Living in the Land of Lincoln is great for the deep-dish pizza and the lakefront views, but the math gets a little fuzzy when you look at your paycheck or a store receipt. Most people just want to know how much of their money is staying in their pocket. Honestly, Illinois has a reputation for being a high-tax state, and while that's true for things like property, the way the state handles your paycheck is actually a bit simpler than you’d expect.

Illinois tax: The flat rate reality

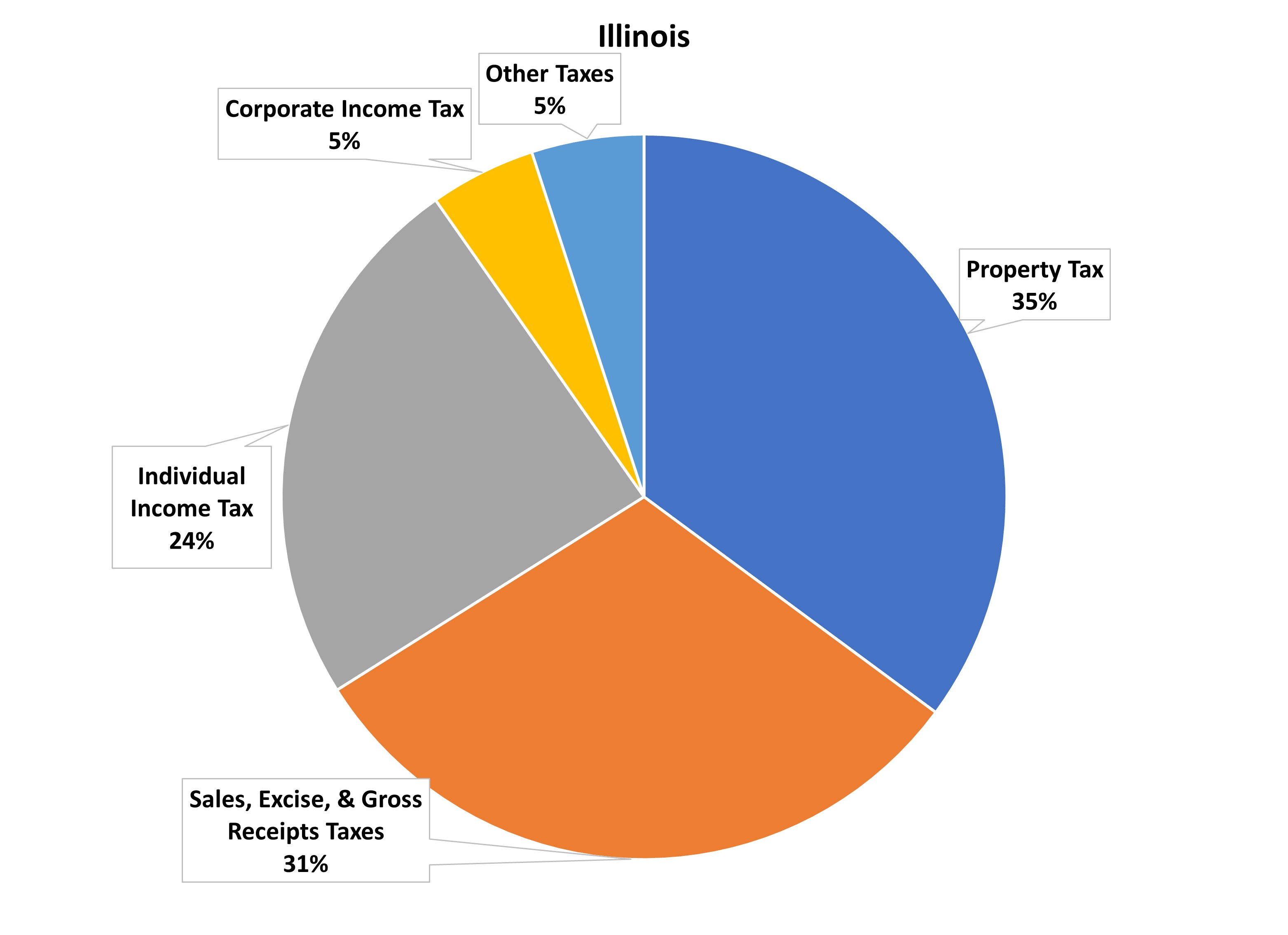

Unlike the federal government, which uses a "progressive" system where you pay more as you earn more, Illinois keeps it level. For 2026, the Illinois tax for individuals sits at a flat 4.95%.

