Waking up to check the news on May 6, 2025, wasn't exactly a party for anyone trying to close on a house. If you've been tracking the market, you already know the vibe: it's volatile. One day we're hopeful, the next we're staring at a screen wondering why the numbers keep climbing.

Honestly, the mortgage interest rates May 6 2025 took a bit of a frustrating turn. While the early spring started with a hint of optimism, today's data shows the 30-year fixed-rate mortgage sitting at 6.75%. It's a jump that feels personal when you're calculating monthly payments on a $400,000 loan.

Why the sudden spike today?

Basically, it's a classic case of the Federal Reserve playing it safe. The Fed is meeting right now—May 6 and 7—and the market is acting like a nervous passenger. Because the latest jobs report came in stronger than anyone expected, investors are betting that the Fed won't be cutting the federal funds rate anytime soon.

Strength in the job market is usually good news, but for mortgage rates, it's a bit of a curse. It signals to the Fed that the economy isn't "cooling" enough to justify lower rates.

Breaking down the numbers for May 6, 2025

If you're out there house hunting right now, here is what the landscape looks like across the board. These aren't just abstract percentages; they change the math on your life.

- 30-Year Fixed: 6.75% (Up from last week’s 6.70%)

- 15-Year Fixed: 5.99%

- 30-Year Refinance: 6.81%

- 5/1 ARM: 7.34%

Wait, why is the ARM higher than the fixed rate? It feels backward, right? Usually, you take the risk of an adjustable rate to get a lower entry point. But right now, the yield curve is still doing weird things. Lenders are pricing in a lot of uncertainty about where the economy will be in five years, making ARMs a tough sell for most people.

📖 Related: GeoVax Labs Inc Stock: What Most People Get Wrong

Tariffs and the inflation ghost

There is something else brewing in the background that most people aren't talking about enough: tariffs. Recent upward shifts in tariffs have created a fresh wave of uncertainty.

When it costs more to bring goods into the country, prices go up. When prices go up, that’s inflation. And as we've all learned the hard way over the last few years, the Fed hates inflation more than almost anything else.

