So, you're looking into Medicare. Honestly, it's one of those things everyone thinks they understand until they actually have to sign up. Then, suddenly, you're staring at a mountain of Parts, Plans, and "Initial Enrollment Periods" that feel like they were written in another language.

Basically, the requirement for medicare isn't just a single rule. It’s a mix of your age, your work history, and sometimes, unfortunately, your health status. Most people think "65" is the magic number and leave it at that. While 65 is the big milestone, it’s not the only way in. You've also got to consider citizenship status and how many "quarters" you’ve paid into the system.

✨ Don't miss: Antibiotics for ear piercing infection: What actually works and when to worry

It gets complicated fast. Let's break down what actually qualifies you in 2026.

The Basic Requirement for Medicare: Age and Residency

The most common way to get in is turning 65. Simple, right? Kinda.

To be eligible, you must be a U.S. citizen or a lawfully admitted non-citizen who has lived in the United States continuously for at least five years. That five-year rule is a big one that people often miss. If you just moved here and you're 66, you might have to wait.

Your "Initial Enrollment Period" (IEP) is a seven-month window. It starts three months before the month you turn 65, includes your birthday month, and ends three months after. If you miss this, you might get hit with late enrollment penalties that stick with you for life. Nobody wants that.

What about work history?

You don't technically need to have worked to get Medicare, but it determines if you pay for it.

- Premium-Free Part A: If you or your spouse worked and paid Medicare taxes for at least 10 years (40 quarters), you usually don't pay a monthly premium for Part A (hospital insurance).

- Buying Part A: If you don't have those 40 quarters, you can still get it, but you'll pay a premium. In 2026, if you worked between 30 and 39 quarters, that premium is $311 a month. If you worked less than 30 quarters, it jumps to $565.

Qualifying Under Age 65: The Disability Route

Medicare isn't just for seniors. If you have a disability, you can qualify much earlier. But there is a catch: the 24-month waiting period.

Most people under 65 must receive Social Security Disability Insurance (SSDI) or certain Railroad Retirement Board disability benefits for 24 months before their Medicare coverage kicks in. You're basically in a holding pattern for two years. However, there are two major exceptions where you get a "fast pass" to coverage:

- ALS (Lou Gehrig’s Disease): If you have ALS, your Medicare begins the same month your disability benefits start. No waiting.

- ESRD (End-Stage Renal Disease): If you have permanent kidney failure and need dialysis or a transplant, you can qualify at any age. Generally, coverage starts on the first day of the fourth month of dialysis.

Medicare Parts: What You Actually Need to Enroll In

The requirement for medicare usually refers to "Original Medicare," which is Part A and Part B.

Part A is your hospital insurance. Think of it as coverage for when you’re "room and board" in a hospital or skilled nursing facility.

Part B is your medical insurance. This covers doctor visits, outpatient care, and things like wheelchairs or walkers. Unlike Part A, everyone pays a premium for Part B. In 2026, the standard premium is $202.90. If your income is higher—specifically over $109,000 for individuals—you’ll pay more due to something called IRMAA (Income-Related Monthly Adjustment Amount).

💡 You might also like: Is Ketamine Legal for Recreational Use? What Most People Get Wrong

Then there’s Part D for drugs. If you want drug coverage, you have to choose a private plan. Interestingly, starting in 2026, there is a new $2,100 out-of-pocket cap for prescription drugs under Part D. That’s a huge win for anyone on expensive medications.

Common Misconceptions That Trip People Up

A lot of folks think Medicare is totally free. It’s not. Between premiums, the Part B deductible ($283 in 2026), and the Part A deductible ($1,736 per benefit period), the costs add up.

Another big mistake? Thinking you’re automatically enrolled.

