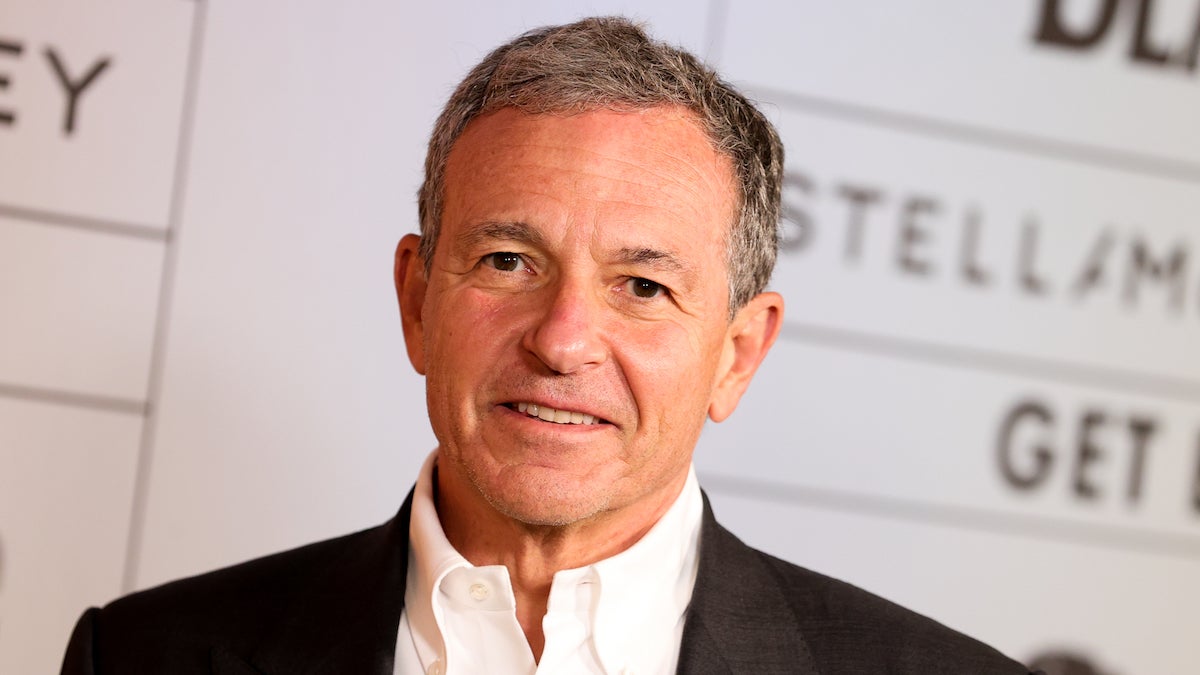

Honestly, if you looked at the Disney board of directors back in late 2022, you’d have seen a group of people in a total panic. Bob Chapek was out. The stock was cratering. The "magic" felt like it was sitting in a discount bin at a suburban mall. So they did the only thing they knew how to do: they called Bob.

Robert Iger Walt Disney—the names are basically synonymous at this point. When Iger walked back into the Burbank headquarters, it wasn’t just a homecoming; it was a rescue mission. But here we are in early 2026, and the vibe is... complicated.

He didn't just come back to fix the pipes. He came back to rebuild the entire house while the family was still living in it. You’ve probably seen the headlines about streaming profits finally hitting the green, or the massive $60 billion commitment to theme parks. It sounds great on paper. But if you talk to the folks who actually track the Mouse House, the story is much messier than a press release.

📖 Related: Price of Halliburton Stock Today: What Most People Get Wrong

The Succession Trap Nobody Saw Coming

Succession. It’s the word that haunts Iger's legacy. He’s retired more times than a legendary boxer, only to lace up the gloves again. Right now, the clock is ticking toward December 31, 2026. That is the hard deadline for his current contract.

James Gorman, the former Morgan Stanley heavy hitter who took over as Disney’s Chairman this month, is not playing around. He’s been tasked with finding the "Next One." But here is the kicker: the board is reportedly considering a co-CEO structure.

Think about that.

