Gold is acting weird. If you’ve looked at the price of gold on stock market tickers lately, you probably noticed the numbers look like they belong in a sci-fi novel. As of mid-January 2026, spot gold is screaming past $4,630 an ounce. Just a few years ago, $2,000 felt like a ceiling made of reinforced concrete. Now? That ceiling is a distant memory.

Honestly, the "safety trade" has turned into a full-blown stampede.

Most people think gold is just a boring metal their grandma keeps in a safe. They’re wrong. On the modern stock market, gold has become a high-octane proxy for global trust—or the lack of it. When the U.S. Department of Justice opened a criminal investigation into Fed Chair Jerome Powell earlier this month over headquarters renovations, the market didn't just flinch. It bolted. Trust in the Federal Reserve's independence is hitting a generational low, and when people don't trust the guys printing the money, they buy the stuff nobody can print.

Why the Price of Gold on Stock Market is Exploding Right Now

It isn't just one thing. It's everything all at once. We're seeing a "perfect storm" that would make a weather forecaster retire in fear.

First, let's talk about the 2025 hangover. Gold outperformed almost every other asset class last year, including most of the S&P 500 and even the crypto darlings that usually steal the spotlight. It rose roughly 65% in 2025. You don't see that kind of move in a "defensive" asset very often.

💡 You might also like: Why Your Good Monday Morning Team Routine Is Actually Falling Flat

The Trump Factor and Geopolitical Friction

The current administration's trade policies are basically high-grade fuel for gold prices. Between the 25% tariffs threatened against anyone trading with Iran and the bizarre diplomatic friction over Greenland, the world feels... unstable.

- Venezuela: The U.S. pushing for regime change to secure oil reserves has put everyone on edge.

- Iran: Massive domestic unrest and currency collapses have led to over 500 deaths, pushing regional instability to a breaking point.

- De-dollarization: This isn't just a buzzword anymore. Central banks are dumping U.S. Treasuries for gold bars at a rate we haven't seen since the 1970s.

When the world gets messy, the price of gold on stock market screens tends to go green. It's the ultimate "I don't know what's going to happen next" hedge.

Central Bank Hunger

You’ve got to keep an eye on what the big players are doing. J.P. Morgan Global Research recently pointed out that central banks are projected to buy around 755 tonnes of gold in 2026. While that’s lower than the record-breaking 1,000+ tonnes we saw recently, it’s still massive compared to the historical average of 400 tonnes.

Basically, the institutions that run the world’s money are hedging against their own systems. That should probably tell you something.

Is $5,000 the Next Stop?

Analysts aren't even being shy about it anymore. Goldman Sachs has set a price target of $4,900, while ANZ and Bank of America are openly discussing $5,000 an ounce before the end of the year. Some, like Peter Schiff, argue we’re never going back to $2,000 again.

But wait. There’s a catch.

Navneet Damani from Motilal Oswal recently warned that 2026 won't be a one-way street. He expects "massive volatility" in the first quarter. Think sharp selloffs and heart-stopping pullbacks. If you’re buying at the top because of FOMO (fear of missing out), you might get punched in the mouth by a 10% correction before the rally resumes.

Gold is a slow-motion asset that occasionally decides to sprint. We are currently in the sprint phase.

How to Actually Play This Without Getting Burned

If you want to track the price of gold on stock market apps, you don't necessarily need to buy a gold bar and hide it under your mattress. That's heavy, and selling it is a pain.

🔗 Read more: USD to IQD Current Rate: Why the Gap Between Official and Street Prices Is Growing

The ETF Route

Most retail investors are flocking to "mini" ETFs. Why? Because they’re cheap. Funds like the SPDR Gold MiniShares (GLDM) have much lower expense ratios than the big legacy funds. You get the same price action but lose less money to management fees.

The Mining Stock Gamble

This is where it gets spicy. Mining stocks like Newmont or Barrick Gold often act like gold on steroids. When the price of gold goes up 10%, a well-run miner’s profit might go up 30%. But—and this is a big but—they also have to deal with "resource nationalism," labor strikes, and rising fuel costs. Bank of America notes that major North American miners are seeing their production costs rise to about $1,600 per ounce. If gold stays above $4,000, they are printing money. If it drops, they hurt way more than the metal does.

What You Should Do Next

Look, nobody has a crystal ball. But the trend is pretty clear. The dollar is wobbling, the Fed is under fire, and the world is a tinderbox.

