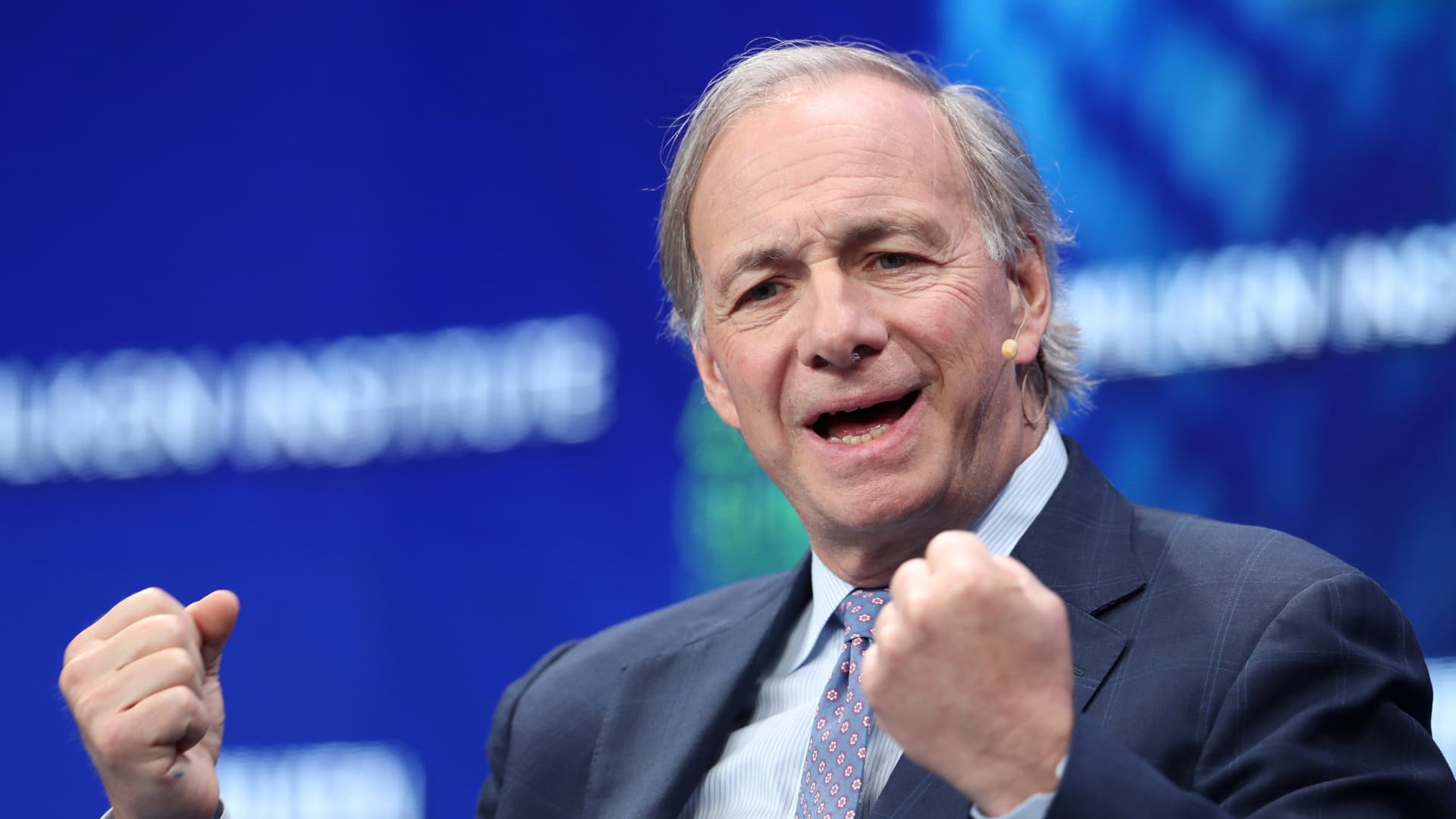

You’ve seen the headlines. The national debt is a "ticking time bomb," or so they say. But if you listen to Ray Dalio, the billionaire founder of Bridgewater Associates, the reality isn't just about a scary number on a screen. It's a cycle. A predictable, repetitive, and frankly exhausting pattern that has played out for the last 500 years.

In his latest work, How Countries Go Broke, released in June 2025, Dalio doubles down on his "Big Cycle" theory. He argues that we aren't just looking at a bad budget year. We’re watching a multi-decade arc of an empire starting to lose its grip. Honestly, most people focus on the wrong things. They argue about tax rates or social programs, but Dalio says you have to look at the "Big Five" forces: debt, internal conflict, external rivalry, acts of nature, and now, the massive wild card of AI.

The Big Cycle: Why Nations Don't Just Trip and Fall

Countries don't go bankrupt overnight. It’s not like a person losing their job and suddenly being unable to pay rent. For a global superpower like the United States, "going broke" looks a lot more like a slow, grinding devaluation of life as you know it.

