If you’ve spent any time watching the ticker for nvda after hours stock, you know it’s a total adrenaline rush. One minute the market closes and everything looks calm, and the next, a single headline about a 3nm node transition sends the price on a wild ride while most of the world is eating dinner.

It’s tempting to think of after-hours trading as just a "preview" of the next day. But honestly? It’s a completely different beast.

Right now, as of mid-January 2026, Nvidia is sitting in a fascinating spot. The stock recently closed regular trading around $186.23, and the after-hours action has been tight, ticking up just slightly to $186.25. That might seem boring. But for a company with a market cap flirting with $4.6 trillion, even a two-cent move represents millions of dollars in shifting value.

The reality of trading after the bell is that the "rules" of the daytime market don't really apply. You’ve got lower liquidity, meaning a few big institutional trades can move the needle way more than they would at 10:00 AM.

The Myth of the "Clean" After-Hours Move

Most retail investors see a 2% jump in nvda after hours stock and assume they’ve missed the boat. Or worse, they think it’s a guaranteed signal for a massive "gap up" at the next morning's open.

That’s a trap.

Think of after-hours as a thin-ice environment. Because there are fewer buyers and sellers, the bid-ask spread—the gap between what people want to pay and what they want to sell for—gets wider. This can create "ghost moves." You might see the price flash to $190 on a small batch of 500 shares, but that doesn't mean there's enough demand to keep it there when 100 million shares start trading the next morning.

I've seen it happen plenty of times: Nvidia releases some news, the after-hours price rockets, and by the time the opening bell rings, the "smart money" has already sold into the hype, leaving latecomers holding the bag as the price retreats.

Why 2026 is Different for Nvidia Traders

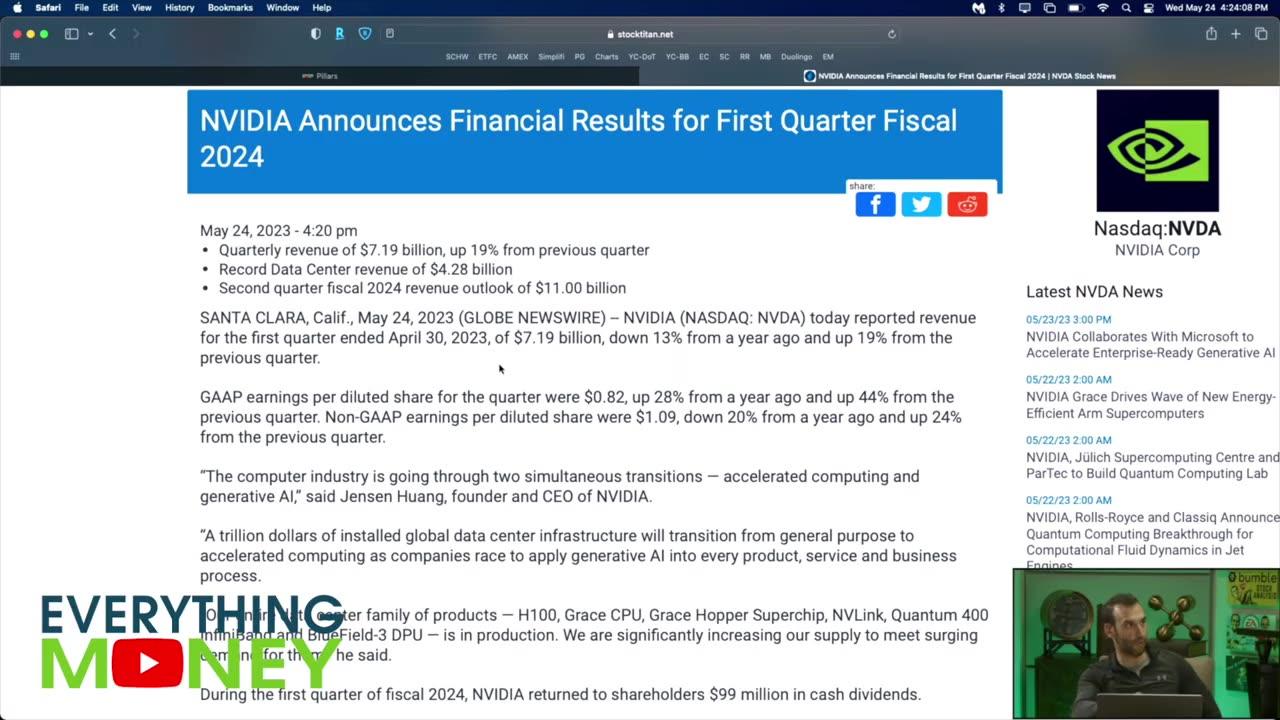

We aren't in 2023 anymore. Back then, every mention of "AI" was enough to send the stock to the moon. Now, the market is much more clinical.

