Health insurance is usually a headache, but when you’re talking about New Jersey state Medicaid, the stakes feel a lot higher. Honestly, most people I talk to think it’s just one simple program. It isn't. It's actually a massive umbrella called NJ FamilyCare, and it’s arguably one of the most generous—and confusing—systems in the country.

If you're living in the Garden State and trying to figure out if you can get a doctor’s visit covered without draining your savings, you’ve likely seen the charts. They're dense. They look like a tax return. But basically, New Jersey expanded its rules years ago, and in 2026, the eligibility window is wider than you might expect.

Let’s get the big thing out of the way first. You don't always have to be "broke" to qualify. That's a myth that keeps people from applying.

💡 You might also like: Protein Powder for Keto: What Most People Get Wrong About Macros and Insulin

The Income Trap in New Jersey State Medicaid

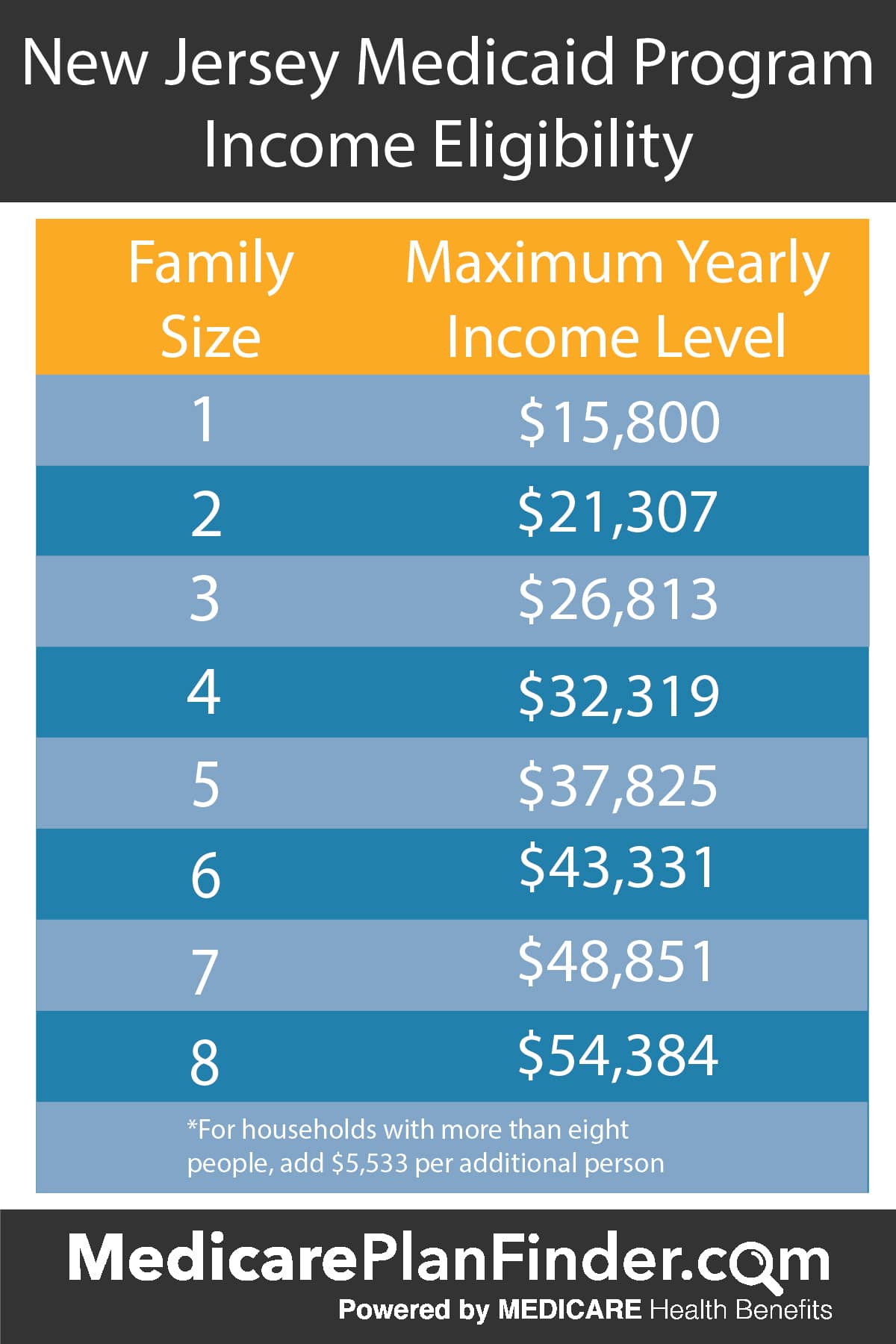

The math for New Jersey state Medicaid is based on the Federal Poverty Level (FPL). In 2026, the numbers shifted again. If you’re a single adult between 19 and 64, you’re looking at an income cap of about $1,800 a month. That's roughly 138% of the FPL. If you’re a family of four, that number jumps to about $3,698.

But here is where people trip up.

New Jersey uses something called MAGI, or Modified Adjusted Gross Income. This isn't necessarily what’s on your weekly paycheck. It’s what you report on your taxes. If you have kids, the rules change entirely. For children under 19, the income threshold in New Jersey is a massive 355% of the FPL. That means a family of four earning nearly $115,000 a year could still get their kids covered through NJ FamilyCare.

