You're standing at a Juan Santamaría Airport ATM, sweating a little because the humidity just hit you like a wet blanket, and the screen asks if you want to withdraw 50,000 colones. You freeze. Is that a fortune? Is it enough for a taxi and a beer? Knowing the value of 1 usd in costa rica colon isn't just about math; it’s about not getting ripped off the second you step onto the curb.

Most people think exchange rates are static. They aren't.

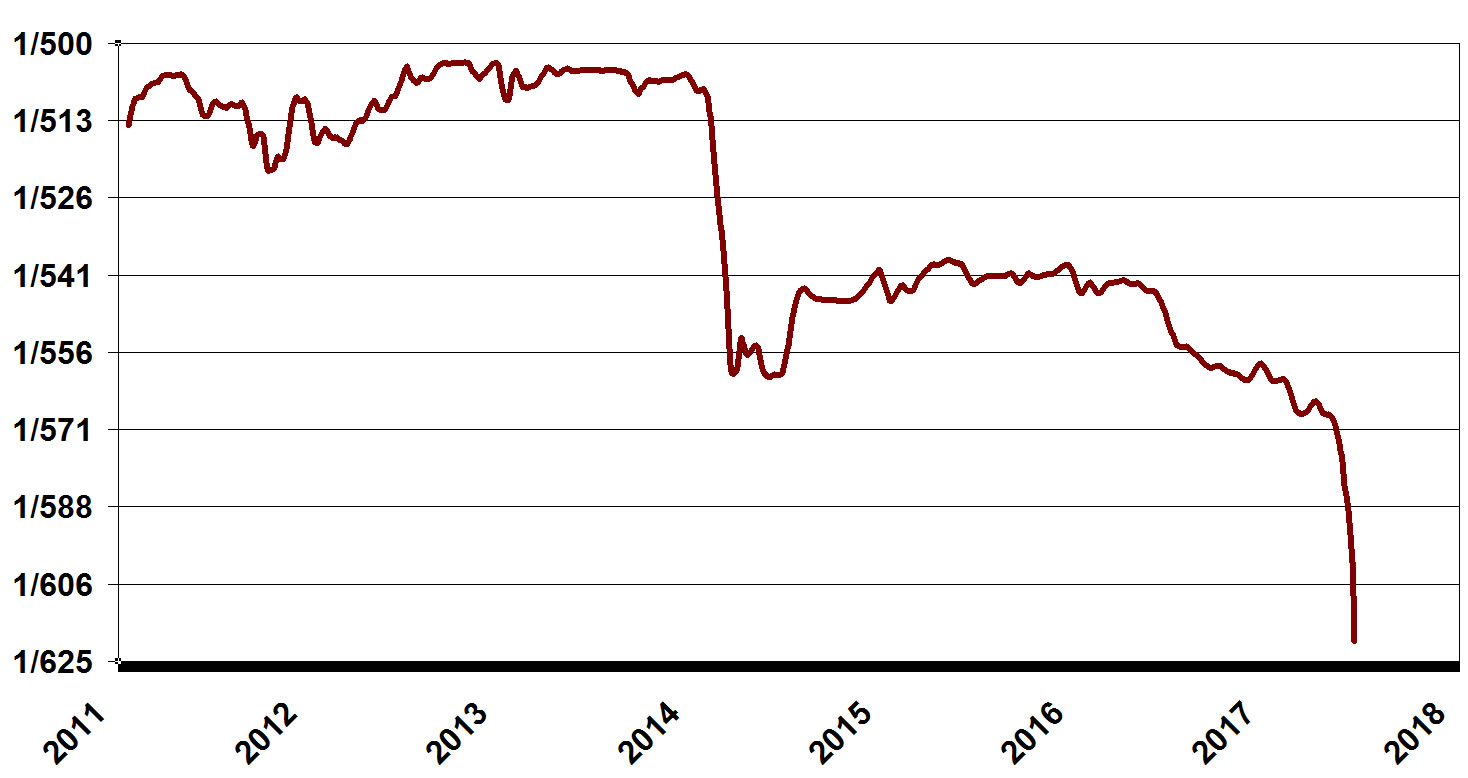

The colon (CRC) is a flighty currency. In recent years, it has behaved in ways that left even seasoned economists at the Banco Central de Costa Rica (BCCR) scratching their heads. We saw a massive appreciation of the colon throughout 2023 and 2024, making the country significantly more expensive for Americans than it used to be.

Basically, your greenback doesn't go as far as it did three years ago.

The Reality of 1 usd in costa rica colon Right Now

Money is weird here.

If you check a converter today, you’ll likely see the rate hovering somewhere between 500 and 530 colones per dollar. But here’s the kicker: that "mid-market rate" you see on Google? You'll almost never get it.

Banks take a cut. Airports take a massive cut.

If you use your credit card at a restaurant in Escazú, the bank might process it at 510. If you go to a "cambio" booth at the airport, they might try to hand you 460 colones for that same dollar. It’s predatory, honestly. You have to be smart.

The colon is named after Christopher Columbus (Cristóbal Colón), and the bills are honestly beautiful—vibrant blues and reds featuring sloths and butterflies—but don't let the pretty colors distract you from the spread. The "spread" is the difference between the buying and selling price. In Costa Rica, this gap can be wide enough to swallow your lunch budget if you aren't careful.

Why the Exchange Rate Keeps Moving

Why does 1 usd in costa rica colon shift so much?

