If you walk into a grain elevator in central Iowa today, the number on the digital readout probably isn't going to make you rich. Honestly, the market is in a weird spot. As of mid-January 2026, the price of corn per bushel is hovering right around $3.85 to $4.10 for immediate cash delivery, depending on how far you are from a major terminal or ethanol plant.

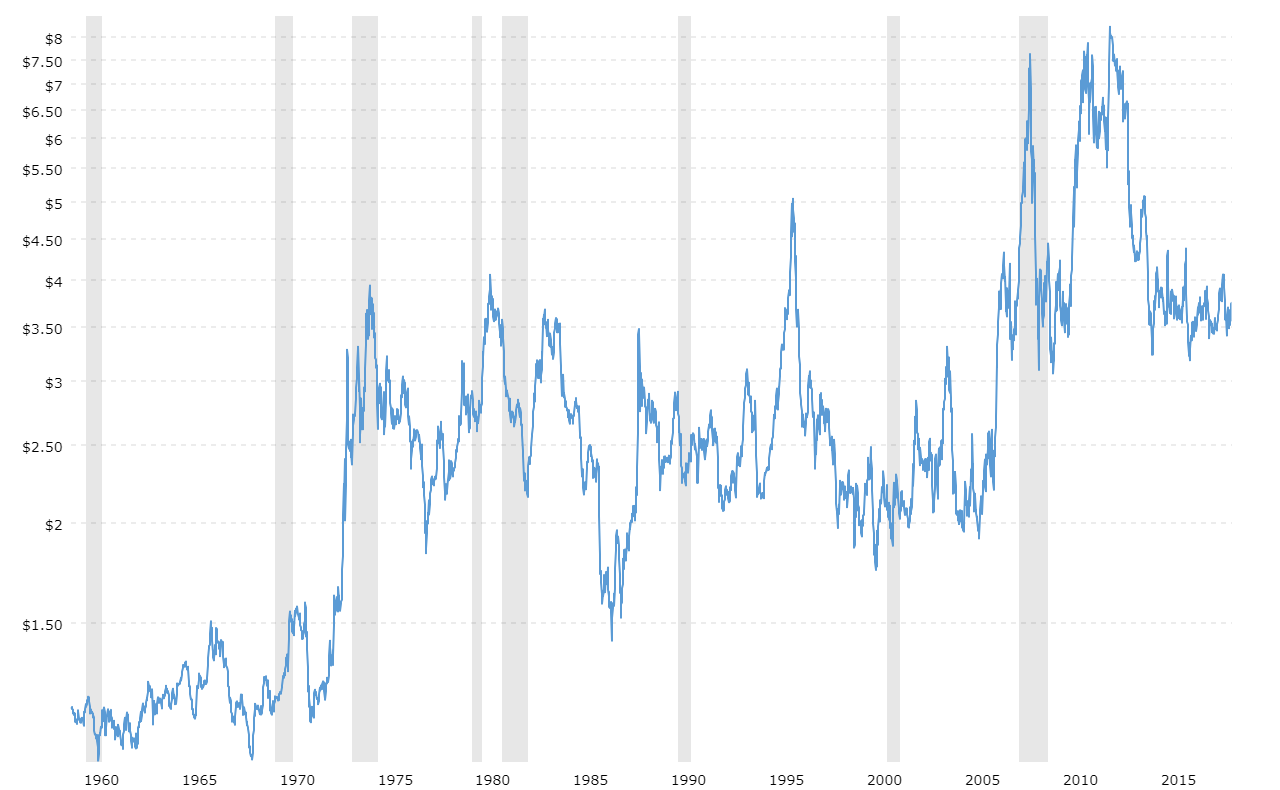

It’s a bit of a gut-punch for anyone who remembers the highs of a few years ago.

Markets take no prisoners. Just this past week, Chicago futures took a nasty 5% tumble after the USDA bumped up production estimates. We are basically swimming in corn. When you have a record-shattering 17-billion-bushel harvest sitting in bins across the Midwest, the "mountain of supply" isn't just a metaphor. It’s a literal weight on the price.

