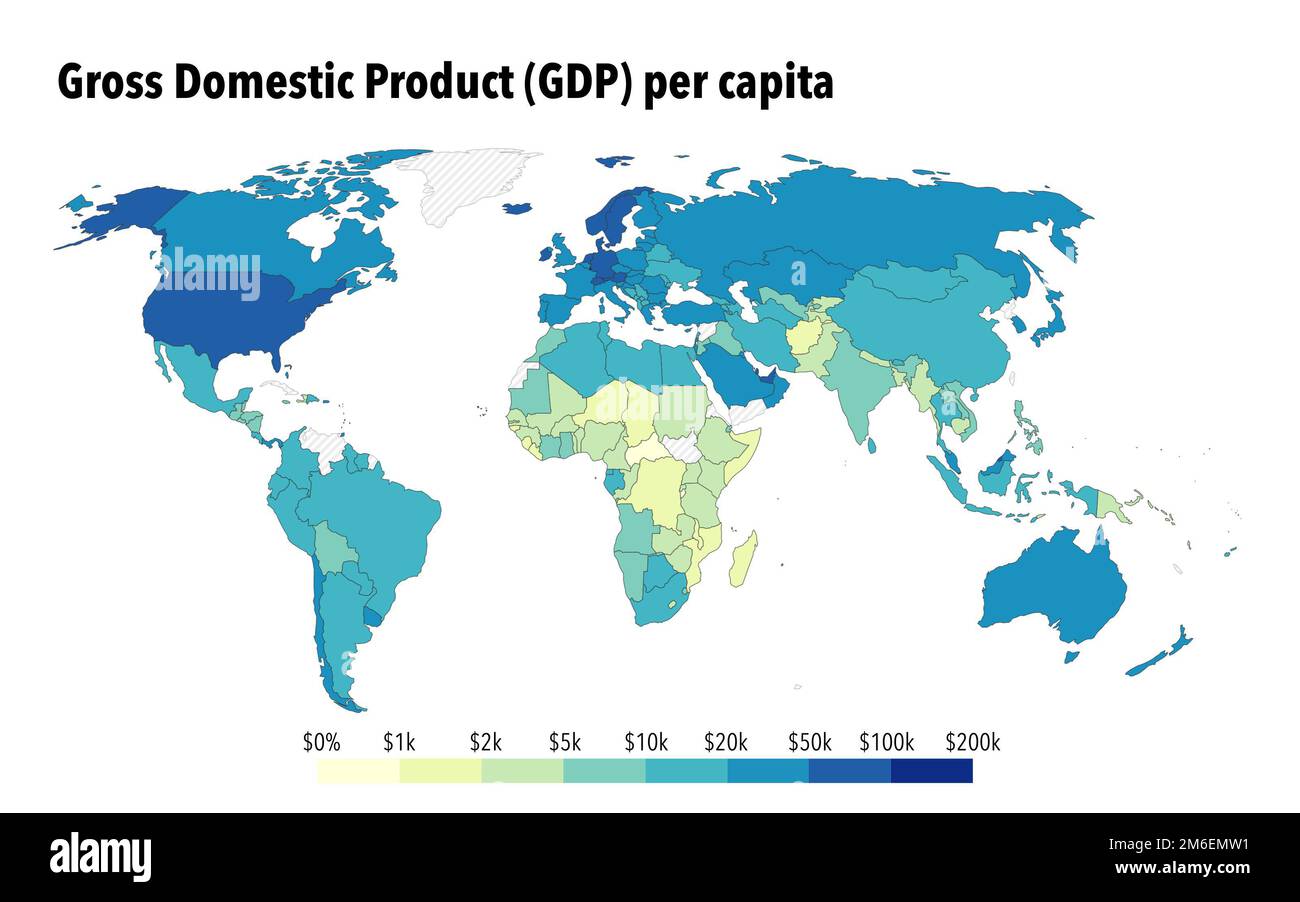

Ever looked at a map of the world's richest countries and wondered how a tiny dot like Luxembourg or a rainy island like Ireland manages to "out-earn" the United States? Honestly, it feels like a glitch in the simulation. You see these lists of the highest GDP per capita in the world and suddenly, places with the population of a mid-sized American suburb are topping the charts with numbers like $140,000 per person.

But here’s the thing: GDP per capita is sorta like a filter on Instagram. It looks great at a glance, but once you start zooming in, the reality is way more complicated. Just because a country has a massive number on a spreadsheet doesn't mean every citizen is walking around with pockets full of gold.

The Numbers Game: Who’s Actually at the Top?

If we’re talking strictly about the International Monetary Fund (IMF) and World Bank data for 2026, the usual suspects are still holding the crown. Luxembourg is sitting pretty at number one, with a nominal GDP per capita that's often double what you'd find in the UK or France.

Right behind them, you’ve got Ireland, Switzerland, and Singapore. Then you have the "special cases" like Monaco and Liechtenstein, which are so small that some economists don't even like putting them in the same category as "real" economies. If you count them, they actually blow everyone else out of the water, but they’re basically playground-sized nations for the ultra-wealthy.

