You’re sitting at your desk, looking at a healthy bank balance from your freelance gig or that new LLC you launched in Columbus. It feels great. Then, that little voice in the back of your head whispers something about the Department of Taxation. Suddenly, you realize you haven't sent a dime to the state all year. This is how the panic starts.

Estimated tax payments Ohio doesn't have to be a nightmare, but honestly, the system is kind of clunky if you aren't used to it. Ohio isn't like some states that just let you settle up in April without a peep. If you're earning money that isn't subject to employer withholding—think 1099 work, interest, dividends, or prize winnings—the state expects its cut throughout the year. If you wait until the deadline, you're not just paying the tax; you’re paying interest and penalties that basically act as a "procrastination tax."

It’s about the threshold. If you expect to owe more than $500 to the state after subtracting your credits and withholding, you’re on the hook for quarterly installments. It’s that simple, yet thousands of Ohioans get hit with the underpayment penalty every single year because they assume the $1,000 federal rule applies to the state level too. It doesn't.

The $500 Rule and Why It Catches People Off Guard

Most taxpayers are familiar with the IRS rule. You usually don't need to worry about federal estimates if you owe less than $1,000. Ohio is stricter. The Ohio Department of Taxation (ODT) sets that bar at $500.

Let's say you're a graphic designer in Cincinnati. You’ve got a side hustle that brings in an extra $15,000 a year. After your expenses, you might owe the state roughly $450 in tax based on Ohio's graduated income tax rates. In this specific case, you might get away with just paying in April. But if that side hustle grows even slightly, or if the state legislature tweaks the brackets—which they do fairly often—you suddenly cross that $500 line.

🔗 Read more: Will Inflation Go Down? What the Data Actually Says About Your Wallet

Ohio's tax rates have been a bit of a moving target lately. Governor Mike DeWine and the state legislature have been aggressive about consolidating brackets. For 2024 and 2025, we’ve seen the state move toward a two-bracket system. If you earn $26,050 or less, your tax rate is 0%. If you earn more than $100,000, you’re looking at a top rate of around 3.5% to 3.75%, depending on the specific budget year's final implementation.

Why does this matter for your estimates? Because if you’re basing this year’s payments on what you paid three years ago, your math is probably wrong. You might be overpaying, which is basically giving the state an interest-free loan, or underpaying, which leads to those annoying IT 2210 interest charges.

When Are These Payments Actually Due?

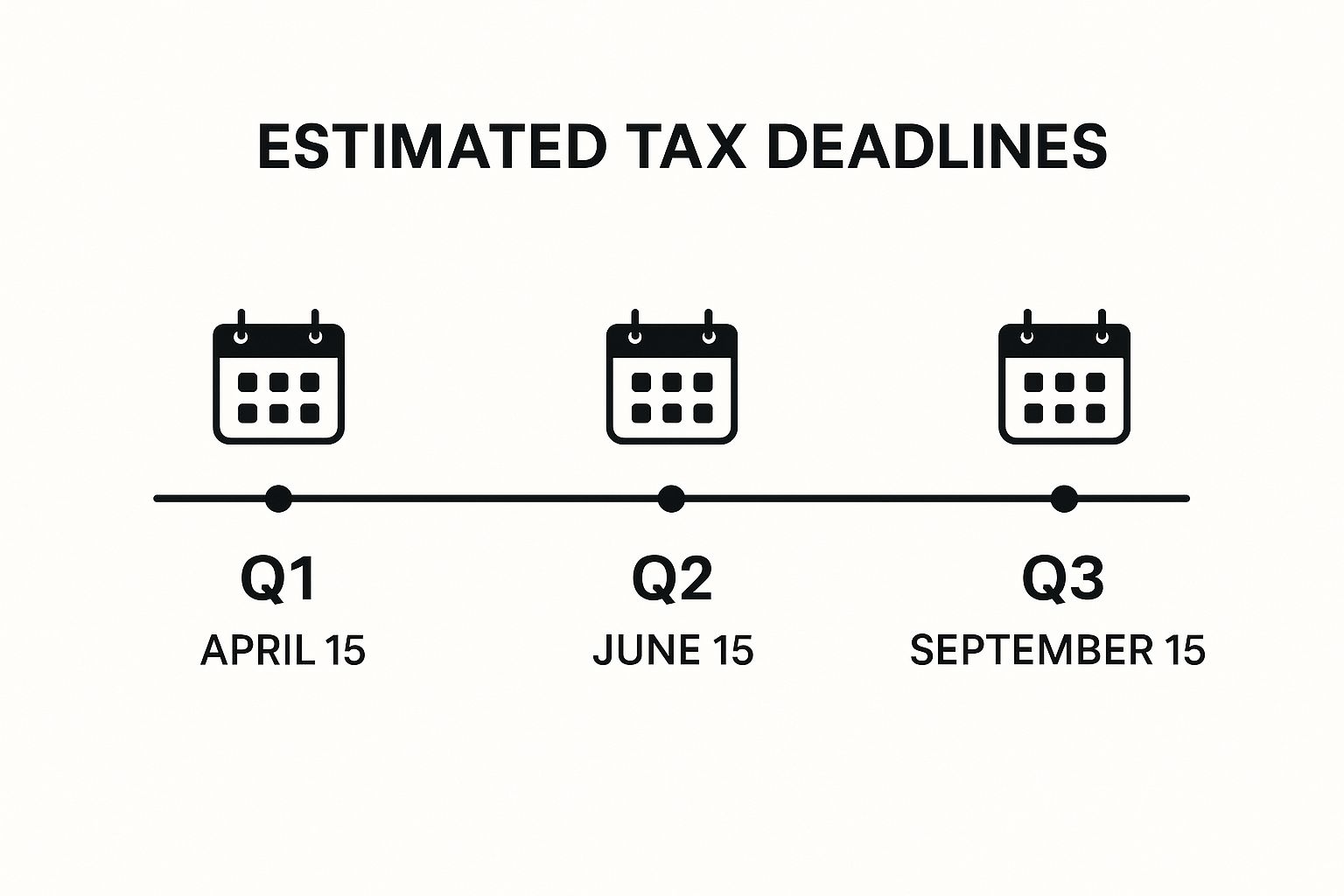

The calendar is your enemy here. The dates aren't spread out perfectly every three months, which is a weird quirk of the tax system that everyone hates.

