Money is weird in Iran. If you're looking at a standard currency converter on your phone and seeing a rate for USD to Iranian Rial, you’re probably looking at a ghost. The number on the screen—the one that says one US dollar is worth roughly 42,000 Rials—is the "official" rate. In the real world, it’s basically useless.

If you actually landed in Tehran today and tried to buy a kebab or pay for a rug using that rate, people would think you're joking. Or worse, they’d realize you're a tourist who hasn't done their homework.

The gap between the official rate and the open market (Bonbast) rate is massive. It’s not just a small percentage difference; we are talking about a gulf that has swallowed the Iranian economy whole over the last decade. For anyone dealing with USD to Iranian Rial transactions, whether for business, travel, or remittances, understanding this "dual-rate" system isn't just helpful—it’s survival.

The Ghost Rate vs. The Street Rate

The Iranian government keeps a "SANA" or official rate for essential imports like medicine and grain. They want to keep the cost of bread down. It makes sense on paper. However, the "Free Market" rate is where the actual life of the country happens. This is the rate you find at the small exchange shops (Sarrafi) tucked away in the corners of the Grand Bazaar or along Ferdowsi Street in Tehran.

Why the split? Sanctions.

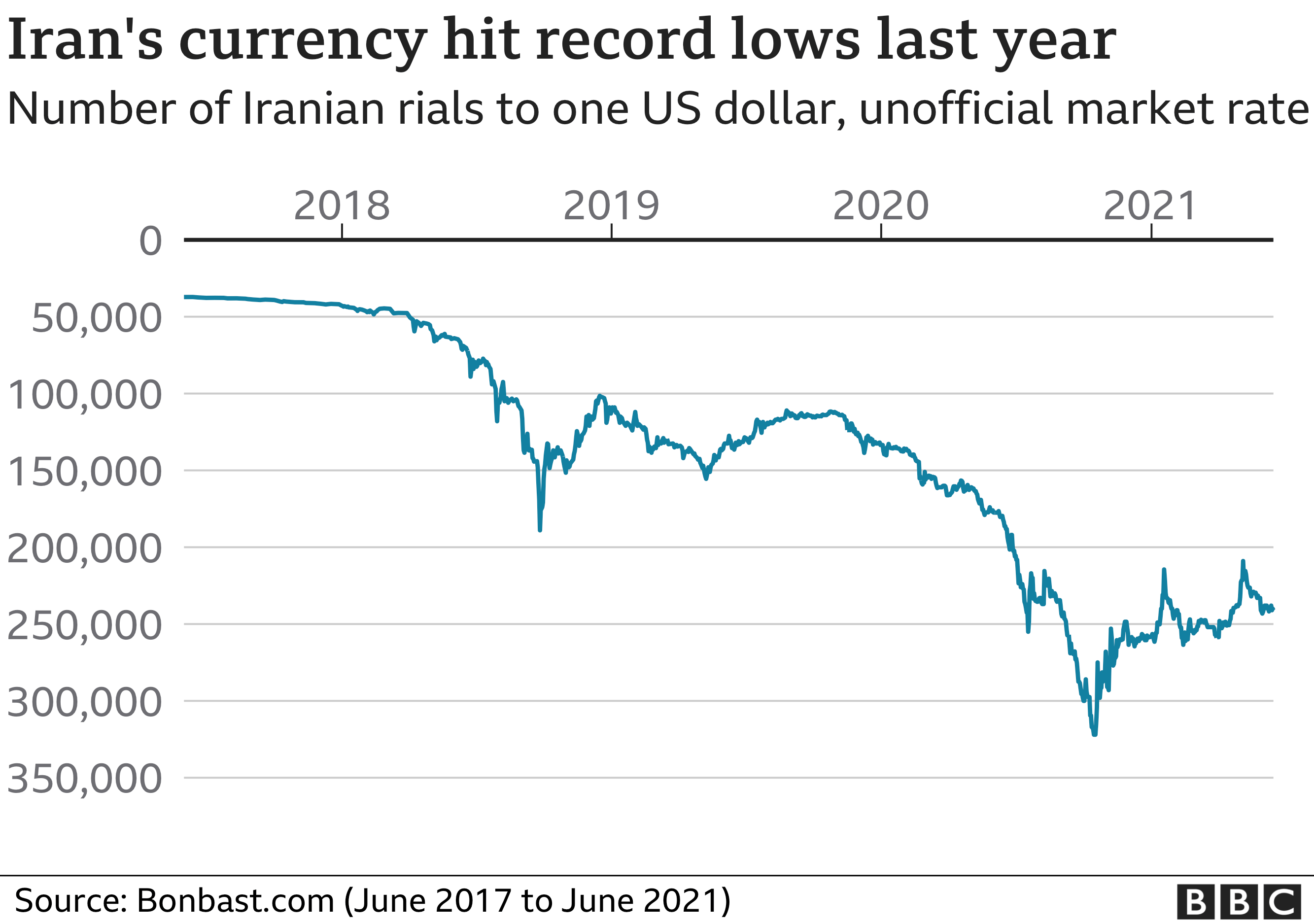

When the US withdrew from the JCPOA in 2018, the Rial didn't just stumble; it fell off a cliff. The pressure on the Central Bank of Iran (CBI) became immense. They tried to peg the currency to stop the bleeding, but you can't command a currency to be valuable if nobody wants to hold it.

People in Iran don't save in Rials if they can help it. They save in gold, real estate, or US dollars. This "dollarization" of the psyche means that the demand for greenbacks is always high, pushing the street price of USD to Iranian Rial to heights that the official government websites refuse to acknowledge.

Forget Rials, Think Tomans

Here is where it gets even more confusing for outsiders. Iranians almost never talk in Rials. If you go to a shop and someone says something costs "50," they don't mean 50 Rials. They don't even mean 50,000 Rials. They mean 50,000 Tomans.

