Tax season is usually just a blur of numbers and anxiety. Most people focus on the big number at the bottom of Form 1040, but the real "meat" of a complicated tax return often hides in the attachments. One of the most common—and often most confusing—is Schedule 2.

If you've ever looked at your tax software and wondered why your "tax" is suddenly way higher than the standard brackets suggested, you're likely staring at the fallout of Schedule 2 Form 1040. It’s basically the IRS's way of saying, "Wait, you owe us for these extra things, too." It’s not just a footnote. For freelancers, high earners, or people with niche financial situations, it's the main event.

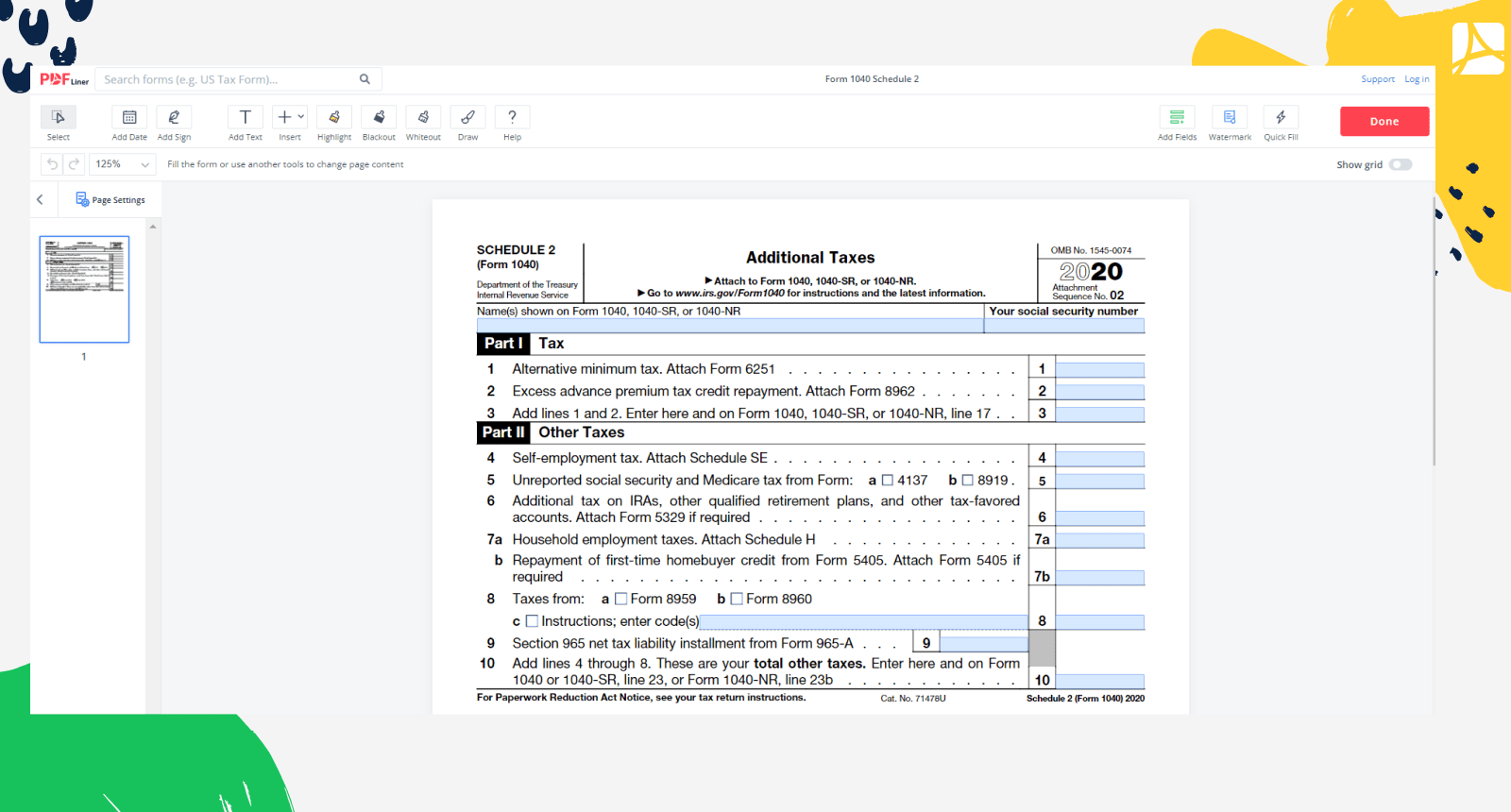

What is Schedule 2 Form 1040 anyway?

Let’s be real: the 1040 itself is pretty stripped down these days. Back in 2018, the IRS tried to make the postcard-sized tax return a thing, and to do that, they had to move a bunch of stuff to "Schedules." Schedule 2 is specifically for Additional Taxes.

Think of it as the "miscellaneous fees" section of your tax bill.

It is divided into two distinct parts. Part I handles tax that isn't based on your standard income brackets—things like the Alternative Minimum Tax (AMT) or the repayment of excess health insurance subsidies. Part II is for "Other Taxes," which is a catch-all for things like self-employment tax, household employment taxes (the "Nanny Tax"), and those annoying penalties on early IRA withdrawals.

💡 You might also like: Goldman Sachs Dallas Texas: Why Wall Street Is Moving to Victory Park

If you’re a W-2 employee with no side hustles and a standard investment portfolio, you might never see this form. But the second you start a "consulting gig" on the side or get a big promotion that triggers the AMT, Schedule 2 becomes your new best friend—or worst enemy.

