You're sitting at your kitchen table, staring at a stack of bills that suddenly feel like they're written in a foreign language. Maybe the company downsized. Maybe your back gave out and you can't pull shifts anymore. Whatever the reason, the mortgage payment is looming like a physical weight. Honestly, it’s terrifying. Most people think they need a lawyer or a professional writer to talk to their bank, but that’s just not true. What you actually need is a hardship letter for mortgage template that doesn't sound like a robot wrote it.

Banks don't want your house. Really. Foreclosure is a massive, expensive headache for them. They’d much rather keep you in the home and paying something than deal with the legal fees of kicking you out. But here’s the kicker: they can’t help you if they don't understand why you're struggling. A hardship letter is your chance to explain the "why" behind the missed payments. It’s the human element in a world of automated spreadsheets.

Why Your Bank Actually Cares About Your Story

Banks are massive bureaucracies. They operate on rules set by investors and federal agencies like Fannie Mae or Freddie Mac. These entities have specific "allowable hardships." If your situation doesn't fit into their boxes, the computer says no.

Your letter bridges that gap. It’s not just about complaining. It’s about evidence. If you say you’re sick, they want to see the medical bill. If you lost your job, they want the severance notice. It sounds cold, but it’s just how the gears turn. You’ve got to be clear, concise, and painfully honest. Don't exaggerate. If they catch you in a lie, even a small one, your chances of a loan modification or a short sale evaporate instantly.

📖 Related: What Really Happened With the Dow Jones When Trump Took Office in 2025

The Real Hardships They Accept

Not every "tough time" counts. If you’re broke because you bought a jet ski you couldn't afford, the bank isn't going to be very sympathetic. They’re looking for things beyond your control.

- Job loss or significant income reduction. This is the big one.

- Illness or injury. Something that kept you from working or created massive debt.

- Divorce or death of a spouse. When a two-income household becomes a one-income struggle.

- Job transfer. Sometimes you're forced to move and can't sell the old place fast enough.

- Natural disasters. Things like floods or fires that insurance didn't fully cover.

Making the Hardship Letter for Mortgage Template Work for You

When you use a hardship letter for mortgage template, the biggest mistake is leaving it too generic. If it sounds like a form letter, the loss mitigation officer—who is likely overworked and reading fifty of these a day—will just skim it. You need to grab their attention in the first three sentences.

Start with your loan number. Put it right at the top. It makes their life easier, and you want them on your side.

