Money is weird. You’d think that a country facing massive international sanctions and a frozen central bank would see its currency crumble into dust, but the relationship between US dollars to afghani has taken a path that almost nobody predicted back in 2021. If you're looking at the charts today, the numbers might seem like a glitch. They aren't.

The Afghani (AFN) has been one of the best-performing currencies globally over the last couple of years. Yeah, you read that right. While the British Pound and the Euro were sweating through inflation spikes and geopolitical jitters, the Afghani was actually gaining ground against the greenback. It makes no sense on paper. But when you dig into the mechanics of how money actually moves in Kabul versus New York, the mystery starts to clear up.

The strange strength of the Afghani

Most people checking the US dollars to afghani rate expect to see a total collapse. Instead, they find a currency that has stabilized significantly since the initial shock of the Taliban takeover. Why? It's not because the economy is booming in a traditional sense. It’s because of a brutal, hyper-fixated control over cash flow.

The Da Afghanistan Bank (DAB) isn't playing by the Federal Reserve's handbook. They’ve basically banned the use of foreign currency for local transactions. If you're in a bazaar in Kandahar or a shop in Kabul, you’re told to use Afghanis. Period. This forced demand keeps the AFN relevant. If you can't spend your dollars legally, you have to trade them for the local script. That keeps the buy-side of the AFN equation heavy.

Then there’s the cash. The UN has been flying in literal planeloads of US dollars for humanitarian aid. We’re talking about roughly $40 million a week at various points. This isn't "digital credit"—it's physical pallets of $100 bills. This massive influx of hard currency provides the liquidity the market needs to keep from flatlining. Without those flights, the exchange rate would likely look like a vertical cliff.

How the Sarai Shahzada works

If you want to understand the real value of US dollars to afghani, you don't look at a Bloomberg terminal. You look at Sarai Shahzada. This is the heart of Afghanistan's financial system—a massive, multi-story open-air market in Kabul where hundreds of money changers trade sacks of cash.

It’s chaotic. It’s loud. It’s also incredibly efficient.

The "Hawala" system operates here. It’s an informal way of moving money based on trust and a network of brokers that spans from Dubai to London to Kabul. Because the formal banking system in Afghanistan is largely cut off from SWIFT, Hawala is the only way people can get money in or out. When a family in Virginia sends $500 to their relatives in Jalalabad, that transaction ripples through the Sarai Shahzada and affects the daily rate.

Why the numbers don't tell the whole story

Focusing purely on the US dollars to afghani exchange rate can be misleading. A "strong" currency usually implies a healthy economy, but in this case, it’s a sign of a highly restricted one.

- Trade Imbalance: Afghanistan imports almost everything. Electricity, flour, fuel—it all comes from outside. Normally, this would drain foreign reserves and tank the currency. But because aid flows in and exports (like coal and talc) are pushed aggressively to neighboring countries like Pakistan and China, a fragile balance is maintained.

