Honestly, if you haven't looked at a paycheck lately, the math behind minimum wage jobs might actually shock you. We are sitting here in January 2026, and the federal floor is still stuck at $7.25 an hour. It has been there since 2009. That is nearly 17 years without a single penny of an increase from Congress. It's wild.

But here is the catch: almost nobody actually makes $7.25 anymore.

While that federal number sits there like a fossil, the rest of the country has basically moved on. We’re currently looking at a massive, messy patchwork of state laws, city ordinances, and "inflation-indexing" that makes answering the question "what are minimum wage jobs?" way more complicated than it used to be.

The Reality of Minimum Wage Jobs in 2026

When we talk about these roles, we're usually talking about "entry-level" work, but that’s a bit of a misnomer. These are the jobs that keep the lights on in America. They are the backbone of the service economy.

Technically, a minimum wage job is any position where the employer pays the absolute legal limit required by their specific jurisdiction. Depending on where you stand, that could mean $7.25 in Mississippi or a whopping $17.13 in Washington State. Some cities, like Tukwila, Washington, have even pushed past the $20 mark this year.

Who is actually working these roles?

There's this old stereotype that it’s just teenagers flipping burgers for gas money. That’s just not true anymore. According to Bureau of Labor Statistics data from 2024 and 2025, while young workers (ages 16-24) are the most likely to be at the bottom of the pay scale, a huge chunk of this workforce consists of adults over 25. Many are women, and many are the primary breadwinners for their families.

