You’ve probably heard the name Joe Lewis and immediately thought of Tottenham Hotspur or maybe that massive yacht that looks more like a floating office building than a vacation boat. Honestly, the story of this Joe Lewis British businessman isn’t just about money; it’s about a guy who started in a pub and ended up moving world markets from a deck chair in the Bahamas.

It’s kinda wild when you think about it. Most billionaires have these polished, PR-managed origins. Lewis? He was born above a pub called the Roman Arms in London’s East End. No silver spoon. Just a kid who left school at 15 because his dad’s catering business, Tavistock Banqueting, needed the help. He wasn't just a helper, though. He was a natural schmoozer who figured out pretty quickly that if you sell luxury goods and "themed" British experiences to American tourists, you can make a killing.

From Pie-and-Mash to Black Wednesday

By the time the late 70s rolled around, Lewis had turned that family catering gig into a massive success. He sold it in 1979 and became a tax exile in the Bahamas. That’s where things got interesting. Instead of just retiring, he dove headfirst into currency trading.

People call him "The Boxer" because he shares a name with the legendary Joe Louis, but in the finance world, he earned that nickname by taking heavy swings. You might remember the 1992 "Black Wednesday" crash. While George Soros is the guy everyone talks about for "breaking the Bank of England," Joe Lewis was right there in the trenches with him. Some insiders even whisper that Lewis walked away with more profit than Soros did that day.

He didn’t stop at currencies. His Tavistock Group eventually grew into a beast with stakes in over 200 companies across 15 countries. We're talking everything from life sciences and energy to some of the most expensive real estate on the planet.

💡 You might also like: AOL CEO Tim Armstrong: What Most People Get Wrong About the Comeback King

The Tottenham Era and the Move to the Shadows

For a long time, if you were a football fan, Joe Lewis was the man behind the curtain at Tottenham Hotspur. He bought a majority stake in the club back in 2001 through ENIC Group. But if you expected him to be at every game shouting from the directors' box, you’d be wrong.

He rarely showed up. He left the day-to-day headaches to Daniel Levy. In October 2022, things changed. Lewis officially ceased "significant control" of the club, handing the reins over to the Lewis Family Trust. It was a move that felt like a preparation for something, and as we saw later, it probably was. By the way, in late 2025, Daniel Levy finally stepped down after nearly 25 years, marking the end of an era for the club's leadership.