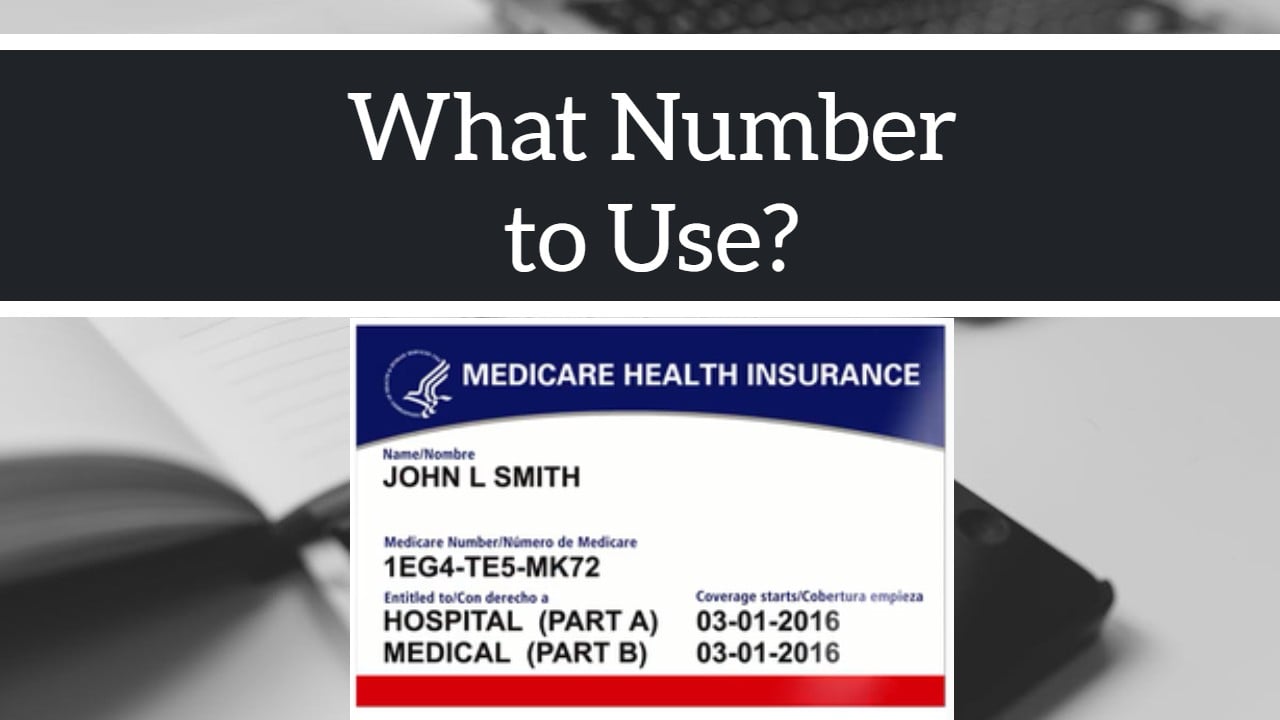

If you are already receiving Social Security benefits, you’ll usually be enrolled automatically in Parts A and B when you turn 65. Your card just shows up in the mail. But if you aren't taking Social Security yet—maybe you're still working—you must sign up yourself. If you assume the government will just do it for you, you’ll likely end up with a gap in coverage and a penalty.

Working past 65

If you’re still working and have insurance through an employer with 20 or more employees, you might be able to delay Part B without penalty. But check with your HR department first. Some smaller companies require you to take Medicare as your primary insurance the second you're eligible. If you don't, they might refuse to pay your claims, leaving you on the hook for thousands.

Actionable Steps to Take Right Now

If you're approaching 65 or helping a family member, don't wait until the birthday cake is on the table.

- Check your Social Security statement: Make sure your work credits are accurate so you know if you'll get premium-free Part A.

- Mark your calendar: Your window starts three months before your 65th birthday. Set a reminder.

- Review your income from two years ago: Since 2026 premiums are based on 2024 tax returns, look at your MAGI (Modified Adjusted Gross Income) to see if you’ll owe an IRMAA surcharge.

- Evaluate your current health: If you have chronic conditions, look into "Special Supplemental Benefits for the Chronically Ill" (SSBCI) which are getting more focused in 2026 to cover things like meal delivery or rides to the doctor.

- Compare Part D plans: With the new $2,100 cap, the math on which drug plan is "best" has changed. Use the Medicare.gov plan finder tool to see how your specific meds fit into the 2026 landscape.

Managing the requirement for medicare is mostly about timing and paperwork. Get those two right, and the rest is just choosing the plan that fits your life.