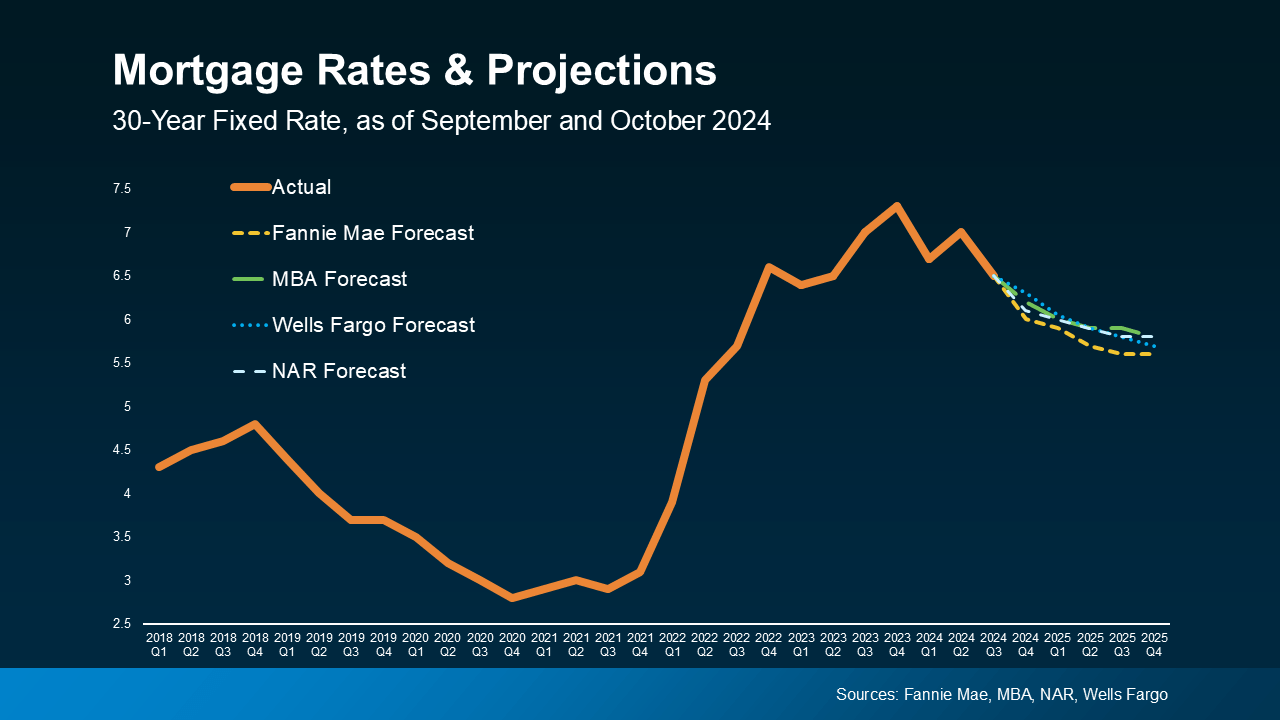

Fannie Mae and the Mortgage Bankers Association (MBA) have been revising their forecasts constantly. Earlier this spring, there was hope we’d be seeing rates in the low 6s by now. Instead, we’re back to the "wait-and-see" game.

What does this mean for your wallet?

Let’s look at a real-world example. Say you’re looking at a $400,000 mortgage.

At a 6.75% rate, your monthly principal and interest payment is roughly $2,594.

By the time you pay that house off in 30 years, you’ll have handed over $533,981 in interest alone.

👉 See also: General Electric Stock Price Forecast: Why the New GE is a Different Beast

That is more than the original price of the home. It's a staggering figure that makes "marrying the house and dating the rate" sound a lot more like a long-term commitment than a casual fling.

Is there any relief coming?

If you look at the projections from the ESR Group at Fannie Mae, they still think rates will end 2025 at about 6.2%. They’re betting that the economy will eventually soften enough to force the Fed’s hand.

But "eventually" is a hard word to bank on when your lease is up in July.

Some buyers are moving anyway. There’s a logic to it: if rates do eventually drop, everyone who was sitting on the sidelines is going to rush back in. That creates bidding wars. Prices go up. You might save $200 a month on interest but end up paying $50,000 more for the actual house because you were fighting ten other offers.

Real-world strategies for right now

So, what do you actually do with this information today?

✨ Don't miss: Fast Food Restaurants Logo: Why You Crave Burgers Based on a Color

First, shop around. It sounds like a cliché, but the "spread" between lenders is wider than usual. One bank might be quoting 6.9% while a local credit union is holding at 6.4% because they have different goals for their portfolio.

Second, look at "buydowns." Many sellers are aware that the mortgage interest rates May 6 2025 are a hurdle. Instead of asking for a price cut, ask the seller for a credit to buy down your rate. A 2-1 buydown can give you a significantly lower rate for the first two years, giving you a breather while you wait for a better time to refinance.

The "Wait and See" trap

Honestly, nobody has a crystal ball. If the Fed meeting tomorrow ends with a "hawkish" tone—meaning they sound worried about inflation—rates could easily tick closer to 7%. If they sound "dovish" or worried about growth slowing too much, we might see a quick retreat toward 6.5%.

For now, the market is in a holding pattern. It’s a K-shaped recovery out there; higher-income households are still buying, while everyone else is focusing on the essentials and trying to make the math work.

Your Next Steps

- Get a "soft" quote today: Call your lender and see where they are actually locking. National averages are great, but your credit score and location change the reality.

- Run the "What If" scenarios: Calculate your budget at 7%. If you can’t afford the house at 7%, you’re cutting it too close at 6.75%.

- Check for seller concessions: Before you offer full price, see if there's room to get that rate buydown. It’s often more valuable than a small price reduction.

- Monitor the Fed statement: Tomorrow afternoon (May 7), the Fed will release their statement. Watch for phrases like "sustained progress on inflation." That’s the code for "rates might finally go down."