Tax season is usually about what you earned, but Form 709 instructions 2024 are all about what you gave away. Most people think they’ll never have to touch this form. They assume it's only for the private jet crowd.

That's a mistake.

🔗 Read more: Singapore Dollar to Philippine Peso: What Most People Get Wrong

If you helped a grandkid with a down payment or moved money into a specific type of trust last year, the IRS might be expecting a 709 from you by April 15. You probably won't owe a dime in actual taxes—honestly, very few people do—but the paperwork is mandatory. Skipping it is a great way to trigger an audit ten years down the line when it's much harder to find your bank statements.

The 2024 Numbers You Actually Need to Know

The IRS isn't known for being generous, but they do adjust for inflation. For the 2024 tax year, the annual exclusion jumped to $18,000.

This is per person.

If you’re married, you and your spouse can effectively give $36,000 to a single human being without even glancing at a Form 709. If you have three kids, you could technically give away $108,000 as a couple and stay under the radar. But the second you give $18,001 to one person? You’ve triggered a filing requirement.

It gets even bigger when you look at the lifetime exemption. For 2024, that number hit a staggering $13.61 million. This is the "bucket" of money you can give away over your entire life (or at death) before the 40% gift tax actually kicks in.

Why bother filing?

Because the IRS needs to track how much of that $13.61 million bucket you’ve used up. If you give a $50,000 gift today, you aren't paying tax on it, but you are telling the government, "Hey, I only have $13,560,000 left in my bucket for the future."

Common Traps in Form 709 Instructions 2024

Most people get tripped up on "Gift Splitting."

Let's say a husband gives $30,000 to his daughter from his personal bank account. Even though the couple is "entitled" to give $36,000 together, because the money came from one person's account, the IRS requires a Form 709 to show that the wife consented to "split" that gift. It's a weird, bureaucratic hoop. You both have to sign the form.

👉 See also: Netflix Stock Price Today: Why the Smart Money is Sitting Tight

Another weird one? Interest-free loans.

If you "lend" your son $100,000 to start a business and don't charge interest, the IRS views the interest you should have charged as a gift. This is called "imputed interest." You have to check the Applicable Federal Rates (AFR) published monthly by the IRS to see if your "kindness" actually counts as a taxable event.

Medical and Education: The "Get Out of Jail Free" Cards

There are two major exceptions where you can blow way past that $18,000 limit and still ignore the Form 709 instructions 2024.

First: Tuition.

If you pay a university directly for someone’s classes, it doesn't count as a gift. It has to go to the school. If you give the check to the student and they pay the school, you just made a taxable gift. Don't do that.

Second: Medical expenses.

Same rule applies. Pay the hospital or the insurance company directly. If you cover your cousin's $50,000 surgery by paying the surgeon, the IRS doesn't care. It’s "invisible" for gift tax purposes.

The Sunset is Coming

There is a ticking clock on all of this.

The current high exemptions—that $13.61 million figure—are part of the Tax Cuts and Jobs Act of 2017. These provisions are scheduled to "sunset" or expire at the end of 2025. Unless Congress acts, that exemption is expected to drop back down to roughly $7 million in 2026.

This makes the 2024 and 2025 filings incredibly important.

Wealthy families are currently "slop-over" gifting—using as much of that exemption as possible before the door slams shut. If you're planning a major transfer of assets, doing it under the Form 709 instructions 2024 rules is likely much more advantageous than waiting a couple of years.

Technical Details: What Goes Where?

