So, you’ve hit that age. Or maybe you’re just a super-prepared planner trying to see over the horizon. Either way, the "Required Minimum Distribution" (RMD) is likely staring you in the face. It’s that lovely time of life when the IRS decides it’s finally time to collect the taxes you’ve been deferring for decades. And if you’re like a huge chunk of American retirees, you’re probably looking at the fidelity ira rmd calculator to make sense of the math.

Honestly, RMDs are a bit of a headache. The rules change constantly. Thanks to things like the SECURE Act and SECURE 2.0, the age when you actually have to start taking money out has jumped around like a grasshopper. First it was 70½, then 72, and now it's 73 (and eventually 75).

If you’re confused, you aren't alone.

What the Fidelity IRA RMD Calculator Actually Does

Basically, this tool is designed to take the guesswork out of the IRS Uniform Lifetime Table. You give it your age and your account balance as of December 31st of the previous year. It then spits out the minimum amount you need to withdraw to avoid a massive 25% penalty.

Yes, 25%. It used to be 50%, so I guess we should be "thankful"? Still, losing a quarter of your required withdrawal because of a math error is a brutal way to spend retirement.

The formula is actually pretty simple

Fidelity (and the IRS) uses a basic equation:

Prior Year-End Balance / Distribution Period = RMD.

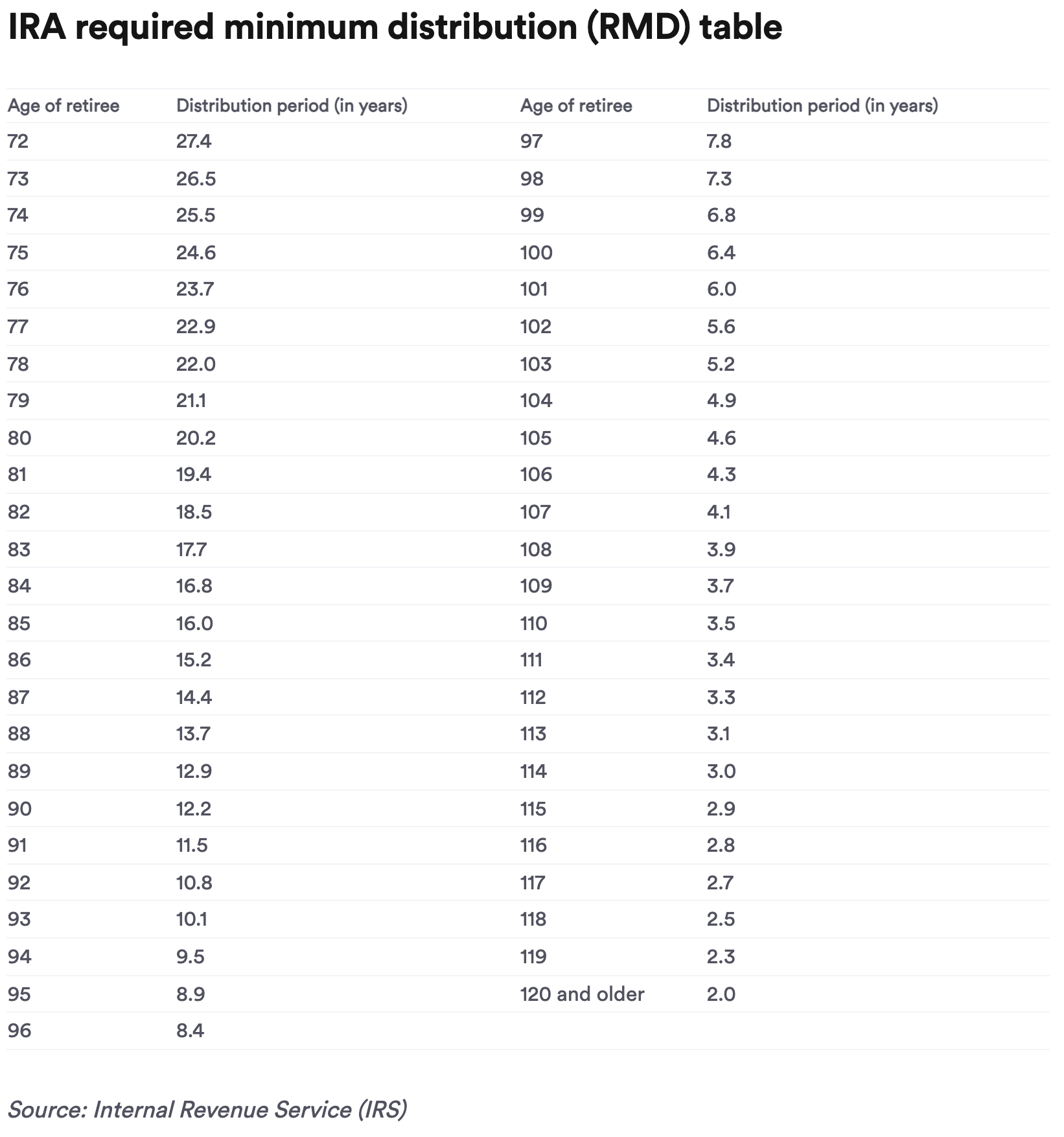

If you turned 73 in 2025 and had $500,000 in your IRA on New Year's Eve, the calculator looks up your "life expectancy factor." For a 73-year-old, that factor is 26.5.