It’s mostly about "Monetary Policy." The BCCR tries to control inflation, but Costa Rica is a tourism-heavy economy. When millions of Americans flood into Guanacaste in December, they bring a literal mountain of dollars. When the market is flooded with dollars, the dollar's value drops relative to the colon.

🔗 Read more: The 59th Street Bridge: What Most New Yorkers Actually Get Wrong

Supply and demand. Simple, yet painful for your wallet.

Then there’s the interest rate situation. When Costa Rican banks offer high interest rates on colon-denominated accounts, investors move their money out of dollars and into colones. This drives the colon's value up. For a traveler, this is bad news. It means your $20 surf lesson suddenly feels like a $25 surf lesson because the local price in colones hasn't changed, but your dollars buy fewer of them.

Real World Examples of What 1 USD Buys

Forget the abstract numbers for a second. Let’s talk about what you can actually do with that change in your pocket.

If you have exactly 1 usd in costa rica colon, you have roughly 500ish colones.

- You can buy a single "empanada de queso" from a street vendor if you're lucky.

- You can pay for about 15-20 minutes of street parking in certain San José neighborhoods.

- You can buy a small bottle of water at a local "pulpería" (a corner grocery store).

- You can't buy a beer. A domestic Imperial or Pilsen usually starts at 1,200 colones ($2.40ish).

If you’re at a high-end resort in Papagayo, one dollar is basically a tip for the bellhop. It won't buy you anything on the menu.

The "Dollarization" Trap

Costa Rica is a dual-currency economy. You can pay for almost anything—hotels, tours, dinners—in U.S. Dollars.

Should you? Usually, no.

When a shopkeeper sees you reaching for dollars, they often use a "simplified" exchange rate. If the official rate is 518, they’ll tell you it’s 500 just to keep the math easy. You lose 18 colones on every dollar. Over a week-long trip, that’s a couple of nice dinners gone to waste.

Always ask: "¿En cuánto está el tipo de cambio?" (What is the exchange rate?).

If they give you a rate that’s lower than what you see on a reputable finance app, pay in colones. It's almost always better to let your credit card company handle the conversion than a guy running a souvenir stand in Jacó.

How to Get the Best Rate

Don't go to the airport exchange booths. Just don't. They are notoriously bad.

Instead, use an ATM (cajero automático). Look for BAC Credomatic, BCR (Banco de Costa Rica), or BN (Banco Nacional). These are the big players. They generally offer the most "honest" rates for 1 usd in costa rica colon.

- Check your bank’s foreign transaction fees. If your bank charges 3%, you're losing money before you even start.

- Withdraw in Colones. When the ATM asks if you want the "guaranteed conversion rate" from the ATM's bank, say NO. Choose "Decline Conversion." Your home bank will almost always give you a better rate than the ATM's predatory software.

- Carry a mix. Use colones for small stuff like "sodas" (local diners), buses, and tips. Use a No-Foreign-Transaction-Fee credit card for the big stuff.

The Psychological Impact of Large Numbers

It’s easy to feel rich in Costa Rica.

A 10,000 colon note feels like a lot of money. It’s purple. It’s pretty. But in reality, it’s only about $19. People often see a bill for 50,000 colones and panic, thinking they’ve just spent a fortune on a sea bass dinner. Take a breath. Divide the number by 500.

50,000 / 500 = 100.

It’s an easy mental shortcut. If the rate is 520, the math is harder, but using 500 as a baseline keeps you from making massive financial blunders.

Nuance: The "Tico" vs. "Gringo" Pricing

There isn't officially a two-tier pricing system in most places, but the currency you use can trigger a "tourist tax." In rural areas like the Osa Peninsula, using colones shows you’ve been in the country for a minute. It suggests you know the value of things.

🔗 Read more: Flight Time From Miami To Turk and Caicos: What Most People Get Wrong

When you pay in dollars, you're signaling that you're fresh off the plane.

Prices at "Sodas" are almost always listed in colones. If you pay in dollars there, you’re basically asking the server to be your personal currency exchanger. They’ll do it, but they’ll take a little extra for the trouble.

Practical Steps for Your Next Move

To maximize your money while the colon remains strong, follow these specific steps.

First, download an offline currency converter app like XE or even a simple calculator. Don't rely on having a data signal in the middle of a cloud forest in Monteverde.

Second, notify your bank that you're traveling. There's nothing worse than having your card eaten by a machine in Quepos because the bank thought someone was stealing your identity.

Third, always keep a stash of small colon bills (1,000 and 2,000 notes). Many small vendors won't have change for a 20,000 colon note, and they certainly won't have change for a $20 bill.

Lastly, pay attention to the news. If you see headlines about the "Tipo de Cambio" dropping, it means the colon is getting even stronger. If that happens, you might want to pre-pay for your hotels or tours in dollars before you leave home to lock in the current rate. If the colon is weakening, wait and pay in local currency when you arrive.

Understanding the flow of 1 usd in costa rica colon isn't about being cheap. It’s about being a traveler who respects the local economy enough to engage with it on its own terms. You’ll save money, sure, but you’ll also feel a lot more like a local and a lot less like a walking ATM.

Actionable Next Steps:

- Verify your credit card's foreign transaction fee policy today. If it's above 0%, apply for a travel-specific card before your trip.

- Locate a Banco Nacional or BCR near your arrival point. Avoid the airport kiosks and head straight to a bank-affiliated ATM for your first 20,000 colones.

- Download an offline currency conversion app. Set it to USD/CRC so you can check prices instantly without needing a local SIM card or Wi-Fi.