Most investors are looking at the wrong numbers. They open up a finance app, look at a twenty-year chart of the S&P 500, and think they're seeing the whole story of American enterprise. They aren't. They’re seeing a "price return" index, which is basically a half-finished painting. If you really want to understand how wealth is built in the stock market, you have to look at s&p 500 total return index historical data. It changes everything.

Price return just tracks the ticker symbol price. Total return assumes you took every single dividend check—those quarterly payments companies like Apple, Microsoft, or ExxonMobil send out—and immediately used them to buy more shares. Over a weekend, the difference is pennies. Over thirty years? It’s the difference between retiring comfortably and wondering where it all went wrong.

The Compounding Engine You Can't See

The S&P 500 Total Return Index (often seen as the SPTR) is the "true" version of the market. Since 1926, dividends have accounted for roughly 40% of the total return of the US equity market. Think about that. Nearly half of the money made by investors didn't come from the stock price going up; it came from the slow, boring drip of dividends being reinvested back into the system.

If you invested $10,000 in the S&P 500 at the start of 1960, the price-only index would have turned that into roughly $600,000 by 2023. That sounds great, right? But if you had looked at the s&p 500 total return index historical data and reinvested those dividends, that same $10,000 would be worth over $4.5 million. It’s a staggering gap. It happens because of a mathematical snowball effect. You get a dividend, you buy more shares, then those new shares pay dividends, and suddenly you’re owning a much larger slice of the pie without ever adding fresh "outside" cash.

Why 2008 and 2022 Look Different in Total Return

History isn't just a straight line up. We’ve had some absolute nightmares. The Great Financial Crisis of 2008 saw the S&P 500 drop about 37% in a single year. It was brutal. Honestly, it was terrifying for anyone with a 401(k). But if you look at the total return data during recovery periods, you see something interesting. Dividends often stay steadier than stock prices. Even when the "value" of a company like Johnson & Johnson drops 20% in a market panic, they usually keep paying their dividend.

Investors who stayed the course and let their dividends reinvest during the 2008-2009 crash were actually buying shares at "sale" prices. They were accumulating more units of the index precisely when the cost was lowest. When the market eventually rebounded, their total return accelerated way faster than someone just waiting for the price to get back to "even."

The 1970s Trap

The 1970s were a "lost decade" for many. High inflation, stagnant growth—it was a mess. If you look at the price of the S&P 500 in 1970 versus 1979, it looks like you made almost nothing. It’s depressing. However, dividends back then were actually quite high compared to today. The total return index shows a much more resilient picture of the 70s than the price charts suggest. You were getting paid to wait.

