Money talks. But if you're looking at a flickering green screen today, you're only hearing a whisper. To hear the roar, you have to look back. Looking at dow jones industrial index historical data isn't just some dry homework assignment for Ivy League analysts or guys in pleated khakis. It is the literal heartbeat of the American experiment.

Ever wonder why 1929 still gives people the chills? Or why the "flash crash" of 2010 changed how your E*TRADE app works?

It’s all in the numbers. Honestly, the Dow is kind of a weird beast. It’s price-weighted, which basically means a stock with a higher price tag has more power than a massive company with a cheaper share price. It's quirky. It's old-school. But since Charles Dow threw together those first 12 companies in 1896—mostly railroads and sugar—it has been the primary way we measure "How are we doing?"

The Numbers That Defined a Century

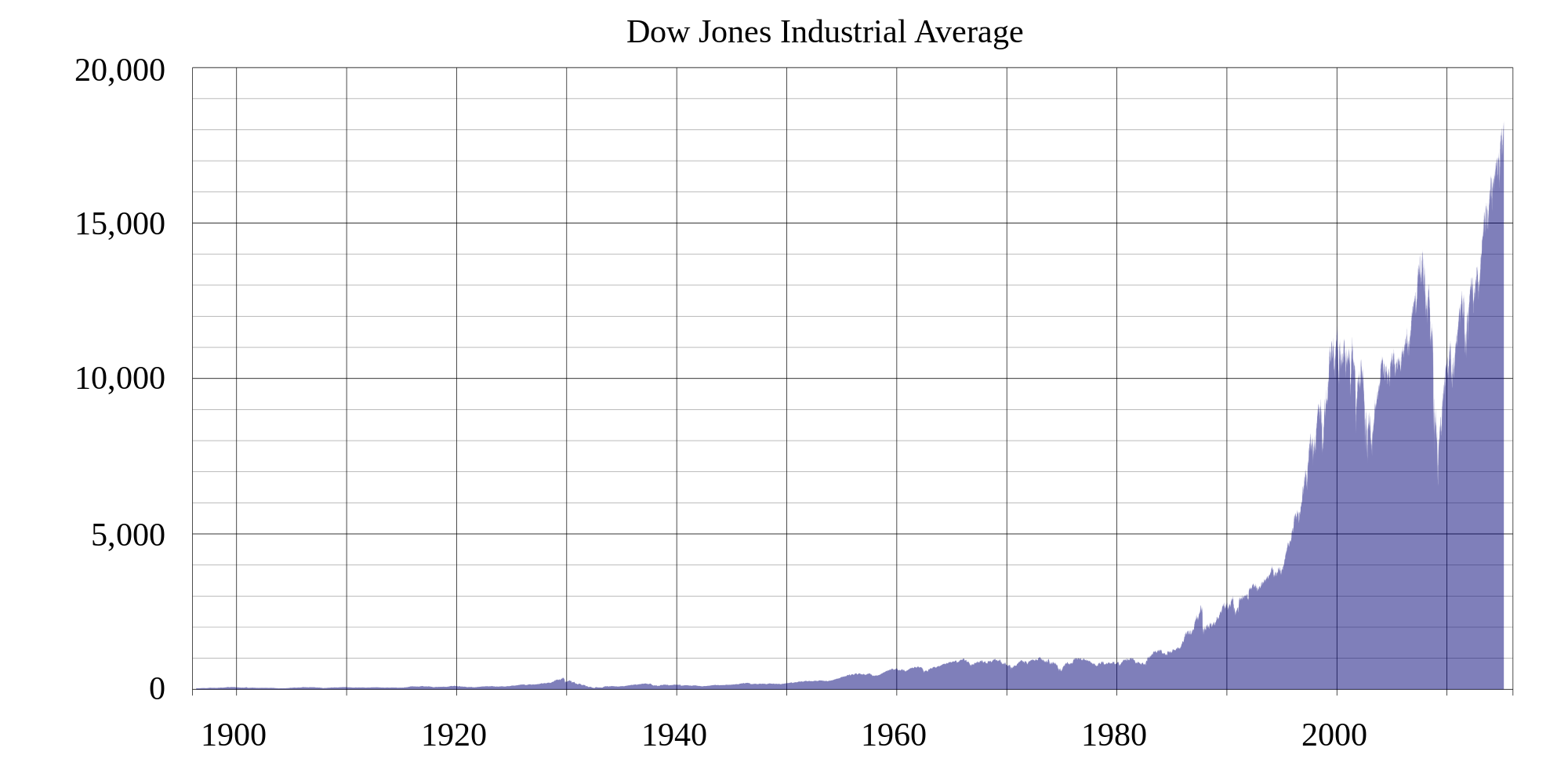

History isn't a straight line. It's a jagged mess of panic and euphoria. When you dig into the dow jones industrial index historical data, you start to see patterns that repeat like a glitch in the Matrix.

