Honestly, trying to figure out your tax bill in the Empire State feels a bit like trying to navigate the subway at 3:00 AM. You think you know where you’re going, but then a "service change" (or in this case, a new tax law) sends you in a completely different direction. If you're looking at new york state income tax rates 2024, you've probably noticed that while the headlines scream about "high taxes," the actual math is a lot more nuanced than a single percentage.

New York doesn't just have one tax rate. It has nine.

Most people assume they'll just lose a flat chunk of their paycheck to Albany, but that’s not how the progressive system works. You're taxed in layers. It's basically like a wedding cake where the bottom layer is cheap and the top layer—if you’re lucky enough to have a really tall cake—is where the state starts taking a much bigger bite.

Understanding the New York State Income Tax Rates 2024 Brackets

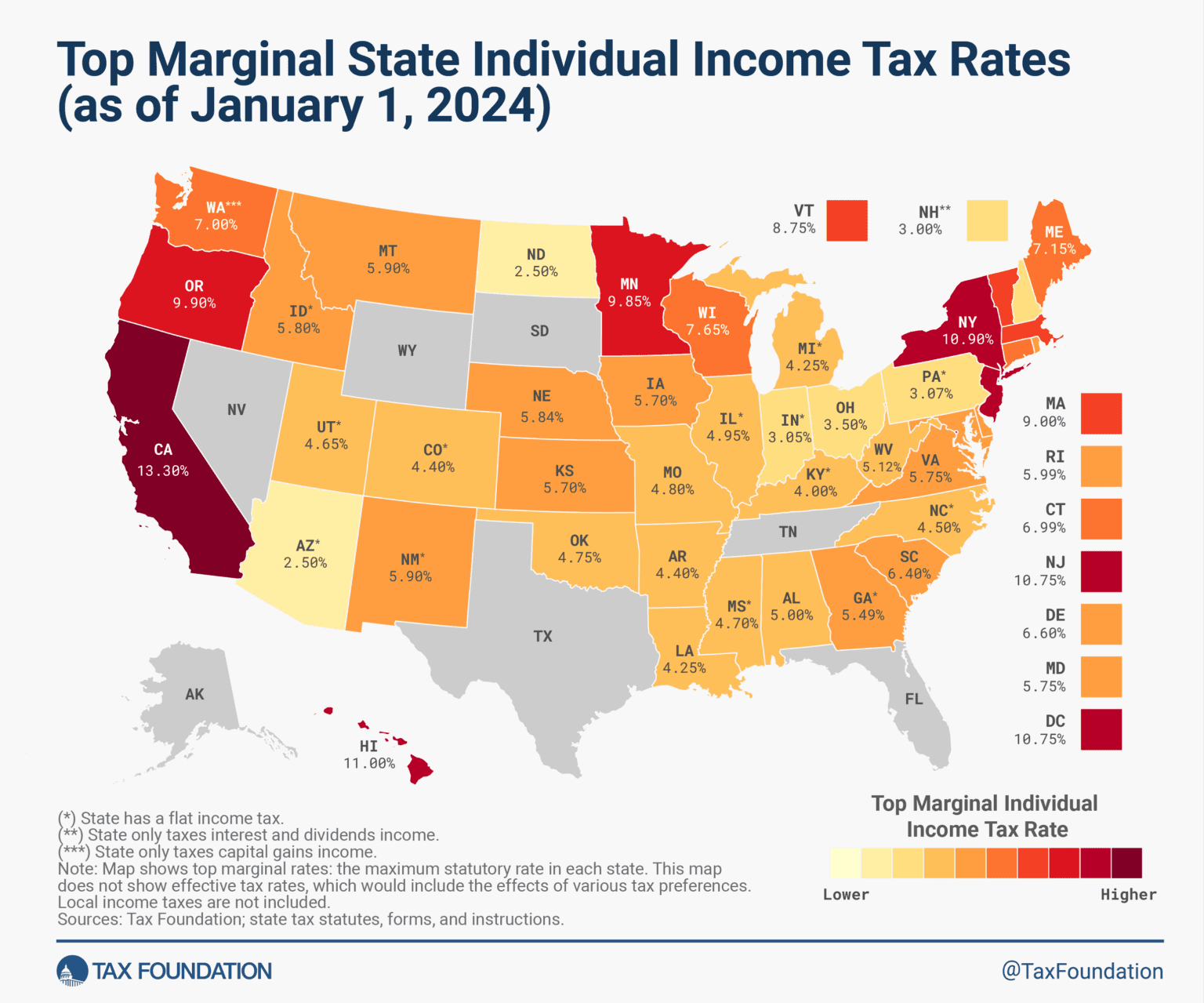

Let's get into the weeds. For the 2024 tax year (the ones you're actually filing right about now in early 2025), the rates start at a modest 4% and climb all the way up to a dizzying 10.9%. But here’s the kicker: hardly anyone pays that 10.9% on their entire income. That top rate is reserved for the ultra-wealthy, specifically those pulling in over $25 million.

