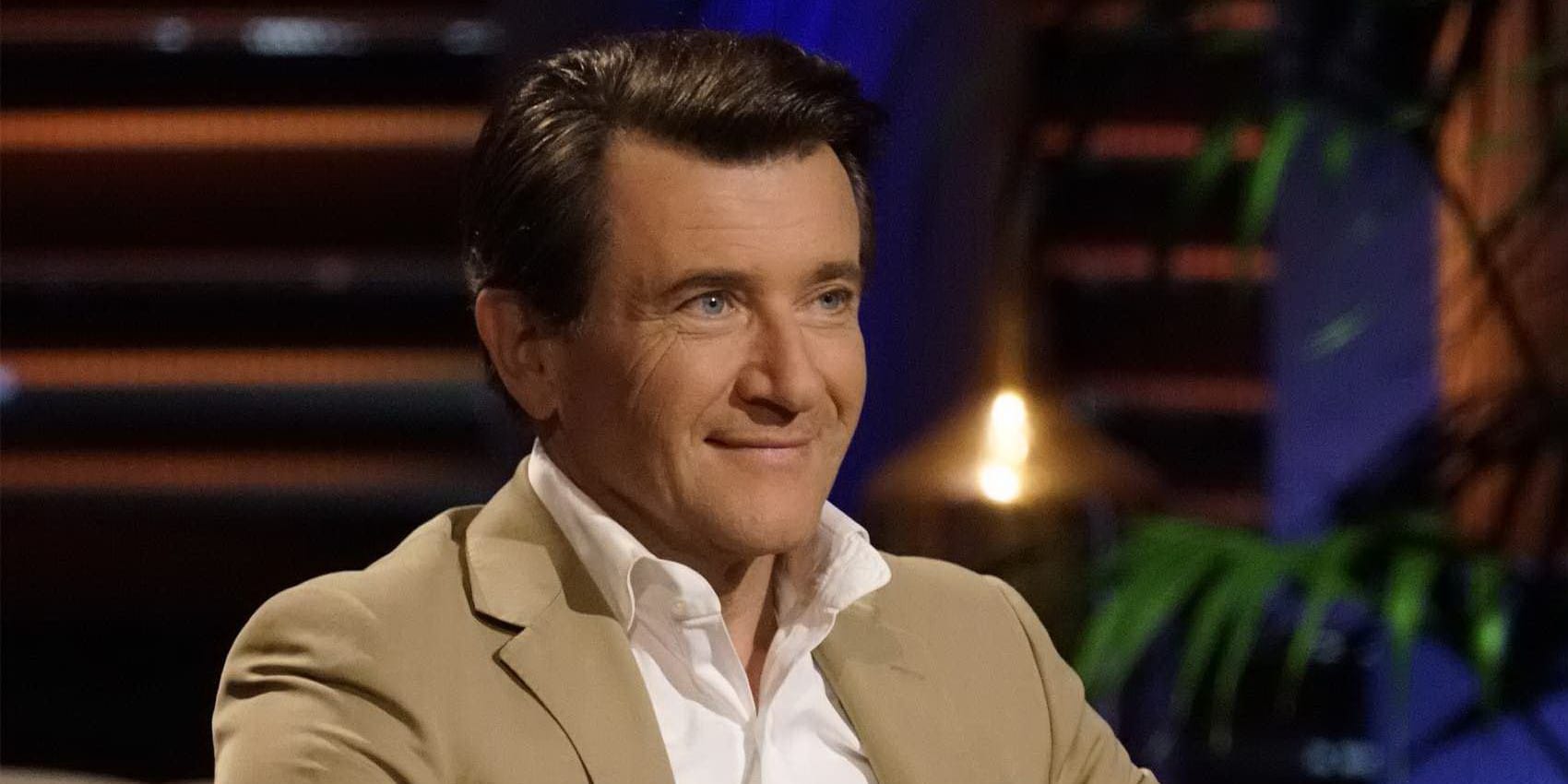

You see him on TV as the "nice Shark," the guy who actually listens and doesn't just scream about royalties. But honestly, there is a massive disconnect between the guy in the tailored suit on ABC and the cold, hard numbers sitting in his bank account.

Most people Googling Robert Herjavec net worth 2025 see a figure like $300 million and call it a day. But if you actually dig into the SEC filings, the cybersecurity mergers, and the high-end real estate flips he’s been pulling off lately, that number starts to look like a massive underestimate.

We are talking about a guy who came to Canada on a boat with $20 in his pocket. Now, he’s buying $26 million mansions in Hidden Hills like they’re stocking stuffers.

The Cybersecurity Empire Nobody Talks About

Most people think Robert makes his money from Shark Tank. He doesn’t. TV is basically a hobby for him. The real engine behind his wealth is a company called Cyderes.

