Banking is personal. It's not just about digits on a glass screen or the weight of a plastic card in your wallet. It is about your rent, your groceries, and that feeling in your gut when a transaction declines for no apparent reason. When you're dealing with the largest Black-owned bank in America, the expectations are high. People don't just want a place to park their cash; they want a movement. But here's the thing: movements still need to answer the phone. OneUnited Bank customer service is a frequent topic of debate in financial circles because it sits at the intersection of high-tech digital banking and the old-school grassroots mission of community empowerment.

Getting a human on the line matters. Honestly, in an era where every "fintech" company hides behind a chatbot named Dave or Maya, the way OneUnited handles its business is a bit different. They’ve leaned heavily into their digital-first strategy, especially since the #BankBlack movement exploded in 2016 and 2020. This surge in popularity was great for their mission, but it put a massive spotlight on how they handle technical hiccups and everyday inquiries.

If you've ever scrolled through reviews on Trustpilot or the Better Business Bureau, you'll see a wild mix. Some people swear by the responsiveness of the team, while others feel left in the lurch during a fraud claim. It’s a polarizing experience. Why? Because OneUnited isn't a massive, faceless conglomerate like Chase or Bank of America with 50,000 call center seats. They are a designated Community Development Financial Institution (CDFI). That status means they have a specific mandate to serve low-to-moderate-income communities, but it also means they operate with more specialized resources.

The Reality of OneUnited Bank Customer Service Today

The most important thing you need to know is how to actually reach them. You can't just walk into a branch in 48 states. While they have physical footprints in Los Angeles, Miami, and Boston, they are effectively a national digital bank. This means OneUnited Bank customer service lives or dies by its phone lines and its app.

If you call their main line at 877-One-United, you’re entering a system designed to prioritize high-volume requests. Most people get frustrated because they expect "concierge" service from a bank that is actually optimized for "essential" service. It’s a nuance that matters. Their hours are fairly standard—Monday through Friday, 9:00 AM to 11:59 PM ET—which is actually better than many traditional credit unions. But don't expect a lot of weekend help. If your card gets eaten by an ATM on a Sunday afternoon, you’re basically waiting until Monday morning unless it’s a standard lost/stolen report handled by their automated vendor.

The digital divide is real. Many users who complain about the service are actually struggling with the bank's strict security protocols. OneUnited is notorious for being aggressive about fraud prevention. It's annoying when your card gets blocked at a gas station, sure. But they do this because they serve a demographic that historically has been targeted by predatory financial schemes. They’d rather over-protect your account and force you to call customer service than let a fraudulent charge drain your savings. It's a trade-off. You get security, but the "cost" is occasionally having to wait on hold to verify that, yes, you really did just spend $200 on sneakers in a different zip code.

✨ Don't miss: Lowe's Home Improvement Killeen TX: What Most People Get Wrong

Navigating the App and Automated Hurdles

The OneUnited mobile app is the "front door" for most service needs. Honestly, it’s where you should start. You can do the basics:

- Deposit checks via image capture

- Transfer funds between accounts

- Apply for the "Way2Save" programs

- Contact support via secure messaging

Wait, let's talk about that secure messaging. It’s often faster than calling. Because the bank handles sensitive financial data, they prefer you use the encrypted channel inside the app. When you send a message here, it creates a paper trail. If you’re dealing with a dispute or a missing deposit, having that timestamped log is your best friend.

One thing that surprises people is the "OneUnited Express" feature. It’s their version of early payday. While it's a product, not a service "department," it generates a ton of customer service traffic. People call in asking, "Where is my money?" at 8:00 AM on Wednesday because they heard they could get paid two days early. The customer service reps then have to explain that "early" depends on when your employer sends the file, not when the bank feels like giving it to you. This creates a bottleneck. If you want to avoid a long hold time, don't call on "early pay" days (usually Wednesdays).

What the Critics (and the Fans) Are Saying

You’ll find a lot of "1-star" reviews that scream about frozen accounts. If we’re being real, this usually happens for two reasons: unconventional deposits or verification issues. OneUnited is a "second chance" bank for many. They offer accounts like "U2 Online" for people who have been dinged by ChexSystems. Because of this, their compliance department is on high alert. If you deposit a $5,000 check into a brand new account and then try to Zelle it out ten minutes later, your account is going to get locked. Fast.