The United States is usually the only "giant" country that cracks the top ten. It’s actually pretty impressive when you think about it. Most of the other leaders are tiny, nimble economies. Maintaining that level of per-capita wealth with over 330 million people is a whole different beast than doing it with 600,000.

Why Luxembourg Always Wins (and Why It’s Kinda Cheating)

You've probably asked yourself: "What do they even do in Luxembourg?"

The secret to their highest GDP per capita in the world title isn't just that they’re rich. It’s a math quirk. See, GDP is the total value of everything produced inside a country's borders. The "per capita" part divides that by the number of people who live there.

In Luxembourg, about half the workforce doesn't actually live in the country. They commute in every single morning from France, Belgium, and Germany. They produce value that goes into the "GDP" numerator, but when it comes time to divide by the "capita" denominator, they aren't counted because they sleep across the border.

🔗 Read more: AED to USD to INR: What Most People Get Wrong About These Rates

Basically, the math assumes 670,000 people are producing all that wealth, when in reality, it's a much larger regional workforce. Plus, they’ve turned themselves into the ultimate hub for investment funds. If you have a 401k or a pension, there's a decent chance some of that money is sitting in a Luxembourgish bank right now.

The Ireland "Leprechaun Economics" Problem

Ireland is another weird one. If you look at the raw data, Ireland looks like the wealthiest place on Earth after Luxembourg. But if you ask a local in Dublin about the "wealth," they might point to the skyrocketing rent and the fact that their paycheck doesn't feel like a "top three in the world" salary.

Economist Paul Krugman famously called this "Leprechaun Economics."

A huge chunk of Ireland’s GDP comes from multinational tech and pharma giants (think Apple, Google, Pfizer) that headquarter there for the low corporate tax rates. When Apple sells an iPhone in Italy, the profit often gets funneled through an Irish subsidiary. This makes Ireland's GDP look astronomical, but that money doesn't always circulate in the local economy.

💡 You might also like: Sun East Credit Union Aston PA: Why Locals Still Choose It Over Big Banks

To fix this, the Irish government actually uses a different metric called *Modified GNI (GNI)**. When you look at that number—which strips out the "fake" multinational money—Ireland is still wealthy, but it’s much closer to the European average.

It’s Not Just About the Paycheck

We often confuse "highest GDP per capita" with "best place to live." They aren't the same thing.

Look at Norway. They’re consistently in the top tier because of their massive sovereign wealth fund, fueled by North Sea oil. But the reason people love living there isn't just the raw GDP; it's how they spend it. High taxes, sure, but you get healthcare and education that actually works.

Contrast that with the United Arab Emirates or Qatar. Their GDP per capita is through the roof because of oil and gas, but the wealth distribution is incredibly lopsided. A massive portion of their population consists of foreign laborers who don't see much of that "per capita" wealth.

Why the US is an Outlier

Honestly, the US is the "Final Boss" of this list. Most countries with a high GDP per capita are "specialty" economies.

- Singapore: A global trade and finance port.

- Switzerland: High-end manufacturing, pharma, and secretive banking.

- Iceland: Tourism and cheap geothermal energy for aluminum smelting.

The US does everything. It’s a tech leader, a manufacturing hub, a massive agricultural exporter, and a dominant force in entertainment and finance. While it might rank 7th or 8th on the per-capita list, its sheer scale makes it the outlier. It's much harder to keep "average" wealth high across a massive geography with diverse industries than it is to do it in a city-state.

What This Actually Means for You

If you’re looking at these rankings to decide where to move or invest, don’t just look at the top-line number. You've got to dig into the Purchasing Power Parity (PPP).

PPP adjusts for the cost of living. A $100,000 salary in Bermuda (which has a high GDP per capita) might actually buy you less than a $60,000 salary in a place where bread doesn't cost $8.

Actionable Insights for 2026:

- Check the GNI, not just GDP: If you're looking at a country's actual economic health, Gross National Income is often a better "vibe check" for how much money is staying in the pockets of residents.

- Factor in the "Expat Tax": High GDP per capita countries like Singapore or the UAE often have incredibly high costs for housing and schooling. The "wealth" can be an illusion if your expenses scale up even faster.

- Watch the Tax Laws: With the global 15% minimum corporate tax starting to bite, the "tax haven" boost for countries like Ireland might start to fade, making these rankings look a lot different by 2030.

- Look at Median Income: GDP per capita is a mean average. If Jeff Bezos walks into a bar, the average person in that bar is a billionaire. But that doesn't help the guy in the corner pay for his beer. Median income tells you what the "middle" person actually earns.

At the end of the day, having the highest GDP per capita in the world is a point of national pride, but it's a deeply flawed metric. It tells you about the size of the engine, but it doesn't tell you if everyone in the car has a seatbelt or if they're even going to the same destination.

Before you assume a country is "rich," look at the infrastructure, the cost of a liter of milk, and how many people are actually sharing the pie. Wealth is about more than just a big number divided by a small population.