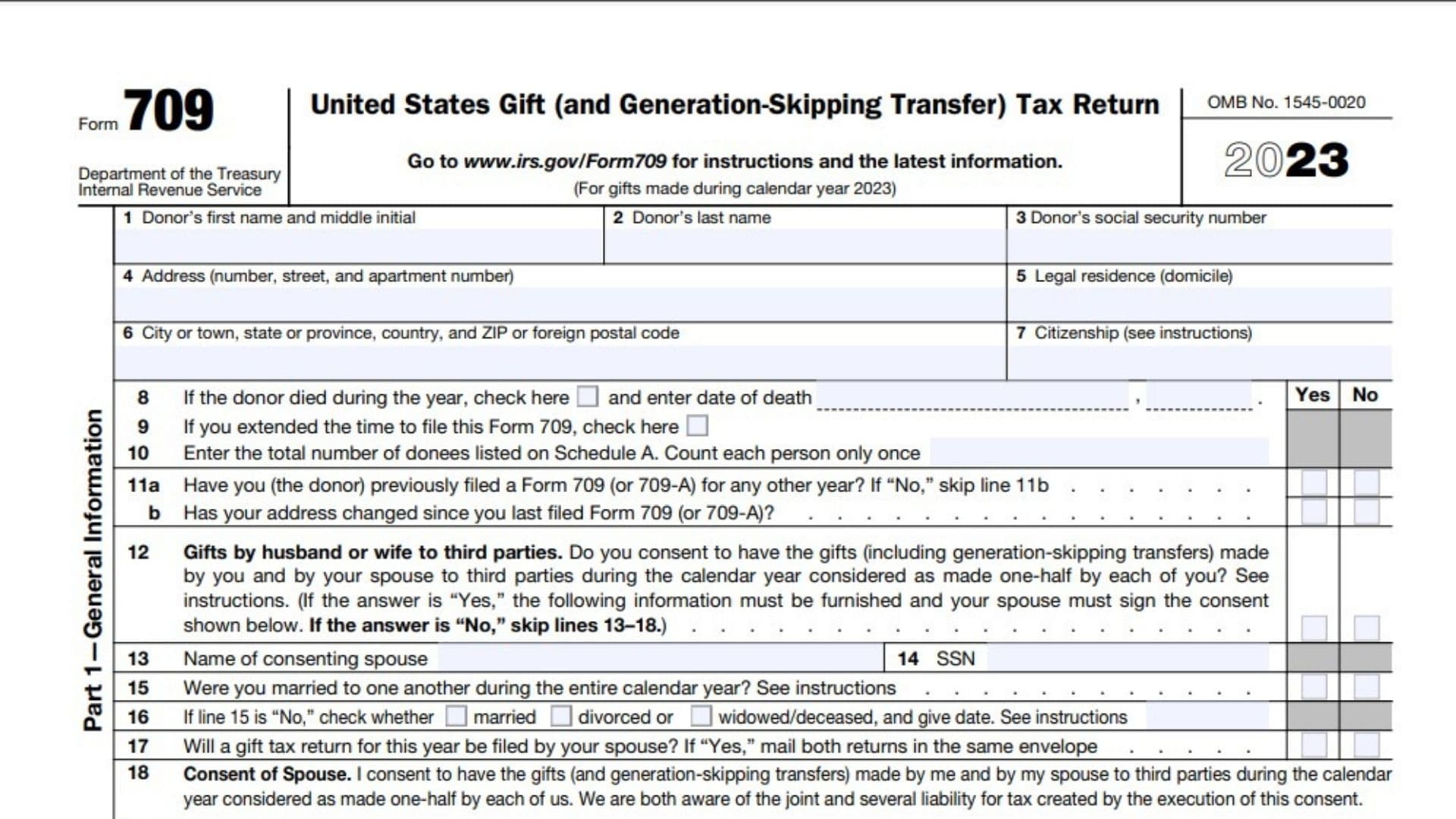

When you actually sit down with the 709, you’ll notice it’s broken into parts.

💡 You might also like: Northrop Grumman Stock News Today: Why Investors Are Betting Big on 2026

- Part 1: General Information. Boring stuff. Name, SSN, address.

- Part 2: Tax Computation. This is where you see if you owe money (again, usually $0).

- Schedule A: This is the heart of the form. You list who got what, when they got it, and what the value was on that specific date.

Valuation is the part that kills people. If you give away cash, it's easy. If you give away shares in a family LLC or a piece of real estate, you can't just guess what it's worth. You need a qualified appraisal. If the IRS challenges your valuation five years from now and you don't have a professional report to back it up, they can re-value the gift, add interest, and hit you with penalties.

529 Plans: The Five-Year Secret

The 529 college savings plan has a "superfunding" rule that is pretty cool.

The IRS allows you to "front-load" five years' worth of gifts into a 529 plan all at once. For 2024, that means you could put $90,000 into a 529 plan ($180,000 for a couple) and treat it as if you gave $18,000 a year for the next five years.

You still have to file Form 709 to "elect" this treatment. You're basically telling the IRS, "I'm using up my future spots in line right now." It’s a powerful move for grandparents who want to move money out of their taxable estate quickly while seeing the benefit for their grandkids immediately.

Don't Forget the GST Tax

This is a bit nerdy, but keep an eye on the Generation-Skipping Transfer (GST) tax.

If you give money to a "skip person"—usually a grandchild or a trust for their benefit—there's an extra layer of tax logic involved. The 709 has a whole section for this. The goal is to prevent families from avoiding estate taxes by skipping a generation. Luckily, the GST exemption is usually the same as the lifetime gift exemption ($13.61 million), but the reporting is stricter.

Practical Steps to Take Now

First, audit your checks.

Go through your bank statements from January 1, 2024, to December 31, 2024. Look for anything over $18,000 to a single person. Don't forget that multiple small gifts to the same person add up. Three gifts of $7,000 equals $21,000. You're over the limit.

Second, gather your receipts for "direct pays."

If you paid a hospital or a college, keep those invoices. You don't need to report them, but if the IRS sees a large chunk of money leave your account, you want proof it was for a non-taxable expense.

Third, check your prior filings.

The Form 709 asks for your "prior periods" taxable gifts. You need your old 709s from 2023, 2022, and so on. If you've lost them, you might need to request a transcript from the IRS, which takes time.

Finally, talk to a pro if you're gifting "hard to value" assets.

Gifting a portion of a farm or a private business is not a DIY project. The Form 709 instructions 2024 are clear about the need for "adequate disclosure." If you don't describe the gift well enough, the three-year statute of limitations never starts. The IRS could theoretically come after you 20 years later.

The 709 isn't just a tax form; it's a historical record of your generosity. Getting it right ensures that your legacy doesn't turn into a headache for your heirs.

Actionable Next Steps:

- Download the current Form 709 and the specific 2024 Instructions PDF from the IRS website to ensure you have the most recent version.

- Create a simple spreadsheet listing every recipient who received more than $15,000 total in 2024, even if you think it won't hit the $18,000 threshold, just to be safe.

- If you performed a "split gift" with a spouse, ensure both of you are ready to sign the return; the IRS will reject a split-gift election with only one signature.

- If you contributed to a 529 plan, verify the exact total contributed to determine if the five-year "superfunding" election is necessary or beneficial for your estate strategy.