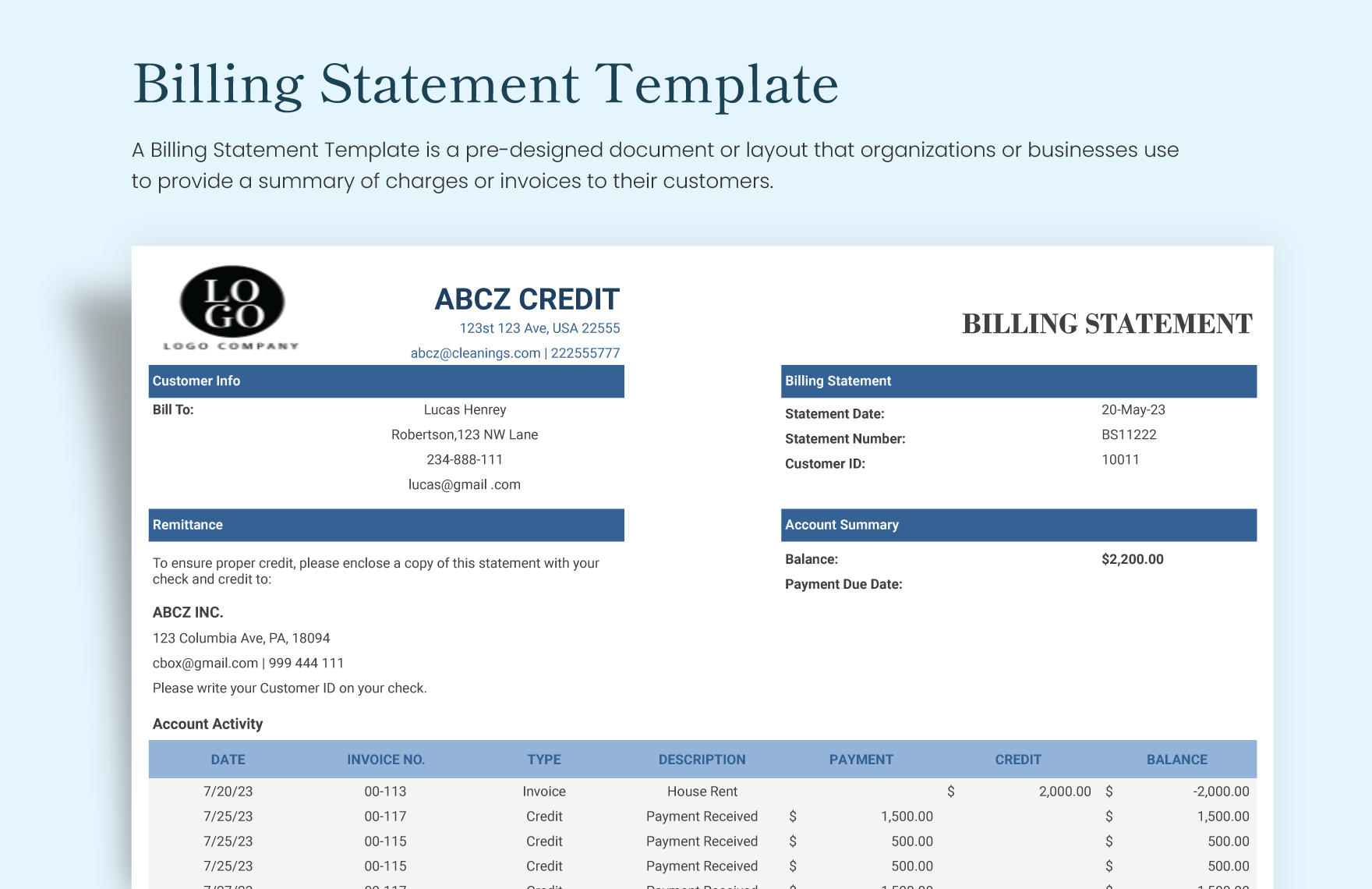

Basically, you need to show the history of the account, not just the current charge. A statement is a bird's-eye view. While an invoice is a specific request for payment for a specific job, the statement is the narrative of the relationship. It shows the opening balance, every payment made, every credit applied, and that final, unavoidable number at the bottom.

What Most Templates Get Wrong (and How to Fix It)

Most people just download a random Excel sheet and change the logo. That’s a start, but it's not enough. A common error is failing to include a "Statement Period." If a client pays you on the 15th, but your statement was generated on the 14th, they’re going to call you confused because their payment isn't showing up. It sounds small. It's actually a huge time-sink for your customer support or your own sanity.

You've got to be specific.

The Anatomy of a High-Conversion Billing Statement

Let’s get into the weeds. Your header needs your legal business name, sure, but it also needs a direct line to whoever handles billing. Not a general "info@" email. People want to talk to a person if they think they're being overcharged.