- April 15th: This is for the first quarter (January through March).

- June 15th: The second quarter (April and May). Notice this is only two months! This is the one people usually miss.

- September 15th: The third quarter (June through August).

- January 15th: The final payment for the previous year’s income.

If these dates fall on a weekend or a legal holiday, you get until the next business day. But don't count on "postmarked by" saves if you can help it. Using the Ohio Guest Payment system or the Ohio Business Gateway is way safer. It’s instant. You get a confirmation number. You can sleep at night.

The Safe Harbor Loophole

There is a way to stop worrying about the math. It’s called the "Safe Harbor" rule. Basically, if you pay 100% of the tax shown on your previous year's return in four equal installments, Ohio generally won't penalize you even if you end up owing way more when you actually file.

Imagine you had a "normal" year last year and paid $2,000 in total state tax. This year, you hit the jackpot or your business explodes, and you’re on track to owe $10,000. If you pay $500 every quarter (totaling $2,000), you’ve hit the safe harbor. You’ll still have to pay the remaining $8,000 in April, but you won't be hit with underpayment penalties. It’s a lifesaver for people with fluctuating incomes.

How to Actually Send the Money

You have options, but some are definitely better than others.

- Electronic Check/Credit Card: You can use the Ohio Department of Taxation’s "Online Services" portal. It’s free if you use an electronic check (ACH debits). If you use a credit card, they’ll tack on a convenience fee that makes the whole thing feel like a rip-off.

- The Paper Voucher: If you're old school, you use Form IT 1040ES. You print it, write a check, find a stamp, and hope the USPS doesn't lose it. If you choose this route, make sure your Social Security number is on the memo line of the check. It sounds basic, but "lost" payments are almost always just payments that couldn't be matched to an account because the handwriting was messy.

- Ohio Business Gateway: If you're running a larger operation or have employees, you’re likely already here. It works, but the UI feels like it hasn't been updated since 2008.

Honestly, just use the guest payment portal. You don't even need a full login for some types of payments. It’s the fastest way to get it off your to-do list.

💡 You might also like: Why eMAG Still Dominates Eastern European E-commerce

Common Blunders: School Districts and Cities

This is where Ohio gets really complicated compared to other states. You aren't just paying the state. You might live in a "taxing school district."

If you live in a district with a school district income tax (SDIT), you might need to make estimated payments for that too, using Form SD 100ES. Not every district has one, but if yours does, the rate is usually between 0.25% and 2%. It sounds small until you realize it’s calculated on your entire taxable income.

Then there’s RITA or CCA. These are the agencies that collect local municipal taxes for hundreds of Ohio cities. If your employer doesn't withhold your local city tax—maybe because you work from home in a different city than your office—you might owe municipal estimates. People often forget that "estimated tax payments Ohio" usually refers to the state-level obligation, but the local guys are often more aggressive about collections.

The Penalty for Getting it Wrong

Ohio calculates underpayment interest daily. They use form IT 2210 to figure out exactly how much you stayed "in the red" throughout the year.

If you were supposed to pay $1,000 in April but didn't pay it until September, you owe interest on that $1,000 for those specific months. You can't just "catch up" in December and expect the penalties to vanish. The state views it as money they were entitled to have in April.

📖 Related: What's The Dow Jones Average Now: Why 49,442 Is Only Half The Story

However, there are exceptions. If you retired during the year, or became disabled, or if some "unusual circumstance" (like a natural disaster) made it impossible to pay, you can check the waiver boxes on the IT 2210. But "I forgot" or "I didn't know the law" almost never works with the auditors in Columbus.

Practical Steps to Get Ahead

Stop guessing. If you're self-employed, set aside 25% to 30% of every check into a high-yield savings account. That covers your federal (15.3% self-employment plus income tax) and your Ohio obligations.

- Check last year’s return: Look at the "Total Tax" line. Divide it by four. That’s your Safe Harbor number.

- Set calendar alerts: Mark June 15th and September 15th specifically. April and January are easy to remember because of the traditional tax season, but the middle ones are the killers.

- Verify your School District: Use the "The Finder" tool on the Ohio Department of Taxation website. Put in your address. It will tell you exactly which school district and municipality you owe.

- Adjust for the SALT cap: If you’re a business owner, look into the Ohio IT 4738. It’s an electing pass-through entity tax that might allow you to deduct your state taxes on your federal return, bypassing the $10,000 SALT limit. It’s a bit complex, so talk to a CPA, but it can save you thousands.

The reality of Ohio taxes is that the state is generally efficient but rigid. They provide the tools to pay, but they won't remind you to use them. If you stay proactive, you keep your money in your pocket instead of handing it over as interest to the state treasury. Keep your records, use the online portals, and always round up your estimates slightly just to be safe. It’s better to get a $50 refund in April than to find out you owe $50 plus $20 in interest because you tried to be too precise.