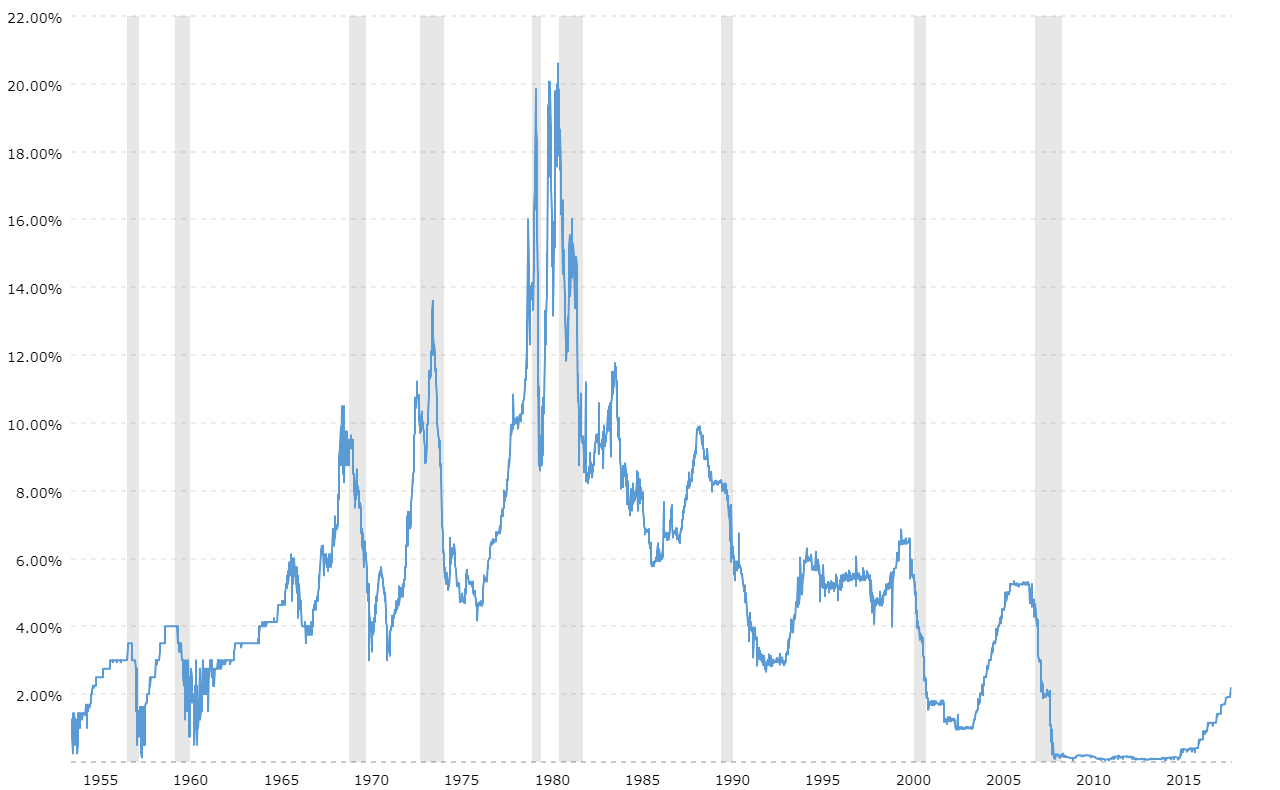

Money isn't free. We sort of forgot that for a decade, didn't we? If you look back at the interest rate history fed records, you’ll see a timeline that looks less like a steady climb and more like a heart monitor during a marathon. Most people think the Fed just wakes up and picks a number to mess with their mortgage. It’s way more chaotic than that.

The Federal Reserve—the "Fed"—is basically the world’s most powerful thermostat. Since its creation in 1913, it has been trying to keep the economy from freezing over or catching fire. Sometimes they nail it. Other times? They accidentally leave the oven on for ten years and then wonder why the kitchen is melting. To understand where we are in 2026, you have to look at the wreckage and the wins of the last fifty years.

The Ghost of Paul Volcker and the 20% Nightmare

When people complain about 5% or 7% rates today, historians just laugh. Bitterly.

Go back to the late 1970s. Inflation was a monster. It wasn’t just "eggs are expensive" inflation; it was "your money is dying" inflation. Enter Paul Volcker. He was the Fed Chair who decided the only way to save the dollar was to try and break the economy. In 1981, the federal funds rate hit an unbelievable 20%. Can you imagine that? A car loan today feels heavy at 6%, but back then, you were basically paying for the car twice just in interest.

Volcker was hated. Farmers drove tractors to the Fed’s headquarters in D.C. and blocked the doors. Homebuilders sent him pieces of 2x4s with "Help!" written on them because nobody was buying houses. But he didn't budge. He stayed the course until inflation broke. This period is the most important chapter in the interest rate history fed archives because it set the "hawkish" standard. It proved the Fed was willing to cause a recession to save the currency's value.

The Era of "Easy Money" and the Great Reset

After the Volcker era, rates generally drifted downward for thirty years. It was a long, slow slide. Then 2008 happened.