1 Toman = 10 Rials.

It’s a psychological trick to lop off a zero because the numbers have become so astronomically large that they don't fit on many calculators anymore. If you see a price tag, ask. Always ask if it's Toman or Rial. Usually, if it sounds too cheap to be true, it’s in Tomans. If it sounds like the price of a small planet, it’s in Rials.

What Actually Drives the USD to Iranian Rial Volatility?

Geopolitics is the obvious answer, but the nuances are more interesting. Every time there is a headline about a nuclear negotiation in Vienna or a new round of sanctions from Washington, the Rial twitches.

- Oil Exports: Since Iran’s economy is heavily dependent on crude, the ability to bypass sanctions and sell to China is the country's main life support. When oil flows, the Rial stabilizes. When the "ghost armada" of tankers gets squeezed, the Rial tanks.

- Internal Inflation: Iran has dealt with double-digit inflation for years. When the cost of milk and eggs goes up by 40% in a year, the currency loses its purchasing power.

- The "Nima" System: This is a secondary official market for exporters to sell their foreign currency back to the state. It sits somewhere between the fake official rate and the expensive street rate. It’s a messy middle ground that complicates the USD to Iranian Rial picture even further.

Honestly, it’s a headache. Even for locals, keeping track of the daily shift is a full-time job. Many Iranians keep a tab open on their browsers specifically for currency tracking sites like Bonbast or TGJU because the rate can change by 5% between breakfast and lunch.

The Logistics of Moving Money

If you are trying to send money from the US to Iran, you've likely realized that Western Union, MoneyGram, and traditional SWIFT transfers are out of the question. They don't work. The sanctions have effectively unhooked Iran from the global banking grid.

So, how does it happen?

- The Hawala System: This is an ancient, trust-based method of money transfer that predates modern banking. You give dollars to an agent in, say, Los Angeles or Dubai. They call their partner in Tehran. That partner hands over the equivalent in Rials (at the street rate) to your recipient. No money actually crosses the border. It’s all based on a ledger and a handshake.