It doesn't matter if you’re making $40,000 a year or $400,000; the state takes the same percentage from the first dollar to the last. Some people love this because it’s predictable. Others hate it because they feel it puts a heavier burden on middle-class families. Back in 2020, there was a big push to change this to a graduated system—where the rich pay more—but voters shot it down. So, for the foreseeable future, 4.95% is the magic number.

You’ve also got to account for the personal exemption. For the 2026 tax year, the standard exemption is $2,925. Think of this as a small "freebie" slice of your income that the state doesn't touch. If you’re filing your returns, you just subtract that amount (plus any for your spouse or kids) from your total income before you apply that 4.95% rate.

📖 Related: Bank of America Corporate Headquarters Charlotte North Carolina: What Most People Get Wrong

Why your receipt looks so expensive

If the income tax is a flat five-ish percent, why does everything feel so pricey? The answer is the sales tax. This is where things get messy because the state, the county, and the city all want a piece.

The base state rate is 6.25%. That's the floor. But you will almost never pay just 6.25%.

Local governments pile on their own "home rule" taxes. If you’re shopping in downtown Chicago, you’re looking at a combined rate of 10.25%. In 2026, several jurisdictions actually hiked their local rates. Places like Benton and Calumet City saw jumps of 1%, pushing their totals well into double digits.

Here is the kicker: Illinois is one of the few states that still taxes groceries. While there have been temporary "holidays" on this in the past, you generally pay a 1% rate on "qualifying food and drugs." It’s lower than the rate for a new TV, but it adds up over a year of grocery runs.

The property tax elephant in the room

You can't talk about Illinois tax without mentioning property taxes. This is the big one. Illinois consistently ranks in the top two or three states for the highest property taxes in the country.

The state doesn't actually set these rates. Your local school board, library district, and park district do. Because Illinois has more individual units of government than any other state (nearly 7,000!), there are a lot of hands in the cookie jar.

On average, you’re looking at an effective rate of about 2.23% of your home's value every year. On a $300,000 house, that’s over $6,600. In high-tax pockets of Lake County or Cook County, it can be significantly higher. The one "bright side" is that you can claim a 5% credit on your state income tax for the property taxes you paid on your principal residence. It’s not much, but it’s something.

Driving through Illinois will cost you

If you own a car, the state gets you at the pump. As of January 2026, the motor fuel tax is roughly $0.483 per gallon for gasoline. But wait—that’s just the "Part A" tax. There is also a "Part B" tax and federal taxes.

When you add it all up, including the sales tax that Illinois (annoyingly) applies on top of the fuel price, you are often paying over $0.70 per gallon in total taxes. This is why gas is almost always cheaper the moment you cross the border into Missouri or Indiana.

Business and Corporate Taxes

For the entrepreneurs out there, the corporate world is a bit steeper. The base corporate income tax is 7%. However, corporations also have to pay a "Personal Property Replacement Tax" of 2.5%.

That brings the total corporate rate to 9.5%.

If you run an S-Corp or a Partnership, you don't pay that 7% income tax at the corporate level. Instead, the income "passes through" to your personal return, where you pay the standard 4.95%. But, you still have to pay a 1.5% replacement tax at the business level. It’s a bit of a double-dip that catches many new business owners off guard.

The 2026 Estate Tax Trap

Illinois is also one of the few states that still has an estate tax—often called the "death tax." Most states followed the federal lead and raised their exemptions, but Illinois has kept its threshold stuck at $4 million for years.

If you pass away in 2026 and your estate is worth $4,000,001, you don't just pay tax on that one extra dollar. The way the math works is complex, but it can trigger a tax bill on a significant portion of the estate. For families with a farm or a small business, this $4 million limit is remarkably easy to hit given today's real estate prices.

What you should do right now

Navigating Illinois tax isn't just about paying the bill; it's about not overpaying. Here are the moves that actually move the needle:

- Check your exemptions: If you had a kid or got married, make sure your IL-W-4 is updated. That $2,925 per person adds up.

- Max out the 529 plan: Illinois gives you a huge tax deduction for contributing to a "Bright Start" or "Bright Directions" college savings plan. You can deduct up to $10,000 ($20,000 if married filing jointly) from your taxable income.

- Keep your property tax receipts: Don't forget that 5% credit on your state return. If you pay $8,000 in property taxes, that’s a $400 straight discount on your state income tax bill.

- Look at the Pass-Through Entity (PTE) tax: If you’re a business owner, ask your CPA about the PTE tax election. It’s a workaround that allows you to deduct state taxes on your federal return, bypassing the $10,000 SALT cap.

Tax season in Illinois is never exactly "fun," but staying ahead of the rates—especially the local sales tax hikes that kicked in this January—is the only way to keep your budget from leaking.