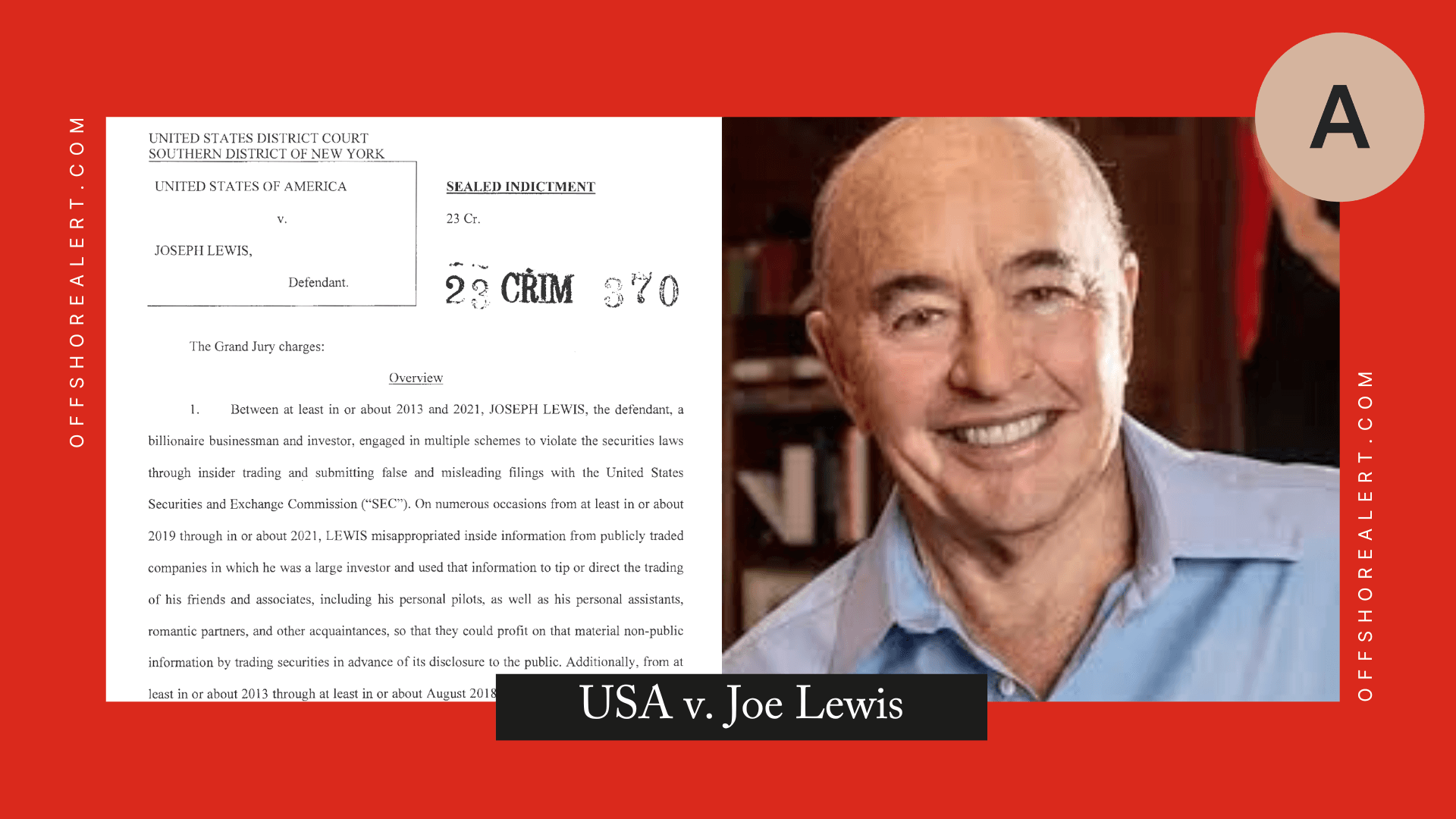

What really happened with the insider trading case?

This is the part that shocked a lot of people. In 2023, the U.S. government came after him. They accused him of running a "brazen" insider trading scheme. It wasn't that he needed the money—the guy is worth billions. It was more like he was treating corporate secrets like party favors.

According to the prosecutors, he was tipping off his private pilots, his personal assistants, and even a former girlfriend. He’d give them the "inside scoop" on biotech companies he invested in, like Mirati Therapeutics, and sometimes even lent them the cash to make the trades.

📖 Related: Wall Street Lays an Egg: The Truth About the Most Famous Headline in History

He pleaded guilty in early 2024. Most 87-year-olds would be looking at a terrifying prison sentence, but because of his age and failing health, a federal judge in Manhattan gave him three years of probation and a $5 million fine.

A Surprising Turn: In November 2025, in a move that caught the financial world off guard, Donald Trump granted Joe Lewis a full pardon. This allowed the aging billionaire to travel back to the U.S. for medical treatment and to see his grandkids without the weight of a felony conviction hanging over him.

Lake Nona and the $1 Billion Art Collection

If you want to see the "physical" legacy of Joe Lewis, you have to look at Orlando, Florida. He’s the visionary behind Lake Nona, a 17-square-mile "Medical City" that’s basically a futuristic tech hub. It’s got the USTA National Campus (the home of American tennis) and massive cancer research centers. It’s not just a housing development; it’s a whole ecosystem.

And then there's the art. Lewis owns one of the most prestigious private collections in the world. We’re talking Francis Bacon, Lucian Freud, and Picasso. Much of this is kept on his yacht, Aviva. It sounds like a movie villain trope, but he literally has a full-sized indoor padel tennis court on that boat. He uses the yacht as his office, sailing around while managing a global empire.

👉 See also: 121 GBP to USD: Why Your Bank Is Probably Ripping You Off

The Reality of His Net Worth in 2026

Estimating his wealth is always a bit of a guessing game because so much of it is private. Most reliable trackers put him somewhere between $5 billion and $6 billion. But you have to remember, his family trust owns the big assets now.

He’s always been a "handshake" guy. He values loyalty above almost everything else, which is ironically what got him into trouble with the insider trading. He wanted to "look after" his people, and in the eyes of the SEC, that's a crime.

Why his story matters now

Joe Lewis represents a specific breed of "old school" billionaire that is slowly disappearing. He didn't build a social media app or a car company. He played the markets, bought land, and stayed out of the spotlight for decades.

Whether you view him as a brilliant visionary who built Lake Nona or a billionaire who thought he was above the law, you can't deny his impact. He’s a guy who came from the East End and ended up owning a piece of the world.

Actionable Insights for Investors and Business Enthusiasts

If you’re looking to learn from the Joe Lewis playbook (without the legal drama), here are a few things to keep in mind:

- Diversification is King: Lewis never stuck to one industry. He moved from catering to currencies, then to sports, then to biotech and real estate. If one sector took a hit (like his $1 billion loss on Bear Stearns in 2008), the others kept him afloat.

- The Power of Long-Term Land Holds: Lake Nona wasn't built overnight. He started buying that land in the 90s. Patience in real estate development is what turns a "project" into a "legacy."

- Operate from the Shadows: You don't need a massive Twitter following to be influential. Lewis proved that you can control significant portions of the global economy while remaining relatively anonymous.

- Trust But Verify: The insider trading scandal is a massive lesson in corporate governance. Even if you're the boss, the rules of the SEC apply. If you're in a position of power, your "generosity" with information can be your downfall.

The era of Joe Lewis as the public face of his empire is essentially over. Between the 2025 pardon and his health concerns, he's retreated back to the Bahamas. But the buildings in Orlando, the stadium in North London, and the companies in the Tavistock portfolio will be around a lot longer than he will.