National debt. It’s the kind of topic that makes eyes glaze over at dinner parties until someone mentions a specific politician. Then, suddenly, everyone is an economist. Honestly, the way we talk about national debt by president is usually a mess of cherry-picked numbers and missing context. You’ve probably seen the memes. One side says President X "spent like a drunken sailor," while the other claims President Y "saved the economy."

The reality? It’s way more complicated than a single person’s signature on a bill.

👉 See also: Indian Rupee to AED: Why the Exchange Rate Rarely Tells the Whole Story

Right now, as we sit in early 2026, the U.S. national debt is hovering around $38 trillion. That is a number so large it basically loses all meaning. To understand how we got here, you have to look past the raw dollar amounts. Comparing a president from the 1980s to one in the 2020s using just dollar signs is like comparing the price of a gallon of milk in 1950 to today—it’s just not helpful.

The Debt vs. Deficit Confusion

Before we look at the names, let’s clear up a massive misconception. People often use "debt" and "deficit" as if they’re the same thing. They aren't.

Basically, the deficit is the difference between what the government takes in (taxes) and what it spends in a single year. The debt is the running total of all those past deficits, minus any surpluses. Think of the deficit as the amount you overspend on your credit card this month, and the debt as the total balance on the statement.

A president might actually reduce the annual deficit but still see the total national debt go up. This happens because even a smaller deficit still adds to the pile. You’re still charging stuff to the card; you’re just charging less than you did last month.

Why Raw Dollars are Deceiving

If you look at the total amount added, recent presidents always look "worse" than older ones. Why? Inflation and the sheer size of the modern economy.

Joe Biden added about $8.5 trillion. Donald Trump, in his first term, added roughly $7.8 trillion. Barack Obama added about $7.7 trillion over eight years. On paper, it looks like a steady escalation. But if you look at percentage increases, the story shifts.

- Franklin D. Roosevelt holds the record for the largest percentage increase in history, mostly because of the Great Depression and World War II.

- Ronald Reagan oversaw a debt that nearly tripled (an 186% increase) as he combined massive tax cuts with a huge military buildup.

- George W. Bush saw the debt double (105%) due to the War on Terror and the 2008 financial crisis.

Breaking Down the Modern Eras

Let's look at the specific "whys" behind the numbers for the most recent administrations. This is where the nuance lives.

The Obama Years (2009–2017)

Barack Obama walked into the Oval Office while the global economy was literally melting down. The Great Recession forced a massive stimulus package (the ARRA) and a drop in tax revenue because people weren't working. When people don't have jobs, they don't pay income tax. It's a double whammy: spending goes up for social safety nets, and income goes down. By the end of his two terms, the debt had grown by roughly 70%.

The First Trump Term (2017–2021)

Donald Trump's debt contribution was driven by two main pillars: the 2017 Tax Cuts and Jobs Act and the COVID-19 pandemic. Before the virus hit, the deficit was already widening because those tax cuts weren't "paying for themselves" as quickly as promised. Then 2020 happened. The CARES Act was a multitrillion-dollar emergency oxygen mask for the economy. The debt jumped by about 40% in just four years.

🔗 Read more: NIOBF Stock Message Board: What You’re Probably Missing

The Biden Term (2021–2025)

Biden’s tenure was marked by the American Rescue Plan and the Infrastructure Investment and Jobs Act. While tax revenues actually hit record highs in 2022, the persistence of high interest rates started to bite. This is the "hidden" debt driver nobody talks about enough. When interest rates rise, the cost to "service" the existing debt skyrockets. By 2025, the U.S. was spending more on interest payments than on the entire defense budget.

The "Lame Duck" Effect and Timing

One thing that drives me crazy in these debates is the "first year" problem. A president takes office in January, but the fiscal year is already set.

Important Note: The federal fiscal year runs from October 1 to September 30. This means a president’s first nine months in office are mostly governed by the previous administration’s budget.

If a president inherits a recession, the debt is going to climb regardless of what they do in their first 100 days. It’s like jumping into a car that’s already going 90 mph; you can’t just slam on the brakes without hitting the windshield.

Who Really Controls the Purse?

We love to blame (or praise) the person in the high-backed chair in the Oval Office. But the Constitution is pretty clear: Congress has the "power of the purse."

A president can propose a budget, but Congress has to pass it. If you have a president who wants to cut spending but a Congress that wants to fund local projects, the debt goes up. Conversely, Bill Clinton’s famous surpluses in the late 90s happened with a Republican-led Congress. It was a mix of the dot-com boom (massive tax revenue) and a political stalemate that actually kept spending in check.

The Interest Rate Trap of 2026

Kinda scary thought: we’ve entered a cycle where the debt grows just because it exists.

In the early 2010s, interest rates were near zero. Borrowing was cheap. Now, with the Federal Reserve holding rates higher to fight the lingering ghost of inflation, the "rent" on our $38 trillion is astronomical. In fiscal year 2026, we're seeing interest payments becoming the fastest-growing part of the federal budget. We aren't even "buying" anything new with that money; we're just paying for the stuff we bought ten years ago.

Why This Matters to You

You might think, "Okay, so the government owes a lot of money. How does that affect my grocery bill?"

- Inflation Pressure: When the government prints or borrows massive amounts of money, it can devalue the currency.

- Higher Interest Rates: To attract buyers for all those Treasury bonds, the government might have to keep rates high, which means your mortgage or car loan stays expensive.

- Crowding Out: Every dollar spent on interest is a dollar NOT spent on fixing bridges, researching cancer cures, or cutting your taxes.