- Crypto: Bitcoin and Tether (USDT) have become huge in Iran. It’s a digital version of the Hawala. It bypasses the banks entirely. However, the Iranian government has a love-hate relationship with it, sometimes encouraging mining to get foreign currency and other times cracking down when the power grid fails.

Travel and Cash

If you're traveling there, you are a walking bank. You cannot use your Visa or Mastercard. You have to carry crisp, new US $100 bills. Older bills or ones with any marks on them might be rejected by exchange shops. You take your cash to a Sarrafi, get a massive stack of Rials, and suddenly you feel like a millionaire with a backpack full of paper that is worth less every day.

A History of Devaluation

Looking back at the history of the USD to Iranian Rial exchange rate is like looking at a heart monitor of a patient in crisis. In 1978, just before the revolution, a dollar was about 70 Rials. By the end of the Iran-Iraq war in 1988, it had climbed significantly. But the real explosion happened in the last decade.

The 2012 sanctions over the nuclear program were the first major body blow. The Rial lost about half its value almost overnight. Then came the brief reprieve of the 2015 nuclear deal (JCPOA), where the currency actually showed signs of life. That was short-lived. Since 2018, the trajectory has been almost exclusively downward.

🔗 Read more: Gerald T. O’Buckley: What Most People Get Wrong About New York Land Surveying

There was talk of a "redenomination" plan—removing four zeros from the currency and officially renaming it the Toman. You might see some of the newer banknotes already doing this, with the zeros printed in a very light, almost invisible ink. It’s a cosmetic fix for a structural problem. Changing the name doesn't change the fact that the economy is struggling under the weight of isolation.

Practical Steps for Handling Rial Transactions

If you find yourself needing to navigate the world of USD to Iranian Rial exchange, stop looking at Google's currency converter. It is lying to you. Instead, follow these steps to ensure you aren't losing 80% of your value to a bad rate.

- Check "Real" Sources: Use sites that track the open market rate. Bonbast is the gold standard for most, though it is often blocked within Iran and requires a VPN.

- The "Sarrafi" is Your Friend: Only exchange money at licensed exchange shops. Avoid people on the street offering "good deals" in front of the hotels. The shops will give you a receipt and a much more honest market price.

- Carry Large Denominations: As mentioned, $100 and $50 bills get better rates than $1 or $5 bills. They must be the "blue" newer version of the US hundred-dollar bill.

- Don't Exchange Everything at Once: Because the Rial is so volatile, it’s often smarter to exchange $100 at a time. The rate might be better tomorrow. If you exchange $1,000 today and the Rial drops 10% tomorrow, you've just lost a significant amount of purchasing power.

- Understand the "Bazaar" Logic: Prices in the bazaar are often more flexible than in northern Tehran malls. Use the current street rate as your leverage.

The reality of the USD to Iranian Rial situation is that it's a political barometer. Until the tensions between Tehran and the West cool down, the Rial will remain a "distressed" currency. It is a reflection of a country with immense resources and a highly educated population that is currently locked out of the global room.

Don't get caught using the 42,000 "official" rate. It's a trap for the uninformed. In the world of Iranian finance, the street always knows the real price better than the central bank. Always check the daily market fluctuations before making any move, and remember that in Iran, cash is king, but the Toman is the language of the kingdom.

🔗 Read more: Gallon of Fuel Cost: Why Prices Are Finally Dipping Under $3

To get the most accurate current rate, look for the "Free Market" or "Open Market" price on independent tracking platforms. Avoid any service that promises to transfer money directly to an Iranian bank account from a US bank—it is likely a scam or will result in your funds being frozen due to compliance triggers. Stick to established "Hawala" networks with physical offices or use peer-to-peer crypto transfers if you are tech-savvy.