Let’s be real. Nobody actually enjoys filling out the FAFSA. It’s tedious. It’s invasive. But for millions of students, that slog is the only thing standing between them and a Federal Pell Grant. If you’re trying to find a federal pell grant eligibility calculator, you’re basically trying to see if the government thinks you’re "needy" enough to deserve a slice of the multi-billion dollar financial aid pie.

Free money. That’s what we’re talking about here. Unlike a loan, you don’t pay this back unless you pull out of school or change your enrollment status mid-semester.

But here’s the kicker: the math behind these calculators changed massively in 2024 and 2025. If you’re looking at old advice from three years ago, you’re basically reading a history book. The "Expected Family Contribution" (EFC) is dead. It’s been replaced by the Student Aid Index (SAI). This isn’t just a name change; it’s a total overhaul of how the Department of Education decides who gets paid.

What a Federal Pell Grant Eligibility Calculator is Really Doing

When you plug your numbers into a calculator, it’s simulating a specific formula set by Congress. It takes your family’s adjusted gross income, adds back in certain untaxed items, subtracts specific allowances, and spits out your SAI.

The range for the SAI is wild. It can go as low as -1,500.

Wait, negative? Yeah. If your SAI is between -1,500 and 0, you’re almost certainly getting the maximum Pell Grant. For the 2024-2025 award year, that max sits at $7,395. It might slightly tick up for 2025-2026 depending on the final federal budget, but that’s your baseline.

A good federal pell grant eligibility calculator doesn't just ask "how much do you make?" It asks about your family size, how many people are in college (though this matters less than it used to, unfortunately), and your assets. If your family makes less than $60,000 and meets certain other criteria, you might skip the asset reporting entirely.

The "Small Business" Trap

Honestly, one of the biggest changes that catches people off guard involves small businesses. Used to be, if you owned a family business with fewer than 100 employees, that asset didn't count against you.

Now? It does. Every penny of net worth in that business is fair game for the formula. This has blindsided a lot of middle-class families who own a shop or a small farm. Their "wealth" on paper went up, even if their bank account stayed the same.

Why Your Income Isn't the Only Factor

You might think making $80,000 a year disqualifies you. Not necessarily.

The formula is nuanced. It looks at whether you are a dependent or independent student. If you’re over 24, married, a veteran, or have children of your own, you’re independent. Your parents' income is irrelevant. This is a massive swing for adult learners heading back to school.

Federal Pell Grant eligibility is also tied to your enrollment status. You don’t get the full $7,395 if you’re only taking two classes.

- Full-time: 100% of the award.

- Three-quarter time: 75% of the award.

- Half-time: 50% of the award.

- Less than half-time: Roughly 25%.

The Department of Education uses something called "Enrollment Intensity" now. It’s more granular. If you take 7 credits instead of 6, your grant might actually shift slightly to reflect that specific load. It's fairer, but it makes the manual calculation a nightmare. That’s why using a federal pell grant eligibility calculator is basically mandatory for planning.

How to Use the Official Tools Effectively

Don't just trust any random website that looks like it was designed in 2005. The gold standard is the Federal Student Aid Estimator. It’s the closest thing to the real deal because it’s built by the same people who process your FAFSA.

Before you sit down to use it, grab your 2023 tax returns (if you're applying for the 2025-26 year). The FAFSA uses "prior-prior" year tax data. It feels weird using two-year-old info, but that’s the system.

Common Mistakes That Mess Up Your Estimate

People mess up the "Assets" section constantly.

Do not include the value of the home you live in. I see people do this all the time, and it nukes their eligibility. The formula only cares about investment properties, second homes, or liquid cash/stocks. Also, do not include your 401k or IRA. Retirement accounts are off-limits for the Pell formula.

If you accidentally report your parents' $400,000 401k as an "investment asset," the federal pell grant eligibility calculator will tell you that you get $0. In reality, you might have been eligible for the max.

The Weird Quirks of the 2024 FAFSA Simplification Act

The transition to the "Simplified" FAFSA was, frankly, a disaster in terms of rollout. But the underlying rules did some good things. For example, the "Sibling Discount" is gone.

In the old days, if you had a brother in college at the same time, your EFC was basically cut in half. Now, the SAI doesn't care if you have ten siblings in med school. This has hurt some families but helped others by raising the income protection allowance.

Basically, the government is trying to target the lowest-income students more aggressively.

If your family’s Adjusted Gross Income (AGI) is below 175% of the federal poverty level (or 225% for single parents), you automatically get the maximum Pell. You don't even have to look at the rest of the formula.

What if the calculator says I get nothing?

