Let’s be real: nobody actually likes buying car insurance. It’s a chore. You spend half an hour on a clunky website from 1998, talk to a guy named "Bob" who tries to upsell you on something called a "vanishing deductible," and then you pay a fortune every month for a piece of paper you hope you never use.

Then there’s Lemonade.

If you’ve seen their ads, you know the vibe. Pink branding, sleek app, and big promises about AI-driven claims that pay out in seconds. It sounds too good to be true, honestly. Most people wonder, how good is lemonade car insurance once you actually get into a fender bender? Is it a revolutionary tech company or just a fancy wrapper on a standard insurance policy?

I’ve spent a lot of time digging into their 2026 data, scouring Reddit threads where people actually vent, and looking at their "Giveback" numbers. Here is the unfiltered truth about whether you should trust them with your car.

The Pay-Per-Mile Catch

Lemonade isn't like State Farm or Geico. They don't just look at your age and zip code and hand you a flat bill. Since they bought Metromile a while back, their whole system is basically built on how much you actually drive.

They use a "pay-per-mile" model. You pay a low monthly base rate—sometimes as low as $25 or $30—and then a few cents for every mile you drive.

For a lot of people, this is a godsend. If you work from home or live in a city like Chicago or Seattle where you mostly take the train, your bill might be half of what the "big guys" charge. One user on Yelp mentioned their Geico renewal was $700 for six months, but with Lemonade, they were looking at a $573 initial price.

But there’s a flip side.

🔗 Read more: Federal Pell Grant Eligibility Calculator: How Much Money Can You Actually Get?

