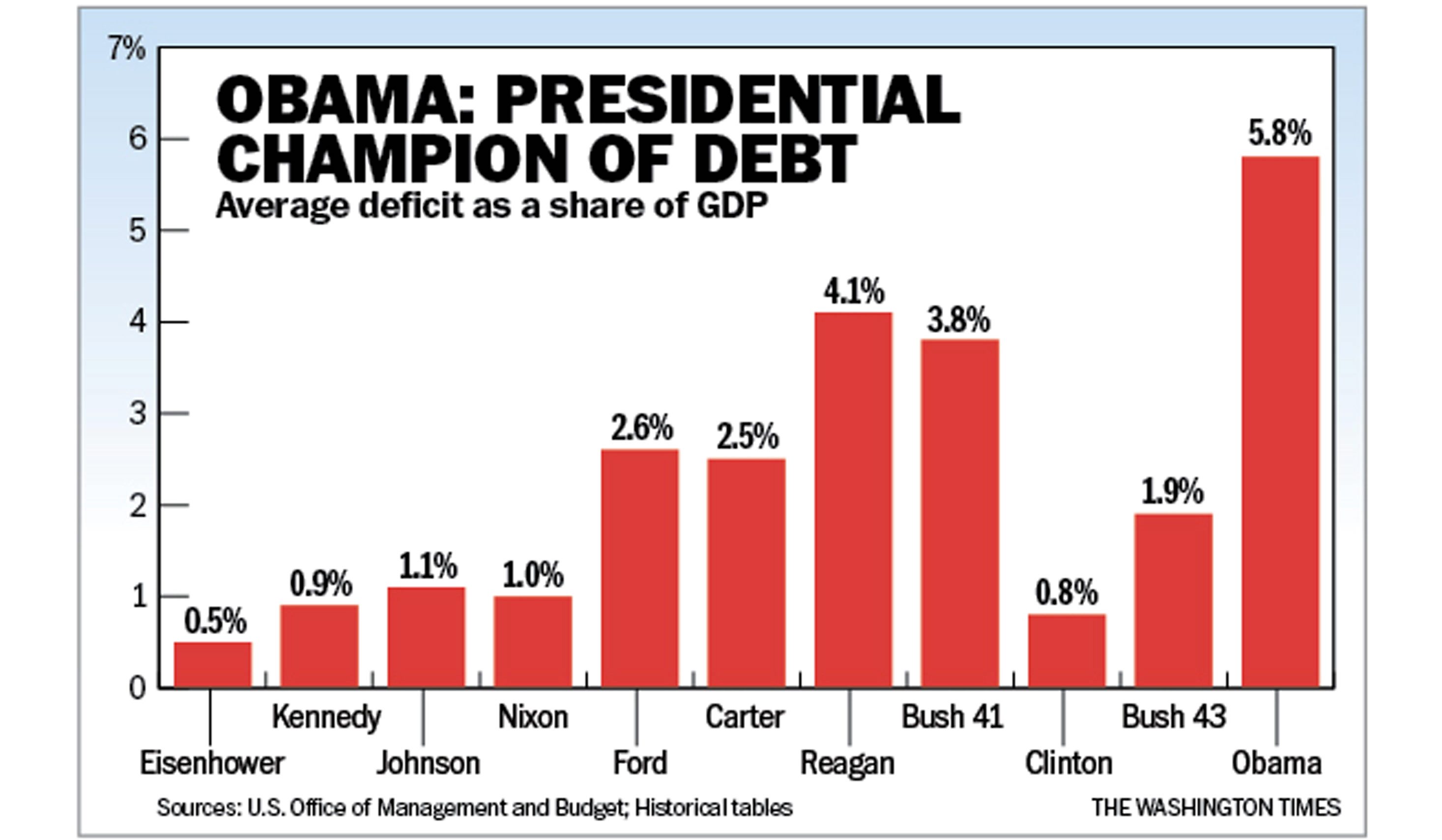

You've probably seen those angry bar graphs floating around social media. You know the ones. They usually show a national debt by presidents chart with one guy’s name looking like a mountain range and another's looking like a molehill. Depending on who shared it, the "bad guy" changes. Honestly, most of those charts are kinda misleading. They're usually missing the context that actually matters, like whether the country was in the middle of a global pandemic or if we were busy fighting a world war.

The U.S. national debt is a monster. As of early 2026, we are looking at a total north of $38 trillion. It's a number so big it basically feels fake. But when you break down which president "added" what, you have to look at two different things: the raw dollar amount and the percentage increase. If you only look at the dollars, modern presidents will always look worse because a dollar in 2026 isn't the same as a dollar in 1980.

👉 See also: Hardship Letter for Mortgage Template: What Most People Get Wrong

Why a National Debt by Presidents Chart is Never Simple

Debt isn't just about a president's "spending." It’s about what they inherited.

When a new president walks into the Oval Office on January 20th, they don't get a fresh bank account. They get the previous guy's budget. The federal fiscal year actually starts on October 1st. This means for the first several months of any presidency, the "spending" is actually tied to the law passed by the previous administration. If you look at a national debt by presidents chart, you'll notice big spikes often happen right at the start of a term.