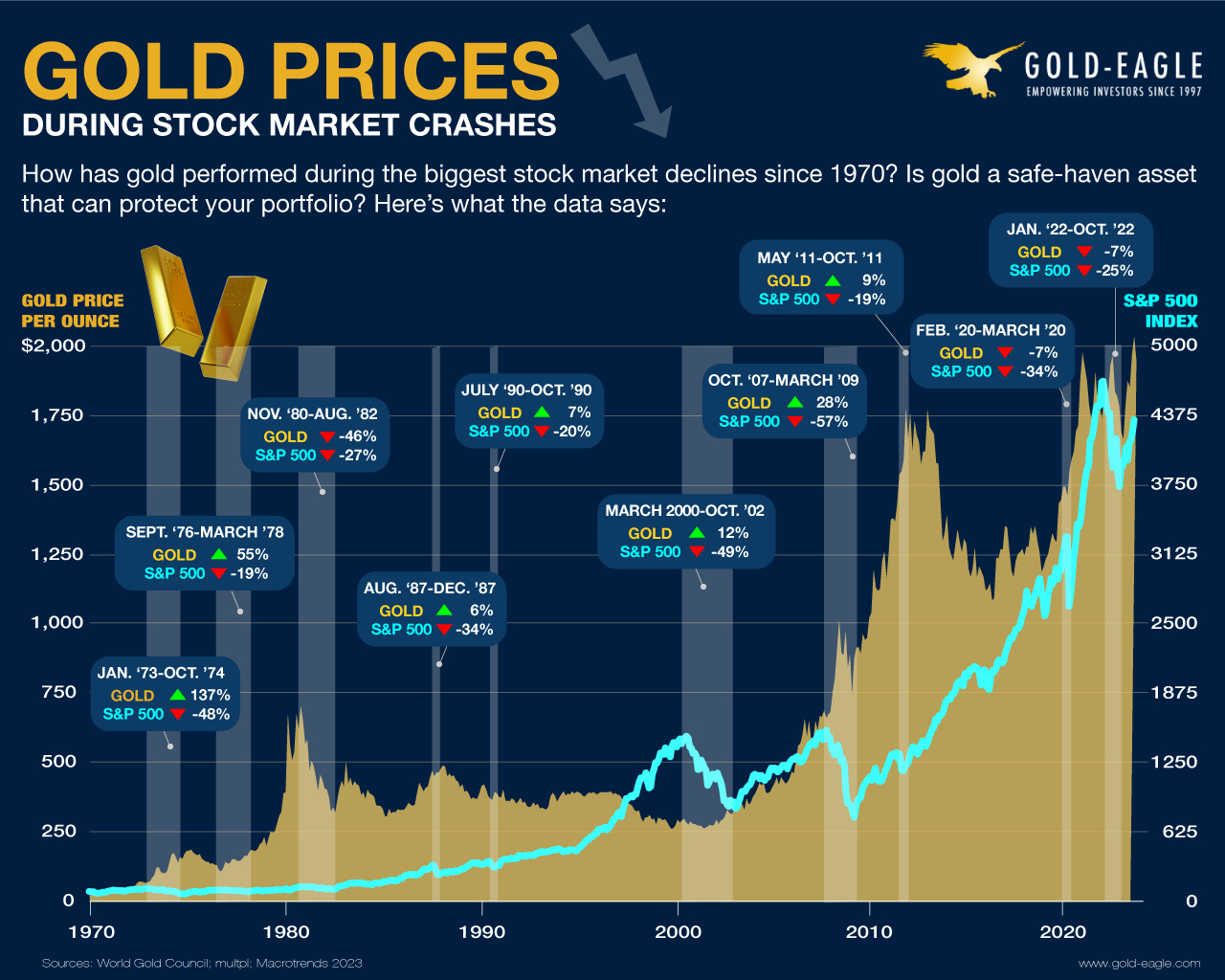

If you’re looking to protect your portfolio, most experts are currently suggesting a 10% to 15% allocation to precious metals. It’s not about getting rich quick; it’s about not getting poor fast when the rest of the market decides to take a dive.

Actionable Steps for the Next 48 Hours:

- Check your exposure: Open your brokerage app. Do you actually own any gold, or is your entire net worth tied to tech stocks and the U.S. dollar?

- Research "Mini" ETFs: Look into low-cost options with expense ratios around 0.1%. These are the "budget-friendly" picks that help you lock in long-term profits without the fees eating your gains.

- Watch the $4,500 level: This is a psychological floor. If gold dips below this, it might be a "healthy correction" buying opportunity. If it stays above, the path to $5,000 is wide open.

- Diversify your entry: Don't dump your life savings in at $4,630. Use dollar-cost averaging. Buy a little now, a little next month. It smooths out the "bumpy ride" analysts are predicting for Q1.

The price of gold on stock market charts isn't just a number; it's a fever thermometer for the global economy. Right now, the patient has a very high temperature.