The AMT Nightmare (Part I)

Alternative Minimum Tax. Just the name sounds like a bureaucratic headache.

The AMT was originally designed to make sure the ultra-wealthy couldn't use so many deductions that they paid zero tax. But because for a long time the thresholds weren't indexed for inflation, it started hitting middle-class families in high-tax states.

On Schedule 2 Form 1040, Part I, Line 1 is where this happens. You calculate your tax the regular way, then you calculate it the AMT way (using Form 6251), and if the AMT is higher, you pay the difference here. It’s a parallel tax system. Honestly, it feels like paying twice, but that’s the law.

There's also the matter of the Excess Advance Premium Tax Credit. If you got a subsidy for health insurance through the Marketplace (Obamacare) but then ended up making more money than you predicted, the IRS wants that subsidy money back. You’ll see that reflected on Line 2. It’s a common trap for freelancers whose income fluctuates wildly throughout the year.

Self-Employment Tax: The Part II Heavy Hitter

This is where most people get tripped up.

If you earned more than $400 from a side hustle, freelance project, or selling handmade goods, you’re officially "self-employed" in the eyes of the IRS. When you work a normal job, your employer pays half of your Social Security and Medicare taxes. When you work for yourself, you are the employer. You pay both halves.

That 15.3% tax is calculated on Schedule SE and then ported over to Schedule 2, Line 4.

It’s a gut punch. You’ve already paid income tax, and then Schedule 2 drops another several thousand dollars of "Self-Employment Tax" on top of it. This is why people tell you to save 30% of every freelance check. They aren't joking.

The Other "Other" Taxes

Schedule 2 isn't just about work. It's about your life choices.

🔗 Read more: Dow Jones Industrial Index Historical Data: Why the Past Still Moves Your Money

- Social Security and Medicare on Unreported Tips: If you’re a server and didn't report all your tips to your boss, they catch up to you here.

- Additional Tax on IRAs: If you took money out of your 401(k) or IRA before you were 59.5, that 10% penalty isn't just a fee—it’s an "Additional Tax" on Line 8.

- Household Employment Taxes: Did you pay a nanny or a housekeeper more than $2,700 in 2024? You’re technically an employer. You owe taxes on their wages.

- Net Investment Income Tax (NIIT): For the high flyers out there, if your Modified Adjusted Gross Income (MAGI) is over $200k (single) or $250k (married), you might owe an extra 3.8% on your investment income.

Why Does This Keep Happening to My Return?

Most taxpayers get blindsided by Schedule 2 because they think of "Tax" as a single percentage of their salary. It's not.

The U.S. tax code is additive. You have your base tax, then you add "extra" taxes for specific behaviors or income types. Schedule 2 is the consolidation point. If you use software like TurboTax or H&R Block, it handles the math for you, but it doesn't always explain why your refund suddenly vanished.

Usually, it’s because of a 1099-NEC or a 1099-K. If you sold more than a certain amount on eBay or Etsy, or did some DoorDash, that income triggers the Self-Employment Tax on Schedule 2.

Nuances and Exceptions

It’s worth noting that not everything on Schedule 2 is a "penalty."

Sometimes, it’s just a correction. Take the Additional Medicare Tax. This hits people earning over $200,000. It's an extra 0.9% tax. Often, employers don't withhold quite enough if you have multiple jobs or if you're married and your combined income crosses the threshold. Schedule 2 acts as the "true-up" mechanism to make sure the government gets exactly what it's owed based on your total household picture.

Also, be careful with the "Section 965" transition tax if you have foreign interests. It’s rare for the average person, but if you own shares in a foreign corporation, things get messy fast.

💡 You might also like: Air Traffic Controller Starting Salary: Why the Numbers Are Weirder Than You Think

Actionable Steps to Manage Schedule 2

Don't let Schedule 2 Form 1040 be a surprise in April. You can actually plan for this stuff.

First, if you have a side hustle, start paying Estimated Quarterly Taxes. You use Form 1040-ES for this. If you pay throughout the year, the "Amount You Owe" on your final 1040 won't be such a shock, even if Schedule 2 shows a high number.

Second, track your expenses. While Schedule 2 records the tax you owe, you can reduce that tax by lowering your business income on Schedule C. Every dollar of valid business expense (home office, equipment, software) reduces the amount that eventually flows into the self-employment tax line on Schedule 2.

Third, if you’re worried about the 10% early withdrawal penalty for an IRA, check for exceptions. There are "hardship" exceptions for medical bills, first-time home purchases, or higher education. If you qualify, you file Form 5329, which can zero out that specific line on Schedule 2.

Finally, check your withholding. If you know you're going to owe the Net Investment Income Tax or the Additional Medicare Tax because you’re a high earner, ask your employer to withhold an extra $50 or $100 per paycheck. It’s much easier to pay $100 a month than $1,200 all at once in April.

Schedule 2 isn't a sign you did something wrong. It’s just the IRS’s way of organizing the complexities of modern income. Whether it's a side gig, a nanny, or a lucky year in the stock market, understanding how these "additional taxes" flow through your return is the first step to actually controlling your finances.

Keep your receipts. Watch your income thresholds. And maybe, just maybe, Schedule 2 won't feel like such a gut punch next year.