The Great Financial Crisis changed the rules. To keep the world from ending, the Fed dropped rates to basically zero. It was called ZIRP—Zero Interest Rate Policy. We stayed there for a long time. Too long, some say. It created a world where "risk" didn't seem to matter because borrowing was essentially free.

The COVID Spike and the 2020s Reality Check

Then came 2020. The world stopped. The Fed dumped trillions into the system and pinned rates at zero again. But this time, the supply chains broke. Everyone wanted to buy a couch at the same moment the factories were closed. Inflation surged to 9% in 2022, and the Fed realized they were behind the curve.

What followed was the fastest rate-hiking cycle in modern history. Jerome Powell, the current Chair, had to pivot from "inflation is transitory" to "we are raising rates every single month." It was a whiplash moment. We went from 0% to over 5% in the blink of an eye. This wasn't just a policy shift; it was a generational shock to anyone who had never seen a world where capital actually cost something.

Why the "Neutral Rate" is a Total Guess

Economists love to talk about the "neutral rate" or "R-star." It’s this mythical interest rate that neither speeds up nor slows down the economy.

Here is the secret: Nobody actually knows what it is.

The Fed tries to find it by looking in the rearview mirror. If unemployment stays low and inflation drops, they think they’ve found it. If the stock market crashes and everyone loses their jobs, they’ve gone too far. It’s like trying to pilot a massive ship where the steering wheel has a 12-month delay. The interest rate history fed data shows that they almost always overshoot. They keep raising until something breaks. In the 1920s, it contributed to the Depression. In the early 2000s, it helped pop the dot-com bubble.

Comparing the Decades: A Messy Timeline

If you look at the 1990s under Alan Greenspan, he was seen as a "maestro." He kept rates around 5% or 6%, and the economy hummed. It felt stable. But his critics argue that by keeping rates low for too long after the 2001 tech crash, he planted the seeds for the 2008 housing collapse.

✨ Don't miss: Writing a Basic Letter of Recommendation for Employee Success Without Overthinking It

Contrast that with the 1950s. Rates were remarkably low and stable, often between 1% and 3%. But that was a different world. We had a manufacturing monopoly and a global gold standard. You can't compare 1955 to 2026 any more than you can compare a horse and buggy to a Tesla. The context of debt-to-GDP ratios matters. Today, the U.S. has over $34 trillion in debt. High interest rates make that debt incredibly expensive to service. The Fed isn't just watching inflation anymore; they're watching the government’s ability to pay its bills.

Misconceptions About the "Pivot"

Everyone waits for the "pivot"—the moment the Fed starts cutting.

Market speculators treat it like a party invite. But historically, a pivot usually happens because something went wrong. In 2007, the Fed started cutting because the subprime mortgage market was exploding. In 2020, they cut because of a global pandemic. Be careful what you wish for. Lower rates often mean the Fed is worried the economy is about to tank.

Honestly, the "higher for longer" mantra we've heard recently is a return to normalcy. The 0% era was the outlier, not the 5% era. If you look at the broad interest rate history fed timeline, the average fed funds rate since 1971 is actually around 5.4%. We aren't in "high" territory; we're just back to the historical average.

The Psychology of Borrowing

When rates are high, people hold onto their homes. Why sell a house with a 3% mortgage to buy one with a 7% mortgage? It’s called the "lock-in effect." It's one reason why home prices stayed high even as rates climbed—nobody wanted to move. This quirk of human behavior complicates the Fed's job. They want to cool the housing market, but by raising rates, they've actually choked off the supply of houses for sale. It’s a mess.

Navigating a High-Rate World: Actionable Steps

The era of easy money is in the rearview mirror. Whether you're an investor or just someone trying to manage a credit card balance, the strategy has changed. You can't rely on "everything goes up" anymore.

📖 Related: Vodafone PLC Share Price: Why Most Investors Are Missing the Real Turnaround

Prioritize High-Interest Debt First

If you have a credit card with a 24% APR, that is a financial emergency. The Fed's rate hikes hit credit cards first and hardest. Pay these off before you even think about the stock market.

Look at Cash Differently

For fifteen years, "cash was trash" because savings accounts paid 0.01%. Now, high-yield savings accounts and Treasury bills are paying 4% or 5%. That is a guaranteed return. If you have a rainy-day fund, make sure it’s actually earning something. Don't leave it in a big-bank checking account that pays you nothing while they earn 5% on your money.

Watch the Yield Curve

Keep an eye on the 10-year Treasury versus the 2-year Treasury. When the 2-year pays more than the 10-year (an inverted yield curve), it’s usually a signal that a recession is coming within 12 to 18 months. It has been one of the most reliable predictors in interest rate history fed tracking.

Re-evaluate Your Risk

Growth stocks and tech companies hate high rates because their future profits are worth less in today's dollars. If rates stay around 4-5%, look for "value" companies—businesses that actually make a profit right now and pay dividends.

The Federal Reserve isn't going back to 0% unless there is a major catastrophe. Understanding that the 2010s were a weird historical fluke is the first step to making better financial decisions in this "new" (but actually old) high-rate environment.