At that point, you’re at the mercy of the OneUnited Bank customer service verification team. This isn't the same as the general help desk. This is a specialized group that looks at IDs and source-of-funds documents. It can take days. It’s frustrating. It feels like they’re holding your money hostage, but they’re actually following federal "Know Your Customer" (KYC) laws that apply to all banks. The difference is that a big bank might have more staff to process these flags, whereas a community bank takes longer to move through the queue.

On the flip side, the fans of the bank appreciate the "Why." You aren't just a number. When you finally do get a rep on the phone, the tone is different. It’s less "corporate drone" and more "community member." Users have reported that the staff is particularly helpful when it comes to explaining the "Credit Companion" tool or helping them understand why their credit score moved. They provide a level of financial literacy education that you simply won't get from a robo-advisor.

Handling Disputes and Fraud

Let's get into the weeds. If someone steals your debit card info, you need to act. OneUnited uses a third-party processor for their Visa cards, which is common. This means if you call after hours to report a lost card, you aren't talking to an employee in the Boston office; you're talking to a global Visa support rep.

To file a formal dispute, you usually have to fill out a form. Yes, a real form. In 2026, we want everything to be a "one-tap" solution, but OneUnited often requires documentation. Pro tip: if you’re dealing with a service issue regarding a dispute, keep your "Case Number" handy. If you call back and don't have that number, you're starting from zero. The system doesn't always automatically link your previous phone call to your current one unless the rep manually updated the notes.

Comparison: OneUnited vs. Big Tech Banks

If you compare OneUnited Bank customer service to something like Chime or Varo, the experience is night and day. Chime is a tech company with a banking license (or a partner bank). Their service is almost entirely automated. It’s slick, it’s fast, but it’s rigid. If you have a problem that doesn't fit into a pre-selected category, you're in trouble.

✨ Don't miss: How to Use Thank You for a Quick Reply Without Sounding Like a Corporate Bot

OneUnited is a bank with a tech layer. It’s a subtle but massive difference. They have actual humans making decisions. This means they can be more flexible in certain situations, like waiving a fee if you have a genuine hardship, but it also means they are subject to human delays. They don't have the infinite "cloud" scaling that a Silicon Valley startup has. They have a building with people in it.

How to Get the Best Results

If you want to avoid the "OneUnited Bank customer service headache," you have to play the game effectively.

First, avoid the peak hours. Monday mornings are a disaster at every bank in the world. Everyone who had an issue over the weekend calls at 9:01 AM. Don't be that person. Call on a Tuesday or Thursday afternoon.

Second, use social media—but be smart about it. OneUnited is very active on Instagram and X (formerly Twitter). They have a brand to protect. If you aren't getting a response through the standard channels, a polite but firm public message often gets a "DM us your details" response very quickly. They don't want negative sentiment lingering on their "Black Excellence" posts. It’s a lever; use it if you have to.

✨ Don't miss: how much is $1 us in canada: Why the Exchange Rate Just Hit a 20-Year High

