You're sitting there with a pile of receipts, a lukewarm coffee, and that nagging feeling that the Franchise Tax Board (FTB) is just waiting for you to slip up. It's California. We pay for the sunshine, and we pay a lot. If you're looking at the ca 540 tax table 2024, you're basically trying to solve a puzzle where the pieces change shape every year.

California doesn't play around with its progressive tax system. It’s one of the most complex in the country. Honestly, most people just let software handle it, but if you're trying to understand where your money actually goes, you have to look at the raw numbers. The 2024 tax year saw some significant adjustments because of inflation. The state adjusts these brackets every year using the California Consumer Price Index (CCPI).

Think about it.

If the state didn't adjust for inflation, you’d end up in a higher tax bracket just because your boss gave you a "cost of living" raise that didn't actually increase your buying power. That's called "bracket creep." It’s a silent killer of savings. Luckily, California is legally required to adjust these numbers so you don't get punished just for keeping up with the price of eggs.

How the CA 540 Tax Table 2024 Actually Functions

The first thing you need to realize is that the ca 540 tax table 2024 isn't a single flat rate. It’s a ladder. You don't pay the highest rate on every dollar you earn. Instead, you pay 1% on the first chunk, 2% on the next, and so on, until you hit the top. For 2024, those brackets start at 1% and climb all the way to 13.3% if you’re a high-flyer.

Wait.

The 13.3% isn't actually in the standard table. That's the "Mental Health Services Act" tax, which adds an extra 1% on top of the 12.3% rate for income over a million bucks. Most of us don't have to worry about that, but it's there, looming. For the average person filing as Single, the brackets shift at very specific intervals.

If you're Single or Married Filing Separately in 2024, your first $10,756 of taxable income is taxed at a measly 1%. Once you cross that, the next bracket kicks in. It goes up to $25,499 at 2%. Then it jumps to 4% for income up to $40,245. Notice how it doubles? That's where it starts to hurt. By the time you’re earning over $68,889, you’re hitting the 8% mark.

For Married Filing Jointly or Qualifying Surviving Spouses, you basically double those income amounts. So, that 1% rate applies to your first $21,512. It’s a bit of a relief for families, but in a state where rent is $3,000 for a cardboard box, those lower brackets disappear fast.

Standard Deduction vs. Itemized Reality

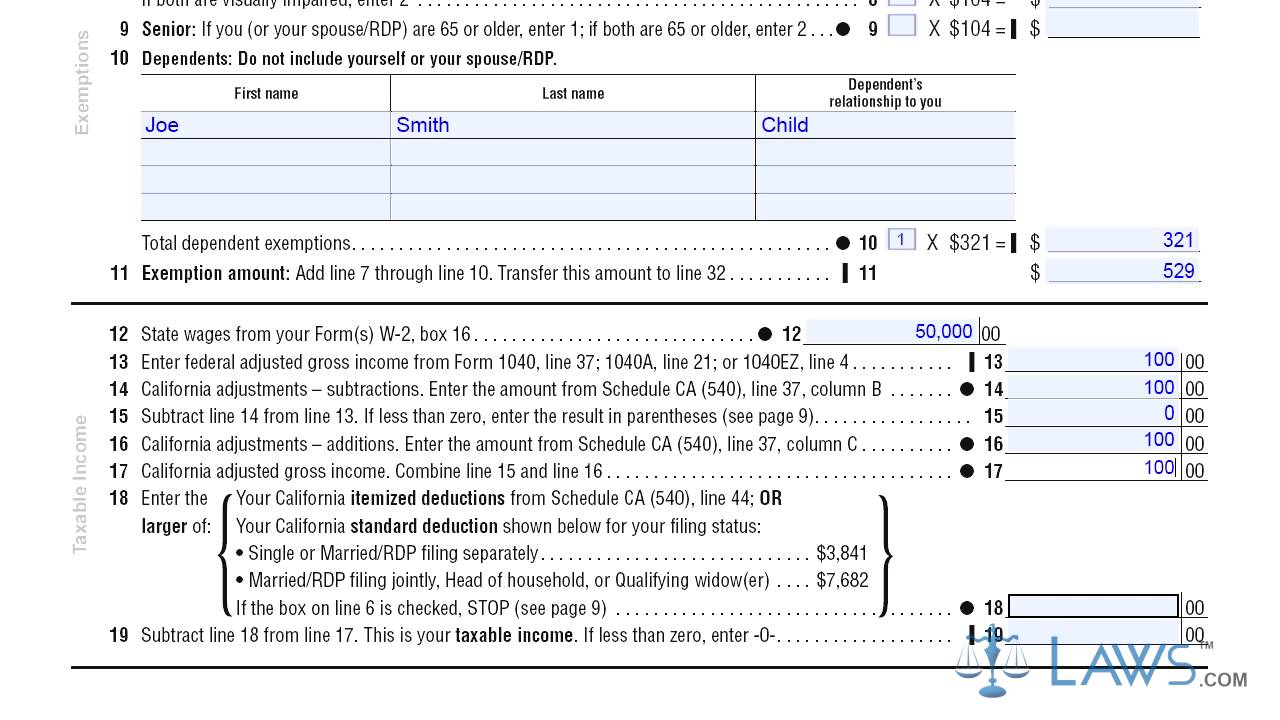

Before you even touch the tax table, you’ve got to figure out your California Adjusted Gross Income (AGI). This isn't the same as your federal AGI. California has its own rules about what counts as income. For instance, California doesn't tax Social Security benefits. If you’re retired, that’s huge. On the flip side, California doesn't always follow federal rules on things like HSA contributions or certain business expenses.

You get a choice: the Standard Deduction or Itemized Deductions.