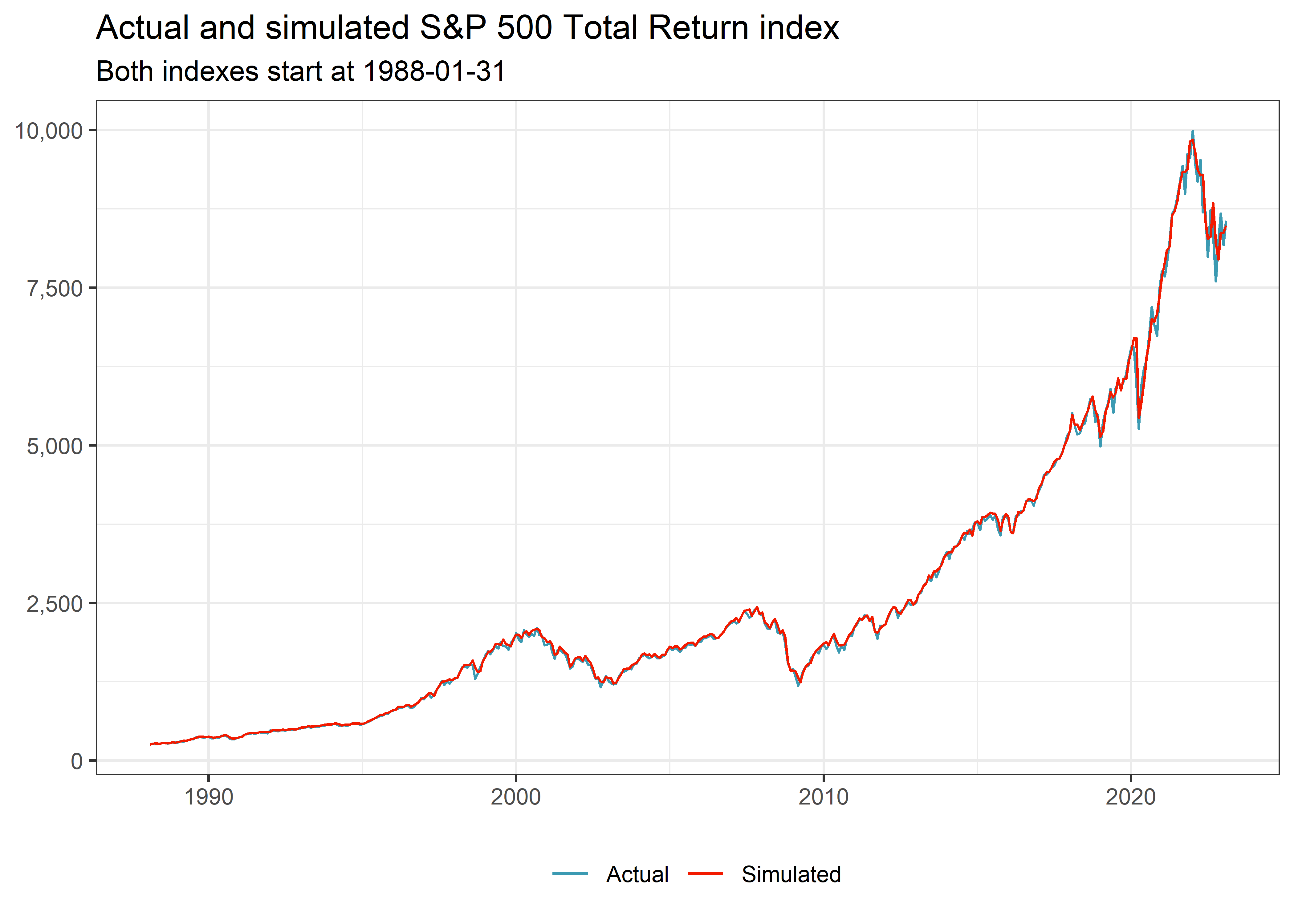

Real Numbers: Examining the S&P 500 Total Return Index Historical Data

Let's talk specifics. I'm not making these up. According to S&P Dow Jones Indices, the long-term average annual return for the S&P 500 Total Return is somewhere around 10% to 10.5% going back to the 1920s.

✨ Don't miss: Who owns the American debt and why you shouldn't panic about China

But nobody actually gets a "10% year." That’s a myth of averages.

In reality, the market is rarely "average." One year it's up 30%, the next it's down 10%. For example, in 2023, the S&P 500 Total Return was up a massive 26.29%. The year before that, 2022, it was down 18.11%. If you only looked at the price, you missed the fact that even in down years, that yield (usually around 1.3% to 1.6% lately) acts as a tiny shock absorber.

Complexity in the "Total" Calculation

How do they actually calculate this? It’s not just adding the dividend percentage to the price. It's a daily adjustment. When a stock in the index goes "ex-dividend," the index calculation assumes that dividend is reinvested into the entire S&P 500 at the close of that day. This creates a "synthetic" growth curve. It’s why you’ll see the SPTR index value in the tens of thousands, while the regular S&P 500 price index is in the five-thousands.

The Tech Bias and the Yield Shift

Something has shifted recently. If you look at the s&p 500 total return index historical data from the 1980s or 90s, the dividend contribution was huge. Today, the index is dominated by massive tech companies like Nvidia, Amazon, and Alphabet.

Amazon doesn't pay a dividend.

Alphabet (Google) only recently started.

Meta (Facebook) just jumped on the bandwagon.

Because these "Magnificent Seven" stocks take up so much weight in the index, the overall dividend yield of the S&P 500 has dropped. It used to be common to see 3% or 4% yields. Now, we’re lucky to see 1.5%. Does this mean total return doesn't matter anymore? No. It means the "growth" part of the total return is doing more of the heavy lifting. But don't be fooled—over long cycles, those tech giants will eventually mature, their growth will slow, and they’ll start returning even more cash to shareholders. It’s the natural lifecycle of a company.

Don't Forget Inflation and Taxes

We have to be real here. Total return looks amazing on a spreadsheet, but it doesn't account for your Uncle Sam or the rising price of eggs.

👉 See also: Exchange Rate US Dollar Swiss Franc: Why the Safe Haven is Winning in 2026

- The Tax Drag: If you hold these stocks in a regular brokerage account, you pay taxes on those dividends every year, even if you reinvest them. This eats into your "real" total return.

- Inflation: A 10% total return feels great until inflation is 8%. Your "purchasing power" only went up 2%.

Smart investors look at "Real Total Return," which adjusts for the Consumer Price Index (CPI). If you look at the historical data through that lens, the gains are still impressive, but they are much more grounded in reality. You aren't just looking for bigger numbers; you’re looking for the ability to buy more stuff in the future.

How to Use This Information Today

You shouldn't just stare at these charts for fun. You use them to set expectations. If you’re planning for retirement and using a "price chart" to estimate your future wealth, you’re lowballing yourself. Conversely, if you're ignoring the impact of taxes on those dividends, you're being too optimistic.

Most people use an ETF like SPY or VOO to track this. These funds don't perfectly match the Total Return Index because they have tiny management fees (expense ratios). For example, VOO costs about 0.03% a year. It’s basically free, but it’s still a tiny "leak" in your total return bucket.

Actionable Steps for the "Total Return" Mindset

- Turn on DRIP: This stands for Dividend Reinvestment Plan. Most brokerages like Fidelity, Schwab, or Vanguard have a toggle switch. Flip it. It automates the "total return" strategy so you don't have to manually buy shares every time Apple sends you $4.

- Check the "After-Tax" Return: If you're in a high tax bracket, look into holding your S&P 500 index funds in a Roth IRA or 401(k). This protects the "total" part of your return from being chipped away by the IRS every April.

- Stop Price Watching: Stop checking the daily price change as your only metric of success. Once a year, look at your "Total Account Value" compared to your "Total Investment." That’s where the magic of the s&p 500 total return index historical data actually shows up in your real life.

- Benchmark Correctly: If you're paying a financial advisor 1% to manage your money, and they say they "beat the market" because they did better than the S&P 500 price index, fire them. They need to beat the Total Return index. That’s the real hurdle.

The historical data proves that the stock market is less of a gambling den and more of a massive, collective compound interest machine. It requires patience that most people just don't have. They see a red day on the news and panic. But if you're focused on total return, you realize that red day is just an opportunity for your reinvested dividends to buy more shares at a discount. It turns the psychology of investing on its head. That is how you actually win the long game.