Back in 2003, he started the Herjavec Group. He grew it into a global powerhouse and then, in 2021, he did something brilliant: he sold a majority stake to Apax Partners. This wasn't just a small exit. It led to a merger with Fishtech Group, creating Cyderes.

By 2024, Robert stepped down as CEO but kept a massive seat on the board and a significant equity stake. Experts estimate the enterprise value of this entity is north of $1 billion now.

When you own a chunk of a billion-dollar cybersecurity firm that’s protecting three of the top ten North American banks, your net worth isn't staying flat at $300 million. It’s moving. Fast.

Breaking Down the Robert Herjavec Net Worth 2025 Figures

So, what is the actual number? If we look at the trajectory of his assets in early 2026, the data points to a range between $300 million and $600 million.

Why the big gap? It’s because so much of his wealth is tied up in private equity and "paper wealth" from his Shark Tank deals.

- BRAK Systems Exit: This was the foundation. He sold it for $30.2 million to AT&T in 2000.

- The Cyderes Stake: This is the current "whale" in his portfolio.

- Shark Tank Portfolio: He’s invested over $20 million across nearly 100 deals.

- Real Estate & Cars: He’s got at least $100 million just sitting in physical assets.

Let's talk about those Shark Tank deals for a second. You probably remember Tipsy Elves. Most people laughed at those ugly Christmas sweaters. Robert didn't. He put in $100,000 for 10%. As of 2025, that company has cleared over **$317 million in lifetime sales**. That single deal likely returned his initial investment a hundred times over.

The Real Estate Flip That Shocked Manhattan

Robert doesn't just buy houses; he plays the market like a professional day trader.

In August 2025, he made headlines again by signing a contract for a $20 million condo at 111 West 57th Street—the famous "pencil tower" on Billionaires' Row in New York.

But check out the move he made right before that: He sold his previous Manhattan apartment at One57 for $38.8 million. He had only paid $31.9 million for it three years earlier. That’s a nearly $7 million profit in 36 months just for living in a nice place.

He’s doing the same thing in California. He recently picked up a $26 million estate in Hidden Hills. When you add up his properties in Toronto, LA, and NYC, his "housing" budget is larger than the GDP of some small islands.

👉 See also: BRK B Stock Price Today Per Share: What Really Matters in the Post-Buffett Era

Racing and Rare Metal

Then there's the car collection. This isn't just a guy with a nice BMW. Robert is a competitive racer. He’s won the Rookie of the Year in the Ferrari Challenge.

His garage is basically a museum. We're talking about:

- Lamborghini Countach LPI 800-4 (Valued around $2.5 million)

- Ferrari LaFerrari

- Hennessey Venom F5 Roadster (One of the fastest cars on earth)

- Ford GT '69 Heritage Edition

These aren't just toys. In 2025, the market for rare hypercars has outpaced the S&P 500. His collection is likely worth $25 million to $40 million on its own.

Where Does He Rank Among the Sharks?

Even with all this, Robert isn't the richest guy on the carpet. Here is how he stacks up against the other regulars as we head into the 2026 season:

- Mark Cuban: ~$5.7 billion (The undisputed king)

- Daniel Lubetzky: ~$2.7 billion (The Kind bar founder)

- Kevin O'Leary: ~$400 million

- Daymond John: ~$350 million

- Robert Herjavec: $300M - $600M

- Lori Greiner: ~$150 million

He’s firmly in the middle of the pack, but his liquid cash position is likely much stronger than Daymond's or Lori's because of his tech exits.

What You Can Actually Learn From Him

Robert’s wealth isn't a fluke. It’s built on a very specific philosophy he calls "building a foundation."

He once told Grant Cardone that if he were down to his last million dollars, he wouldn't gamble it on a startup. He’d put it into income-producing real estate.

He believes in "aggressive saving" followed by "leveraged investing." Basically, live like you're poor until you have enough to buy assets that pay you while you sleep. He didn't buy the Ferraris until he had the $30 million from AT&T in the bank.

Actionable Takeaways from the Herjavec Method

If you're looking to build your own "Shark-sized" net worth, here’s the blueprint Robert actually uses:

- Focus on Cash Flow: Don't just look for "value." Look for businesses or assets that spit out cash monthly.

- Adapt or Die: Robert moved from selling film (his first job) to internet security because he saw the world changing. If you're in a dying industry, leave. Now.

- Fail Strategically: He’s been fired. He’s lost millions on bad deals. He views those as tuition payments for his "business degree."

- The 10% Rule: Even as a multi-millionaire, he rarely takes more than a 10-20% stake in startups. He keeps his risk diversified so one bad "Shark" deal doesn't sink the ship.

To get a true sense of your own financial trajectory, start by auditing your current "foundation." Are you investing in assets that appreciate, like Robert's real estate, or just liabilities that depreciate?