For the rest of us living in reality, the brackets look a bit different.

If you are filing as a single person or married filing separately, your first $8,500 of taxable income is taxed at 4%. Once you pass that, the next chunk up to $11,700 is hit at 4.5%. This continues up the ladder. Most middle-class New Yorkers find themselves sitting in the 5.5% to 6% range.

📖 Related: Target Town Hall Live: What Really Happens Behind the Scenes

Now, if you're married filing jointly, the state gives you a bit more breathing room. Your 4% bracket extends all the way to $17,150. Basically, the state doubles the width of those lower brackets so you aren't penalized just for combining households.

The Standard Deduction: Your First Shield

Before you even look at those rates, you have to subtract your standard deduction. In 2024, if you’re single and can’t be claimed as a dependent, your New York standard deduction is $8,000. If you’re married filing jointly, it’s $16,050.

Think of this as "free" money. The state doesn't touch this amount.

It's actually quite a bit different from the federal standard deduction, which is significantly higher (around $14,600 for singles in 2024). This is a common trap. People see their federal taxable income and assume New York will use the same number. Nope. New York wants its own math.

The "New York City" Surprise

If you live in the five boroughs, I have some bad news. You aren't just paying the state. You’re paying the city too. New York City residents face an additional local income tax that ranges from roughly 3.078% to 3.876%.

👉 See also: Les Wexner Net Worth: What the Billions Really Look Like in 2026

When you combine the new york state income tax rates 2024 with the NYC local rates, your "all-in" marginal tax rate can easily jump past 9% even if you aren't a millionaire.

Yonkers residents also get hit with a local surcharge, though it’s calculated as a percentage of their state tax rather than a separate set of brackets. If you live in Buffalo or Albany? You’re in the clear—relatively speaking. You only deal with the state rates.

What Most People Get Wrong About Deductions

There's this myth that you can't itemize in New York if you didn't itemize on your federal return. That is 100% false.

New York actually "decoupled" from the federal tax changes back in 2018. This means you can take the standard deduction on your federal forms (because it's so high now) but still choose to itemize on your New York State return if your specific expenses—like large medical bills, charitable gifts, or property taxes—add up to more than the NY standard deduction of $8,000.

The SALT Cap Loophole

You’ve probably heard of the $10,000 SALT (State and Local Tax) cap. It's a thorn in the side of high-tax states. While the federal government limits how much of your state taxes you can deduct, New York doesn't impose that same limit on itself for your state return. If you paid $15,000 in property taxes, you might be able to use that full amount to lower your New York taxable income, even if the IRS says "no" to anything over ten grand.

✨ Don't miss: Left House LLC Austin: Why This Design-Forward Firm Keeps Popping Up

New Credits You Should Actually Care About

Governor Hochul didn't raise the base rates this year, but the 2024-2025 budget did shuffle some coins around in the form of credits. Credits are better than deductions. A deduction lowers the income you're taxed on, but a credit is a straight-up discount on the check you owe.

- Empire State Child Credit: There was a one-time extra payment sent out in late 2024 for parents. If you received at least $100 for this credit on your 2023 return, you likely got a "bonus" check in the mail. The best part? You don't have to report that bonus as income on your 2024 state return.

- Commercial Security Tax Credit: This is a big one for small business owners. If you spent money on security cameras or alarms to prevent retail theft, you might be eligible for a credit worth $3,000 per location.

- Earned Income Tax Credit (EITC): New York’s version of the EITC is usually 30% of the federal amount. For NYC residents, the city expanded its own EITC, meaning some low-income families are seeing their local benefit increase by 200% or more.

High Earners and the "Temporary" Hikes

If you're making over $1.07 million, you're sitting in the 9.65% bracket. This was supposed to be a temporary hike, but like many things in New York politics, "temporary" is a relative term. The state extended the itemized deduction limitation for people making over $10 million through 2029.

Basically, if you’re rich, the state is going to keep making it harder for you to write off your lifestyle against your tax bill.

Actionable Steps for Your 2024 Filing

Don't just hand your W-2 to a software program and click "submit."

- Compare the Deductions: Run the math on itemizing for New York specifically, even if you took the standard deduction for the IRS.

- Check Your Residency: If you moved out of the city to the suburbs mid-year, make sure you're only paying the NYC resident tax for the months you actually lived there. Those few months of "Part-Year Resident" status can save you thousands.

- Look at 529 Contributions: New York allows you to deduct up to $5,000 ($10,000 if married) of contributions to a 2024 New York 529 college savings plan.

- Gather Security Receipts: If you run a shop, find those invoices for the new alarm system. That $3,000 credit is sitting there waiting.

The new york state income tax rates 2024 aren't going to get lower anytime soon, so your best bet is to be aggressive with the credits and deductions the state actually allows. Pay what you owe, but not a penny more.