💡 You might also like: The Peter Principle Book: Why Everyone You Work With Seems Incompetent

Dalio breaks this down into stages.

First, there’s the Early Stage. This usually follows a massive restructuring—often a war or a total economic collapse. Debt is low. People are productive. Money is "sound." Then comes the Growth Stage. Confidence builds. People start borrowing because, well, why not? Things are going great. This leads to the Bubble Phase, where debt grows faster than income. You start seeing asset prices (houses, stocks) skyrocket not because the economy is better, but because everyone is using borrowed money to buy them.

When the Music Stops

Eventually, you hit the Peak. This is where the US is teetering right now, according to Dalio's models.

👉 See also: Trinidad Dollars to US Dollars: What Most People Get Wrong

The central bank—the Fed—is stuck. If they raise interest rates to kill inflation, they make the debt harder to pay back. If they keep rates low, inflation eats the currency alive. It's a "pushing on a string" scenario where traditional tools just stop working. When a country can't pay its debts, it has two choices: default or print money.

Spoiler alert: they always print the money.

The 18 Indicators of National Health

Dalio isn't just vibes-based. He uses a "Power Index" to rank countries based on 18 different determinants. He’s been tracking the top 24 economic powers, and the trends are... concerning.

The US still leads in things like education quality, military strength, and technology. But those are "lagging" indicators. They stay high even as the foundation starts to rot. The "leading" indicators—the ones that tell you what's coming in ten years—are things like cost competitiveness, debt growth, and internal conflict.

- Internal Conflict: This is a big one for 2026. Dalio points out that when the wealth gap is huge and the economy slows down, people stop compromising. They get populist. They get angry. Compromise starts to look like weakness.

- External Rivalry: For the first time in most of our lives, there is a legitimate rival to the US. China has been gaining ground on almost every metric Dalio tracks, especially in trade and STEM graduates.

- The Reserve Currency Trap: Having the world's reserve currency is the ultimate "get out of jail free" card. It allows a country to borrow more than anyone else. But it also leads to over-consumption and under-production. You start buying stuff from other countries with printed money instead of making things yourself.

How Countries Go Broke Explained (Simply)

Basically, a country goes broke when the holders of its debt (like bondholders) realize they’re never going to be paid back in "real" purchasing power.

Imagine you lent someone $100. They give you back $110 a year later. Great! But if the price of a loaf of bread went from $2 to $5 in that same year, you actually lost money. You can buy less bread now than you could before you lent the money. That is monetization of debt. It's a "soft" bankruptcy. The government "pays" you, but the money is worth significantly less than when you earned it.

Dalio identifies 2026 as a potential "financial heart attack" year. Why? Because interest payments on US debt are projected to hit $1 trillion annually. When you're spending that much just to pay the interest on your old credit cards, you don't have money left for schools, roads, or new tech.

What This Means for Your Wallet

So, how do you navigate this "Big Cycle" without losing your shirt? Dalio is famous for his "All Weather" approach, but his current advice is even more specific.

1. Watch the Debt-to-GDP Ratio

If debt is growing faster than the economy (GDP), you’re in a bubble. It's that simple. In 2026, keep a close eye on whether the government can actually find buyers for its bonds without the Fed having to step in and "print" the money to buy them.

2. Diversify Across Currencies and Borders

Dalio often says that "cash is trash" during these phases because it’s being devalued. He’s a big proponent of "hard assets"—things that can’t be printed. This includes gold, certain commodities, and even "digital gold" (Bitcoin), though he approaches the latter with his usual clinical caution.

3. Monitor the "Conflict Gauge"

Economic cycles and political cycles are the same thing. If you see internal polarization reaching a boiling point, it’s usually a signal that a wealth redistribution event is coming. This could mean higher taxes, more regulation, or outright civil unrest.

Actionable Steps for the "Change in Order"

You don't have to be a billionaire to protect yourself from the Big Cycle. It’s about shifting your mindset from "growth at all costs" to "resilience."

- Evaluate your "Real" Returns: Stop looking at the dollar amount in your bank account. Look at what those dollars can actually buy. If your portfolio grew 5% but your cost of living went up 8%, you are technically going broke along with the country.

- Reduce Debt Exposure: If a country is heading toward a debt crisis, interest rates can become incredibly volatile. Avoid being on the wrong side of variable-rate debt.

- Focus on Productivity: In the long run, productivity is the only thing that creates real wealth. Invest in skills that AI can't easily replicate or skills that help you leverage AI.

- Geographic Diversification: It sounds extreme, but Dalio suggests having some "boots on the ground" or assets in countries that are in the "Early Stage" of their cycle—low debt, high growth, and social cohesion.

The "Big Cycle" isn't a death sentence, but it is an environment change. It’s like the seasons. You don’t get mad at winter; you just put on a coat. Understanding ray dalio how countries go broke is essentially your weather report for the next decade. Be ready for the cold.