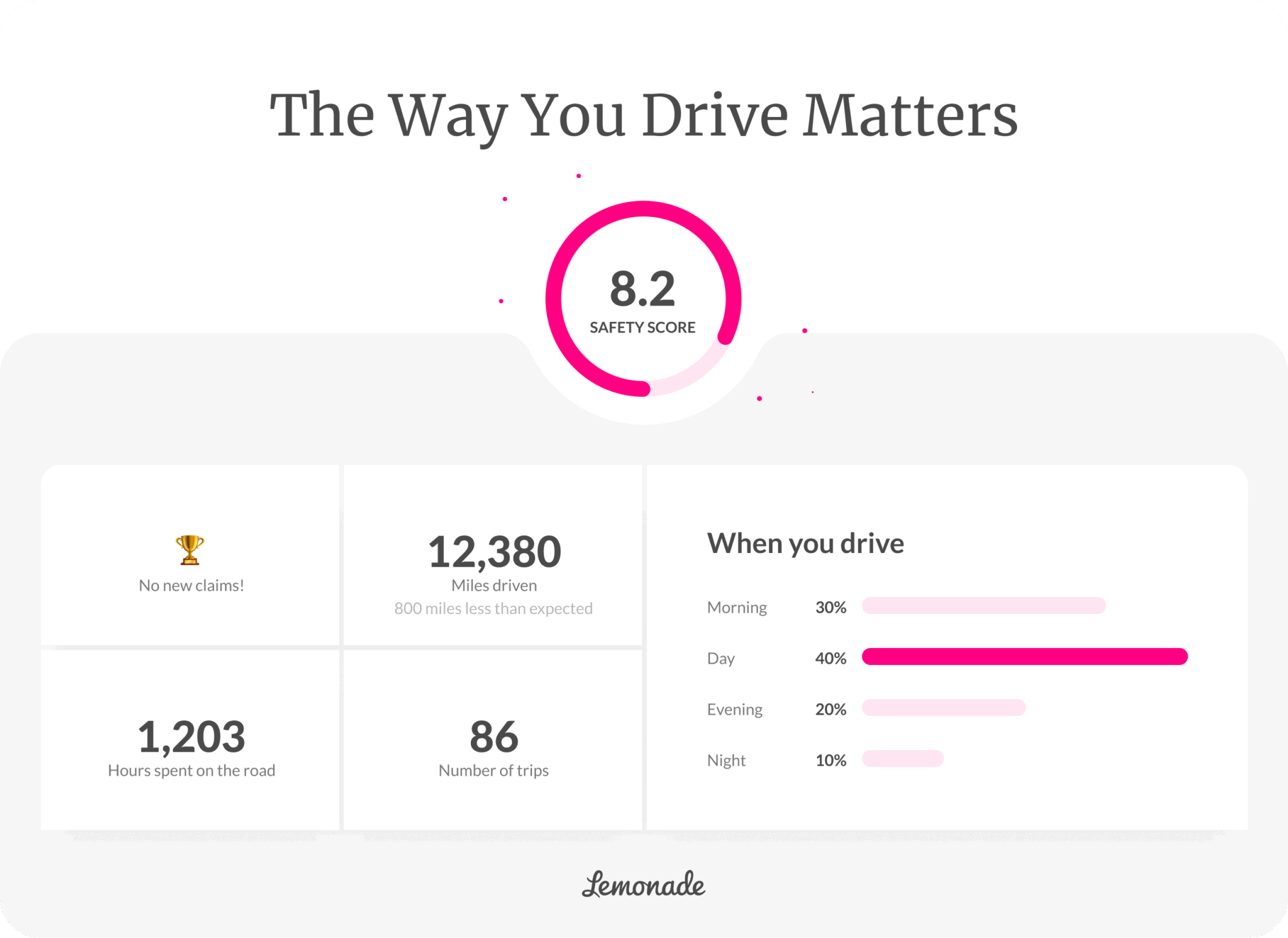

If you decide to take a spontaneous cross-country road trip, or if your commute suddenly gets longer, your bill is going to spike. It’s transparent—you see every trip in the app—but it’s not for the person who spends three hours a day on the freeway. Honestly, if you’re a high-mileage driver, Lemonade is probably going to be more expensive than a traditional policy.

Where Can You Actually Get It? (The Short List)

This is the biggest frustration for people. You see the cool ads, you download the app, and then—boom—it’s not available in your state.

As of early 2026, Lemonade Car is still only in a handful of states. We're talking:

- Arizona

- California

- Colorado

- Illinois

- Indiana

- Ohio

- Oregon

- Tennessee

- Texas

- Washington

If you live in New York or Florida, you’re basically out of luck for now. They are expanding, but they’re doing it slowly. They have an A rating from Demotech, which is a fancy way of saying they have enough cash to pay your claims, but their limited footprint makes them feel a bit like an "exclusive club" that hasn't quite reached the masses yet.

The Claims Experience: AI Maya vs. Reality

Lemonade claims that about 40% of their claims are handled "instantly" by AI. You record a video explaining what happened, hit submit, and the money is wired to you.

When it works, it feels like magic. There are stories on Reddit of people getting paid for glass repairs or minor accidents within minutes. One guy even joked it was easier than ordering a pizza.

But here’s what most people get wrong: The AI can't handle everything.

If you’re in a serious accident involving three cars and a dispute over who had the green light, the AI isn't going to help you. It gets handed off to a human team. This is where the reviews get messy. While their digital experience scores are sky-high (around 4.8/5 on the App Store), their complaint index with the NAIC is actually higher than average.

Basically, if your claim is simple, Lemonade is the best in the business. If your claim is a legal nightmare, you might find yourself wishing you had a local agent you could call on their personal cell.

What's Actually Covered?

They cover the standard stuff you’d expect—Liability, Collision, Comprehensive, and PIP. But because they are "new school," they have some cool perks that traditional companies ignore.

🔗 Read more: Rite Aid Oil City PA: What Is Actually Happening with the Seneca Street Location

- EV Perks: If you drive a Tesla or a Rivian, they offer discounts and even cover your home wall charger up to $3,000.

- Pet Injury: If your dog is in the car during a crash, they’ll cover up to $1,000 in vet bills. Most companies make you buy a separate rider for that.

- Temporary Transportation: Instead of just giving you a crappy rental car, they’ll reimburse you for Ubers or even public transit while your car is in the shop.

The "Giveback" Program

This is the "feel good" part of the business. Lemonade takes a flat fee from your premium, and if there’s money left over at the end of the year (meaning people didn’t file too many claims), they donate it to a charity you choose.

In 2025 alone, they donated over $2 million to 45 different nonprofits. It’s a cool way to make insurance feel less like a "scam" and more like a community pot. Does it make the insurance "better"? Not technically. But if you're stuck between two companies with the same price, most people are going to pick the one that plants trees or feeds hungry kids.

Is It Right For You?

So, how good is lemonade car insurance? It really depends on your lifestyle.

It’s amazing if:

💡 You might also like: Current Tariff Rate on China: Why the Numbers Keep Shifting

- You drive less than 9,000 miles a year.

- You live in one of the 10 states they actually cover.

- You hate talking to humans on the phone.

- You have an electric vehicle.

It’s kinda bad if:

- You’re a "road warrior" who lives in your car.

- You have a spotty driving record (they are picky about who they insure).

- You want a local agent you can visit in person.

- You have an older car that doesn't play nice with their tracking device.

Actionable Next Steps

If you're thinking about switching, don't just cancel your current policy. Here is how you should handle it:

- Check the App: Download the Lemonade app and get a "soft" quote. It won't hurt your credit score, and it takes about 90 seconds.

- Look at Your Mileage: Check your car’s odometer from a year ago. If you drove 12,000+ miles, the pay-per-mile math might not work in your favor.

- Bundle Up: If you already have Lemonade for renters or pet insurance, the multi-policy discount is actually pretty significant—sometimes up to 10% or more.

- Review Your State Laws: Ensure your state doesn't have specific "telematics" laws that make tracking your driving habits a privacy concern for you personally, as Lemonade requires location services to be on 24/7.