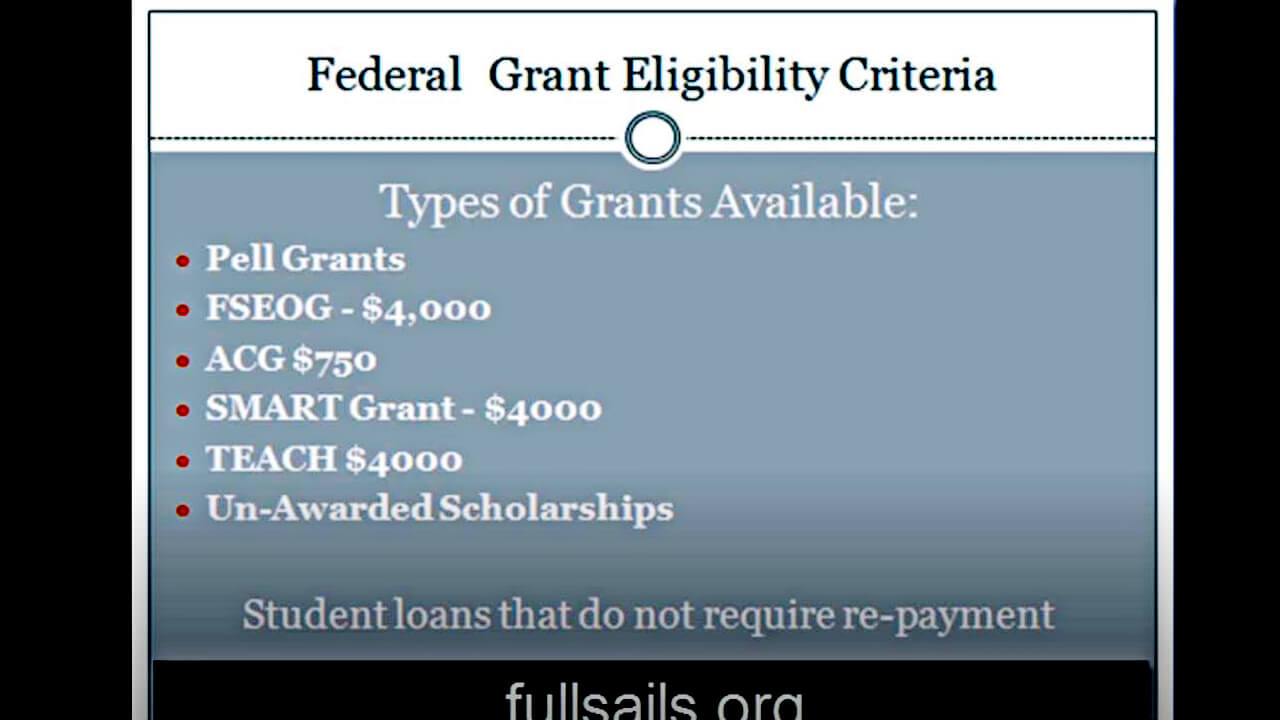

Don't panic. The Pell Grant is just the floor.

Even if a federal pell grant eligibility calculator shows a big fat zero, you still want to file the FAFSA. Many state-level grants and school-specific scholarships use the FAFSA data to give out their own money. Some "institutional" aid is actually more generous than the Pell Grant, but you can't get it without that SAI number.

Real World Example: The Independent Student

Let's look at a 26-year-old working as a server, making $32,000 a year.

Since they are over 24, they are independent. They have no significant assets. A federal pell grant eligibility calculator will likely show an SAI of 0 or even -1,500. This student is getting the full $7,395.

Now, imagine that same student is 22. Their parents make $150,000. Even if the parents aren't paying a dime for college, the government considers their income. The SAI will be high—maybe 15,000 or 20,000. Pell eligibility? Zero.

It feels unfair, but that’s the logic. The government assumes parents will help until you hit 24, unless you’re married or in the military.

Actionable Steps for Maximizing Your Aid

- Check your dependency status first. If you can wait until you're 24 to start your degree, you might save $30,000 in tuition via Pell Grants alone. It's a legitimate strategy.

- Move assets if necessary. If you have money in a standard savings account in the student's name, it's taxed heavily by the formula (about 20%). If that same money is in the parent's name, it's taxed at a much lower rate (around 5.6%).

- Appeal if things changed. The calculator uses old tax data. If your parent lost their job yesterday, the federal pell grant eligibility calculator results are wrong. File the FAFSA anyway, then call the financial aid office at your school and ask for a "Professional Judgment" review. They have the power to manually override the system and give you the grant if your current reality is worse than your tax returns suggest.

- Watch the deadlines. Pell is an entitlement, meaning if you qualify, you get it. But many other grants that use the same calculator results are "first come, first served."

The reality is that the Federal Pell Grant is a lifeline. It’s the difference between taking out a predatory private loan and graduating with a manageable balance. Use the tools available, but understand the "why" behind the numbers so you aren't leaving money on the table.

✨ Don't miss: Dow Jones Industrial Average: Why the World’s Most Famous Index is Kinda Weird

To get started, gather your most recent tax transcripts and use the official Federal Student Aid Estimator tool. Check your eligibility for both the current and upcoming academic year, as thresholds change annually based on inflation adjustments. Once you have your estimated SAI, contact your school's financial aid office to see how that number translates into their specific "Cost of Attendance" (COA) package. Knowing your Pell eligibility is just the first step in building a full financial aid strategy that includes state grants, work-study, and subsidized loans.