Breaking Down the Current Numbers

You’ve got to look at two different numbers to understand what’s actually happening. First, there’s the "Board Price" (the futures) at the Chicago Board of Trade (CBOT). Then, there’s the "Cash Price" (what the farmer actually gets).

Right now, the March 2026 corn futures are trading near $4.21-$4.25 per bushel.

But wait. You won't actually see $4.25 in your pocket at the local level. That’s because of something called "basis." Basis is essentially the difference between the Chicago price and your local price. In many parts of the Grain Belt, the basis is running "40 under," meaning you subtract 40 cents from that Chicago price.

- National Cash Average: Roughly $3.89 to $3.95 per bushel.

- New Crop (Fall 2026) Bids: Some elevators are dangling $4.05 to $4.10 for corn delivered after next harvest.

- The "YOLO" Factor: Interestingly, some retail traders are starting to bet on "micro" corn contracts, hoping for a spring weather rally.

Why the Price of Corn Per Bushel is Under So Much Pressure

It’s mostly a supply story, but there's some geopolitical spice in the mix too.

The 2025 harvest was massive. We’re talking about yields hitting a record 186.5 bushels per acre. When the technology gets this good, we almost out-produce our own ability to use the stuff. Ben Brown, an agricultural economist at the University of Missouri, recently pointed out that we have a "lot of corn to chew through." He’s not wrong.

Then you have South America. Brazil is the elephant in the room. If their second crop (the safrinha) comes in strong, they will continue to undercut U.S. prices on the global market. To stay competitive and keep the grain moving out of New Orleans, U.S. prices basically have to stay low enough to tempt international buyers away from Brazilian ports.

The Ethanol Wildcard

About a third of every bushel grown in the U.S. goes into a gas tank. Ethanol margins are actually decent right now, which is a rare bit of good news. The National Corn Growers Association (NCGA) is pushing hard for year-round E15 (15% ethanol blends). If that gets finalized by early March as expected, it could create a "floor" for the price. Without ethanol, the price of corn per bushel would likely be staring down the barrel of $3.50.

Is $4.70 the Magic Number?

Farmers are looking for a "selling window." Many analysts, like Jeff Peterson from Heartland Farm Partners, suggest that if the December 2026 futures market can claw its way back toward $4.70, that’s the time to pull the trigger on sales.

But getting there requires a "problem."

Markets hate stability if you're looking for high prices. We need a weather scare in Mato Grosso, Brazil, or a wet, delayed planting season in Illinois this April. Without a supply disruption, the market is just "sideways to lower." It’s boring, and for a farmer with $900-per-acre input costs, boring is dangerous.

Real-World Impact: What Happens Next?

If you’re watching the price of corn per bushel to decide on your 2026 planting strategy, you're likely noticing the "soybean tilt."

Because corn prices are so suppressed, many growers are planning to switch acreage to soybeans. The current forecast suggests we might see corn plantings drop by about 4 million acres this spring. That’s a huge shift. If enough people jump ship on corn, the reduced supply might eventually help prices recover by late 2026.

👉 See also: Missouri Gold Buyers and Jewelry: What Most People Get Wrong

Actionable Insights for the 2026 Season:

- Watch the Basis: Don't just watch the green and red numbers on the TV. Call your local elevator. If they are "full," the basis will widen, and your local price will tank even if Chicago stays flat.

- The March 31 USDA Report: This is the big one. It’s the Prospective Plantings report. If it shows a massive shift out of corn, expect a "relief rally" in prices.

- Check Your Breakeven: With production costs still hovering near record highs—around $928 per acre in some regions—selling at $3.90 might mean losing money. Look into the Agriculture Risk Coverage (ARC) or Price Loss Coverage (PLC) programs, as 2025 payments (paid out in late 2026) could be the only thing keeping some balance sheets in the black.

The bottom line? The price of corn per bushel is currently stuck in a "supply trap." It’s going to take more than just strong exports to Mexico or healthy ethanol demand to break it out of the $4 range. Keep a close eye on the South American weather maps over the next six weeks; that’s where the next big move will start.