👉 See also: Fox Business Charles Payne: What Most People Get Wrong About the Making Money Host

People are obsessed with the Rubin architecture and the Blackwell Ultra ramp-up. CFO Colette Kress recently noted that orders for these systems are actually blowing past the initial $500 billion guidance. That's a staggering number. When news like that drops after 4:00 PM ET, the volatility is basically a lightning strike.

Analysts like Mark Lipacis at Evercore ISI are still pounding the table with price targets as high as $352, which is nearly double where we are now. But then you have the bears—and they have a point too. Some models, like the ones from Simply Wall St, suggest that based on discounted cash flow, the "fair value" might actually be closer to $162.

When you’re looking at nvda after hours stock, you're essentially watching these two worlds—the "to the moon" bulls and the "valuation matters" bears—duke it out in a dark room with very little supervision.

What Actually Moves NVDA When the Market is Closed?

If you're watching the screen at 5:30 PM, you aren't usually seeing "regular" news. You're seeing the fallout from three specific things:

- Earnings Surprises: This is the big one. Nvidia usually reports after the bell. In late 2025, they posted record revenue of $57 billion, and the stock swung 5% in minutes.

- Supply Chain Whispers: In January 2026, everyone is watching Micron (MU) and SK Hynix. Since these companies provide the HBM (High-Bandwidth Memory) that Nvidia needs for its chips, their news often hits NVDA stock before its own PR team can even draft a tweet.

- Geopolitical Jitters: Because Nvidia is so tied to global manufacturing, a 6:00 PM report about trade restrictions or tariffs can tank the after-hours price before you’ve even finished your first cup of coffee.

How to Handle the After-Hours Volatility

Honestly, if you aren't an experienced trader, the best thing to do with nvda after hours stock is just... watch. It's a great data point, but it's a dangerous place to place "market orders."

If you absolutely must trade, use limit orders. This ensures you don't get filled at some insane price because the liquidity evaporated for three seconds.

✨ Don't miss: PA State Income Tax Calculator: Why Your Take-Home Pay Isn't What You Expected

Also, keep an eye on the volume. If you see a price jump of 3% but only 10,000 shares have traded, ignore it. That’s noise. If you see a 3% jump on 2 million shares, then you’ve got a real trend forming.

The Path to a $6 Trillion Market Cap

There’s a lot of chatter about Nvidia becoming the first company to hit a $6 trillion market cap this year. To get there, the stock needs to climb about 34% from its current levels.

For that to happen, the after-hours sessions following the upcoming February earnings report will be critical. Wall Street expects annual revenue to hit $213 billion. If they miss even slightly, or if the guidance for the Rubin chips looks "soft," the after-hours session won't just be volatile—it'll be a bloodbath.

Actionable Steps for Investors

Don't let the flashing green and red lights of extended trading distract you from the fundamentals.

✨ Don't miss: Convert MYR to USD: Why Your Bank Is Probably Ripping You Off

- Check the Volume First: Never trust an after-hours price move unless it's backed by significant trading volume (usually at least 500k+ shares for a mover like NVDA).

- Watch the "Sympathy" Plays: Sometimes nvda after hours stock moves because a competitor like AMD or a partner like Microsoft released news. Always look for the source of the move before reacting.

- Set Your Price Targets Now: Don't decide to buy or sell while the price is swinging wildly at 7:00 PM. Have your "buy" and "sell" zones written down during the day when your head is clear.

- Understand Your Broker's Rules: Most platforms like Public or Robinhood allow trading until 8:00 PM ET, but the "rules of engagement" regarding margin and order types can change once the regular session ends.

The bottom line? Nvidia isn't just a chip company anymore; it's the engine of the entire AI economy. Whether it's trading at $186 or $286, the after-hours market will always be the first place where the future is priced in—just make sure you aren't the one paying for everyone else's dinner.