It’s one of the highest limits in the United States.

Why Your Immigration Status Might Not Matter for Kids

In a huge shift that started a couple of years back and holds firm in 2026, New Jersey covers children regardless of their immigration status. If they live in the state and the family meets the income requirements, they’re in. For adults, it's still a bit tougher—usually requiring a five-year "lawful permanent resident" status—but for the kids, the state basically decided that health is a priority over paperwork.

How the Managed Care "MCO" Choice Actually Works

Once you’re approved for New Jersey state Medicaid, you don't just get a card and go anywhere. You have to pick a "Managed Care Organization" or MCO. Think of these like your private insurance companies that the state pays to take care of you.

As of early 2026, you've got five main players in Jersey:

- Horizon NJ Health (the biggest one, usually has the most doctors)

- UnitedHealthcare Community Plan

- Wellpoint (this used to be Amerigroup)

- Fidelis Care

- Aetna Better Health

Selecting one is a big deal. If your favorite primary care doctor doesn't take Horizon, you're stuck. I always tell people to call their doctor before they pick the plan on the application. Don't trust the online directories; they’re notoriously out of date. Ask the receptionist: "Which NJ FamilyCare MCOs are you currently in-network with?"

The 2026 Insulin and Asthma Capping

Governor Murphy recently signed legislation that actually impacts how these plans work for you. Even on Medicaid, some people were facing weird copays for specialized meds. Now, New Jersey has capped insulin at $35 and certain inhalers at $50. This applies across the board, making the "out of pocket" surprise way less scary for those managing chronic issues.

Senior Care and the "Spend Down" Reality

Everything I just said? Throw it out if you’re over 65.

💡 You might also like: Did RFK Say Tylenol Causes Autism? The Facts Behind the Viral Claims

For seniors, New Jersey state Medicaid operates under different, much stricter rules. This is often called "Medicaid Only" or the MLTSS (Managed Long Term Services and Supports) program.

The asset limit is the killer.

For a single person in 2026, you generally cannot have more than $2,000 in "countable assets." That doesn't include your home (usually) or one car, but it does include that old savings account or those stocks you've held forever. The income limit for seniors needing nursing home level care is around $2,982 a month.

If you earn $2,983? You're technically over.

That’s where a "Qualified Income Trust" (QIT) comes in. It’s a legal workaround that lets you "park" the extra money so the state doesn't count it. It’s a bit of a legal dance, but it's the only way many Jersey seniors can afford a nursing home without losing every penny.

The NJ WorkAbility Secret

There is a specific version of New Jersey state Medicaid that almost nobody talks about. It’s called NJ WorkAbility.

It’s for people with disabilities who want to work but are afraid they'll lose their health insurance if they earn too much. In 2026, this program is more robust than ever. If you’re between 16 and 64 and have a permanent disability, you can earn significantly more than the standard Medicaid limits—sometimes up to $70,000 or more depending on the year's adjustments—and still keep full Medicaid.

You might have to pay a small premium, like $25 a month.

Compare that to a private plan with a $5,000 deductible. It's a no-brainer. New Jersey actually just introduced legislation (Senate Bill 2573) to increase the hours for personal care assistants in this program up to 112 hours a week. They’re trying to make it so people can actually live a life and work a job without being penalized for their health needs.

Getting the Application Right the First Time

Applying for New Jersey state Medicaid is a test of patience. You can do it online at the NJ FamilyCare website, but the system is... let's call it "vintage."

- Gather the Paperwork: You need four weeks of pay stubs, your most recent tax return, and proof of address like a PSE&G bill.

- Social Security Numbers: You need them for everyone applying.

- The Follow-up: If you apply and hear nothing for three weeks, call them. 1-800-701-0710. Honestly, applications get stuck in the digital void all the time.

- The Renewal: This isn't a "one and done" thing. You have to renew every single year. If you move and don't tell them, your renewal packet goes to the old address, you don't sign it, and your coverage gets cut off. It happens to thousands of people every year.

What about the "Easy Enrollment" program?

New Jersey now has a checkbox on the state income tax return. If you check it, the state shares your info with the Medicaid office to see if you qualify. It’s a great way to start the process without filling out the 20-page manual, though you’ll still have to provide proof of income later.

📖 Related: Cell and Gene Therapy News: What Really Happened to the One-and-Done Cure?

Actionable Next Steps for You

If you think you're eligible for New Jersey state Medicaid, don't wait for a medical emergency to find out.

- Check your 2025 Tax Return: Look at your Adjusted Gross Income. If you're a single adult under $21,600 (roughly), or a family of four under $44,000, you likely qualify for free coverage.

- Verify your kids: Even if you make $80k or $90k, your children are almost certainly eligible for some form of NJ FamilyCare.

- Call your doctors: Ask specifically for the "Medicaid Managed Care" plans they accept.

- Set an "Update Address" reminder: If you move, the very first thing you should do—after the post office—is call the NJ FamilyCare hotline to update your contact info.

The system is complicated, and the state's budget for 2026 is tight, but the benefits are there for those who can navigate the red tape. Focus on your MAGI, pick the right MCO for your specific doctor, and keep your paperwork in one folder.