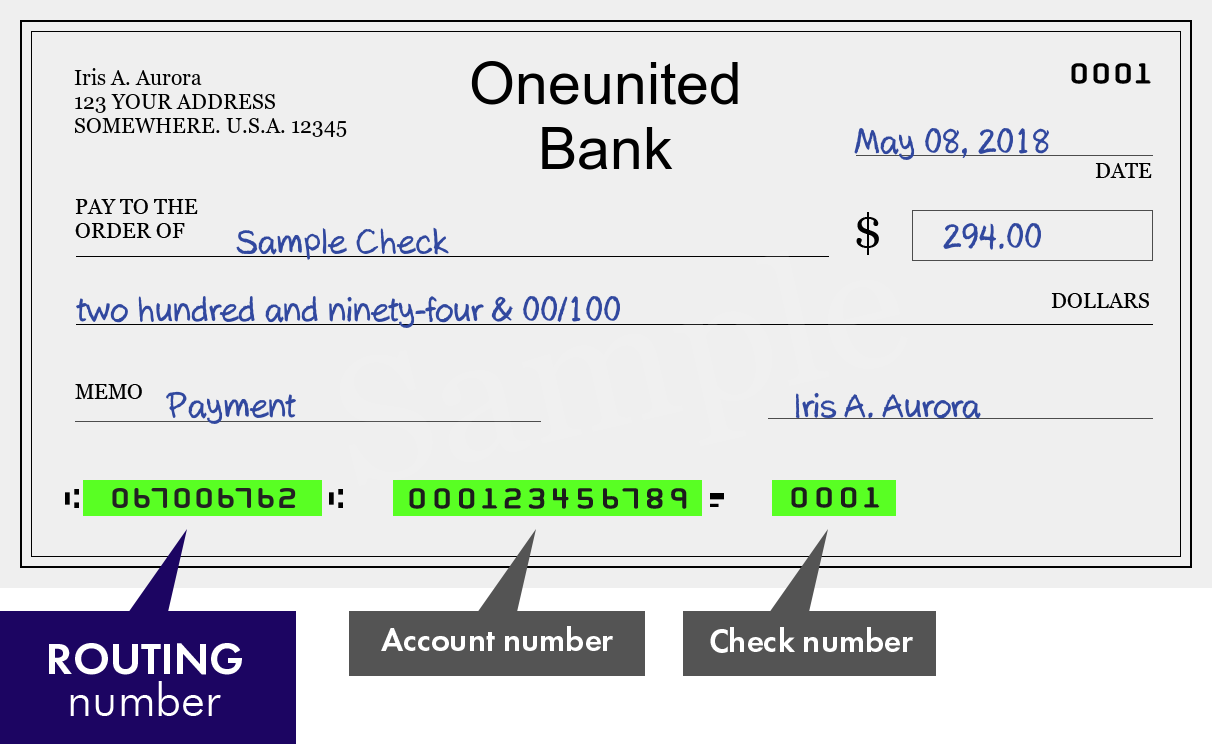

Third, verify your identity before you call. Have your account number, your last four of your SSN, and your recent transaction history ready. If the rep has to spend five minutes just proving you are who you say you are, that’s five minutes less spent solving your actual problem.

Common Misconceptions About Their Support

One big myth is that because they are a "Black-owned bank," they only serve Black customers or have specific "cultural" rules. Not true. They are a federally regulated bank open to everyone. Their customer service follows the same EQL (Equal Credit Opportunity) and privacy laws as any other institution.

Another misconception is that their customer service can "speed up" a wire transfer or a check hold. They can't. Those holds are determined by the "Reg CC" schedule (Availability of Funds and Collection of Checks). No matter how nice you are to the person on the phone, they cannot override the federal hold on a $10,000 out-of-state check. Understanding these limitations will save you a lot of breath.

Actionable Steps for Current and Future Customers

If you are currently facing an issue or thinking about opening an account, follow this checklist to ensure you aren't stuck in a customer service loop:

- Download the App Immediately: Do not rely on the mobile browser. The app has the most stable version of their secure chat.

- Set Up Alerts: Go into your settings and turn on push notifications for every single transaction. This prevents you from having to call customer service to "check" if a deposit cleared. You’ll know the second it happens.

- Keep Your Contact Info Updated: Many "service issues" are actually just the bank trying to send a verification code to an old phone number. If you change your SIM or your email, update the bank first.

- Document Everything: If you call, write down the name of the person you spoke to and the exact time. In the world of community banking, this level of detail can help a supervisor track down a recording if a promise isn't kept.

- Check the FAQ First: Honestly, 40% of the questions people call about are answered on their website under the "Support" tab. Save yourself the 20-minute hold time.

OneUnited is a mission-driven institution. Their customer service reflects that balance of trying to be a modern digital powerhouse while maintaining the soul of a community bank. It isn't always perfect. Sometimes it’s downright slow. But for those who value the "Bank Black" mission, the occasional wait is often seen as a small price to pay for keeping capital within the community. Just remember: be patient, be prepared, and use the app whenever possible.