For a company built on the singular vision of Walt, having two people at the top—likely Josh D’Amaro and Dana Walden—feels like a massive hedge. D’Amaro is the "Parks Guy." He’s got the charisma, the rapport with fans, and he’s currently sitting on a segment that pulled in a record $10 billion in operating income last year. Walden, on the other hand, is the "Content Queen." She understands the alchemy of a hit TV show in a way few others do.

If they go with both, it’s a sign that Iger’s shoes are simply too big for one human to fill. Or maybe it's just that the company has become too fragmented to manage under one brain.

Why the Robert Iger Walt Disney Era is Different This Time

When Iger first took over in 2005, he was the guy who bought Pixar, Marvel, and Lucasfilm. He was the aggregator. Today, he’s the trimmer. He spent 2024 and 2025 hacking away at costs, trying to make Disney+ more than just a place to watch The Mandalorian on loop.

And it's working, sorta.

In the latest fiscal reports from late 2025, the streaming business finally coughed up a $1.3 billion profit for the year. That’s a massive swing from the $4 billion losses they were posting just a few years ago. But the cost has been high. Prices for Disney+ have spiked, and they’ve started cracking down on password sharing with the same ruthlessness as Netflix.

The China Equation

Then there's the international side of things. Just this month, Iger was in Beijing meeting with Vice Premier Ding Xuexiang. While other American CEOs are cooling on China, Iger is leaning in. He’s celebrating the 10th anniversary of Shanghai Disney Resort this year by announcing even more expansions.

Why? Because the domestic parks are showing some weird cracks.

While the "Experiences" segment is profitable, domestic attendance actually dipped about 1% last year. People are feeling the pinch. A trip to Disney World now requires a second mortgage and the planning skills of a logistics general. Iger knows he needs the international markets to offset the "theme park fatigue" hitting families in the U.S.

The ESPN Gamble

You can't talk about Iger without talking about sports. ESPN is his biggest headache and his biggest potential win. The launch of the "Flagship" direct-to-consumer service in 2025 was a massive bet.

By giving the NFL a 10% stake in ESPN, Iger basically tethered Disney’s future to the most powerful force in American media. It’s smart. But it's also risky. If the transition from cable to streaming doesn't happen fast enough, the massive rights fees for the NBA and NFL could eat the company alive.

What Most People Get Wrong About Iger’s Return

People think he came back for the glory. Most analysts I talk to think he came back because he couldn't stand seeing his legacy dismantled. He hated what Chapek did to the creative culture.

But here’s the reality: Iger has become a bit of a polarizing figure. To some, he’s the savior. To others, he’s the guy who stayed too long and failed to train a replacement. Even in fan polls recently, Iger’s approval rating among die-hard Disney fans has slipped. They’re tired of the price hikes. They’re tired of the "sequel-itis" at the box office.

Robert Iger Walt Disney is a partnership that defined the 21st century. But as we look at 2026, the focus isn't on what he built. It's on whether he can actually walk away this time and leave the keys to someone who won't crash the car.

Actionable Insights for Investors and Fans

If you're watching this saga unfold, here are a few things to keep your eye on over the next six months:

- The Early 2026 Successor Announcement: The board has promised a name "early" this year. If they miss this window, the stock will likely take a hit due to uncertainty.

- The "Co-CEO" Rumor: Watch for title changes for Dana Walden and Josh D'Amaro. If Walden gets more "enterprise-wide" duties, she’s likely the one.

- Capex Spending: Disney is planning to spend $9 billion this year on "strategic expansion." Look for where that money goes—if it’s all in China and Cruise Ships, domestic park fans should prepare for fewer new rides in Orlando and Anaheim.

- Short-Form Content: Disney just announced at CES 2026 they are bringing TikTok-style vertical video to Disney+. This is a huge shift to capture Gen Z, so watch if engagement numbers actually move.

The era of Iger is ending. For real this time. Probably. But in the world of Disney, there's always a post-credits scene.

Next Steps for Your Disney Strategy

If you're an investor, check the Q1 2026 earnings report for updates on the ESPN "Flagship" subscriber numbers. For the fans, keep an eye on the Big Thunder Mountain reopening in Spring 2026; it’s being used as a test case for new "interactive queue" tech that Iger is personally championing to solve the wait-time problem.