Take Barack Obama, for example. He took office in 2009. The debt jumped significantly that year. Was that all him? Not really. The 2009 budget was largely set under George W. Bush, and the country was already sliding into the Great Recession. Bank bailouts (TARP) were already in motion.

The Big Spenders: Dollars vs. Percentages

If we talk raw cash, Joe Biden and Donald Trump are at the top of the list. By the end of his first term in early 2025, Biden had added roughly $8.4 trillion to the national debt. Trump’s first term saw an increase of about $7.8 trillion.

But wait.

If you look at the percentage increase, the "winners" change completely.

- Abraham Lincoln saw the debt increase by about 4,000% because, well, the Civil War.

- Franklin D. Roosevelt (FDR) is the modern king of percentage increases. He took the debt from about $20 billion to $260 billion. That’s a 1,000%+ jump. Why? The New Deal and World War II.

- Woodrow Wilson saw a massive spike for World War I.

Basically, big jumps in debt usually happen because of "black swan" events—wars, depressions, or pandemics.

Breaking Down the Modern Era

Let's look at the numbers people actually fight about at Thanksgiving.

Ronald Reagan is often cited as the father of modern deficit spending. He pushed "supply-side economics," which meant big tax cuts combined with a massive buildup of the military. During his two terms, the debt nearly tripled, going from roughly $900 billion to $2.6 trillion.

Then came Bill Clinton. He’s the only one in recent memory who can claim a "surplus" in the yearly budget for a few years. By the end of his term, the debt was actually lower as a percentage of the economy (GDP) than when he started.

George W. Bush saw the debt climb from about $5.7 trillion to $11.1 trillion. This was the era of the "War on Terror," the wars in Iraq and Afghanistan, and the 2001 tax cuts. Then the 2008 housing bubble burst, and the government started spending like crazy to keep the world's economy from melting.

The Pandemic Effect

When you see a national debt by presidents chart for the 2020s, the line goes vertical. This is where Trump and Biden both get hit.

In 2020 alone, the U.S. government threw trillions at the COVID-19 pandemic. We had the CARES Act and multiple rounds of stimulus.

Donald Trump's debt contribution was heavily back-loaded. In his first three years, the debt was rising steadily, but 2020 blew the doors off.

Joe Biden's contribution continued that trend. He signed the American Rescue Plan and the Inflation Reduction Act. While some of these bills were meant to reduce deficits long-term, the immediate effect was a massive increase in the total debt stock.

What Most People Get Wrong About Debt to GDP

If you really want to sound like an expert, stop looking at the total dollar amount. Look at the Debt-to-GDP ratio.

GDP is essentially the country's "income" or the value of everything we produce. If you have $100,000 in debt but you make $1,000,000 a year, you're fine. If you have $100,000 in debt and you make $20,000 a year, you're in trouble.

Right now, our debt-to-GDP ratio is sitting around 120%.

Historically, this is very high. After World War II, it hit about 106% and then fell for decades. It hit a low point in the 1970s (around 35%) before Reagan’s era started the upward climb again.

Why the Debt Keeps Growing Regardless of the President

The truth? No single president is 100% to blame. There is a "structural mismatch" in how the U.S. government functions.

- Mandatory Spending: Things like Social Security and Medicare are on "autopilot." As the population gets older, these costs go up automatically. No president can change this without an act of Congress that would be political suicide.

- Interest Payments: This is the scary part. As the debt gets bigger and interest rates rise, we have to pay more just to "rent" the money we already borrowed. In 2025, the U.S. was spending over $2.6 billion per day just on interest.

- Tax Revenue: We simply don't collect enough taxes to cover what we spend. Whether it's tax cuts or just a complex code full of loopholes, the "income" side of the ledger is always short.

What Really Happened with the National Debt by Presidents Chart

When you look at a chart today, you’ll see that the debt has increased under every single president since the 1980s. It doesn't matter if they are a Republican or a Democrat.

Republicans tend to add to the debt through tax cuts and defense spending.

Democrats tend to add to the debt through social programs and economic stimulus.

The result is the same: the line goes up.

One thing to watch is the "Intragovernmental Debt." About $7 trillion of the national debt is actually money the government owes to itself—specifically, to things like the Social Security Trust Fund. The rest is "Debt Held by the Public," which is what we owe to investors, pension funds, and foreign countries like Japan and China.

Actionable Insights: How to Read the Data

Next time you see a national debt by presidents chart, do a quick mental check:

- Check the dates: Does the debt for a new president start on the day they were inaugurated, or did the creator of the chart unfairly blame them for the previous year's budget?

- Look for "Debt-to-GDP": If the chart only shows dollars, it's designed to scare you. If it shows the ratio to the economy, it's trying to inform you.

- Factor in the "Why": Was there a war? A pandemic? A housing market collapse?

The debt isn't going away. In fact, current projections show it hitting 134% of GDP by 2035 if things don't change.

If you want to track this in real-time, the best source is the U.S. Treasury's Fiscal Data website. They update the total debt daily. You can also look at the Congressional Budget Office (CBO) reports. They are non-partisan and give the most honest (and often most depressing) look at where the numbers are headed.

To stay informed, focus on the primary deficit—the gap between what we spend and what we take in, excluding interest. If we can get that number to zero, the debt starts to become manageable. Until then, the mountain on the chart is just going to keep getting taller.