What Most People Get Wrong: The Summary

It's easy to look at a chart and point fingers. But if you want to be the smartest person in the room (or at least the most reasonable), keep these three things in mind:

- Events over Politics: Wars, pandemics, and global recessions add more to the debt than almost any specific policy.

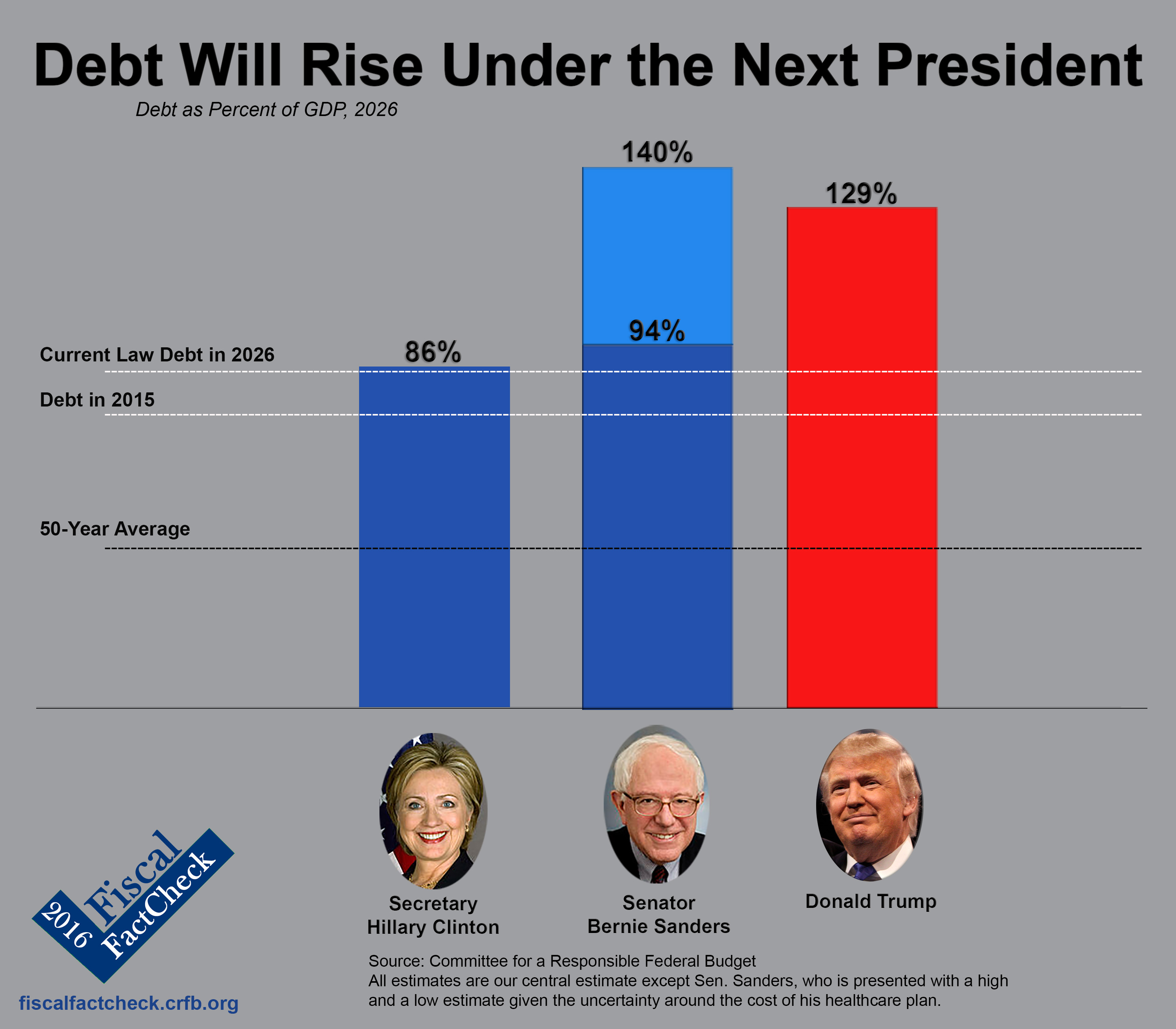

- The GDP Ratio: The total dollar amount is scary, but economists look at Debt-to-GDP. It's like your debt compared to your salary. Currently, our debt is about 120% of our annual economic output. That's the real number to watch.

- Mandatory Spending: About two-thirds of the budget is "on autopilot" (Social Security, Medicare). No president can change these without massive, politically risky legislation.

Actionable Next Steps

If you want to keep a closer eye on how your elected officials are handling the money, don't just wait for the evening news.

📖 Related: The Xanadu Project New Jersey: Why the World’s Ugliest Building Became American Dream

- Track the "Daily History of the Debt": The U.S. Treasury actually publishes the exact debt number every business day on the TreasuryDirect website.

- Check the CBO Projections: The Congressional Budget Office (CBO) is non-partisan. They release "The Budget and Economic Outlook" every year. It’s dense, but the "Summary" section will give you the real forecast without the political spin.

- Look at Debt-to-GDP, not just Dollars: Use the FRED (Federal Reserve Economic Data) tool to see the debt as a percentage of the economy. If that line is going up, the country is getting "poorer" relative to its obligations, regardless of who is in the White House.

Understanding the national debt by president requires looking at the hand they were dealt, not just the score at the end of the game. Stay skeptical of simple answers to $38 trillion questions.