For 2024, the California Standard Deduction for a Single person or Married Filing Separately is $5,463. If you’re Married Filing Jointly, Head of Household, or a Qualifying Surviving Spouse, it's $10,926.

Most people just take the standard. It's easy. It's clean. But if you have a massive mortgage in San Francisco or Los Angeles, or you gave a ton to charity, you might want to look at Schedule CA (540). That’s where you reconcile the differences between your federal return and what California wants to see.

The Weird Quirks of California Tax Credits

The ca 540 tax table 2024 is just the starting point. The real magic—or frustration—happens with credits. A credit is better than a deduction. A deduction lowers the income you’re taxed on, but a credit is a straight-up dollar-for-dollar reduction in the tax you owe.

California has some specific ones you shouldn't ignore:

- Personal Exemption Credit: For 2024, this is $144 for Singles and $288 for Married Filing Jointly. It’s a small "thanks for existing" gift from the state.

- Dependent Exemption Credit: This is where the money is for parents. It’s $453 per dependent. If you have three kids, that’s over $1,300 off your tax bill.

- California Earned Income Tax Credit (CalEITC): This is for lower-income workers. If you earned less than $30,000, you might get a significant chunk back.

- Young Child Tax Credit (YCTC): If you qualify for CalEITC and have a kid under 6, you could get up to $1,177.

- Renter’s Credit: If you paid rent in California for at least half the year and your income is below a certain threshold ($50,746 for Singles in 2024), you can grab a small credit. It’s only $60 or $120, which won’t even buy a tank of gas in some places, but hey, money is money.

Why Your AGI Matters More Than You Think

The FTB uses your California AGI to determine if you even need to file. If your gross income is under a certain amount—say $22,341 for a single person under 65 with no dependents—you might not have to file a return at all.

But wait.

Even if you don't have to file, you probably should if you had any tax withheld from your paycheck. The only way to get that money back is to file Form 540 and show the state that, according to the ca 540 tax table 2024, you actually owe $0.

Common Mistakes When Using the Tax Table

People mess this up all the time. One of the biggest errors is looking at the wrong column. The 2024 instructions come with a massive table that lists income in increments of $100. If your taxable income is $45,050, you look for the line that says "Over 45,000 but not over 45,100."

Then you have to find your filing status.

If you accidentally look at the "Head of Household" column instead of "Single," your math will be toast. Head of Household status is generally more favorable because the brackets are wider, meaning you stay in lower tax percentages for longer. But you have to actually qualify—usually by being unmarried and paying more than half the costs of keeping up a home for a qualifying person.

Another trap?

The "California Tax Rate Schedules." These are different from the tables. You use the schedules if your taxable income is over $100,000. At that point, the big table in the back of the booklet stops, and you have to do some actual math.

For example, if you're Single and your taxable income is $150,000, you’d use Schedule X. You take a base amount of tax—for 2024, it might be something like $10,145.44—and then add 9.3% of the amount over $68,889. It sounds like high school algebra, and it feels just as annoying.

The Mental Health Services Tax (Millionaire's Tax)

California is famous for its "Millionaire's Tax." Officially, it’s the Mental Health Services Act. If your taxable income exceeds $1,000,000, you pay an additional 1% surtax. This applies regardless of your filing status.

✨ Don't miss: Rancho Cucamonga Mark Zwerner: Why Local Context Matters More Than You Think

So, if you’re a single filer making $1.2 million, your top marginal rate isn't actually the 12.3% you see on the standard ca 540 tax table 2024. It’s 13.3% on that last $200,000. It’s one of the highest state income tax rates in the nation, which is why you see so many headlines about tech moguls moving to Florida or Texas.

Filing Logistics You Can't Ignore

The deadline for 2024 taxes is April 15, 2025.

California is actually pretty chill about extensions. If you can’t make the deadline, they give you an automatic six-month extension to file. You don't even have to ask.

But—and this is a huge "but"—that is an extension to file, not an extension to pay.

If you owe the FTB money and you don't pay by April 15, they will start tacking on interest and penalties faster than you can say "Sacramento." The penalty for late payment is 5% of the unpaid tax, plus 0.5% for each month it remains unpaid, up to a maximum of 25%.

Use CalFile if You Can

If your tax situation is simple, don't pay some big software company $60 to file your state return. The FTB has a tool called CalFile. It’s free. It’s direct. It uses the ca 540 tax table 2024 logic automatically. If you're just a W-2 employee with standard deductions and maybe some interest income, it’s a no-brainer.

The FTB also has a "Tax Calculator" on their website. It’s a literal life-saver if you want to double-check the math your software gave you. You just plug in your taxable income and filing status, and it spits out the tax before credits.

Actionable Steps for Your 2024 California Return

Stop guessing. If you want to handle your 2024 taxes like a pro, follow these steps:

- Gather your 1099s and W-2s. You can't even look at the tax table until you know your AGI.

- Calculate your California adjustments. Subtract that Social Security income. Add back any out-of-state municipal bond interest.

- Determine your filing status carefully. If you’re newly divorced or your kid moved out, your status might have changed, and that changes which part of the ca 540 tax table 2024 you use.

- Subtract your deduction. Use $5,463 (Single) or $10,926 (Joint) unless your itemized deductions (mortgage interest, property tax up to $10k, medical over 7.5% AGI) are higher.

- Find your Taxable Income. This is the number you take to the table.

- Apply Credits. Subtract your $144 personal credit and that $453 per kid.

- Check for CalEITC. Even if you make $25,000, you might be owed money back.

California taxes are a beast, but they aren't impossible. The ca 540 tax table 2024 is just a map. As long as you know where you are on the income ladder and which credits you can grab on the way down, you’ll survive another season. Pay your estimated taxes if you’re self-employed, keep your receipts for five years (yes, five, California is stricter than the IRS), and don't wait until April 14 to start.