$$500,000 / 26.5 = 18,867.92$$

That’s your number. You have to take at least that much out by December 31st.

The Trap: What the Calculator Might Miss

Here is where people trip up. A calculator is only as good as the data you feed it.

👉 See also: Jasmine Crockett Net Worth Before Congress: What Most People Get Wrong

If you have all your money at Fidelity, their "Retirement Distribution Center" usually handles the math automatically. It’s convenient. But if you have an old 401(k) at a former employer or a random IRA at another bank, the fidelity ira rmd calculator won't "see" those balances unless you manually type them in.

And don't even get me started on inherited IRAs.

Inherited accounts are a total different beast. If you inherited an IRA before 2020, you might be able to "stretch" it over your life. If you inherited it in 2020 or later, you're likely stuck with the 10-year rule, which means the whole account has to be empty by the end of the tenth year. The standard RMD calculator doesn't always account for these specific beneficiary nuances unless you're using the dedicated "Inherited IRA" version of the tool.

Why "Automation" Is Your Best Friend (Usually)

Fidelity lets you set up automatic RMD withdrawals. This is great for the "set it and forget it" crowd. You can choose to have them sell off a specific mutual fund or just take cash from your core position.

But watch the taxes.

The calculator will show you the gross amount, but it won't tell you exactly how much to withhold for the IRS. If you don't withhold enough, you might get a surprise bill in April. If you withhold too much, you’re giving the government an interest-free loan. Most people find that withholding 10-20% for federal taxes is a safe "middle ground," but your mileage will vary depending on your other income.

👉 See also: U.S. Steel Clairton Works: What Most People Get Wrong

A Quick Note on the "First Timer" Perk

If this is your very first RMD year, you actually have until April 1st of the following year to take your first distribution.

Sounds great, right?

Wait.

If you wait until April to take your 2025 RMD, you still have to take your 2026 RMD by December of that same year. You’ll end up with two distributions in one tax year. That can skyrocket your taxable income and potentially push you into a higher tax bracket or trigger higher Medicare premiums (IRMAA). Kinda sucks. Usually, it's better to just take the first one in the year you turn 73.

Nuances the Pros Talk About

The fidelity ira rmd calculator is a math tool, not a tax strategy tool.

If you don't actually need the money to live on, you might want to look into a Qualified Charitable Distribution (QCD). If you’re over 70½, you can send up to $105,000 (as of 2024/2025 limits) directly from your IRA to a charity. This counts toward your RMD but doesn't show up as taxable income.

The calculator won't suggest this. It just sees numbers.

Also, if your spouse is more than 10 years younger than you and is your sole beneficiary, you get to use a different table—the Joint Life and Last Survivor Expectancy Table. This lowers your RMD amount. Make sure the calculator you use is asking for your spouse's birthday, or you'll end up taking out more than you need to.

Practical Next Steps

Don't wait until December 20th to figure this out. The markets can be volatile, and processing times can slow down during the holidays.

👉 See also: 20000 Pounds in American Money: What You’ll Actually Get (and Why It’s Changing)

- Gather your year-end statements. You need the balance from December 31st of last year for every non-Roth IRA you own.

- Log into the Fidelity Retirement Distribution Center. If your accounts are there, see if they’ve already calculated the amount for you.

- Double-check the age. Ensure your birth date is correct in their system. A one-year error changes the divisor and the final amount.

- Decide on your "Tax Move." Are you taking the cash? Doing a QCD to a charity? Moving it to a taxable brokerage account?

- Set up the transfer. If you do it now, you can spread the "income" over the year rather than taking one giant hit in December.

RMDs are just a part of the game. Using the fidelity ira rmd calculator is a solid first step to staying on the right side of the IRS, but remember that the tool is the map—not the driver. You still need to keep your eyes on the road.

Check your "Total RMD" across all your traditional IRAs. You can aggregate the total amount and take it from just one IRA if that’s easier, but remember that 401(k) RMDs must be taken from each specific 401(k) account individually. Mixing those up is a classic mistake that the calculator won't warn you about.