Take the Great Depression. The Dow hit its pre-crash high of 381.17 in September 1929. By July 1932? It was sitting at 41.22. Think about that for a second. That is nearly 90% of the value of the most powerful companies on earth just... poof. Gone. It took until 1954—twenty-five years!—just to get back to where it was before the crash.

📖 Related: Astra Micro Stock Price: Why Everyone Is Watching This Defense Play

People think the market always "bounces back" quickly. History says: not always.

Then you've got the 80s. The 1987 "Black Monday" crash saw the Dow drop 22.6% in a single day. One day. If that happened today, we'd be talking about a 9,000-point drop in a few hours. But if you look at the data from the end of 1987, the index actually finished the year up. That's the power of perspective. Short-term trauma, long-term growth.

The Era of "Cheap" Money and Tech Dominance

Fast forward to the 2010s and 2020s. This is where the dow jones industrial index historical data gets really spicy. We saw the longest bull market in history. Low interest rates acted like rocket fuel. We saw the Dow cross 20,000, then 30,000, then 40,000 in what felt like a blink.

But the components changed.

Gone are the days when Sears or General Electric—the last of the original members—ruled the roost. Today, it’s about Apple, Microsoft, and UnitedHealth. When you track the historical shifts, you’re watching the American economy transition from smoke stacks to silicon chips.

Why Does Price-Weighting Even Matter?

Most people don't get this. They think every company in the Dow has the same impact. Nope.

Because the Dow is price-weighted, a $500 stock moving 1% has a much bigger impact on the index than a $50 stock moving 1%. This is totally different from the S&P 500, which cares about market cap (total value).

This quirk means that sometimes the Dow looks healthy while the rest of the market is screaming in pain, or vice versa. It’s a narrow lens. Only 30 companies. Yet, it’s the one your grandma asks about. It's the one that makes the evening news.

Looking for "The Bottom"

Whenever the market dips, everyone starts hunting through dow jones industrial index historical data to find a floor. They look at "support levels." They look at the 200-day moving average.

But here is the truth: the "average" return of about 10% annually is a bit of a myth.

The market rarely actually returns 10% in a single year. Usually, it's up 25% or down 15%. "Average" is just the middle of the chaos. If you look at the yearly returns over the last century, you'll see a scatterplot that looks like a shotgun blast.

Real-World Lessons from the Data

What can you actually do with this?

First, stop panic-selling. If you look at the data from the 2008 financial crisis, the Dow bottomed out around 6,500 in March 2009. People were convinced the world was ending. But history shows that the maximum point of pessimism is usually the best time to buy.

Second, watch the components. The Dow is curated by a committee at S&P Dow Jones Indices. They swap companies out to keep the index "representative." When a company gets kicked out of the Dow—like Intel recently—it’s usually a sign that an entire industry sector is losing its grip on the throne.

Inflation vs. The Dow

We have to talk about "real" returns. If the Dow goes up 5% but inflation is 7%, you actually lost money. When you look at dow jones industrial index historical data adjusted for inflation, the 1970s look like a "lost decade." The index stayed flat in nominal terms, but in terms of purchasing power, investors got crushed.

✨ Don't miss: Online Master of Science in Analytics: What Most People Get Wrong

It reminds us that the number on the screen isn't everything. You have to account for the value of the dollar itself.

How to Use This Data Today

Don't just stare at the charts. Use them to build a strategy.

- Check the Dividend Yield: Historically, the Dow has a higher dividend yield than the Nasdaq. In choppy markets, these payouts are your safety net.

- Study the "Dogs of the Dow": This is a classic strategy where you buy the 10 highest-yielding stocks in the index at the start of the year. It's based entirely on historical mean reversion—the idea that bad years are usually followed by good ones.

- Mean Reversion is Real: Prices eventually return to their historical averages. If the Dow is trading way above its historical P/E (Price-to-Earnings) ratio, be careful. If it's way below, look for deals.

The dow jones industrial index historical data shows us that the biggest risk isn't a market crash. It's being out of the market when the recovery happens. Most of the Dow's lifetime gains happen in just a handful of the best-performing days. If you missed the best 10 days of the last decade, your returns would be cut nearly in half.

Moving Forward With Your Portfolio

The past doesn't predict the future, but it definitely rhymes.

To turn this historical knowledge into a real-world advantage, start by pulling a 10-year chart of the Dow against the Consumer Price Index (CPI). This will show you if your investments are actually growing or just keeping pace with the cost of milk and eggs.

Next, audit your holdings against the current 30 Dow components. Are you over-leveraged in "Old Economy" stocks, or are you riding the tech-heavy wave that has defined the last few years?

Finally, stop checking the price every hour. The data proves that the "noise" of daily fluctuations is meaningless compared to the "signal" of multi-year trends. Build a plan that ignores the Tuesday morning dip and focuses on the decade-long climb. History is on the side of the patient.