The "Account Summary" section is where the magic happens. It should be a tiny box at the top right.

- Previous Balance: What they owed before this period.

- Payments Received: Give them credit! Show the money they already sent.

- New Charges: The total from the current month.

- Total Amount Due: Bold this. Make it big.

Underneath that, you list the transactions. Don't just put "Service." That’s useless. Put "Quarterly SEO Audit - Oct 2025." Precision prevents pushback. If you're using a statement template for billing that doesn't allow for descriptions longer than 10 characters, delete it. You need room to breathe.

Aging Buckets: The Secret Weapon for Getting Paid

If you aren't using aging buckets at the bottom of your statement, you’re basically asking people to pay you whenever they feel like it. An aging table breaks down the debt into categories: Current, 1-30 Days Overdue, 31-60 Days, 61-90 Days, and the dreaded 90+.

It’s social pressure without the awkward phone call. When a client sees $500 in the "61-90 Days" column, they realize they are officially "that guy." Most professional outfits want to keep their accounts in the "Current" column. It’s a matter of prestige.

💡 You might also like: What Really Happened With the Eva Claire Financial Scandal

I remember a freelance developer who was struggling with a client who always paid "eventually." He switched to a template that clearly highlighted the 30-day overdue balance in a subtle shade of red. No aggressive emails. No threats. Just the visual data. The client paid within 48 hours. People respond to visual cues better than they do to nagging.

Technical Considerations for 2026

We're in an era where paper is basically a novelty. Your statement template for billing must be "clickable." If you're sending a flat PDF that requires the client to log into their bank, add your routing number, and manually type in a total, you've already lost.

Incorporate "Pay Now" links directly into the PDF metadata or use a platform that generates a live web view. Integration with tools like Stripe, PayPal, or specialized B2B gateways isn't a luxury anymore; it's the standard. Also, consider the mobile view. A lot of CEOs check their "to-do" list while in an Uber or waiting for coffee. If your billing statement looks like a jumbled mess on an iPhone screen, it’s going to stay unpaid until they get to a desktop—which might be next Tuesday. Or never.

Legal and Compliance Nuances

Depending on where you are—like if you're dealing with VAT in Europe or GST in Australia—your statement might need specific tax ID numbers to be legally valid. In the U.S., you want to ensure your "Remittance Advice" section is easy to detach if they do decide to mail a check. Yes, some people still use checks. It's wild, but you have to accommodate them.

Choosing the Right Format: Excel vs. Specialized Software

Honestly, Excel is fine if you have three clients. Once you hit ten, it becomes a nightmare of manual entry and human error. One typo in a cell formula and you've accidentally billed a client $50,000 instead of $5,000. That’s a fun conversation to have at 9:00 AM.

Software like QuickBooks, FreshBooks, or even modular ERPs for larger firms, handle the statement template for billing generation automatically. They pull from your ledger. This ensures that the "Balance Forward" is always mathematically certain. If you're hell-bent on a manual template, use a Google Sheets version with protected ranges so you don't accidentally break the math.

Real-World Example: The "Graceful" Billing Statement

Imagine a boutique marketing agency. They don't want to look like a cold, corporate machine. Their statement template uses a clean sans-serif font, plenty of white space, and a small "Thank you for your partnership" note at the bottom. It feels like a premium experience.

On the flip side, a construction firm needs something rugged. Their template might focus heavily on "Job Numbers" and "Phase IDs." The "correct" template is the one that speaks the language of your specific industry.

Actionable Steps to Audit Your Billing Process

Stop using the first template you find on Google Images. It's likely outdated and lacks the "Aging" sections that actually drive collections. Instead, follow these steps to tighten up your accounts receivable:

- Review your current layout on a phone. If you can’t read the "Total Due" without zooming in 400%, your template is failing.

- Add a "Late Fee" policy line. Even if you don't always enforce it, having it printed on the statement as a standard term creates a "shadow" incentive for on-time payment.

- Audit your descriptions. Spend ten minutes making sure your line items actually describe the value provided. "Consulting" is vague. "Strategic Brand Workshop" justifies the price tag.

- Implement a "Communication Log" section. If you had a conversation about a discount or a deferred payment, note it briefly on the statement. "As per our call on 1/12/26, 10% discount applied to line item 4." This prevents the "I thought we talked about this" emails that delay payment by weeks.

- Clean up your data. Ensure your client’s contact name is correct. Sending a bill to "Accounts Payable" is fine, but sending it to "Accounts Payable - Attn: Sarah Jenkins" gets it processed faster.

By treating your statement template for billing as a communication tool rather than a chore, you turn your billing department from a cost center into a cash-flow engine. Consistency is everything. Send them on the same day every month. Make them look identical every time. Reliability breeds trust, and trust gets you paid.