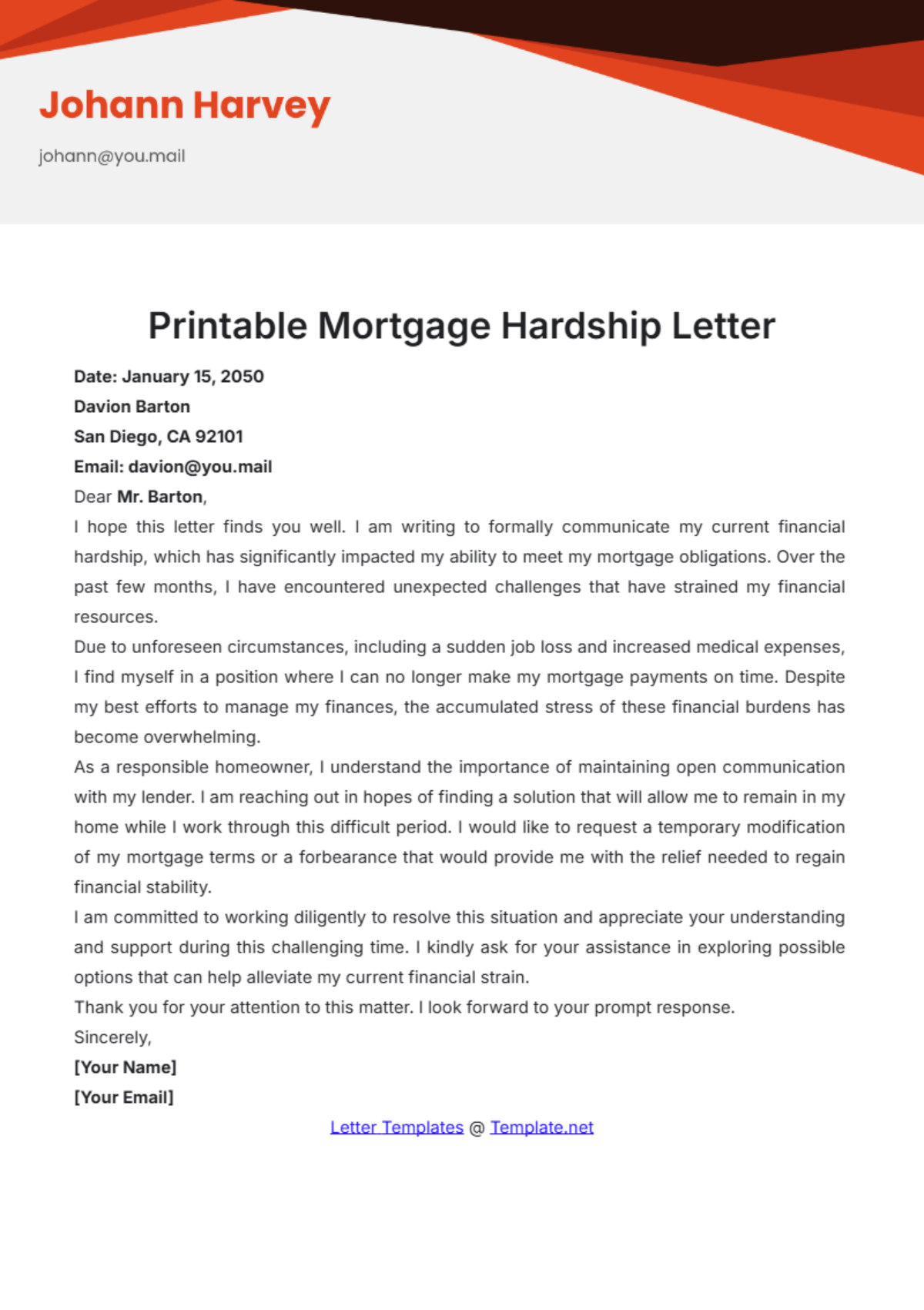

An Illustrative Example of the Right Tone

Date: January 18, 2026

Loan Number: 123456789

Property Address: 742 Evergreen Terrace, Springfield

To the Loss Mitigation Department,

I am writing this letter to explain why I have fallen behind on my mortgage payments and to request a loan modification. My family has lived in this home for eight years, and we have every intention of staying here, but a series of unexpected events has made our current payment impossible to meet.

Basically, my husband was laid off in October when the local manufacturing plant closed its doors. We tried to keep up using our savings, but then our daughter required emergency surgery in December. Between the loss of his $4,500 monthly income and the $12,000 in out-of-pocket medical expenses, we simply ran out of room.

The good news is that he started a new job last week. While it pays about 15% less than his previous role, our income is finally stable again. We just need a way to restructure the arrears or adjust the interest rate so we can get back on track. We are committed to this home.

Thank you for your time.

Sincerely,

Jane Doe

The "Do's" and "Absolutely Do Nots"

I've seen people write ten-page manifestos about their childhood traumas. Don't do that. The person reading this isn't your therapist; they are a gatekeeper for a financial institution. Keep it to one page. If it's longer than that, you're rambling.

Be specific with dates. Don't say "a while ago." Say "On November 12th."

Focus on the future. The bank wants to know that if they help you, you won't be back in this same spot in three months. Show them the "fix."

Don't blame the bank. Even if their customer service has been terrible, this letter isn't the place to vent. Stay professional. If you sound angry or entitled, they’re less likely to go the extra mile for you. It’s human nature.

✨ Don't miss: Why Share Market Down Today: What Most People Get Wrong

The Document Trail

A letter is just a piece of paper without proof. You need to back up every claim.

- Two years of tax returns.

- Two months of pay stubs (or a letter from an employer).

- Two months of bank statements.

- A "4506-C" form which lets them see your tax transcripts.

- Evidence of your hardship (doctors' notes, layoff letters).

If you’re self-employed, this gets trickier. You’ll need a Profit and Loss statement. Banks hate P&Ls because they’re easy to fudge, so make sure yours is detailed and matches your bank deposits.

Common Pitfalls That Tank Your Request

One thing people get wrong is "strategic default." They think if they just stop paying, the bank will be forced to negotiate. This is a dangerous game. Some banks won't even talk to you until you're 60 days late, but others have programs for people who are "imminently at risk" of default. If you can still pay but see the cliff coming, tell them that.

Another mistake? Ignoring the phone. If the bank calls, answer. Even if you don't have the money. Avoiding them makes you look like you've abandoned the property.

Also, watch out for "Foreclosure Rescue" scams. If someone calls you promising to fix your mortgage for a $3,000 upfront fee, hang up. They are vultures. You can do all of this yourself for free, or you can talk to a HUD-approved housing counselor. They are the real deal and won't charge you a dime for advice.

The Different Paths You Might Take

A hardship letter for mortgage template isn't just for loan modifications. Depending on your goal, the "ask" at the end of the letter changes.

💡 You might also like: CEO of Abercrombie and Fitch: Why the Brand is Actually Good Now

If you want to keep the house, you're asking for a Loan Modification or Forbearance. Modification changes the actual terms—lower interest or a longer payoff time. Forbearance just hits the pause button for a few months.

If you know you can't afford the house ever again, you're looking for a Short Sale or Deed-in-Lieu of Foreclosure. This is basically you telling the bank, "I can't do this anymore. Let's find a way for me to leave that doesn't ruin my credit as badly as a foreclosure would."

Actionable Steps to Take Right Now

Stop worrying and start acting. The longer you wait, the fewer options the bank has to help you.

- Call your servicer today. Ask for the "Loss Mitigation Department." Not regular customer service.

- Request a Loss Mitigation Package. This is the formal application. The hardship letter is just one part of it.

- Find a HUD-approved counselor. Go to the HUD website and find someone in your area. They can review your letter and tell you if it sounds realistic.

- Organize your finances. Get your bank statements and pay stubs into a single folder. Scan them. Have digital copies ready to email.

- Draft your letter. Use the structure above but use your own words. If you're a blue-collar worker, don't try to sound like a Harvard lawyer. Just be you.

The goal is to show the bank a path forward where everyone wins. You stay in your home, and they keep getting paid. It’s a business transaction, so keep it business-like, but don’t be afraid to show the real-life consequences of your situation. Clarity and honesty are your best tools here.

Once you send that letter, follow up. Don't wait for them to call you. Call them every week. Ask if they received the documents. Ask if they need anything else. Persistence is often the difference between an approved modification and a foreclosure notice. You've got to be your own best advocate because nobody else is going to do it for you.