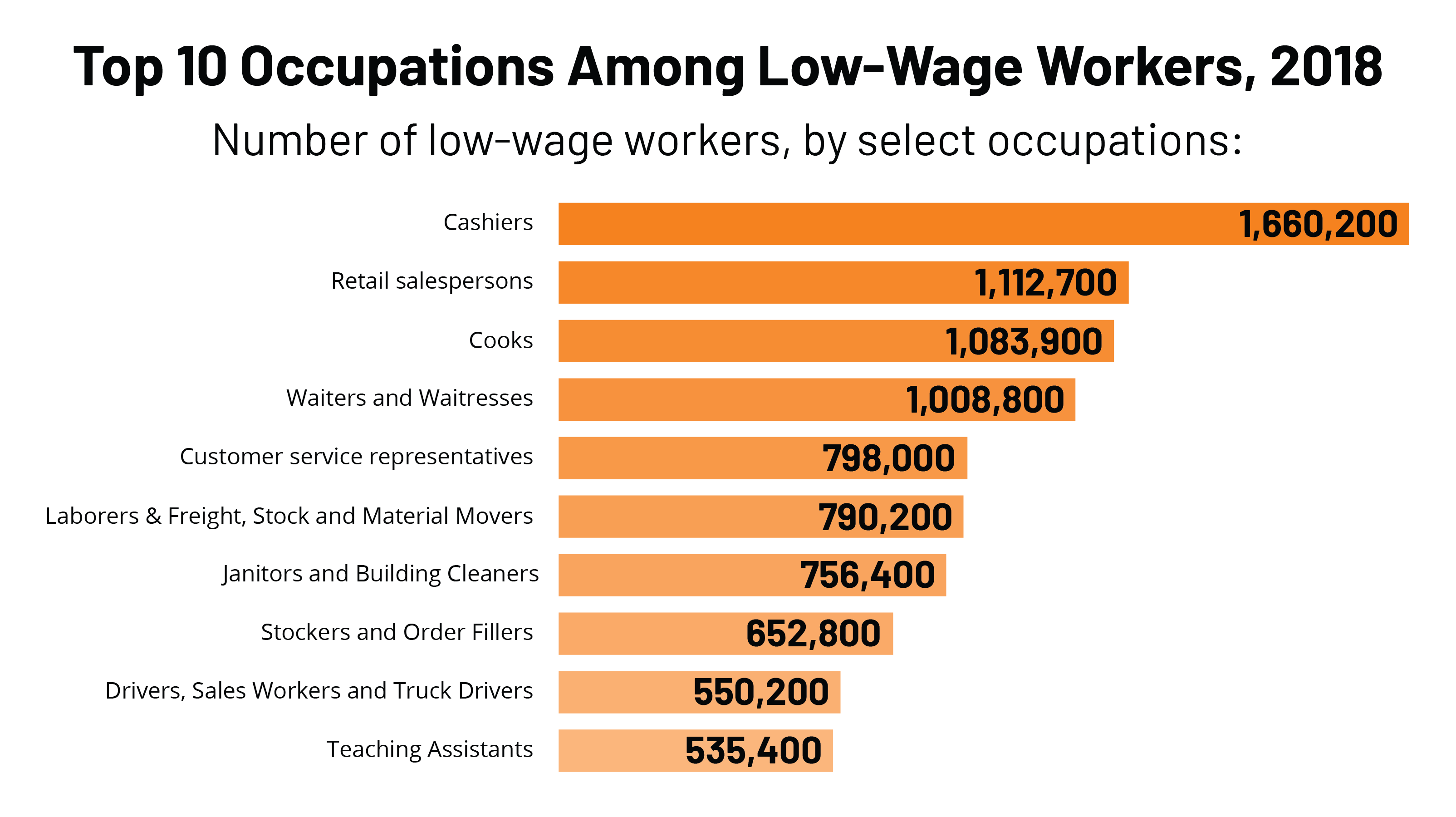

The biggest sectors? You probably already know them:

- Food Service: Waiters, fast-food crew, and dishwashers.

- Retail: Cashiers and stockers at your local big-box stores.

- Healthcare Support: Home health aides and personal care assistants.

- Hospitality: Hotel housekeepers and front desk clerks.

The Massive Gap: Federal vs. State

This is where things get kinda confusing. In 2026, where you live determines your quality of life more than almost any other factor.

💡 You might also like: Converting 4000 Rupees in USD: What You Actually Get After Fees and Inflation

The $7.25 States

There are still about 20 states—mostly in the South and Midwest like Alabama, Louisiana, and Mississippi—that haven't touched their minimum wage laws. If you're working one of these jobs there, you're likely relying on the federal Fair Labor Standards Act (FLSA). The reality is that even in these states, the "market rate" has often pushed wages to $10 or $12 because businesses simply can't find people to work for seven bucks and change.

The "Fight for $15" (and Beyond)

On the flip side, we have states like New York and California. As of January 1, 2026, if you're in New York City, Long Island, or Westchester, the minimum is $17.00. California sits at $16.90. These states have "indexed" their wages, meaning they automatically go up every year to keep pace with inflation. It’s a completely different economic universe.

What Most People Get Wrong About Tipped Work

There’s a specific category of minimum wage jobs that confuses everyone: the tipped employee.

Under federal law, the "tipped minimum wage" is still only $2.13. The idea is that tips will make up the difference to reach $7.25. If they don't, the employer is supposed to pay the difference, but "wage theft" in this area is a massive issue that labor experts like those at the Economic Policy Institute (EPI) talk about constantly.

However, some places are killing this system. Flagstaff, Arizona, for instance, just officially phased out the "tip credit" this month. Now, waiters there get the full $18.35 state minimum plus their tips. That is a life-changing shift for service workers.

✨ Don't miss: Indian Telephone Industries Limited Share Price: What Most People Get Wrong

The Business Perspective: Why Some Pay More Voluntarily

You might wonder why companies like Bank of America or Costco pay $20+ an hour when they don't have to. It isn't always out of the goodness of their hearts.

High turnover is expensive.

If a retail store loses a worker every three months, they spend thousands on recruiting and training. By paying a "living wage" (which is usually much higher than the legal minimum), companies often find that employees stay longer and work harder. It’s a business strategy as much as a social one.

Actionable Steps for Navigating Minimum Wage Jobs

If you are looking for work or currently in a low-wage role, here is how to handle the 2026 landscape:

✨ Don't miss: 100 USD to NGN: Why the Black Market and Official Rates Are So Wildly Different Right Now

- Check your local city laws. Don't just look at the state level. Cities like Seattle, Chicago, and Los Angeles often have much higher requirements than the states they are in.

- Know the "Tip Credit" rules. If you work for tips and your paycheck plus tips doesn't equal your state's minimum wage, your boss legally owes you the difference. Period.

- Look for "Indexed" states. if you have the flexibility to move or commute, targeting jobs in states where the wage rises automatically with inflation (like Washington, Maine, or Colorado) protects your purchasing power over time.

- Audit your "compensable time." New 2026 labor updates emphasize that things like "pre-shift roll calls" or travel time between medical appointments (for home health aides) must be paid. Don't work for free.

The bottom line is that the term "minimum wage" is a moving target. In some parts of the US, it’s a poverty trap; in others, it’s a starting point that finally reflects the actual cost of milk and rent. Staying informed about your specific zip code’s laws is the only way to ensure you're getting what you're legally owed.