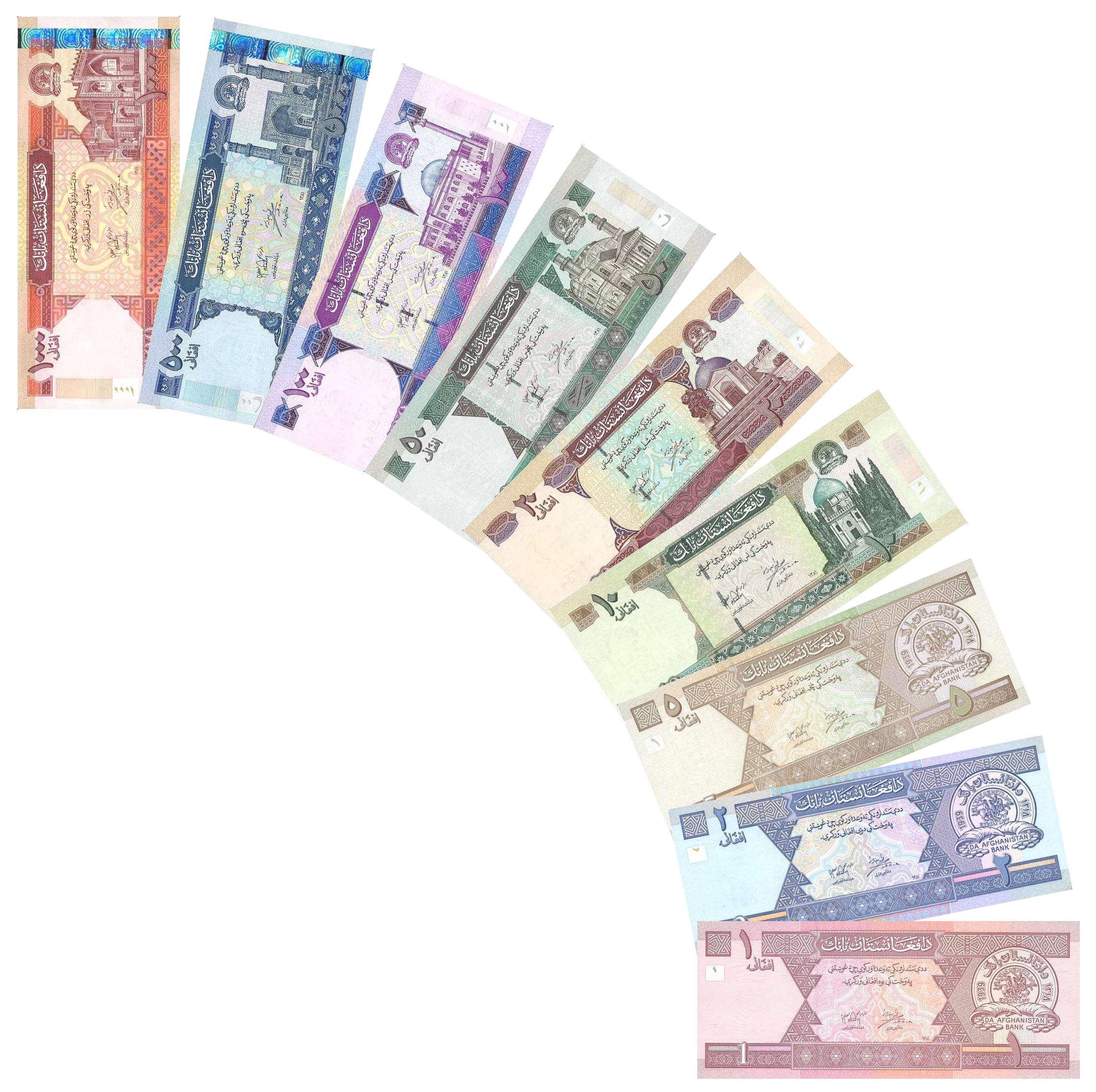

- The Liquidity Trap: There is a massive shortage of physical Afghani banknotes. The previous government had them printed in Europe, but those contracts were canceled or paused. When there isn't enough physical cash to go around, the value of the remaining cash goes up. It's basic supply and demand, just applied in a very painful way.

- No Interest Rates: Unlike the US, where the Fed hikes rates to fight inflation, the DAB doesn't really use interest rates as a tool. Their primary lever is just controlling the physical supply of money and arresting people who try to smuggle dollars out of the country.

It’s a "command economy" in the truest sense.

What the Experts Say

Economists like William Byrd from the United States Institute of Peace (USIP) have pointed out that while the exchange rate looks stable, the underlying economy is still in a state of "permanent crisis." The stability is a facade built on humanitarian aid and strict capital controls. If the UN stops the cash flights tomorrow, the Afghani would likely lose 20-30% of its value in a single afternoon.

Conversely, the World Bank has noted that inflation in Afghanistan actually turned into deflation for a period in 2023 and 2024. People simply didn't have enough money to buy things, so prices dropped. A "strong" exchange rate doesn't help much if you have no income to exchange in the first place.

Practicalities: Converting US dollars to afghani

If you're actually dealing with this currency pair—maybe for NGO work or family support—you have to be careful. The "official" rate you see on Google isn't always what you get on the ground.

- Bank Limits: Afghan banks often limit how much you can withdraw, even if the money was sent in USD. You might be forced to take your payout in AFN at a rate the bank decides, which is usually worse than the market rate.

- Physical Condition: In the Sarai Shahzada, the physical condition of your US dollars matters. Old, wrinkled, or marked $100 bills (the "small head" Benjamin Franklins) are often traded at a lower rate than the new "blue" notes. It sounds ridiculous, but it's a real factor.

- Volatility: The rate can swing wildly based on a single news report about sanctions or aid packages.

The Future of the AFN

Predicting where the US dollars to afghani rate goes next is a fool's errand, but there are signposts. Watch the relationship between the Taliban and the international community regarding the $7 billion in frozen Afghan central bank assets held in the US and Switzerland. If even a portion of that is released for "liquidity purposes," the Afghani could see another artificial boost.

✨ Don't miss: 30000 lbs to dollars: How Weight and Currency Collide in 2026

On the flip side, if the humanitarian "bridge" of cash flights ends, the currency is toast. There's no internal industry strong enough to support the Afghani's current valuation without that external life support.

Actionable Steps for Navigating the Rate

If you are managing funds or sending money, don't just look at the ticker.

- Use specialized remitters: Companies that specialize in the Middle East and Central Asia often have better "real-world" rates than the big global players.

- Watch the news in Kabul, not just DC: Policy changes from the Ministry of Finance in Kabul (like new taxes or mining deals) often move the rate faster than US inflation data does.

- Diversify your timing: Don't send one giant lump sum. The AFN is thin-marketed, meaning a few big trades can move the needle. Break up your transfers to average out the exchange rate.

Understanding the US dollars to afghani exchange requires looking past the screen. It’s a mix of medieval-style cash markets, high-stakes international diplomacy, and a local population just trying to afford bread in a system that defies every rule in the macroeconomics textbook. Keep your eyes on the humanitarian aid updates; that's the real "gold standard" backing the Afghani right now.

👉 See also: 24 million won to usd: Why This Specific Number Matters Right Now

Next Steps for Managing Currency Exposure:

- Monitor the weekly UN humanitarian aid flight schedule, as these injections often coincide with temporary AFN strengthening.

- Verify the "Sarai Shahzada" street rate through local contacts or specialized Telegram channels before committing to a large transfer.

- Keep US Dollar holdings in the "new" blue-strip $100 denominations to ensure maximum value during physical exchange in-country.